Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Jan 18, 2022

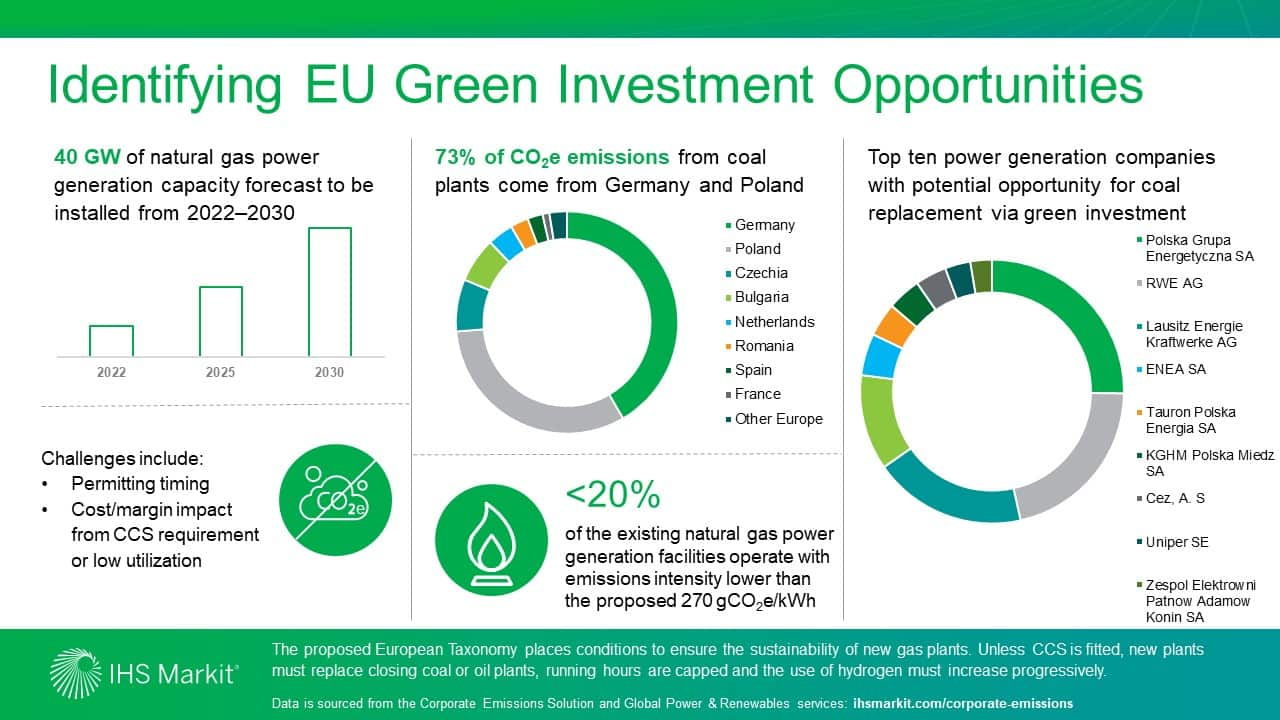

The EU sustainable finance taxonomy adopted in July 2020 provides a framework for sustainable investments to meet the EU's climate and energy targets. Recently, a draft of the potential criteria that would be used to define what counts as sustainable, or green, investments in power generation was leaked. The proposed criteria for new gas plants are either that they utilize carbon capture sequestration (CCS), or if they do not, that they meet the following criteria:

Given this information, how do you quantify the potential for green investments in natural gas power generation in the EU? For the infographic below, we looked at:

For more information on exploration of green investments, visit our Corporate Emissions Solution and Global Power and Renewables service pages.

You can also explore samples of our content by signing up to access the Climate and Sustainability Hub.

Bob MacKnight is a vice president at the Climate and Sustainability practice at IHS Markit.

Posted on 18 January 2022

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.