Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Apr 25, 2022

By Xiaonan Feng

On 24 January 2022, the State Council issued the Comprehensive Work Plan on Energy Conservation and Emissions Mitigation in the 14th Five-Year-Plan Period. The work plan will serve as the guiding document on energy conservation under China's "1+N" climate policy framework, in addition to being part of the regular policy streams of China's FYPs.

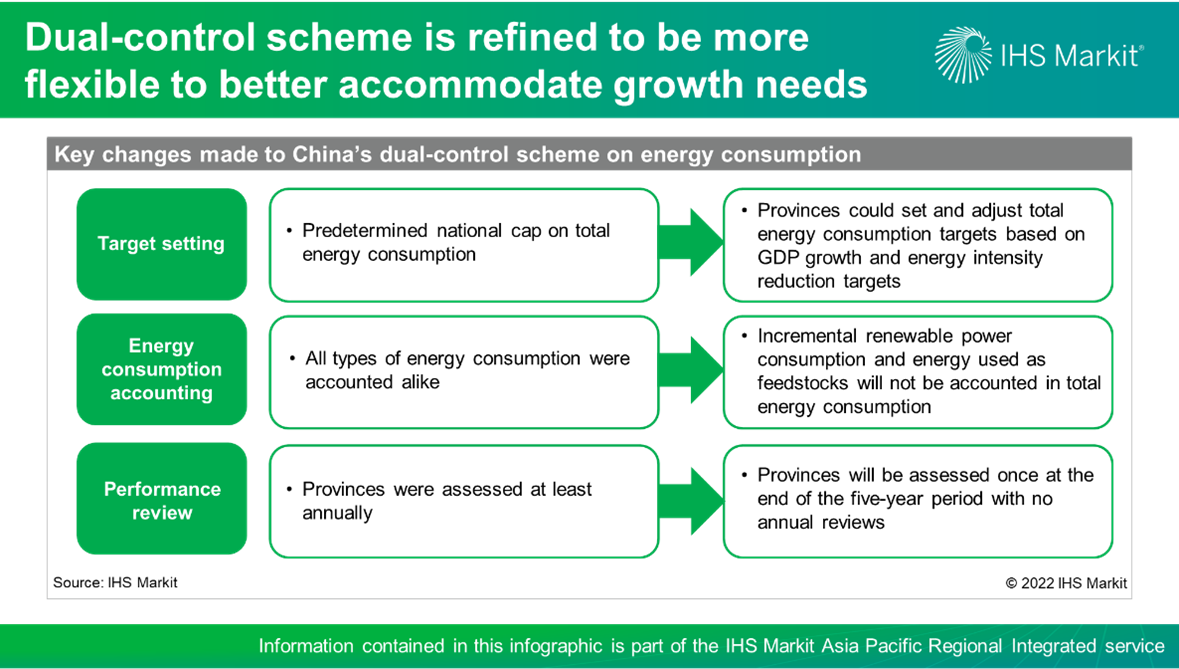

Different from the 13th FYP work plan, the 14th FYP work plan sets no predetermined—although non-binding—national cap on total energy consumption, but rather gives provinces more room to set and adjust their own targets to better suit local development needs. This signals that China is taking on a marginally relaxed stance towards capping energy consumption in an effort to prioritize economic growth.

In the meantime, China will also adopt a more flexible approach in setting and assessing energy-intensity reduction targets. Specifically, the national target to reduce energy intensity by 13.5% can be flexibly adjusted across the five years, and will be assessed only once at the end of the five-year period, instead of annually, as in most previous years, or even quarterly, as in 2021. This will better allow provinces to allocate energy use over the five-year period depending on the pace of local economic growth, instead of having to "dash" toward a set of predetermined year-end intensity reduction targets at the risk of disrupting economic activities.

The Work Plan designed some new mechanisms to enhance the implementation flexibility of the "dual-control" scheme.

Incremental renewable power consumption during the 14th FYP period will be exempted from the provincial accounting of total energy consumption and hence will not add to the pressure of meeting total energy consumption targets. The exemption, together with the RPS targets, will incentivize provinces to prioritize the use of renewable power to support economic growth. However, this does not mean that renewable power can be used without limit to develop energy-intensive industries or towards inefficient ends, as all renewable power consumption, be it incremental or not, will still be assessed against energy intensity reduction targets.

In addition to renewable power, energy that is used as feedstocks will be exempted from the assessment of both energy intensity reduction and total energy consumption targets. This primarily concerns the use of coal, crude oil, and natural gas to produce petrochemical and agricultural feedstocks. This will ease fossil-to-chemicals projects from the pressure of securing energy consumption quotas, thereby helping to maintain the supply security of a range of fossil-based industrial and commercial products. This will also pave the way for the transition of "dual-control" of energy consumption to that of carbon emissions, by excluding embedded carbon from the calculation.

Learn more about our coverage of the Asia Pacific energy research through our Asia-Pacific Regional Integrated Service

Xiaonan Feng, based in Beijing, is a senior research analyst Gas, Power, and Climate Solutions team and primarily focuses on the Asia Pacific carbon market analysis, including carbon capture and storage outlook in the power sector, carbon trading, carbon emissions, carbon tax, and carbon- and climate change-related policies.

Posted on 25 April 2022

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.