Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Agriculture, Energy Transition, Natural Gas, Biofuel, Renewables, Emissions

June 03, 2025

HIGHLIGHTS

US RNG facility total grows to 914

Biogas Council urges legislative action on biogas

Platts’ assessed premiums for RNG drop on year

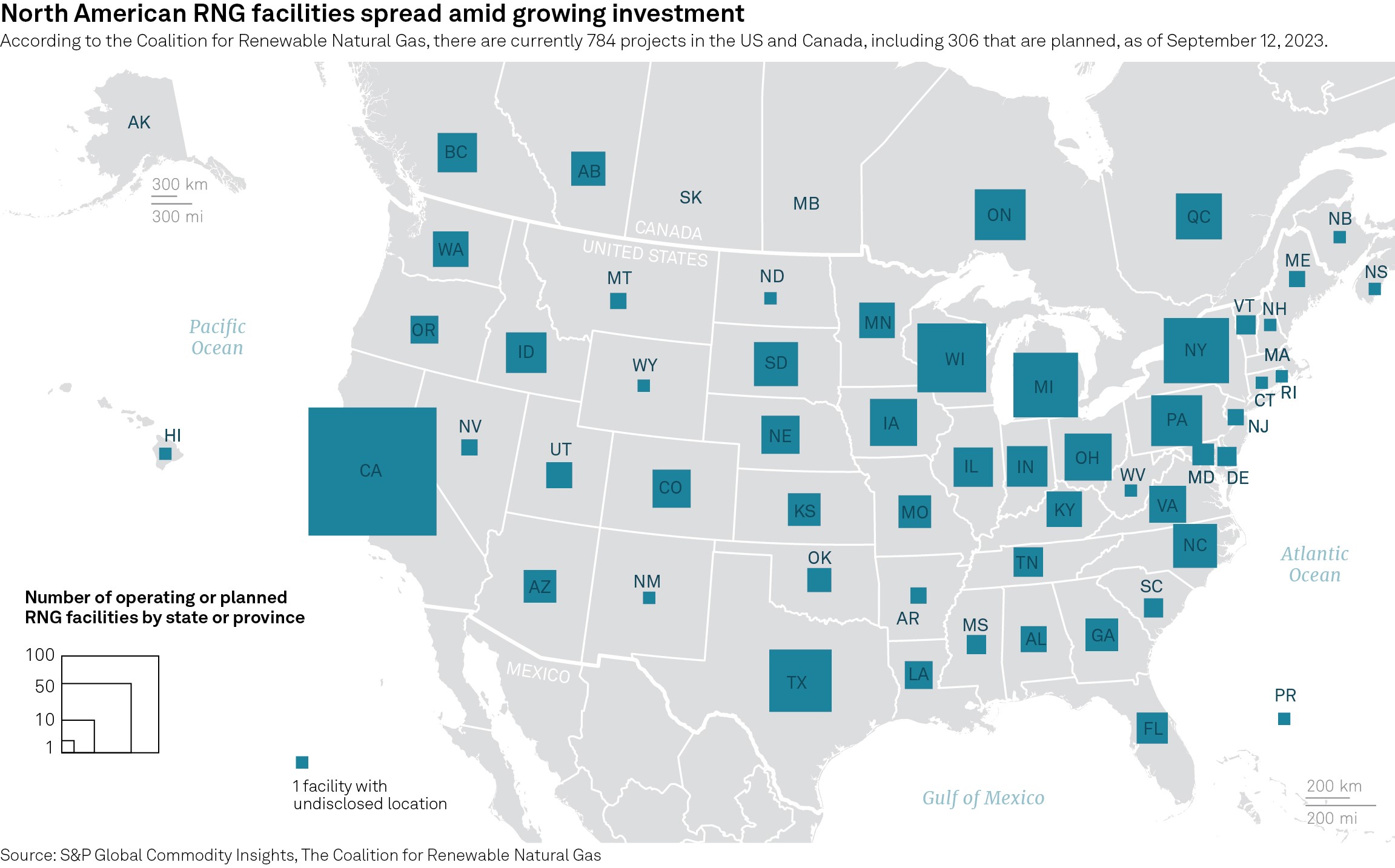

The US renewable natural gas sector is expanding, with the total number of facilities increasing to 914, driven by legislative support despite declining market premiums.

States like California and Texas have seen the most of this growth, while the American Biogas Council urges further legislative action to enhance biogas production.

There are currently 914 RNG feedstock facilities in development or operation in the US, up from the 781 reported in July 2023, according to data from the RNG Coalition.

"The market growth is likely to continue as long as the favorable legislation does," Erin Tully, an analyst at S&P Global Energy, said.

Several states in the US have grown RNG infrastructure. California currently has the highest total of feedstock infrastructure in the US, with 219 facilities, up from 177 in July 2023. With the growing number of facilities in California, low carbon fuel standard prices in the state have been slipping since 2024.

Platts, part of Energy, assessed the LCFS carbon credit price at $47.50/mt on June 2, flat on the day, but up $2.25 year on year.

Similarly, Texas has seen the number of facilities rise to 56 from 35 since 2023. New York and Wisconsin have also seen notable increases. New York currently has 45 facilities, up from 36, and Wisconsin has 60, up from 29. Oklahoma has more than doubled its facility count, jumping to 12 from five, according to data from the RNG Coalition.

Conversely, some states have experienced stagnation or minimal growth. Vermont's facility count remains unchanged at three facilities since 2023, while Washington has seen a slight increase to 12 from 10. Indiana has faced a decline, losing one facility to drop to 15. Additionally, Pennsylvania has seen a decrease to 24 facilities from 26, while North Dakota's count stays at one. Conversely, Ohio has increased its total by one to reach 23 facilities in the period.

The trend in Canada mirrors some of the stagnation seen in the US. The number of facilities in British Columbia remains stable at 15, while Alberta's count has declined to 10 from 11. Ontario has seen growth, increasing its facility count to 34 from 25.

The American Biogas Council reports that only 14.7% of potential biogas systems, which serve as feedstocks for RNG produced through the anaerobic digestion of organic matter, have been built in the US. Expanding these systems could tap into waste resources, including nearly 1 million dry tons of wastewater sludge, 33 million dry tons of inedible food waste and 1.4 billion dry tons of manure from farms annually.

Additionally, more than 470 landfills currently flare gas that could be harnessed for energy. Increasing biogas systems could generate about 3,632 Bcf of biogas each year, the American Biogas Council said.

Should this untapped biogas potential be realized, supply in the RNG space could grow significantly, reducing dependence on greenhouse gases while repurposing waste to create an environmentally friendly energy alternative. With large volumes of RNG being injected into pipelines, the current bearish demand sentiment could shift as corporations across the US continue initiatives reliant on renewable energy.

Looking ahead, recent favorable national and state legislation introduced or passed point to a potentially bullish direction for biogas production systems

On the regulatory side, the US House passed reconciliation legislation on May 22 that extended the Clean Fuel Production Tax Credit. This federal tax incentive is for the production of clean transportation fuels, including RNG.

The American Biogas Council has commended this move, emphasizing its importance in refining the carbon intensity scoring for manure-based biogas projects.

"The American Biogas Council welcomes House passage of legislation that extends the Section 45Z Clean Fuel Production Tax Credit and makes crucial changes to carbon intensity scoring for manure-based biogas projects," Patrick Serfass, ABC executive director, said.

ABC "urges the Senate to follow quickly suit" by passing legislation that incorporates provisions favorable to biogas. These measures are expected to accelerate the deployment of biogas systems that convert organic materials, such as manure, food waste, and wastewater solids, into clean energy.

Additionally, the council advocated for the Senate to extend support for biogas systems under the clean electricity and clean hydrogen tax credits. These credits are vital for farmers, municipalities and other operators who are unable to utilize Section 45Z but still aim to generate renewable energy from decomposable waste.

Recent polling indicates that three out of four US voters support increased biogas production and federal funding to facilitate this growth as a solution for waste reduction and energy production, according to data from ABC.

California dairy farmers could also see incentives for biogas production.

"The California Clean Fuel Standard allows dairy methane to generate credits for avoided emissions, meaning RNG can generate magnitudes more credits per unit than any other fuel in the program," Tully said. "It also allows RNG to use the book-and-claim system, meaning RNG does not need to be physically delivered to California to qualify for credits."

In a significant move for environmental reform, Washington Governor Bob Ferguson signed several waste and recycling bills, including the Recycling Reform Act, which represents the largest overhaul of the state's recycling system in decades. Among the new laws is HB 1409, which sets an ambitious target for fuel suppliers to cut carbon intensity by 45% by 2038, boosting demand for RNG and marking a pivotal step in Washington's transition to renewable fuels. Notably, Washington has not seen much growth in feedstock facility count over the last two years, increasing only from 10 to 12 facilities.

In the past year, the premiums for RNG across the US have also seen a notable decline.

Platts assessed the non-California landfill RNG premium at $21.80 /MMBtu on June 2, about 20% lower than the $27.26/MMBtu assessment a year prior. Similarly, the premium for California landfill RNG was assessed at $26.35/MMBtu on June 2, about 10% lower on the year.

The D3 Renewable Identification Number price has also slipped on the year, assessed at 232 cents/RIN on June 2, compared to 320.25 cents/RIN a year prior, down 28%.

D3 RINs are linked to RNG through the US Renewable Fuel Standard program, which mandates the blending of renewable fuels into the transportation fuel supply. RNG produced from organic waste can qualify for D3 RINs, providing financial incentives for producers and adding market value to their products.

Market participants noted slowdowns in RIN generation, leading to an expectation for forward supply constraints.

Energy data showed that during April, RIN production was down 88.5% on the month at 11.2 million cellulosic D3 RINs.

Products & Solutions

Editor: