Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

May 11, 2022

By Yun Yun Teo

To paraphrase Charles Dickens: these are the best of times, these are the worst of times. The fate of the offshore rig market is inexorably linked to oil prices. And since Russia made its incursion into Ukraine in February 2022, Brent has consistently pushed well above USD 100 a barrel, giving hope to a rig industry that has been languishing since the offshore downturn in 2014, that a meaningful turnaround lies ahead.

But these are also different times. The last two years has seen the world turned upside down by the pandemic and the climate crisis, and this turbulent period has made it increasingly clear that the Energy Transition is, as planet-busting movie villain Thanos calls himself, inevitable. In response to these global upheavals, pivotal shifts in the social, policy and market arenas are driving fundamental change towards a low-carbon world. The war too, has clarified to some countries like Germany that it might be better to be weaned off oil and gas.

As it affects the rig market, however, these two forces - Energy Security versus Energy Transition - pull in opposite directions. On one hand, the high oil price and improved economics for oil and gas exploration beckons oil operators to go forth and drill. At the same time, these C-suite decision makers are facing pressures from stakeholders, activist investors and the public alike for more climate accountability. It is a balancing act for oil companies, to maintain or increase profitability while decreasing emissions and re-structuring towards a more sustainable portfolio.

In the near term, the choice is clear as energy security is the immediate concern. With Russian energy supplies uncertain and the need to alleviate pain at the pumps urgent, governments like the United States' have been imploring oil and gas producers to increase their output. Offshore projects are expected to pick up, but they will take time to put together and cost inflation - for crew, equipment and other services - is already setting in.

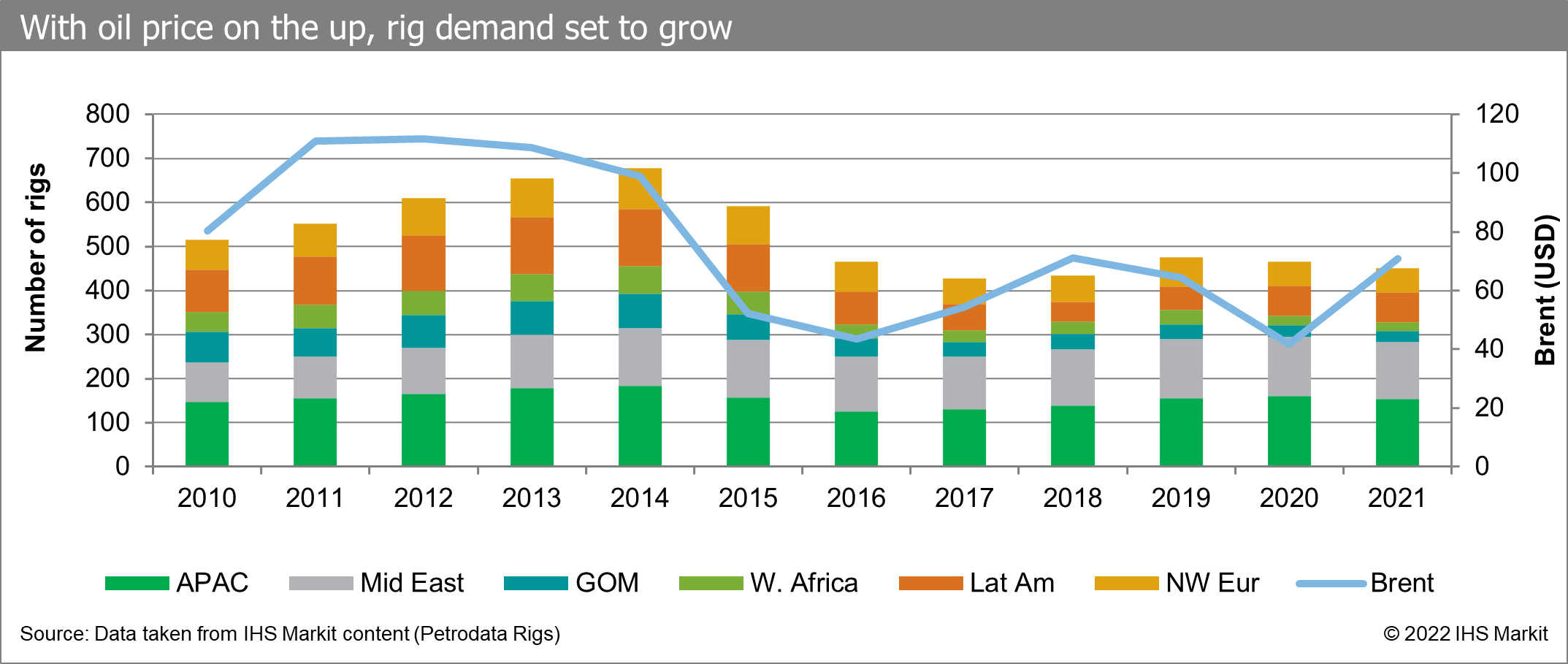

The chart above shows how closely offshore rig demand tracks oil price over the last decade. The rig market - comprising drillships, semisubmersibles and jackups - fell hard from its last height in 2014, but has remained relatively resilient over the last two years despite the logistical chaos caused by the pandemic and the 2020 oil price crash. That year alone, there were 79 rig contract cancellations. The lone region that saw demand grow during this trying period, while the rest shrank, was Latin America, which is recording strong demand from Brazil, Guyana and Suriname.

The Middle East, too, is forecast to see incremental requirements from Saudi Arabia, Qatar and the United Arab Emirates push rig numbers from 126 jackups to about 140 units over the next year. On aggregate, for the unfolding 12 months ahead, IHS Markit Petrodata anticipates worldwide jackup demand to improve from around 332 units now, to 361 units; semis from 39 units currently to 56 units; and drillships from 63 units to around 72.

Even when the going was tough, many rig contractors took measure of the times and worked to get their rigs 'greener'. Since 2020, they have been exploring different ways to optimise drilling, as well as utilise alternative energy systems and innovate with new cleantech to improve efficiency and reduce emissions. An example is the Selective Catalytic Reduction (SCR) system, an emissions control technology that injects ammonia to convert noxious oxides into harmless water and nitrogen, now installed on 16 rigs. So far, the progress is mostly limited to rigs working in Northwest Europe where more governments offer support for such green initiatives. To date, just 36 out of the over 700 rigs worldwide have green notations by classification societies.

The momentum for the Energy Transition has already resulted in reduced investments in upstream oil and gas projects, prompting a number of traditional oil and gas operators like Chevron to diversify into greener ventures like offshore wind. Even yards like the newly merged Keppel-SembMarine are jumping on the bandwagon. Keppel is spinning off its remaining unsold drilling assets, while the new combined entity has pledged to focus on building sustainable offerings like floating carbon capture storages and hydrogen-driven vessels.

In the long run, there will no doubt only be more cutbacks on drilling projects. But in the meantime, the road to a net-zero world is a long one. Green tech is still relatively nascent and will take time to become commercially viable at scale. And with global oil inventories at an all-time low, the world still needs to fuel its energy requirements while the world figures out the path to meet optimistic temperature targets.

For now, the robust oil price will definitely help invigorate the rig market, even though any up-cycle potential for increased drilling will likely be tempered by the opposing push to reduce our carbon footprint through efficiencies and power generation. Ultimately, how things pan out will also depend on the geopolitical landscape after the dust settles when the war in Ukraine is over. Hopefully, it is not one where partisan blocs dominate and less co-operation takes place, for while such an unstable outcome may prop up the oil price that supports offshore drilling, it could well accelerate the world towards a truly unimaginable worst of times.

For more data and insight on the global offshore drilling market, usePetrodata Rigs by IHS Markit.

Posted 11 May 2022 by Yun Yun Teo, Principal Analyst, Offshore Rigs, S&P Global Energy

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.