Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

PRODUCTS & SOLUTIONS

Turn big data into real-time energy analytics for faster decisions across the energy value chain.

Not sure what plan is right for you? Contact our team and we’ll find the subscription that works for you.

Energy Studio Impact is a web-based platform that transforms big data into real-time energy analytics across the entire energy value chain at the speed of curiosity.

It covers upstream, midstream, emissions, and commodity pricing datasets with Platts market-based forward curves. The platform helps geoscientists, engineers, asset managers, and financial analysts to make commercial decisions faster.

We cut down the time spent prepping data to allow users to focus only on the best-performing assets.

We support oil and gas executives and strategists in making the best commercial decisions.

We fill technical gaps for investors and make oil and gas data transparent, comprehensive, and easy for screening investment opportunities.

We cut down the time spent prepping data to allow users to focus only on the best-performing assets.

We support oil and gas executives and strategists in making the best commercial decisions.

We fill technical gaps for investors and make oil and gas data transparent, comprehensive, and easy for screening investment opportunities.

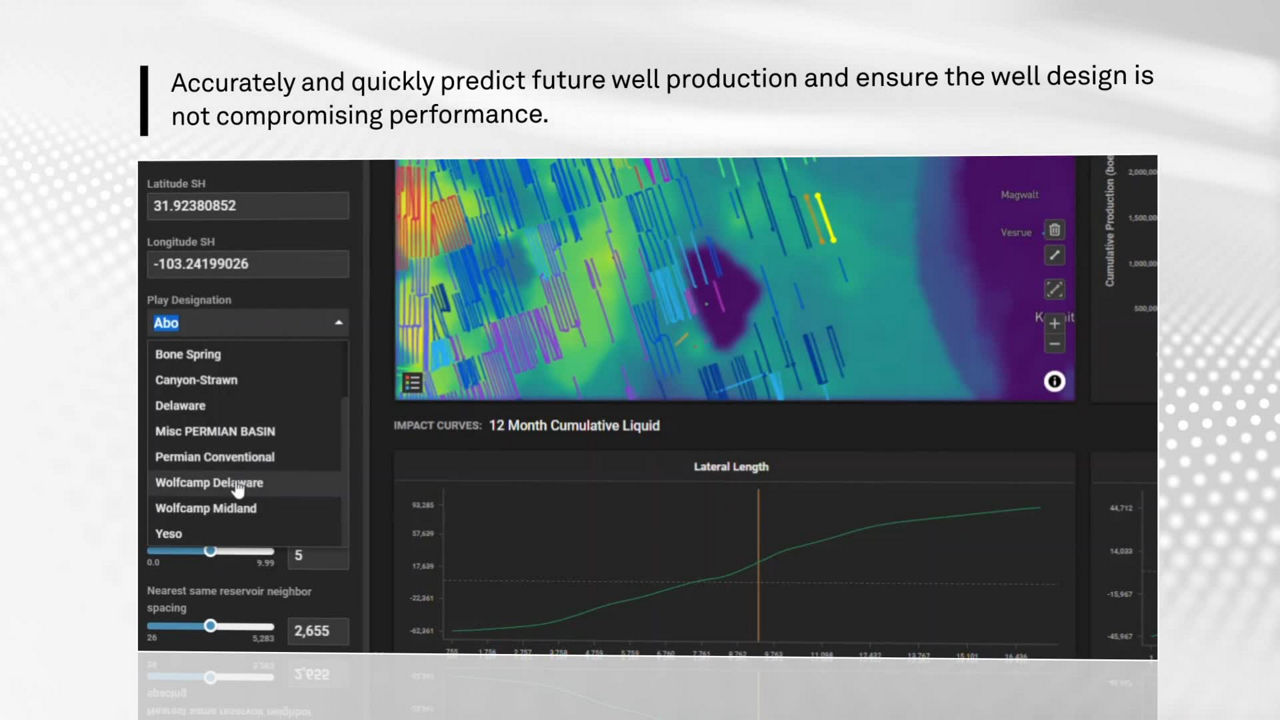

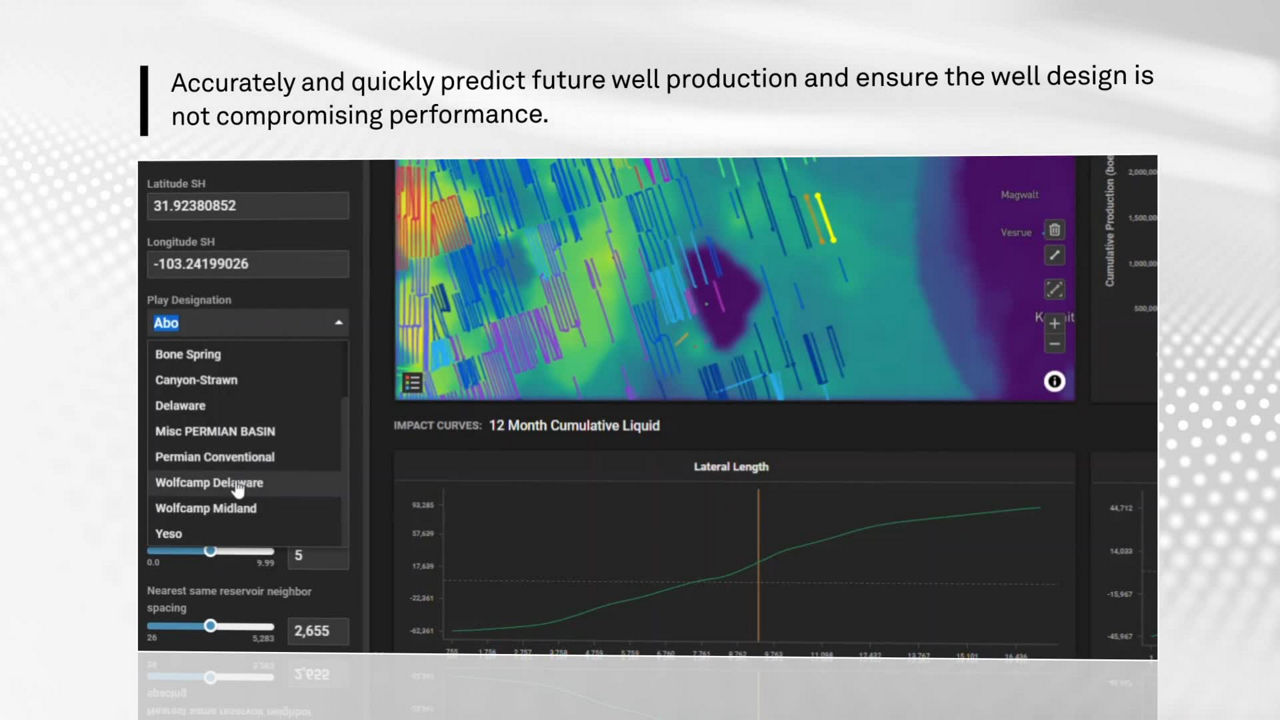

With our Plan and Predict model, you can compare analyses with multiple inputs and adjust parameters to forecast revenue on future oil wells at a variety of commodity prices. Our mergers and acquisitions database includes type curves, peaks, breakevens, and more for every highest-producing oil well in North America, so you can ensure you are paying the right price for a prospect or play. The pre-built oil and gas type curves eliminate the need for decline curve analysis and determining b-factors.

Eliminate tedious manual calculations with our analytics-ready oil and gas data from every part of the energy value chain. Well spacing, completion trends, type curves, rig count—we have the data, and it is ready to go. Quickly identify the most promising opportunities and focus your work on the right asset.

Benchmark your assets against competitors and peers to see how you are performing. The side-by-side comparisons can identify underperforming assets and provide valuable insight into what’s driving production.

The energy analytics platform has type curves for every producing well in North America. We used proven screening technology from Harmony and artificial intelligence to partition wells and produce hyperbolic parameters that lead to accurate oil production forecasting. And you can test future production outcomes based on a variety of well designs and parameters.

With production and completion data for every basin in North America, you can quickly identify underperforming wells and develop a strategy to increase asset performance. Evaluate their drilling and completions designs to determine if the culprit is geology or engineering. Analyze well completion trends across the basin and decide which wells are candidates for recompletions.

In a market environment that generates plenty of uncertainties, our Platts Forward Curves offer an independent, verifiable source to help validate models and asset valuations, project future revenues and expenses, and better align risk tolerance with business strategy. Platts Forward Curves help you to immediately assign value to future production and assess the economic impact of underperforming wells over time.

With our Plan and Predict model, you can compare analyses with multiple inputs and adjust parameters to forecast revenue on future oil wells at a variety of commodity prices. Our mergers and acquisitions database includes type curves, peaks, breakevens, and more for every highest-producing oil well in North America, so you can ensure you are paying the right price for a prospect or play. The pre-built oil and gas type curves eliminate the need for decline curve analysis and determining b-factors.

Eliminate tedious manual calculations with our analytics-ready oil and gas data from every part of the energy value chain. Well spacing, completion trends, type curves, rig count—we have the data, and it is ready to go. Quickly identify the most promising opportunities and focus your work on the right asset.

Benchmark your assets against competitors and peers to see how you are performing. The side-by-side comparisons can identify underperforming assets and provide valuable insight into what’s driving production.

The energy analytics platform has type curves for every producing well in North America. We used proven screening technology from Harmony and artificial intelligence to partition wells and produce hyperbolic parameters that lead to accurate oil production forecasting. And you can test future production outcomes based on a variety of well designs and parameters.

With production and completion data for every basin in North America, you can quickly identify underperforming wells and develop a strategy to increase asset performance. Evaluate their drilling and completions designs to determine if the culprit is geology or engineering. Analyze well completion trends across the basin and decide which wells are candidates for recompletions.

In a market environment that generates plenty of uncertainties, our Platts Forward Curves offer an independent, verifiable source to help validate models and asset valuations, project future revenues and expenses, and better align risk tolerance with business strategy. Platts Forward Curves help you to immediately assign value to future production and assess the economic impact of underperforming wells over time.

Get the edge in today’s global markets with our Essential Intelligence® delivered through the providers and platforms which suit you.

For decades, we've monitored the global energy sector, using expert insights, software, and proprietary data to help you assess value, manage risk, and seize opportunities to achieve success.

With coverage of over 200 countries and territories, we offer data that is not only comprehensive but also global in scope, supporting your international and regional projects.

Our independent expertise allows us to provide unbiased, industry-specific guidance that helps our clients navigate complex market dynamics.

Gain access to upstream data and insights delivered when and how you need it. From the established to the cutting edge – all via multiple platforms that can give you a decisive edge over the competition.

Partnering to help you achieve a successful future, our global team of upstream experts offers extensive knowledge across the entire Energy Value Chain.

We leverage advanced AI/ML technologies—from geological datasets to E&P software and analytics, to asset transaction value research—enabling AI-driven efficiencies for smarter, faster decision-making in the upstream energy industry.

Interested in this product?

Complete the form and a team member will reach out to discuss how our solutions can support you.