Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Feb 05, 2024

By Andre Lambine, Jian Ren Lim, Kaori Tachibana, Logan Reese, and Vince Heo

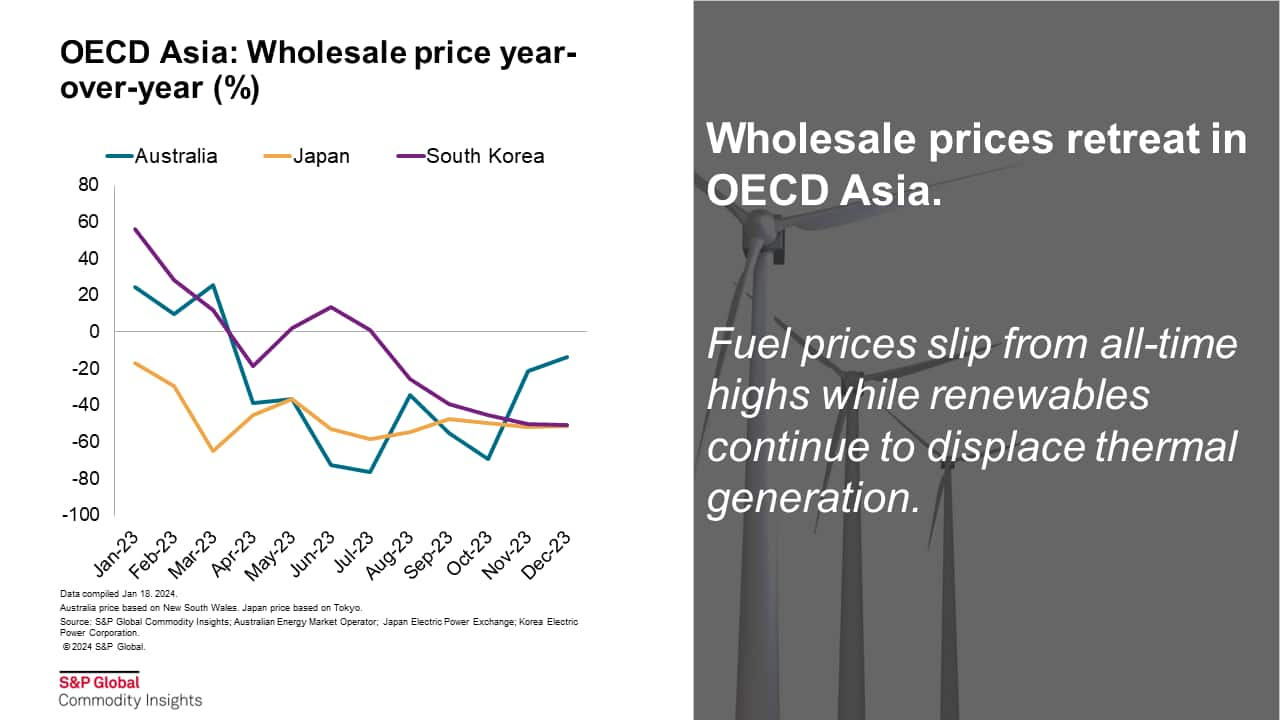

Wholesale power prices declined year-on-year in all 3 markets within OECD Asia (Australia, Japan, South Korea). In South Korea, the wholesale power price contracted by 49% in the fourth quarter of 2023 thanks to lower fuel prices for LNG and coal, down 44% and 38% year-on-year, respectively. Similarly, lower LNG prices helped cut Japan wholesale power prices in half in the fourth quarter 2023 compared to the year prior. Meanwhile, Australia experienced lower gas prices that when combined with sustained growth in behind-the-meter solar generation contributed to a 40% year-on-year decline in wholesale power prices in the fourth quarter 2023.

Our short-term forecast indicates modest growth in power demand in Japan and South Korea. South Korea is largely driven by the government's estimate of 8.5% growth in exports for 2024, compared with a decline of 7.4% in 2023. The increase in exports will likely be "spearheaded" by semiconductors, as mentioned on Jan. 11 by the Ministry of Trade, Industry and Energy (MOTIE). In Japan, any growth in power demand is expected to be met in part by an expected increase in nuclear generation with two announced reactor restarts, and a possible third unit at the very end of the year. However, the earliest restart will take in place in May, so most of the increase in nuclear generation will take place during the second part of 2024. As the units come online, the thermal gap will shrink, and there will be lower output from both coal- and gas-fired power generation; just as observed during 2023.

In this quarter, several new announcements and developments have been observed;

Australia

Japan

South Korea

If you are interested in learning more about our Asia-Pacific gas, power and renewables coverage, please click here.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.