Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Sep 08, 2022

Placing a value on an oil and gas company is easier said than done. The value of an exploration and production company is driven by its assets; the value of a company's assets is driven by commodity prices, which change every day. As the past decade has shown, downturns and drastic price swings are the new normal.

To make smart investment decisions and decrease risk, analysts must thoroughly evaluate every potential investment. Metrics like net asset value, field netback, and enterprise value to reserves are all part of operator valuation. A robust dataset of both financial and technical data is critical for a comprehensive evaluation.

In today's competitive market, analysts must act quickly when evaluating potential purchases. But it's hard to act quickly when collecting and cleaning data takes more time than the actual analysis - especially when the seller's data is unavailable and analysts are forced to rely on the seller's claims about their asset value. Sellers will portray their assets in the best possible light, and without transparency into their data or methodology, it's difficult to know if their claims are true.

Validating future production claims on multiple wells per day is time-intensive and requires a robust dataset, but the costs of indecision are high. Every day that goes by without a decision is a chance for a competitor to scoop up the best companies.

Validating a seller's claims without access to their data is possible with the right database and platform. Access to data from every part of the energy value chain in a single platform makes it easy to analyze trends and understand what affects production and revenue.

With integrated datasets, analysts can take advantage of several techniques to validate sellers' claims about their assets:

Comparing a company to its peers is one way to determine if it is a good investment. For oil and gas companies, benchmarking companies of similar size and similar acreage holdings is the best approach. With access to oil and gas data from all operating companies in North America, analysts can perform an unbiased comparable company analysis, without relying on the seller to provide data.

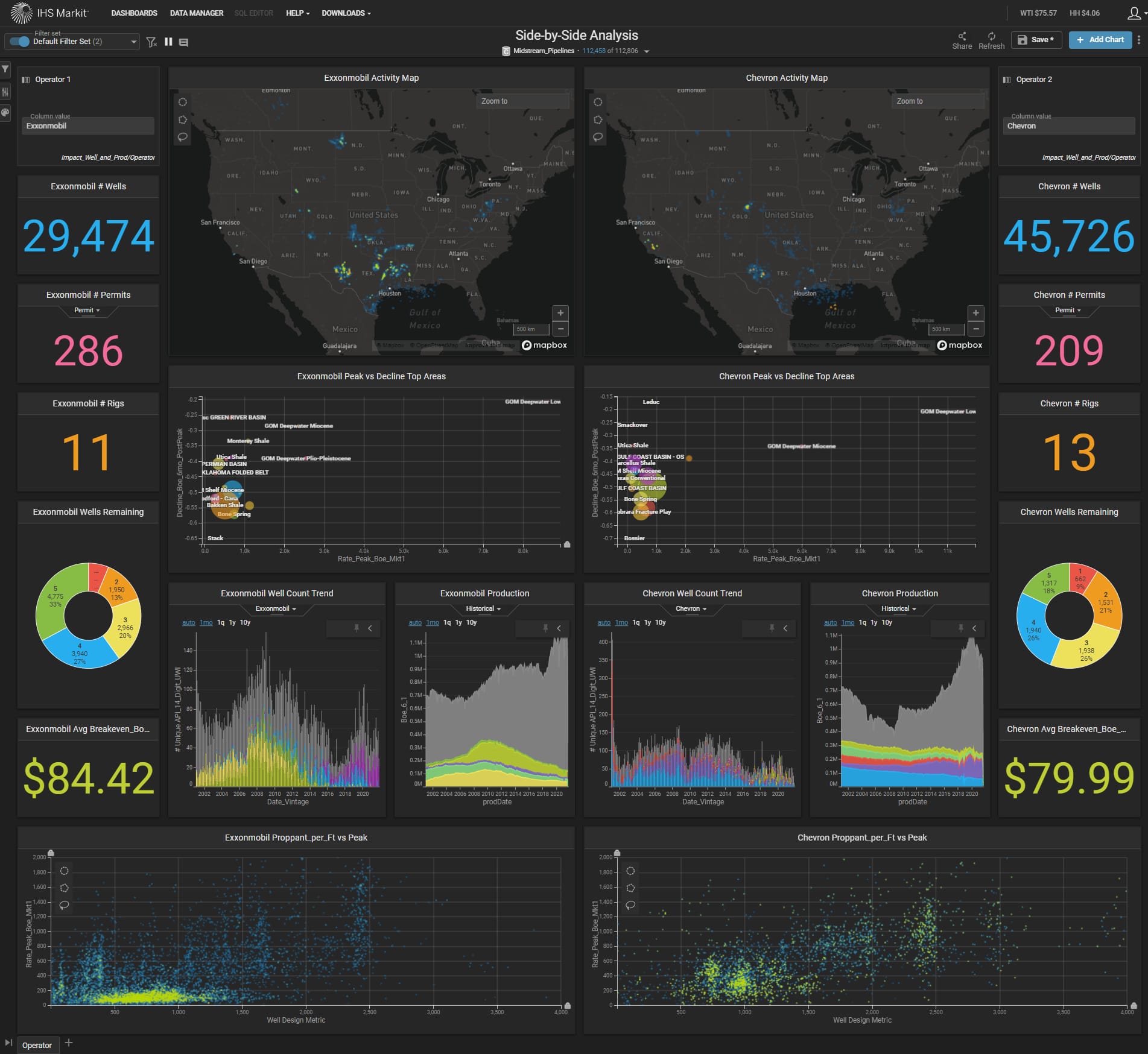

A side-by-side comparison of ExxonMobil (left) and Chevron (right) in the U.S. past, current and future data about wells, acreage quality, breakeven, production, completion, and more provides a full picture of how an operator is performing relative to its peers.

Historical and current oil and gas market trends, like drilling activity, historical transactions, and available assets, are valuable tools in determining a company's fair market value. Companies that are outperforming the market likely have a high ROI, while companies that are lagging should be avoided. Comprehensive technical and financial datasets show the full picture of a company's valuation, helping decrease risk in investment decision-making.

Economic factors, like operating expenses and commodity prices, can make or break a potential purchase. The oil and gas production forecasts from type curves can be used to model future revenue based on capital expenditure (CAPEX) and oil prices. This oil and gas data can also be used to calculate breakeven prices—a key factor in determining the economic viability of an operator's assets.

It's important to look at type curves for every well, as sellers may be showing only the best data or data from a certain time period. Companies tend to drill the most promising areas first, so initial oil and gas production results may not reflect the company's entire portfolio. Analyzing type curves from all of an operator's wells and the surrounding area provides important context when evaluating potential revenue.

Modelling a variety of scenarios provides a comprehensive idea of what to expect from a potential purchase. Every asset in an operator's portfolio contributes to their overall value and revenue potential. While an asset's geology can't be changed, the well designs and completions programs are flexible. Engineering changes can affect oil and gas production and costs; modelling a variety of scenarios tells analysts what to expect if service costs change or new engineering designs must be implemented. Commodity prices change, so forecasting revenue at a range of oil prices is essential to fully understand a prospect's potential.

New from S&P Global Energy, Energy Studio: Impact takes the guesswork out of investment evaluations. The platform integrates data from the entire energy value chain, including acreage, rigs, permits, type curves, economics, and more. Users no longer have to rely on sellers to provide data, enabling them to validate claims about an operator's revenue potential.

The platform includes type curves for every producing well in North America, as well as estimated CAPEX and breakeven points, allowing analysts to benchmark performance and accurately predict revenue from future production. All oil and gas data in the platform is analytics-ready, eliminating the lengthy data gathering process required for each prospect.

In today's lean, competitive market, time is money. With the right data, users can out-analyze their peers and make a confident decision about every investment opportunity.

About 'Energy Studio: Impact'

Energy Studio: Impact is a web-based platform that transforms big data into real-time energy analytics across the entire energy value chain. It covers upstream, midstream, emissions, and commodity pricing datasets and was created to help engineers, geoscientists, strategists, business development, and financial analysts to make better decisions faster. Energy Studio: Impact provides normalized and derivative content that accelerates the ability to extract meaningful insights. Whether you are trying to understand what drives productivity, do a quick screen for opportunities, or benchmark performance, our integrated workflows will get you there faster.

Utilizing the power of Heavy.AI's GPU processing power, you can answer questions at the speed of curiosity, and save custom dashboards to revisit the analyses that are most important to you. By integrating upstream and midstream datasets with derivative content, Energy Studio: Impact can provide a clear end-to-end workflow solution to reduce risk, improve returns and provide objective valuation abilities.

***

Want to determine if a certain oil and gas operator is a good investment candidate with a high ROI or not? Book a 15-minute personalized demo to run a quick background check on operators and validate their claims of forecasted revenue on potential investments.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.