Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Metals & Mining Theme, Ferrous

December 10, 2025

By Mayara Baggio and Jose Guerra

HIGHLIGHTS

Price negotiations between rebar producers, buyers

Construction sector matures, adding to buying strength

Rebar supply competition increases

Brazilian construction demand, which accounts for 40% of rebar sales in the country, is expected to remain strong in 2026, particularly for low-income housing projects, according to Renato Correia, president of the Brazilian Construction Industry Chamber, or CBIC.

"The housing outlook for next year, analyzing funding as an impetus, will be of the same size as this year, and, in infrastructure, it is also at least the same," Correia told Platts in an interview. "The possibility of growth is driven by retail, which could regain strength, considering a potential drop in interest rates at the beginning of the year. Furthermore, 2026 will be a year of presidential elections in Brazil, when there is normally a greater circulation of resources."

In Brazil's infrastructure construction sector alone, growth exceeded expectations, with more than half of projects coming from governments and with private concessions responsible for building 70%-75% of that total, Correia said.

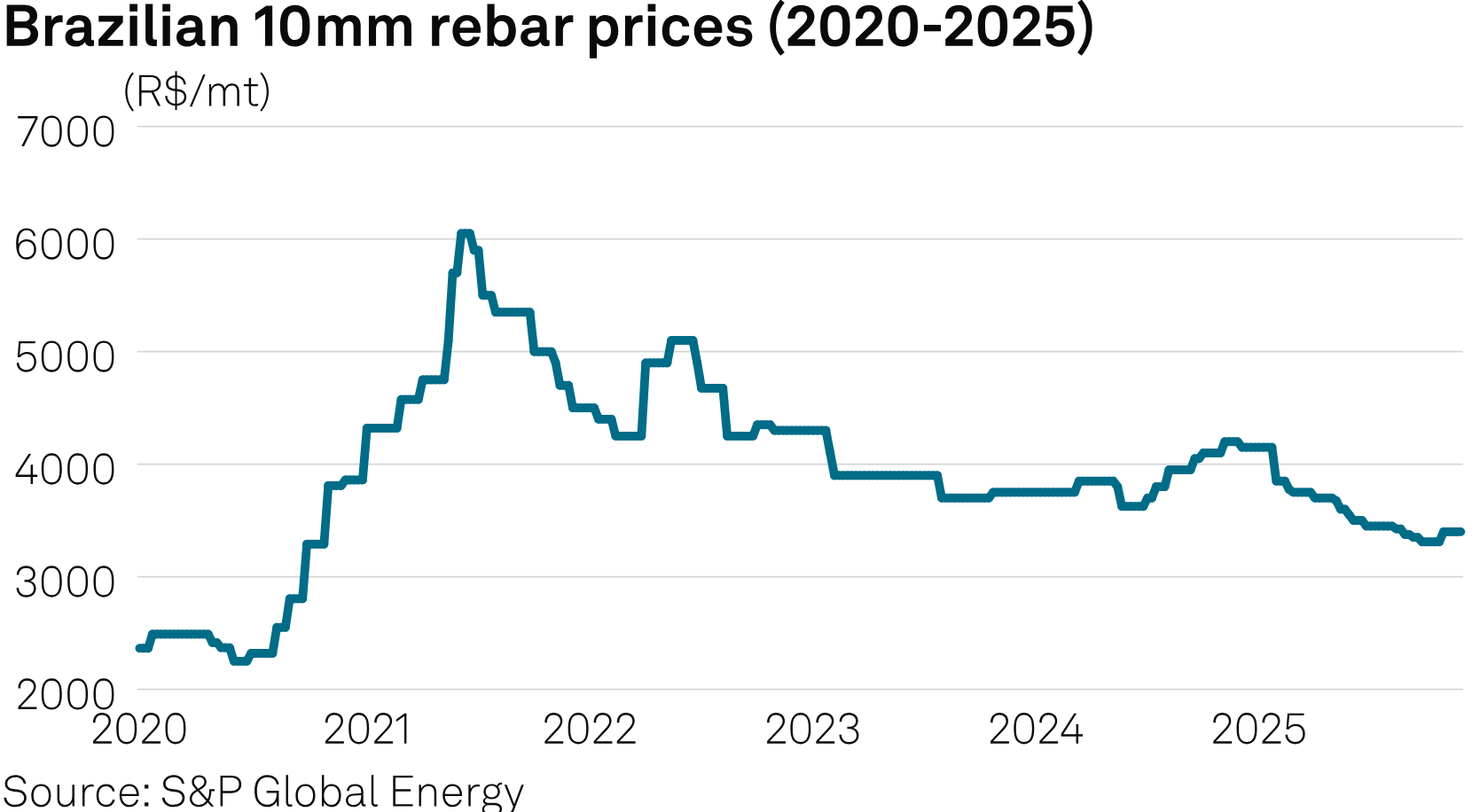

Brazilian rebar prices January through November decreased 9.3% to Real 3,400/mt, a level last seen at end-2020, from Real 3,750/mt. Market participants also experienced unprecedented price volatility and intense competition among producers.

Market participants have said that price negotiations for rebar in 2025 were more fluid, primarily due to construction companies that were previously less inclined to seek discounts or extended payment terms. The key drivers of this movement include the excess of steel in the market, with domestic volumes exceeding demand and increased imports from Egypt since 2024, sources said.

Platts, part of S&P Global Energy, assessed weekly Brazilian domestic rebar prices Dec. 5 unchanged on the week at Real 3,400/metric ton ($637.90/mt) ex-works, within a Real 3,300-3,500/mt range, taxes excluded, based on deals, offers and bids.

Brazil's construction sector has matured, supported by increased competition in the segment's supply chains, Correia said.

"We have 160,000 companies in construction, 80,000 in the housing area alone," he said. "I believe that the maturation process of companies leads us to want to talk to partners and negotiate more."

Correia cited a narrowing of margins for construction companies.

"The sector has grown," he said. "Real estate is a good investment, but construction costs have risen significantly in recent years. Look at the companies' balance sheets, the larger ones have more efficiency, the smaller ones less so."

"The management process has improved, pressured by the challenge of offering a price to the consumer that they can afford," he continued. "Brazilians still have a low average income; we don't have much room to raise the price."

While 2025 was a highly productive year for Brazil's construction sector, reaping the benefits of changes to a federal housing program providing government assistance for housing purchases and from other government programs, retail sales of construction materials to individuals suffered greatly due to high interest rates and family debt.

For middle-class and upper-middle-income housing construction, Correia foresees fewer starts in all of 2025, primarily due to the higher interest rates, although he expects the market to be resilient.

"The number of high-income launches and sales fell about 10% in the second half of the year, but we believe that this could also be resumed due to the prospect of falling interest rates in 2026," Correia said. Higher-income home buyers, however, need less bank financing, he added.

In additon to the high interest rates, the construction sector's main obstacles in 2025, Correia said, included a scarce labor force, a heavy tax system for business activities and the bureaucracy involved in approving and municipal building permits. A legitimate time period to obtain a permit would be a maximum of 120 days, he said.

"Today it takes us 18 months to approve projects, while some work can last [only] six months," Correia said.

Products & Solutions

Editor: