Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Chemicals, Polymers

May 01, 2025

HIGHLIGHTS

R-PE prices rise despite oversupply

R-PET spread widens in April

Recycled styrenics spread narrows

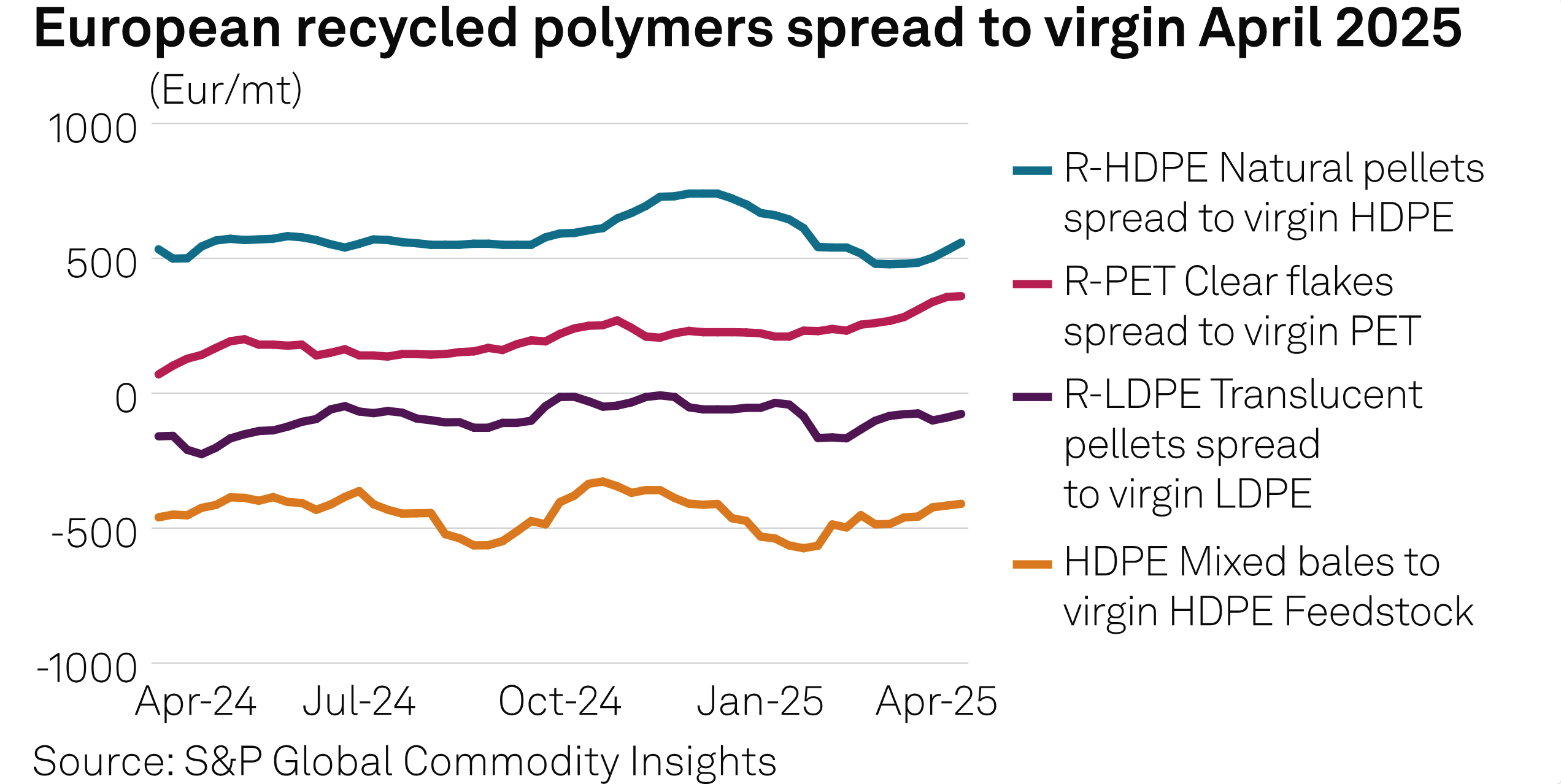

In April, European recycled polymer markets experienced overall price increases across various recycled materials, with notable widening spreads compared with virgin materials, driven by shifts in demand and supply dynamics.

European recycled high-density natural pellet spot prices strengthened through April due to a marginal demand increase from the cosmetics and packaging sectors, despite oversupply in the virgin HDPE market, which hampered domestic trading activity.

Platts, part of S&P Global Energy, assessed R-HDPE natural pellets at a Eur478/mt ($541.70/mt) premium to virgin on April 30, down Eur62/mt from Eur480/mt at the start of the month.

European recycled low-density translucent pellet spot prices also strengthened throughout April, though to a lesser extent than R-HDPE natural. Supply and demand dynamics remained stable, prompting steady pricing for R-LDPE pellets across the month, despite the tightening supply of LDPE bales.

Platts assessed R-LDPE translucent pellets at a Eur84/mt discount to virgin on April 30, down Eur83/mt from Eur75/mt at the start of the month.

Throughout the month overall, both recycled polyethylene markets saw price strengthening driven by pockets of marginal demand upticks. However, overall appetite for R-LDPE and R-HDPE remained low, with key sectors such as construction and automotive continuing to see a lack of appetite, with market players harboring more positive sentiment closer to summer.

Demand fundamentals weakened during the second half of April for black and natural pellets, leading to softer pricing across the month despite tightness in the supply of bales for black pellets.

For much of the month, black pellets continued to see a boost from seasonal demand in the gardening sector, as manufacturers sought material ahead of stocking for the summer gardening season. However, this demand has started to diminish, as manufacturers have gradually fulfilled their stocking requirements.

A weakening in demand subsequently balanced a tightening of supply amid limited availability of PP bale feedstock, resulting in softer pricing fundamentals.

Platts assessed the monthly average price for PP black pellets DDP NWE at Eur853.75/mt in April, down Eur11.97/mt compared with the March monthly average.

Natural pellets also saw a price decrease month over month. While packaging demand remained resilient, natural pellet demand has been more exposed than black pellets to weak economic fundamentals that have resulted in poor ongoing demand from the construction and automotive sectors.

Platts assessed PP natural pellets DDP NWE at Eur1,731/mt in April, down Eur27.1/mt compared to the March monthly average.

In the European recycled polyethylene terephthalate market, the spread between virgin and recycled PET continued to widen in April, amid softer virgin prices.

The virgin PET spot price continued a downward trend amid overall weak demand and softer feedstock costs. With the virgin PET spot price falling in April, while R-PET prices rose, the spread between the two widened, with consumers indicating a greater preference for virgin PET.

"We have consumers asking to switch to virgin PET because of the current delta," a consumer said. "If preform buyers are looking for more recycled content, they will opt for Asian food-grade pellets, which are priced close to European flake price."

Platts assessed the recycled polyethylene terephthalate free-delivered Northwest Europe food-grade pellet spot price at Eur1,680/mt April 30, up Eur20/mt month over month, at a Eur686/mt premium to Virgin PET FD NWE.

Despite weak demand, R-PET prices rose this month as clear flakes saw strong demand and tight conditions, further supporting the pellet spot price.

In the recycled polystyrene market, the price spread between virgin HIIPS and recycled polystyrene black pellets narrowed in April due to rising prices in the recycled market. This came about because of persistent supply tightness in the recycled polystyrene market.

Platts assessed the recycled polystyrene black pellet spread to virgin HIIPS DDP NWE at Eur670/mt, narrowing Eur30/mt from April 2.

The recycled ABS market also saw the spread between virgin and recycled material narrow. This is due to virgin ABS prices falling amid weak purchasing demand, while the recycled ABS market maintained largely stable conditions.

Platts assessed the recycled ABS black pellet spread to virgin ABS DDP NWE at a discount of Eur935/mt April 30, Eur55/mt narrower from April 2.

Products & Solutions

Editor: