Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

The numbers you need to gauge markets,

ready to seize opportunities as the markets move.

Not sure what plan is right for you? Contact our team and we’ll find the subscription that works for you.

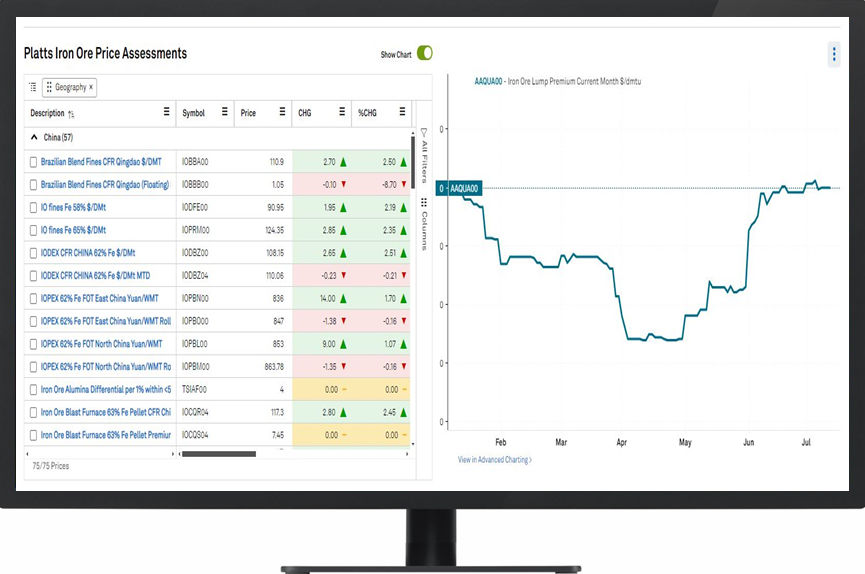

Unlock the power of informed decision-making with our comprehensive Ferrous Metals Market Data service. We offer the widest selection of global prices across the entire ferrous metals supply chain, from raw materials to downstream steel products, all in one accessible platform. Whether you're a buyer, seller, or investor in the ferrous metals market, our extensive data on steel, iron ore, coal, and scrap empowers you to analyze and compare markets effectively.

With over 14 years of daily price assessment history for iron ore and metallurgical coal, 500+ steel and scrap price assessments, and the first-to-launch carbon-accounted steel price premiums, our Platts price benchmarks are designed to enhance your trading and investment strategy within the ferrous metals market.

Monitor dynamic commodity markets with extensive price data, so you can confidently negotiate contracts, manage risk, and develop your trade and investment strategies.

Professionals across the industry trust our ferrous metals market data every day.

Platts publish daily price assessments that serve as the foundation for your contracts, providing you with the flexibility to capitalize on market fluctuations and negotiate with confidence.

Every day, traders and producers rely on our prices globally to navigate ferrous metals market trends, inform pricing decisions, and mitigate risks in volatile commodity markets.

With access to our comprehensive Ferrous Metals Market Data, gain full price history so you can dive into historical price trends, analyze market patterns, and strategize your next moves to stay ahead of the competition within the ferrous metals market.

Our data can be delivered how it best suits your systems, whether it’s via desktop or mobile through S&P Global Energy Core, cloud services, data feed or API solutions.

We are widely trusted in the global market for providing independent, unbiased Platts assessment process. We gather data from a diverse range of market participants, applying rigorous quality control measures, and adhering to strict editorial guidelines and IOSCO principles.

Platts publish daily price assessments that serve as the foundation for your contracts, providing you with the flexibility to capitalize on market fluctuations and negotiate with confidence.

Every day, traders and producers rely on our prices globally to navigate ferrous metals market trends, inform pricing decisions, and mitigate risks in volatile commodity markets.

With access to our comprehensive Ferrous Metals Market Data, gain full price history so you can dive into historical price trends, analyze market patterns, and strategize your next moves to stay ahead of the competition within the ferrous metals market.

Our data can be delivered how it best suits your systems, whether it’s via desktop or mobile through S&P Global Energy Core, cloud services, data feed or API solutions.

We are widely trusted in the global market for providing independent, unbiased Platts assessment process. We gather data from a diverse range of market participants, applying rigorous quality control measures, and adhering to strict editorial guidelines and IOSCO principles.

Key areas for Platts price benchmarks and assessments in the iron ore and metallurgical coal include:

Key areas for Platts price benchmarks and assessments in the iron ore and metallurgical coal include:

Platts Iron Ore Index, or IODEX, is a leading global benchmark for the spot price of physical iron ore. For over 15 years It is used by steelmakers, traders, and mining companies globally to price long-term and spot contracts.

IODEX and accompanying iron ore price assessments have brought increased transparency to an industry which continues to evolve in terms of the pricing methods it employs, most recently manifest in the forms of floating price deals for physical cargoes, hedged using positions in the financial derivatives market.

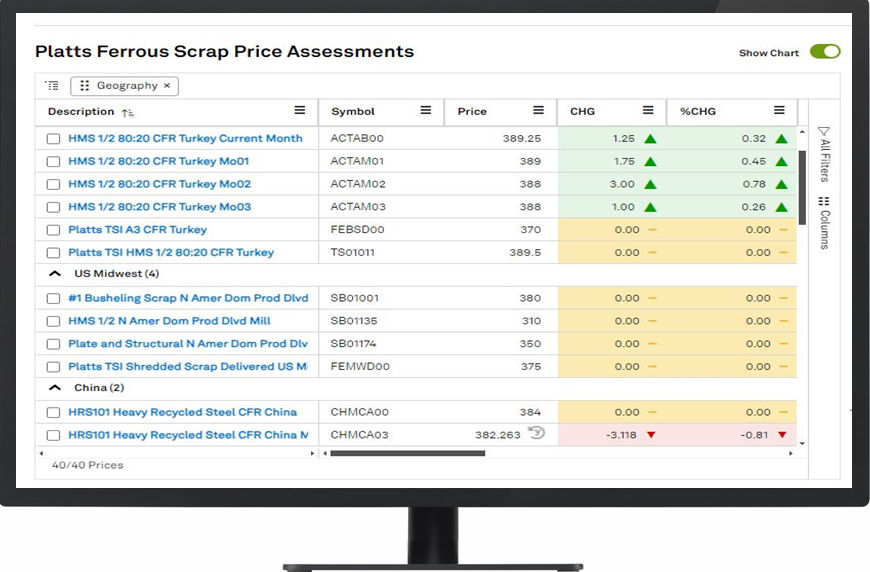

Turkey's steel scrap market plays a significant role in global steel trade, including long and flat steel products, being exported worldwide. Across the supply chain the physical spot price is used in futures contracts by commodity exchanges.

Platts TSI Heavy Melting Scrap 1/2 80:20 price assessment reflects the tradeable value of bulk ferrous scrap imports into Turkey from all supply regions. These supply regions are predominantly the US, UK, Benelux and Baltics.

Platts Turkish scrap prices are listed on LME exchange.

Through Platts' carbon-accounted steel price assessments, market participants will get daily snapshots of this important emerging market. Such illumination should aid across the value chain, from producers seeking acknowledgement of the advances made in reducing carbon at the steelmaking stage, to end-users demanding material certified by suppliers that it meets certain decarbonization criteria.

Platts CEMDEX and Clinker FOB Turkey prices are unique first-of-its-kind assessments launched to bring transparency to the cement and clinker market. As global construction surges, demand for cement and clinker is climbing—making price transparency more critical than ever. With sustainability pressures mounting, cement manufacturers face the challenge of balancing decarbonization with profitability.

Platts Iron Ore Index, or IODEX, is a leading global benchmark for the spot price of physical iron ore. For over 15 years It is used by steelmakers, traders, and mining companies globally to price long-term and spot contracts.

IODEX and accompanying iron ore price assessments have brought increased transparency to an industry which continues to evolve in terms of the pricing methods it employs, most recently manifest in the forms of floating price deals for physical cargoes, hedged using positions in the financial derivatives market.

Turkey's steel scrap market plays a significant role in global steel trade, including long and flat steel products, being exported worldwide. Across the supply chain the physical spot price is used in futures contracts by commodity exchanges.

Platts TSI Heavy Melting Scrap 1/2 80:20 price assessment reflects the tradeable value of bulk ferrous scrap imports into Turkey from all supply regions. These supply regions are predominantly the US, UK, Benelux and Baltics.

Platts Turkish scrap prices are listed on LME exchange.

Through Platts' carbon-accounted steel price assessments, market participants will get daily snapshots of this important emerging market. Such illumination should aid across the value chain, from producers seeking acknowledgement of the advances made in reducing carbon at the steelmaking stage, to end-users demanding material certified by suppliers that it meets certain decarbonization criteria.

Platts CEMDEX and Clinker FOB Turkey prices are unique first-of-its-kind assessments launched to bring transparency to the cement and clinker market. As global construction surges, demand for cement and clinker is climbing—making price transparency more critical than ever. With sustainability pressures mounting, cement manufacturers face the challenge of balancing decarbonization with profitability.

For 100+ years, we've delivered Platts price assessments for physical and forward markets. Customers count on us for news, pricing, and analytics, ensuring transparent, efficient markets for confident decisions.

With 250+ Platts benchmarks, we're the industry standard for pricing negotiations and contracts. Our proven credibility in market transparency spans established and emerging markets.

Our robust methodology guarantees data integrity with stringent quality controls, diverse sources, and adherence to strict guidelines and IOSCO principles. We openly publish methodologies and price assessments to foster trust.

Gain access to our essential intelligence direct and from multiple providers – from the established to the cutting edge – all via multiple platforms that can give you a decisive edge in today's global markets.

Globally, our extensive pricing experts, dedicated to each commodity ensure that pricing and methodology accuracy and that reflect the nuances and complexities of the markets, offering invaluable insights to clients.

Platts offers an independent and unbiased view. Our commitment to impartiality ensures that our assessments and insights are trusted by market participants.

Get the edge in today’s global markets with our Essential Intelligence® delivered through the providers and platforms which suit you.

PLATTS PRICE ASSESSMENTS

S&P Global Energy methodologies bring consistency and robustness to our price assessments through principles and parameters that guide our market specialists at every stage of the process.

Our metals solutions offer global market coverage, with our offerings split between ferrous and non-ferrous metals. Subscription services are available in three packages per metals type, including Market Insights and Market Data packages, all providing crucial metal prices information.

Interested in this product?

Complete the form and a team member will reach out to discuss how our solutions can support you.