Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Mar 16, 2023

By Erik Meyer, Joaquim de Azevedo, and Maria Lupachik

China National Offshore Oil Corp (CNOOC) is assumed to have completed its highly anticipated exploration drilling campaign offshore Gabon, as the rig has moved from Gabon and was on route to Canada. At the time of writing, CNOOC had not released any results for either of the wells. Should CNOOC announce positive results for either of the wells, it would de-risk significant tracts of deep-water acreage. The post-salt Seal prospect, defined as a large three-ways structure closer in stacked Albian carbonates, was the second test in this two well program. The prospect, estimated to hold around 320 million barrels (MMbbls) of recoverable oil resources, is located within the offshore Block BCD10, operated by CNOOC with 100% interest.

The undeveloped Leopard field was the first discovery made within the block back in 2014. The Leopard-1 well encountered a substantial gas-bearing column of around 200 m net gas pay in a pre-salt reservoir. However, the Seal well was targeting a post-salt oil reservoir within the Madiela Group expected to be intersected at a depth of approximately 2,200 m. The well was spudded around the 19th of February by the Stena "Ice Max" drillship at a water depth of roughly 400 m. The rig completed drilling operation on the 11th of March. If it turns out that the well was successful, the possible development of the field would involve a floating production, storage and offloading (FPSO) vessel with offshore loading onto shuttle tankers to export the crude oil to market.

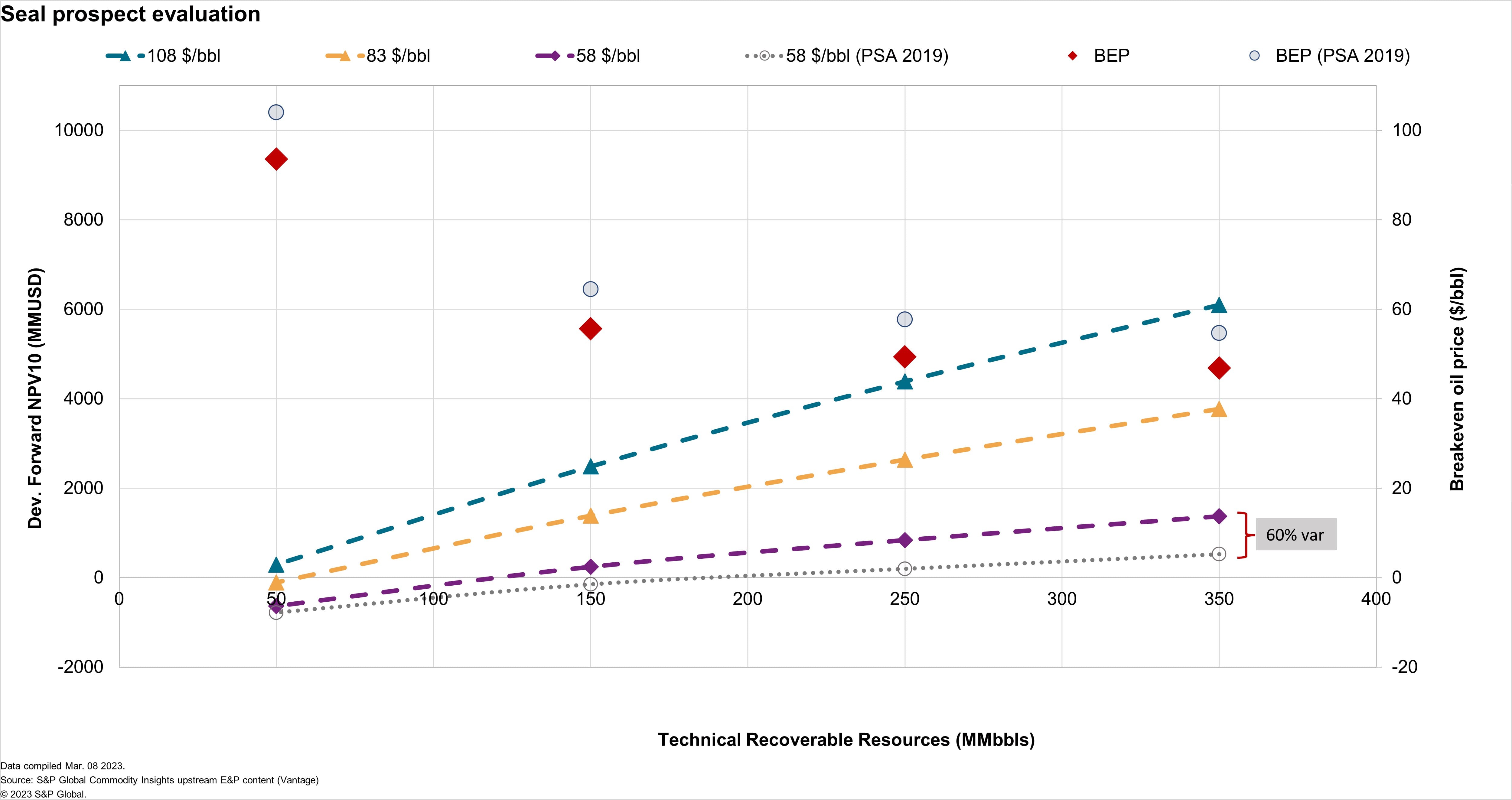

According to the analysis in the case of a positive probe, at a Brent oil price scenario of $83/bbl CNOOC would require a discovery estimated to be in the region of 60 MMbbls recoverable to break even, while a discovery of 350 MMbbls would have a net present value (NPV) of over USD 3.8 billion with a break-even price (BEP) below 50$/bbl. At a more conservative Brent oil price scenario of $58/bbl, CNOOC would have to discover at least 120 MMbbls recoverable to break even, while a discovery of 350 MMbbls would be worth at least USD 1.4 billion with rate of return (IRR) of 15% and a government take of around 50%. The fiscal regime in the region suggests that with a break-even price below 60$/bbl CNOOC is likely targeting a discovery equal to at least 150 MMbbls, below which the BEP increases dramatically (Figure 1).

Figure 1: Seal 1 prospect valuation

The contract for Block BCD10 was awarded in 2007, providing more attractive terms than subsequent fiscal regimes. Under the Gabon Production Sharing Agreement (PSA) of 2007, the limits imposed on royalty, cost recovery and profit share vary by production rates and water depth. As the water depth and production increase the profit share decreases. For deep water projects like Seal, the profit share decreases in tranches of 10% and depending on the production rate will range between 50-60%. Consequently, at the Brent oil price scenario of $58/bbl the calculated NPV from a comparative analysis shows approximately 60% higher values under the 2007 PSA compared to the 2019 terms. However, the differences decrease for the discoveries below around 200 MMbbls recoverable, due to minimum parameters terms for Royalty, production bonuses and Profit Share being triggered, as the three fiscal terms are linked to production, resulting in almost equally rates being applied in both 2007 and 2019 terms.

It is worth highlighting that BEP improves around 15% under fiscal regime of PSA 2007 compared to the PSA 2019 terms. Contractual islands (contracts that are more favorable when compared to surrounding contracts or the model contract currently available to explorers) represent opportunities for explorers to gain access to the same geology under potentially far better fiscal terms (Figure 2).

Should Seal 1 ultimately be announced as successful, CNOOC would have capitalized on attractive terms and de-risked significant post salt acerage.

Figure 2: Gabon contractual islands

***

Want to access more upstream content? Visit S&P EDIN & Vantage.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.