Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Energy Transition, Carbon, Emissions

October 28, 2025

HIGHLIGHTS

About half of 2023 vintage credit volumes already retired

Kuamut's new vintages 2022 and 2023 were issued in August

Kuamut (removal) credits priced at $25-$26/mtCO2e: traders

Nearly one-third of the newly issued 2022 and 2023 vintages of the Kuamut Rainforest Conservation Project carbon credits under Verra have already been retired, according to registry data analyzed by Platts, underscoring firm demand for high-quality, nature-based offsets.

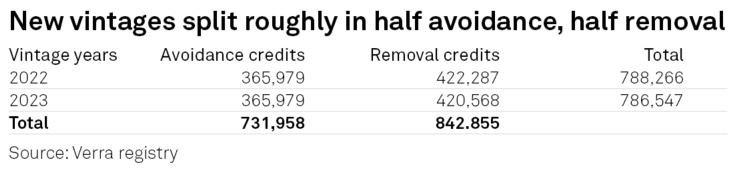

The two vintages, issued in late August, totaled 1.6 million carbon credits, 786,547 from 2023 and 788,266 from 2022. As of Oct. 28, around 339,500 credits (43.2%) of the 2023 issuance had been retired, alongside 187,359 credits (23.8%) of the 2022 vintage.

This rapid uptake, within just two months of issuance, highlights the appeal of Kuamut’s high-integrity profile among corporate buyers.

“[There has been] strong demand for Kuamut… a rare instance for an IFM [Improved Forest Management] project outside the Americas,” Chamss Ould, head of carbon at dClimate, told Platts, part of S&P Global Energy.

In October alone, Australia’s GHD Group and Italy’s Eni Plenitude SPA Società Benefit retired 18,500 credits from the 2023 vintage. For the 2022 vintage, a total of 181,859 credits were retired by GHD Group, Singapore’s GIC Private Limited, Eni Plenitude, Eni Gas & Power France, and Malayan Banking Berhad.

"Buyers in the voluntary carbon market have grown increasingly selective, with purchase decisions heavily influenced by project ratings, certification standards, co-benefits, and transparency.

In the nature-based segment, Kuamut has stood out for its strong certification credentials and its status as a premium Agriculture, Forestry and Other Land Use, or AFOLU, activity through IFM.

Urvesh Kotecha, chief commercial officer at Permian Global, noted that established buyers, especially those purchasing at scale, continue to see value in both avoidance as well as removal types of credits.

Permian Global is one of the major investors in the project, which was developed as a public–private partnership between Malaysia’s Sabah Forestry Department, Rakyat Berjaya Sdn Bhd, and Permian Malaysia, a subsidiary of Permian Global.

The latest vintages received triple Gold distinctions -- Climate Gold, Community Gold, and Biodiversity Gold -- under the Climate, Community & Biodiversity (CCB) Standards. This is an upgrade from earlier vintages that achieved only Climate Gold.

“Kuamut’s traction reflects more than its biodiversity and community co-benefits,” said Ould. “It’s also one of the few IFM projects outside the Americas … clear climate goals and is building an emerging policy framework for carbon markets and nature-based solutions.”

Kuamut is registered under Verra’s VM0010 methodology, which typically commands a price premium over other AFOLU project types due to its higher perceived integrity and broader co-benefits.

The methodology generates credits from two main activities: preventing planned timber harvests (avoided emissions) and enabling new forest growth (carbon removals). Unlike other IFM protocols limited to specific regions, VM0010 applies broadly to tropical, temperate, and boreal forests.

Its latest version requires developers to distinguish between avoidance and removal credits, which is important for companies seeking specific instruments to meet net-zero targets.

The differentiation between credits generated from avoidance activities and those from carbon dioxide removals has allowed the separately labelled credits to be traded at different prices, Kotecha told Platts in an email.

According to traders, Kuamut removal credits for 2022-2023 vintages were indicatively priced at $25-$26/mtCO₂e, while avoidance credits were around $20/mtCOe.

The share of carbon removals tends to grow over time and in projects where forests grow quickly or are actively managed, while avoided logging is usually more important in the early stages or in areas where a lot of logging would otherwise occur, according to Ould.

"Parts of the forest had undergone severe degradation prior to us establishing the project. Since then, there has been a considerable amount of regeneration," Kotecha said, adding that for the 2022 and 2023 vintage credits, approximately 46% are from avoidance activities and 54% from removals..

Demand for voluntary carbon credits typically improves toward the end of the year as corporates scramble to offset their annual emissions, market sources said.

“End corporates are not that keen on REDD+ as a whole … mainly Kuamut, Rimba Raya, and Katingan [are garnering demand],” a Singapore-based trader told Platts. "[Price for] Kuamut is rising."

However, premium pricing remains a hurdle for some buyers.

“A few of our clients were looking at Kuamut too, but it is too expensive,” another Singapore-based trader said. “There was a demand for 20,000 credits for Kuamut last week, but no target price.”

The Kuamut Rainforest Conservation Project aims to conserve 83,381 hectares of rainforest in Sabah, Malaysia, through enhanced land-use management. The project, operational through December 2045, is expected to generate approximately 16.3 million carbon credits over 30 years, averaging about 543,000 credits annually.

After applying a 12% buffer discount rate, 1.6 million credits were eligible for issuance for the 2022-2023 monitoring period.

With its strong retirement rate, triple CCB Gold certification, and transparent labeling of avoidance and removal units, Kuamut is potentially a benchmark for high-integrity IFM credits in Asia.

Products & Solutions

Editor: