Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Mar 14, 2023

By Eduardo de Freitas and Matheus Varanda

One of the most important indicators used to evaluate an O&G company is the reserve-to-production ratio, which has direct influence on estimating a company's capabilities of generating future income.

Hence, exploration activities play a central role in the strategy of several global O&G operators (both NOCs and IOCs), having an arguably secondary, yet relevant role, in smaller independent companies focused on acquiring and redeveloping mature assets.

Being undoubtedly one of the riskiest endeavors in the upstream value chain, both from a return-on-investment and operational perspective (i.e. wildcat wells in prospective new plays with scarce geological knowledge), exploratory projects are carefully assessed by the operators before committing any resources to them.

Nevertheless, over recent years the average success rate in global technical exploration achieved an annual rate within the range of 39-49% owing to technological advancement and streamlined procedures while commercial success fell to around 10%, showing the hurdles of finding economical amounts of hydrocarbons in more challenging environments such as deepwater.

We'll briefly address the key developments around the latest offshore exploration block relinquishments in Brazil and a few trends revolving around them.

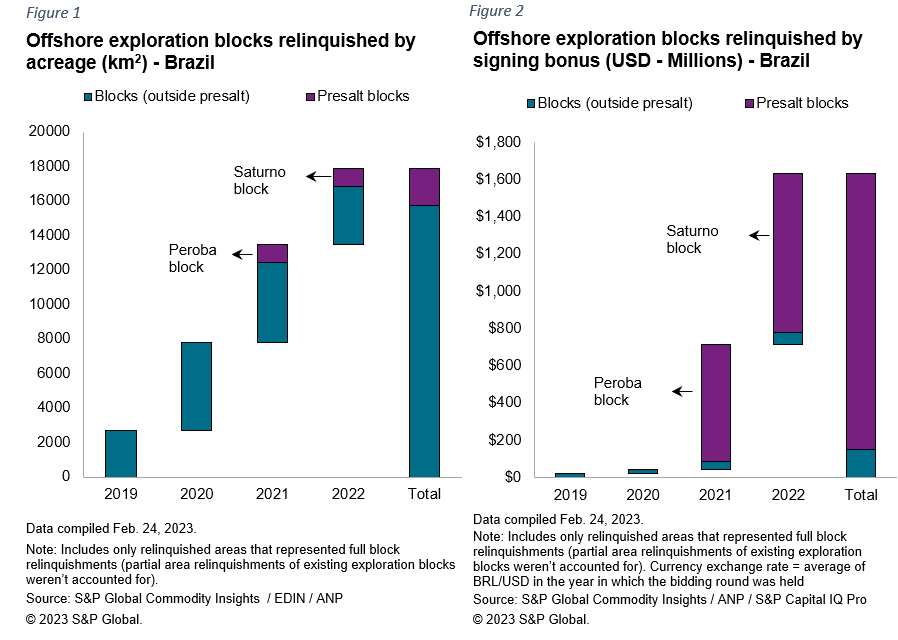

Over the past four years, nearly 5 offshore exploration blocks were fully relinquished [1] per year, representing an average acreage of approximately 3,950 km2 that were returned to ANP. From a company perspective, those events involved the Brazilian NOC Petrobras, major IOCs (i.e. Shell and bp) and independent international and local players (i.e. Chariot, 3R Petroleum etc).

The relinquished areas span a wide range of basins across southeastern and northern clusters, with Ceará and Potiguar leading the pack with 6 blocks each. Figure 1 below depicts the total relinquished acreage in the period of 2019-22. While the two presalt blocks fully relinquished in 2021 and 2022 (Peroba and Saturno) accounted for less than 15% of the total acreage, their signing bonuses represented over 90% of the total disbursements in this exploration cost category [2] (Figure 2). Despite the startling differences between those figures, one must recall that those presalt blocks were bid in two of the very first production sharing rounds held in 2017 and 2018 in a play deemed as one the most prolific in the global deepwater landscape - so the "price tickets" were indeed quite high amid more aggressive bids by the market participants.

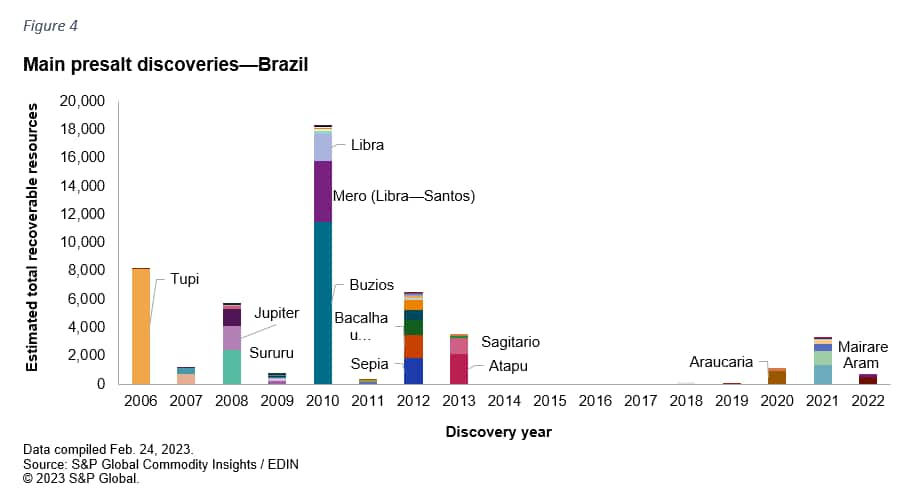

The Saturno area was spudded by Shell back in 2020 and its new field wildcat (NFW) failed to encounter hydrocarbons while the well spudded in Peroba successfully hit a target reservoir, but its high CO2 content (close to 90%) was a serious hindrance to any potential development project. As we pointed out in some of our previous reports, results of recent exploratory drilling campaigns in the presalt point out to an overall decrease in the volume of the discoveries (see Figure 4) or no discoveries at all. Additionally, recurrent gas-prone discoveries in the outboard of the play, several of them with high CO2 content, pose additional development challenges.

Another factor behind the relinquishments of exploration blocks is the higher selectivity by operators in undertaking exploratory activities. The current oil and gas scenario differs greatly from the one when those blocks were acquired, especially those acquired in the heydays of the offshore E&P in the 2000s, amid a growing demand for oil and the virtually unanimous market perception about the need to tap into deeper waters to fulfill the expected supply gap in a time when US shale was still not a real deal.

There are several past and present reasons behind the changing dynamics on the offshore exploration front both globally as well as locally.

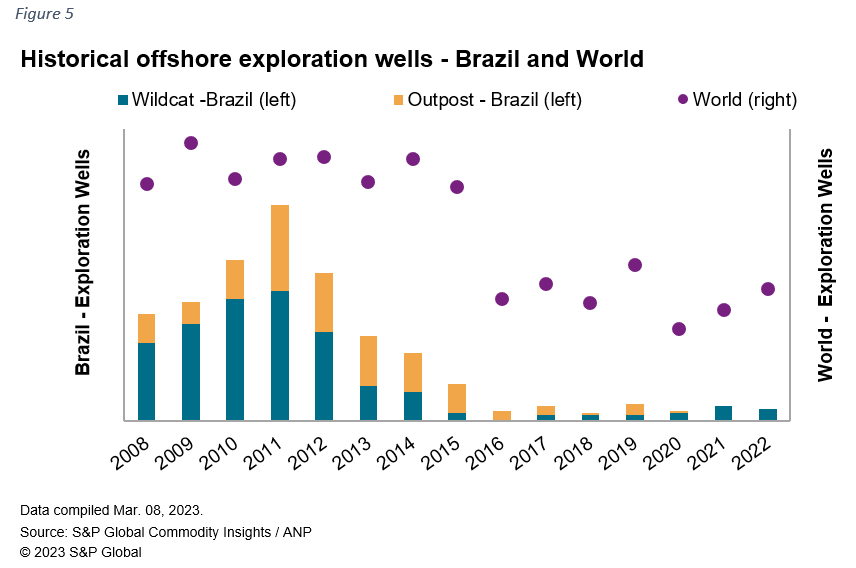

The chart below depicts the startling reduction observed in offshore exploration wells drilled in Brazil over the past decade. While a significant reduction is observed in deepwater global exploration drilling over the same timeframe, the decline in Brazil is even more acute and less than 10 wells were drilled per year since 2016.

However, the decline in the number of exploratory wells drilled in Brazil was exacerbated by the challenging domestic environment, marked by Petrobras' critical financial situation between 2014-16, as the NOC has historically spearheaded offshore exploration activities in the country (i.e. nearly 60% of all offshore exploratory wells from 2008-14 were drilled by Petrobras). The debacle of local E&P companies with ambitious exploration plans also contributed to this situation - the case of OGX is the most notorious one as the company drilled nearly 20% of all offshore exploratory wells between 2009-13 and had its operations virtually halted in 2013 after filing for bankruptcy protection. Furthermore, the departure of independent American firms, who shifted their focus to the US shale, further exacerbated the decline.

Additionally, the pressure of the cost spikes observed throughout the supply chain, has had an impact on investments thorough the whole chain of oil and gas development. Petrobras' FPSO tenders closed in 2022 resulted in offers at least 30% higher than the tenders finished one year before, leading to the cancelation of one of the processes and review of the procurement strategy.

The investors pressure over the oil industry led the financial market to charge a premium for oil projects, raising the NPV cut-off rate and leaving some projects off the companies' portfolio.

The development cost increases help to explain why the economic success is dropping, with more areas returned or abandoned, even amid improved technical success.

There are other reasons at play for operators with different profiles and strategies to relinquish exploratory blocks, with the geological factor invariably playing a key role. However, while there has been a global decline in deep offshore exploration drilling, the movement in Brazil was significantly more aggressive. The relinquishment of the promising pre-salt blocks also shines a light on the recent disappointing exploratory results in the play. The upcoming campaigns in the region will be critical to understand if the play can still deliver new volumes or if it is time to move on to new frontiers such as the Equatorial Margin. While there are great expectations that this area can become a promising new play, the heavy environmental and regulatory burden should keep international companies at bay from operatorship roles in the region - TotalEnergies and bp, for example, gave up on Foz do Amazonas exploration blocks in 2020 and 2021 upon insurmountable difficulties in obtaining drilling permits in the area.

We invite the reader to access our full product reports and data analytic tools to stay abreast of major Upstream trends in Latin America.

Notes:

[1] This figure considers only relinquished areas that represented full block relinquishments (partial area relinquishments of existing exploration blocks weren't accounted for).

[2] Estimated nominal signing bonuses paid by the companies in US dollars (USD) without monetary correction.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.