Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Aug 09, 2022

By Paul Hughes

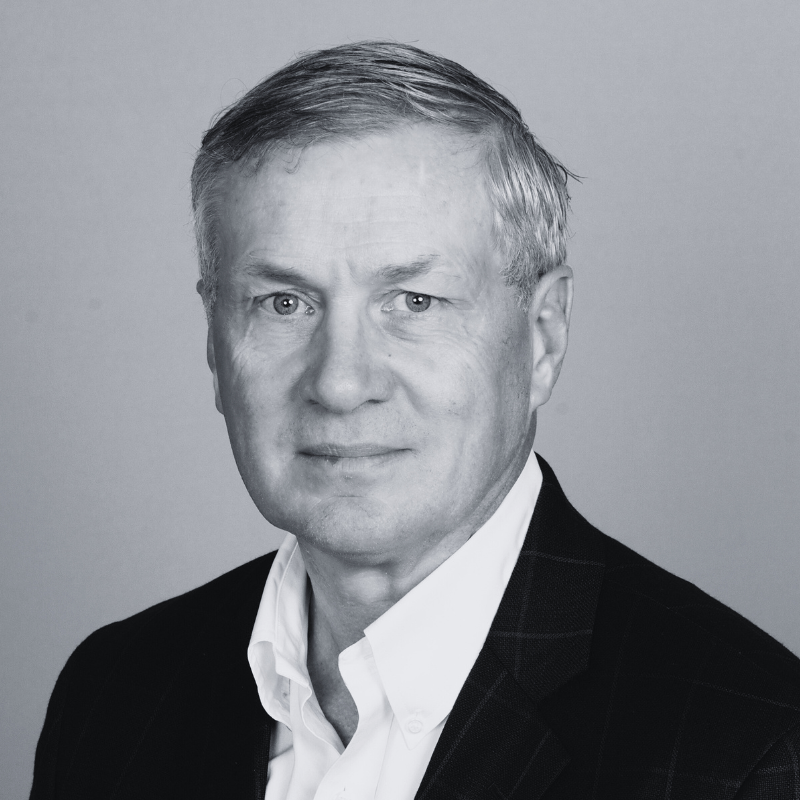

The US Consumer Price Index (CPI), the broadest measure of inflation at the consumer level, has maintained near 8.5% for three consecutive months, the highest level since 1981. In comparison, during April-June 2020, when the US and much of the world faced lockdowns per COVID restrictions, the CPI was running just above zero (0.2%-0.7%). US Food CPI had not mirrored the overall CPI through 2020 and early 2021. In recent months, however, food inflation has exceeded the general rate. In May, Food CPI was up 9.7%, 1.2% above the general inflation rate. A similar phenomenon is taking place in Europe. In late-2021/early-2022, food inflation lagged the general rate in the Eurozone. However, food inflation exceeded the general rate in the past two months. In May, the Eurozone food inflation was 8.9% compared to the 8.1% general consumer inflation rate.

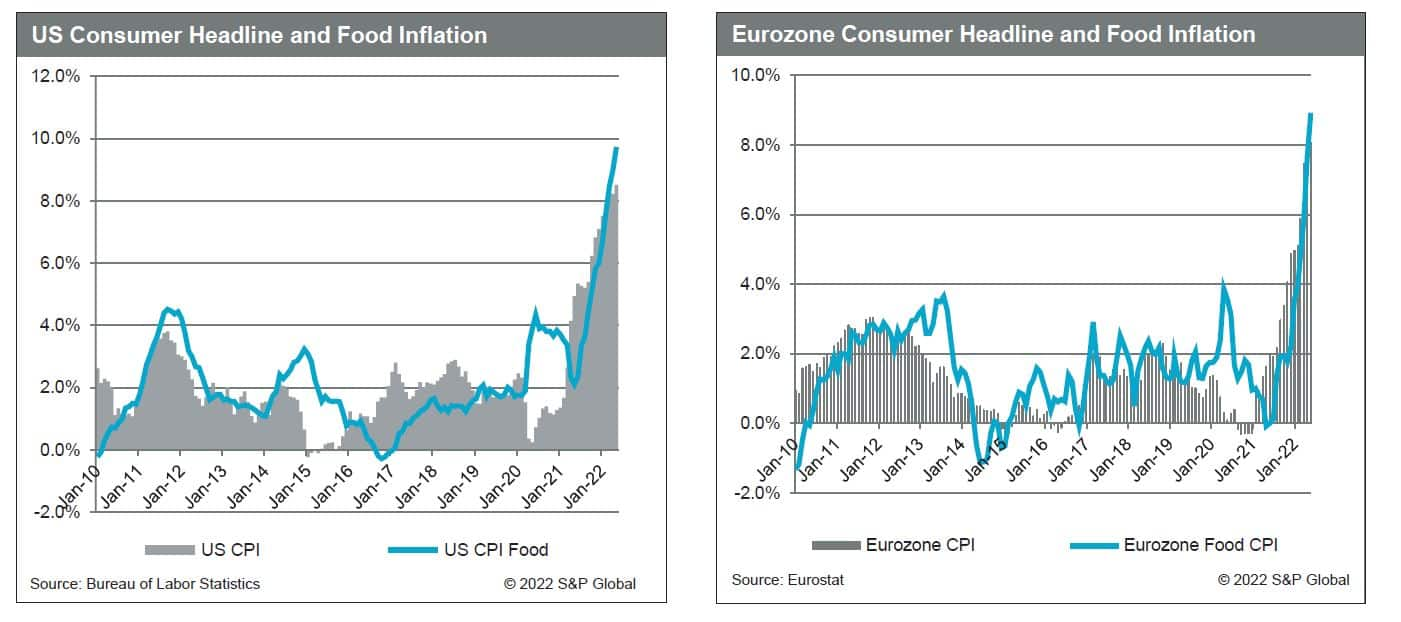

In response to this raging inflation, the US Federal Reserve has acted to cool it. As early as February, the Fed Funds Rate was effectively zero. However, recent actions have taken the rate up to 1.50%-1.75%, still historically low but rising rapidly. During the Fed's June meeting, they decided to increase rates by 0.75%, the biggest single increase in more than a generation. This is on top of a 0.5% increase in May. Moreover, the expectation is for another rise of 0.50% to 0.75% in July and for the Fed Funds Rate to be near 3.4% by year-end. If this expectation proves correct, interest rates will be 2.0% higher than today by year-end.

Download and Read the Full Report

Posted 09 August 2022 by Paul Hughes, Chief Agricultural Economist & Director of Research, Agribusiness at S&P Global Energy

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.