Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Research & Insights

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Research & Insights

Coal

January 22, 2025

By Lizzie Ko and Olivia Zhang

HIGHLIGHTS

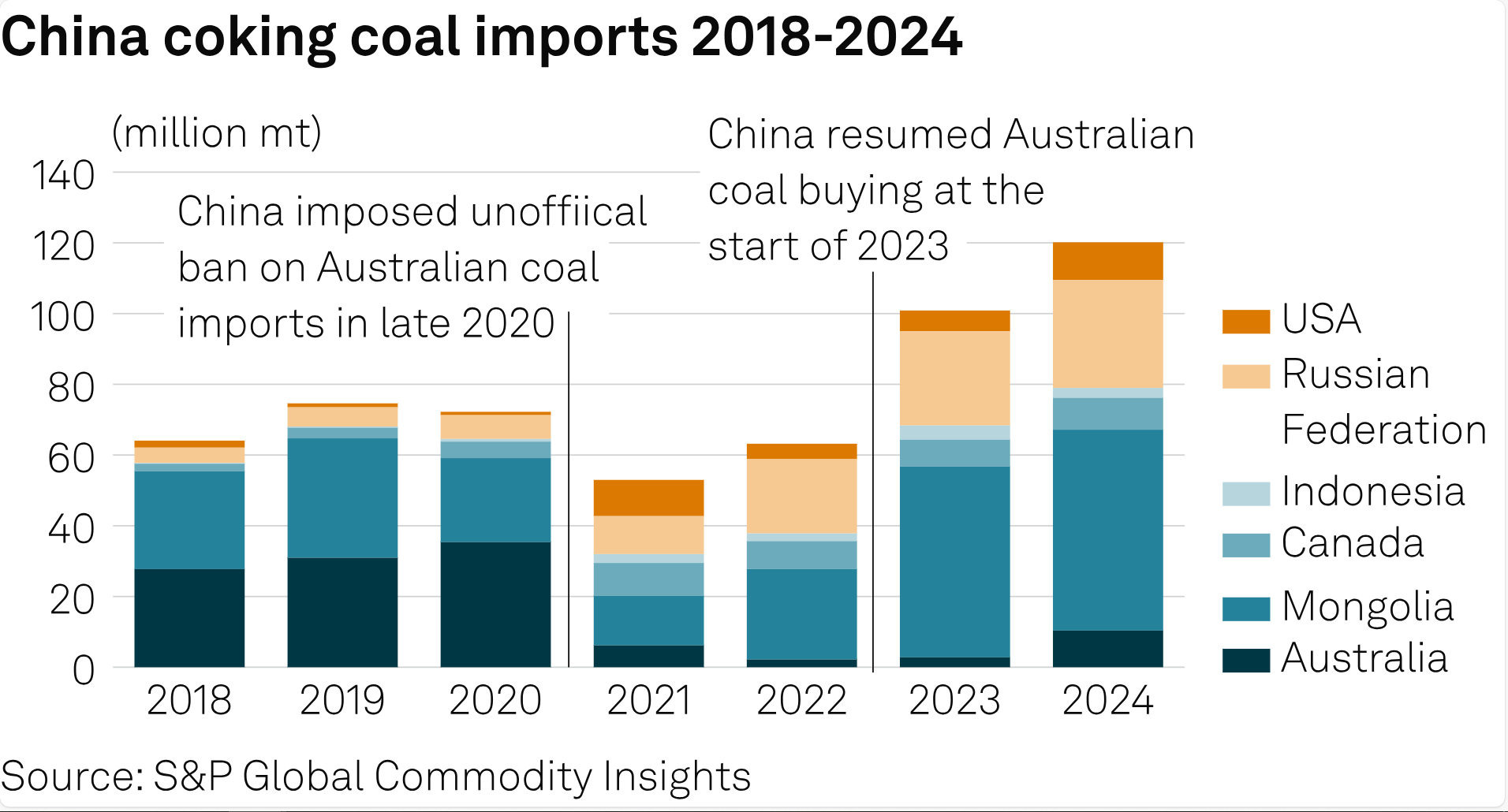

China’s metallurgical coal imports rise 19%

Australian coal inflows surge 270% YOY

China's metallurgical coal import rose 19% year over year reaching around 122 million mt in 2024, as imports across varied origins booked year-over-year increase amid a slowdown in the steelmaking industries in ex-China markets, according to customs data released Jan. 21.

Imports from Mongolia via the land borders stood at 56.8 million mt, up 5% from the prior year, accounting for 46% of the country's total import volume. Inflow from Russia increased 14.5% in the same period to 30.5 million mt as China remained the major destination as Washington stepped up sanctions on Russian miners.

Australian imports surged 270% on the year to 10.4 million mt, accounting for 8.5% of the total, making Australia the fourth largest supplier, trailing Mongolia, Russia and the US. The increase was more substantial in the second half of 2024, and the Australian import volume reached its all-year high in November at 1.8 million mt.

Prior to that, the delivered prices of premium hard coking coal to China demonstrated a downtrend in the third quarter. Platts, part of S&P Global Energy, assessed Premium Low Vol Hard Coking Coal at $195/mt CFR China on Sept. 10, down from $246/mt at the beginning of the quarter.

However, prices started to rebound in the second half of September and maintained upward momentum in the first half of October amid a pickup in buying interest from China for forward delivery prime coal cargoes, fueled by expectations of government economic stimulus measures.

Some of the China-based market participants said Australian coal inflow to China could continue to grow in 2025 if China remains the destination of last resort amid lukewarm demand overseas. A Chinese steelmaker said imports from the US could dry up if Beijing retaliates against US tariff increases on Chinese imports and thus make way for coal of alternative origins, especially those from Australia and Canada.

The US booked 10.7 million of imports to China, up 81% year over year. Canadian coal imports rose almost 19% year over year to 9 million mt.

In the coke segment, Chinese exports declined 6% year over year to 8.3 million mt, and that was accompanied by a 31.5% year over year decrease in the export volume to India, at 903,651 mt. Several Chinese coke suppliers attributed the decreased volume to the more competitive offers from their Indonesian peers.

The customs data also showed that China imported 128,397 mt of coke in 2024, down 46% year over year, with Russian coke as the main bulk at 62,670 mt. Indonesian coke, which was once deemed not economically viable to end-users due to the value-added tax (VAT) in China, had a steady inflow in the fourth quarter, with 15,000 mt to 21,000 mt imports recorded each month.

Indonesian coke producers will be prompted to reduce their production or find alternative destinations as India has put in place a country-wise import quota for low-ash met coke in the January-June 2025 period. While Indonesian coke has made its inroads into the Chinese market in recent months, the VAT being imposed on the imports would still make the products less attractive to most of the end-users in China, a Chinese coke trader noted.