Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

May 23, 2023

By Celina Hwang and Kevin Birn

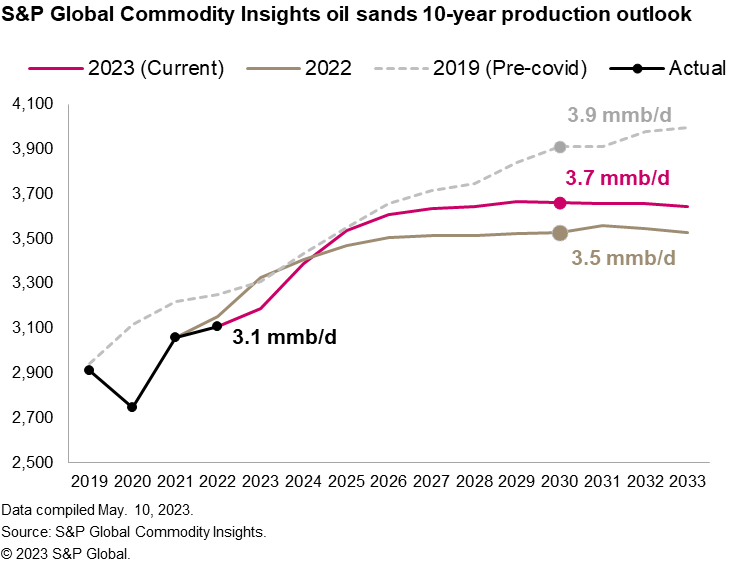

The 2023 release of S&P Global Energy 10-year oil sands outlook is the first upward revision in our expectation of oil sands growth in over half a decade. Canadian oil sands production is expected to reach 3.7 million barrels per day by 2030. This is half a million b/d more than today and an increase of 140,000 b/d in 2030 from last year's outlook.

Last year we wrote that heightened energy security concerns (and higher prices) hadn't changed the outlook for Canadian oil sands. A year later, one might conclude that the response to higher prices just took longer than anticipated to have their usual effect.

Certainly, oil prices are critical. Capital expenditures in 2022 did reach their highest level since 2015 and could go higher still in 2023.*[FTNT: Based on average of first nine months reporting for 2022 the four largest oil sands asset owner and operators.] To date however there has been no resurgence in large-scale greenfield or even brownfield oil sands projects. Overall, we estimate expenditures were only modestly higher than 2021 (8%) and rose to a large degree to offset an increase in inflation.

Last year we identified future optimizations as a key upside risk to our outlook. Indeed, the key culprit behind the upward revision has been the identification of further opportunities to improve efficiency and/or optimize output.

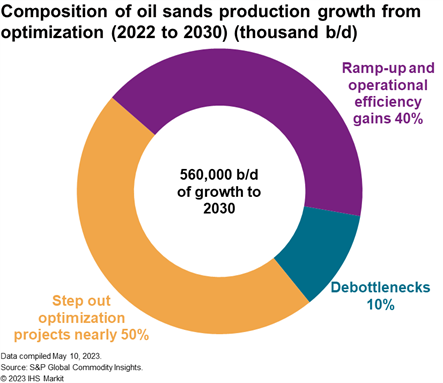

Optimizations now dominate S&P Global Energy oil sands production growth outlook. The most significant contributors being the ongoing ramp-up and operational efficiency gains from learning by doing and step-out optimization projects.*[FTNT: One potential exception is a recently announced intention to commercialize the existing Blackrod oil sands steam assisted gravity drainage pilot into a 30,000 barrel per day operation.] Step-out optimizations are a relatively new phenomenon and include, as the name suggests, stepping out from existing operational areas into new high quality adjacent lands. Within this category we also include the deployment of new technologies such as steam displacements in thermal oil sands extraction, which would include solvent assisted extraction. Collectively learning by doing and step-out optimizations account for nearly 90% of our overall production outlook with the remainder of additions coming principally from debottlenecking projects—another form of optimization.

The organic nature of how optimization projects emerge makes them particularly challenging to anticipate. They can also come with negligible impact on emissions which complicates emissions forecasting as well. This is particularly true for steam displacement technologies which reduce steam demand per unit of output, lowering emission intensity, but also frees up stream that can be used to increase output. These forecasting challenges imply that there will continue to be upside potential to our outlook. The opportunities for optimizations are not infinite, however, and when coupled with the potential for the industry to advance several large-scale capital-intensive decarbonization projects in the near future, such as carbon capture and storage, the upside risk to our production outlook could be tempered.

In the grand scheme of things, the revision is relatively minor—only about 2.5% by 2030. This however highlights the scale of the oil sands production today. In a system that topped 3.2 million b/d of production in 2022 (3.7 million b/d of supply when diluent blending is included), even a small percentage represents a significant volume.

Looking to the future, Canada is expected to continue to post new record production and export levels. A deceleration in growth is expected begin around the mid to late 2020s before a very shallow decline begins to emerge in the early 2030s. The decline is particularly shallow due to the long flat production profile of Canadian oil sands assets.

However, policy -- and in particular the advancing federal oil and gas cap which intends to establish an absolute oil sands emissions target - remains the most likely source of downside risk. If the emissions targets prove too stringent, and unattainable by the industry, then further investment—however modest—could be at risk.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.