Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Sep 25, 2023

By Timothy Stephure

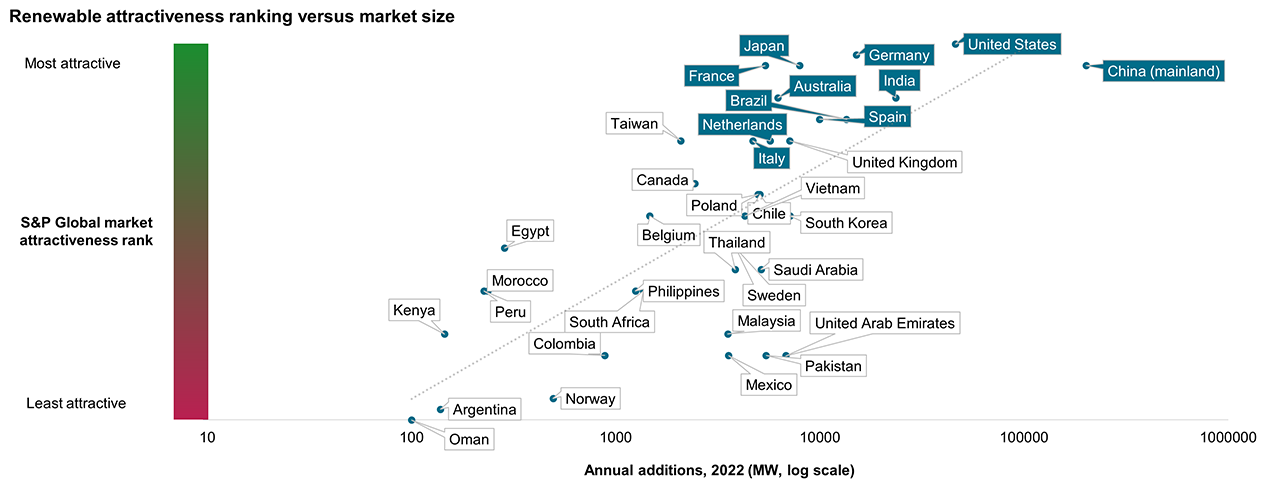

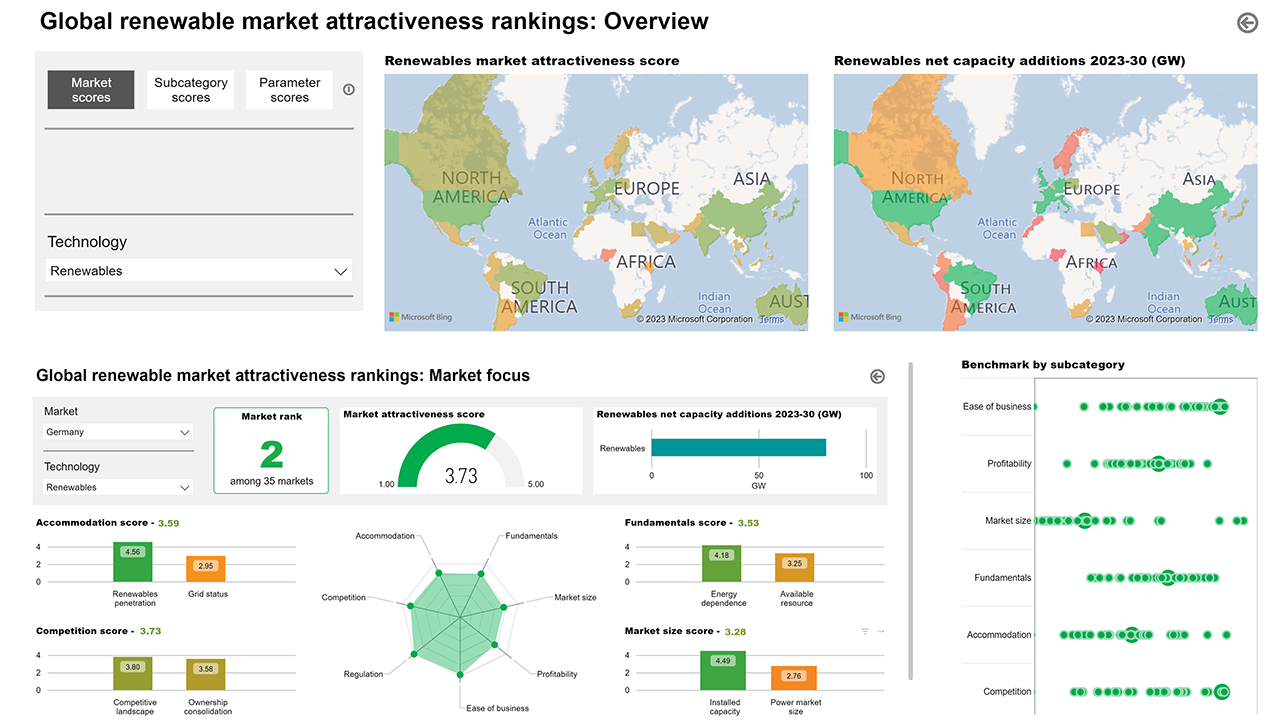

This year will mark a landmark year for clean energy investments as players across the value chain position themselves to take advantage of significant new developments in some of the world's most dynamic renewables markets. Over the next 10 years, over 5300 GW of new renewables capacity is expected to be built around the globe. Where the most attractive opportunities arise is continually shifting with market fundamentals, competitive dynamics and investment conditions. This year's iteration of S&P Global's Renewable Market Attractiveness Rankings assess the promise of solar photovoltaic (PV), onshore wind and offshore wind investments across 37 markets and 18 individually weighted scoring parameters. The parameters include the policy framework, supply-demand fundamentals, investor friendliness, infrastructure readiness, revenue risks and return expectations, competitive dynamics, and the overall opportunity size for each market.

Some key highlights from the full report and interactive dashboards recently published by S&P Energy include:

Learn more about our global power and renewables research.

Timothy Stephure is a research director on the Gas, Power, and Climate Solutions team at S&P Global Energy.

Posted 25 September 2023

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.