Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

May 15, 2023

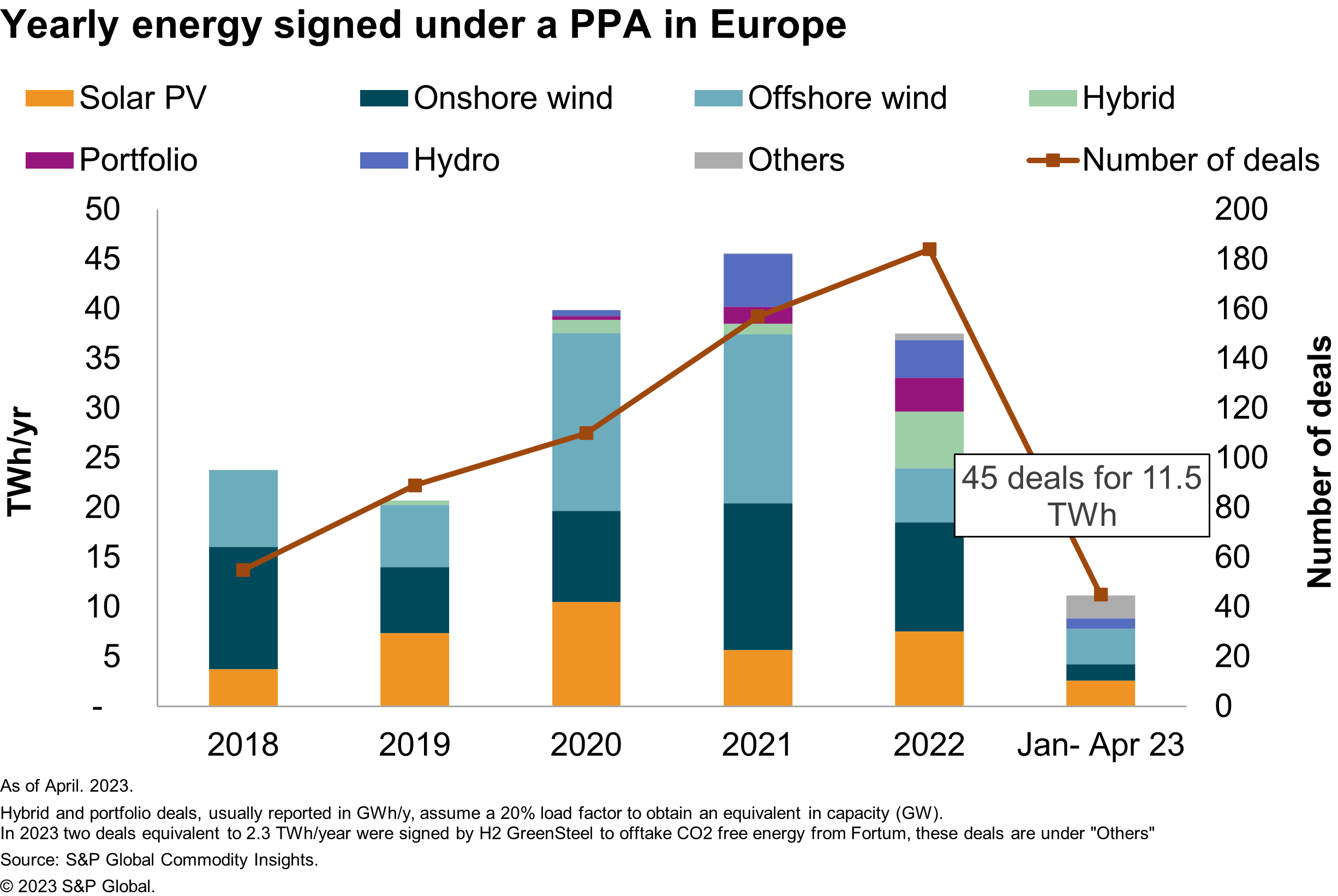

Over the past four years, the number of European power purchase agreement (PPA) transactions has tripled, with over 180 deals signed in 2022 alone. Year on year, this corresponds to a 17% increase. So far in 2023, 47 deals have been signed, setting the pace for further expansion of the PPA market.

The total capacity contracted in 2022 remained steady at 15.5 GW for an equivalent of 37.5 TWh/year. So far in 2023 4.6 GW for an equivalent of 11.5 TWh/year have been signed under a contract.

Although there was a record number of transactions in 2022, there was a slight decrease in total energy volume contracted compared to 2021. This is mostly likely due to a reduction in utility demand for PPAs, which has typically preferred production from wind power. Instead, solar photovoltaic (PV) deals increased in 2022, driven by corporate demand, leading to a lower volume of energy traded. This phenomenon seems to be replicating in 2023 based on deals signed to date.

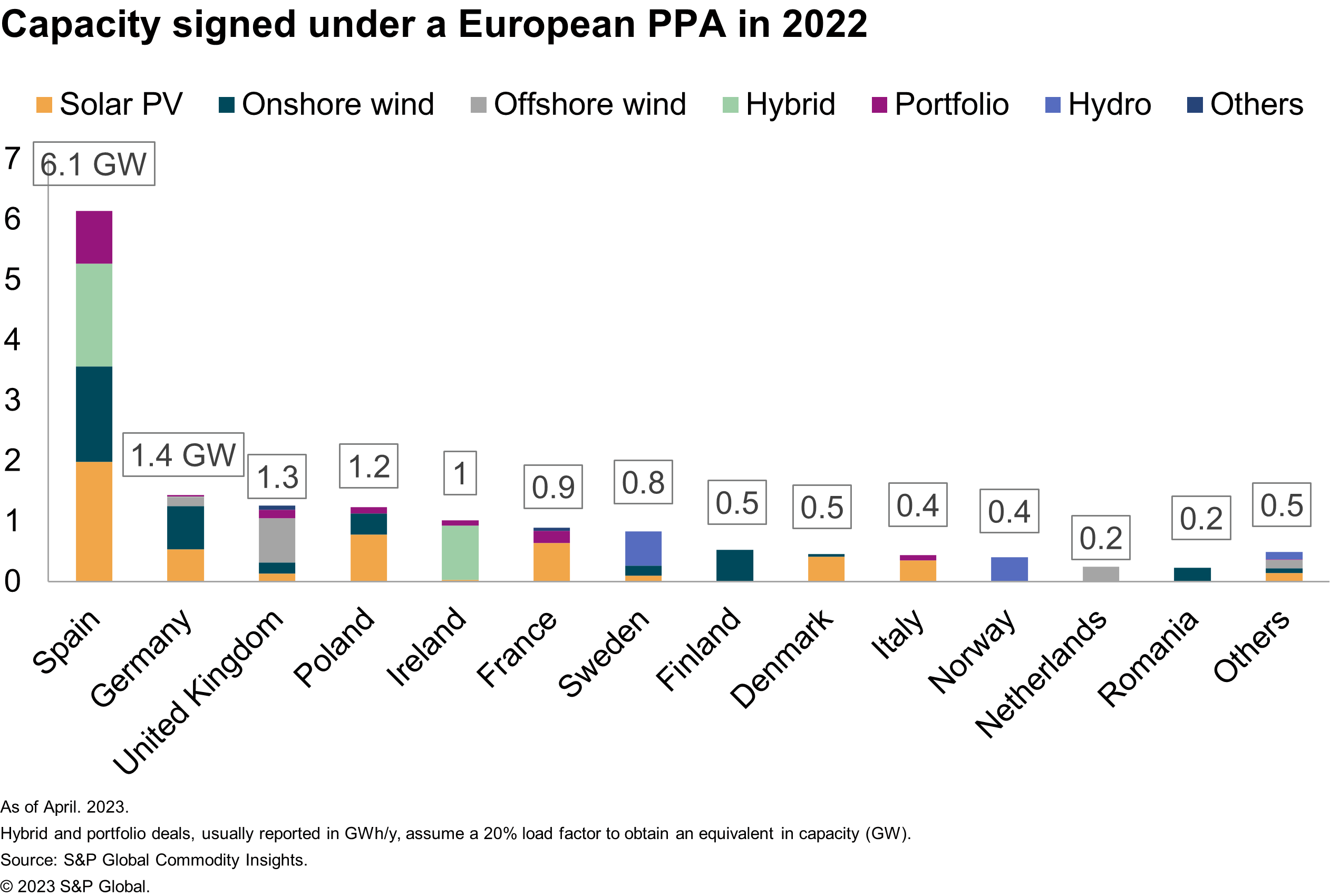

Spain emerged as the most dynamic European PPA market in 2022, accounting for most transactions, as it did in the previous year. Big industrial companies, such as Alcoa, were the main offtakers for onshore wind, but other technology and retail companies such as Amazon, Equinix or Ikea signed major solar PV deals.

The preferred structure for PPA contracts is the pay-as-produced, where the producer sells all its output with the variability risk taken on by the buyer. This offtake structure is the most common for corporate deals sourcing energy directly from projects. In 2022, pay-as-load contracts gained popularity. This is where the producer delivers enough production to meet the offtaker's request — usually relies on a utility as the middleman between the producer and offtaker since it will be able to deliver the required load from a combination of sources, which will be reflected in the price of the PPA.

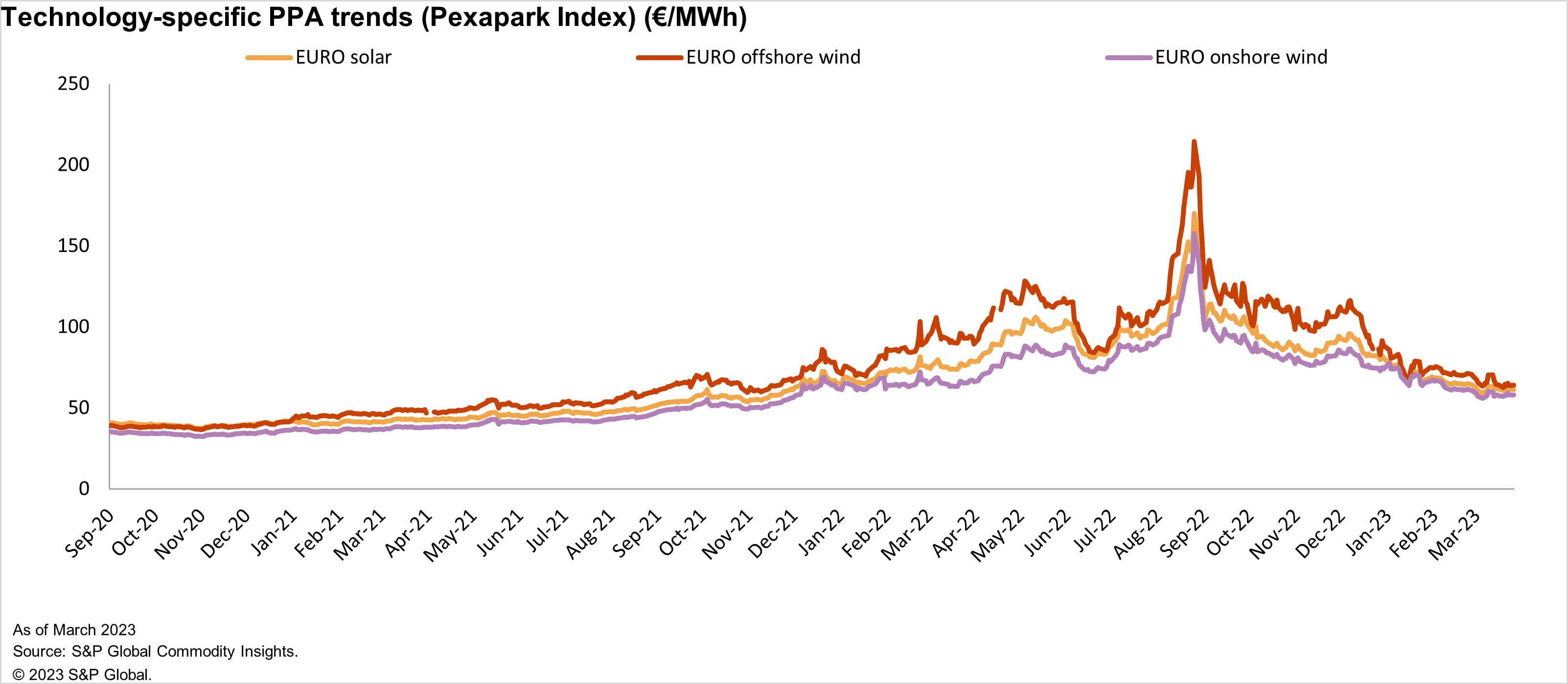

The European wholesale market experienced a considerable price surge and volatility in 2022 due to the Russian invasion of Ukraine and escalating inflation, causing an increase in PPA prices across Europe. Ian line with the trend in wholesale forward prices, PPA prices saw a downward correction in PPA prices following a price spike in August and September 2022. In March 2023, PPA prices were almost back to pre-invasion levels.

Further growth is expected as the European Commission wants member states to facilitate PPAs. The proposal aims to address the major hurdle limiting the growth of the PPA market by introducing measures such as state guarantees to reduce and manage counterparty credit risk. This move is expected to encourage more investment in renewable energy projects and provide a stable market for the sale of renewable energy. Norway, Spain, and France have already put these measures in place.

For more information about European PPA coverage, visit our European regional integrated energy or clean energy procurement service pages.

Diego Ortiz, a principal research analyst with the Gas, Power, and Climate Solutions team at S&P Global Energy, is currently dedicated to the analysis of the European renewable power sector.

Posted on 15 May 2023

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.