Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Metals & Mining Theme, Ferrous

June 04, 2025

HIGHLIGHTS

Calls for urgent action to prevent steel market crisis

Says US tariffs could redirect 27 million mt of steel

EU steel exports face significant barriers from tariffs

The European Steel Association, EUROFER, has called for the urgent implementation of "highly effective" trade measures as outlined in the European Commission's Steel and Metals Action Plan, warning that without immediate action, the industry could face catastrophic consequences after the US raised blanket tariffs on steel imports to 50%.

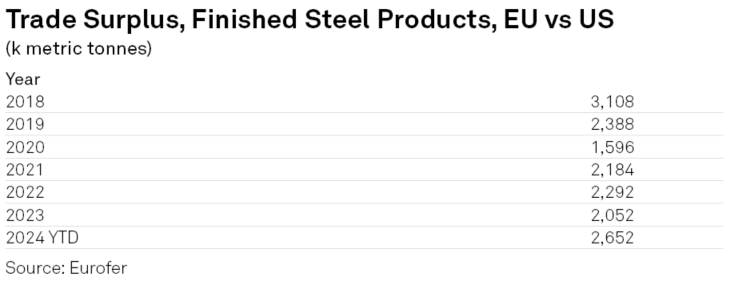

"With the doubling of US blanket tariffs on steel to 50% without exceptions, we expect massive deflection of the 27 million mt of steel previously destined for the US towards the European market, just as we saw in 2018 when the first US tariffs were introduced," said Axel Eggert, director general of EUROFER.

The current landscape is particularly dire, with import penetration in the EU reaching 30% against a backdrop of depressed demand. "Without swift action, we will not just be underwater -- we will drown," Eggert said. He urged the EC to act quickly, warning that if measures are not in place before the current EU steel safeguard expires in 2026, much of the industry could be damaged beyond repair.

Eggert noted that approximately 3.8 million mt of EU steel exports are now effectively barred from the US market due to the prohibitive tariffs, and that a 50% blanket tariff means that even Europe's highest-quality, most competitive steel products will be priced out.

A negotiated EU-US solution is paramount to preserving European steel exports, Eggert said. "The US and the EU should reopen negotiations, stalled in 2024, to address global overcapacity jointly."

Global excess capacity was estimated at 602 million mt in 2024 and is forecast to reach 721 million mt by 2027.

According to the OECD, global steelmaking capacity is expected to increase by up to 6.7%, or 165 million mt, from 2025 to 2027, exacerbating excess capacity. This increase is driven by rapid ongoing capacity expansions in Southeast Asia and the Middle East, coupled with declining steel demand in key markets such as China. As a result, rising oversupply is dampening steel prices and affecting other markets.

German steel association WV Stahl was the first association to make a statement after Trump announced the new tariffs, saying the move marked a new escalation in the trans-Atlantic trade conflict and would put "massive pressure" on the European steel industry.

"A 50% levy on steel exports is a massive burden for our industry, as it will further increase the pressure on an already crisis-ridden economy and impact our steel industry in many ways," WV Stahl Managing Director Kerstin Maria Rippel said.

She said the measures would add a greater burden on direct exports to the US, while indirectly, traditional supplier countries would divert their steel to the EU, intensifying the already considerable import pressure on Europe. Rippel said 1 mt of steel out of 3 mt was already imported, with 3 million-4 million mt/year coming from Russia.

The US is the second-largest export market for EU steelmakers, accounting for 16% of total EU steel exports in 2024. In 2023, Germany was the sixth-largest exporter of steel products to the US, after Japan, South Korea, Mexico, Brazil and Canada, with 1.041 million mt supplied, according to the American Iron and Steel Institute. In 2017, before the first tariffs were imposed by Trump, Germany exported 1.52 million mt to the US.

Platts, part of S&P Global Energy, assessed hot-rolled coil in Northwest Europe at Eur615/mt ex-works Ruhr June 3, stable day over day.

Products & Solutions

Editor: