Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Electric Power, Energy Transition, Renewables

February 28, 2025

By Maxim Grama

HIGHLIGHTS

ERCOT West Hub bitcoin mining sets within $40-$50/MWh

Market expects AI inference models to raise energy demand

'Bitcoin mining sites will transition towards AI computing': Stoewer

The Bitcoin Energy Consumption Index has rebounded from a monthly low of 1.17 GWh recorded Feb. 25, according to data from S&P Global Energy.

This index measures the energy consumption per bitcoin mined using a standard graphics card, specifically the Antminer S19 Pro, which operates at an average hashrate of 110 TeraHashes per second (TH/s) and consumes 3.25 kW.

"We do not believe most miners are at the point yet where they will shut off due to another $10k drop in BTC price," Alex Stoewer, COO of Digital Power Optimization, said.

Stoewer noted that bitcoin prices would need to decline by more than 20% before it becomes economically viable to shut down a significant number of 2022-vintage machines.

"Our 2022-vintage ASICs, for example, still earn over $60/MWh, which is more than double our $26/MWh opportunity cost of power at our Wisconsin hydro asset. Our newer ASICs earn over $120/MWh," Stoewer said.

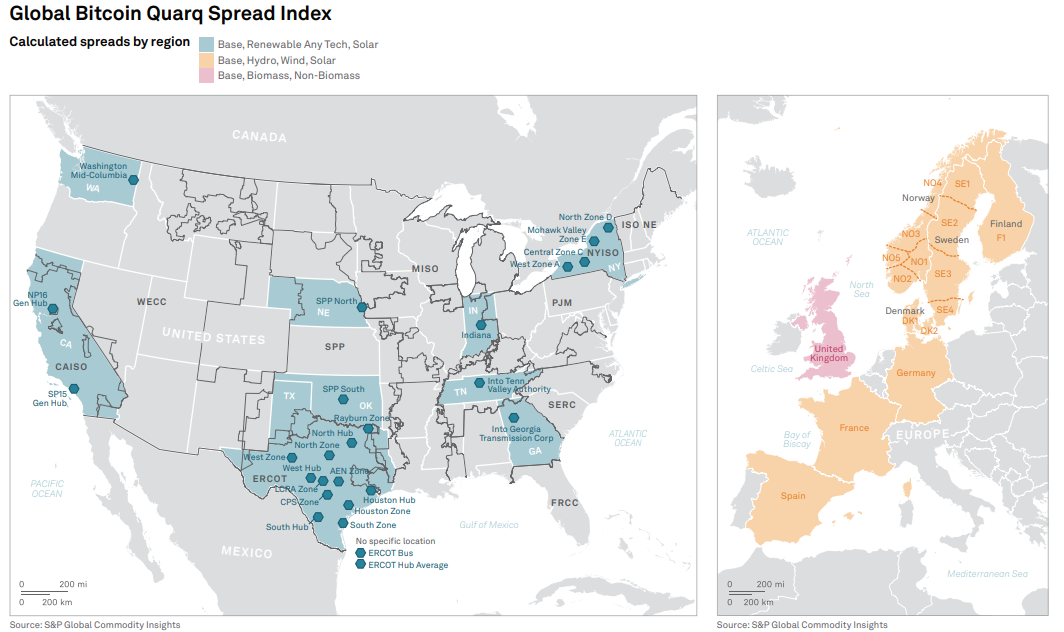

Platts, part of S&P Global Energy, Renewable Bitcoin Quarq Spreads Index indicates that profitability in the ERCOT West Hub has rebounded to the $40-$50/MWh range, but it is still holding the discount to Norway's NO4 zone.

The Renewable Bitcoin Quarq Spreads index illustrates bitcoin mining profitability based on grid-delivered electricity, factoring in renewable certificates across 43 regions in the US and Europe.

Significant investments have also been announced in High-Performance Compute (HPC) Data Center infrastructure to support the rapid advancements in artificial intelligence (AI) models.

An increased demand for power is expected as AI models evolve towards inference from pre-training and post-training. This surge in power requirements raises a critical question: will there be sufficient power capacity available on the most constrained days, typically during midday heat waves or extreme cold snaps, to support not only the data centers but also other essential services?

To address this challenge, backup generation already on-site at data centers will need to be opened up as a grid resource. Additionally, agreements among data centers to curtail their load during rare grid events may be needed to prevent power shortages.

"If the data center and utility industries don't gain the flexibility to do that, we will need either a breakthrough in energy storage or many more gas peaker plants to ensure capacity for everyone," Stoewer said. "Over time, bitcoin mining at average sites without differentiated power costs will become a weak business. We believe many bitcoin mining sites will transition to AI computing."

Many Bitcoin mining sites are well-suited for HPC and AI applications, primarily due to their immediate access to substantial load interconnections.

"We believe that as their ASICs age, many bitcoin miners will opt to convert their sites to AI/HPC development rather than replace the old ASICs," Stoewer concluded.

Platts assessed the National Green-e Certificates REC Any tech at $2.55/MWh and Texas SREC current-year at $2.13/MWh Feb. 27.

Platts assessed Nordic hydro and EU solar current-year Guarantees of Origin at Eur0.73/MWh and Eur0.71/MWh, respectively, Feb. 27.