Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Chemicals, Polymers

March 12, 2025

By Tareen Kazi and Gustavo Kruger

HIGHLIGHTS

Rising US demand for recycled resin limits exports to Asia

Bales remain bullish in Mexico from high demand, tight supply

Brazil keeps importing recycled PET flakes from Asia

This content is part of the WPC 2025 series, where we explore key themes from the 40th annual World Petrochemical Conference.

Trade flows for post-consumer plastic in the Americas have seen notable shifts in the past year, as new regulations emerge and recycling industries develop while feedstock supply remains a challenge.

In the US, the growing domestic recycling industry has absorbed more post-consumer recycled polyethylene, reducing the availability for export to Southeast Asia, where stricter import regulations further complicate access to feedstock. Rising import interest for post-consumer polyethylene terephthalate bottles from Mexico is driving prices higher on the US West Coast, pressuring domestic recyclers' margins.

The PET recycling industry in Brazil has increasingly relied on imported flakes to support its operations and meet strong downstream demand; however, it faces unclear legislation that has impeded some imports.

US demand for recycled polyethylene continues to rise, driven by corporate sustainability commitments and supportive legislation, which has in turn tightened the supply of high-quality scrap available for export to Southeast Asia. As domestic buyers are willing to pay more, Asian recyclers are finding it difficult to compete, and distributors have noted a decrease in waste available for export.

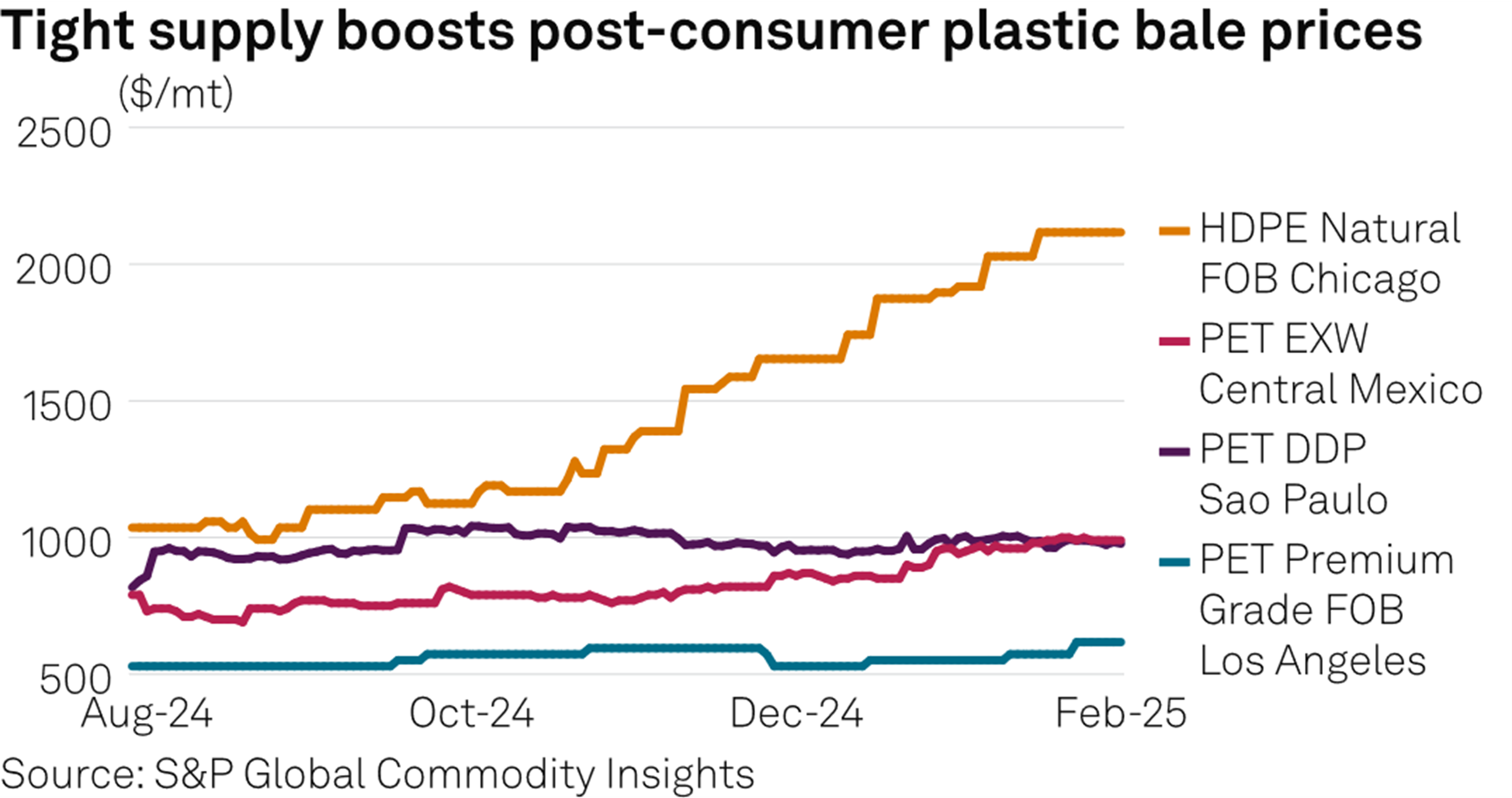

Demand for recycled high-density polyethylene skyrocketed in the past year, driven by 2025 sustainability targets.

Companies have made voluntary commitments to use more post-consumer recycled content in their packaging and manufacturing, with recycled HDPE natural highly sought out given its versatility in applications and flexibility in coloring. As supply is limited, this has led to little negotiation power for buyers procuring this material, with spot pricing surging. According to Platts data, spot pricing for recycled HDPE natural bales has surged 64 cents/lb year on year to be assessed at 96 cents/lb on March 11.

As a result, what is left for export is often secondary-grade material like recycled low-density polyethylene that requires additional sorting or processing. While recycled LDPE bales were a key US export to Asia, growing domestic LDPE processing capacity is shifting supply inward.

US recycling infrastructure is expanding, bolstered by recent acquisitions and the expansions of new mechanical and advanced recycling facilities, which are increasing the country's ability to process more post-consumer plastic waste domestically.

Advanced recycling, which can break down hard-to-recycle plastics into feedstock for new resin production, is gaining momentum and could allow for the processing of dirtier waste streams that would typically be exported.

Platts, part of S&P Global Energy, is launching a US daily spot assessment for mixed plastic waste bales, suitable as feedstock for advanced recycling via pyrolysis, effective March 12.

As advanced recycling technology continues to scale, some market participants believe the US will eventually retain even lower-quality scrap that was once sent overseas, further reducing available exports.

Simultaneously, Southeast Asian recyclers face tightening regulations on imported plastic waste, such as Thailand's and Indonesia's 2025 ban on plastic waste imports.

Platts assessed post-use LDPE Grade-A bales at 18 cents/lb FOB Chicago and Grade-B bales at 13 cents/lb FOB Chicago, both on March 11.

High demand and limited supply have kept bottle bale prices elevated in Mexico since mid-2024, driven by increased recycling production and brand sustainability efforts. Market participants are exploiting the arbitrage between USWC and Mexican post-consumer PET bales, pressuring US recycling to improve collection rates for domestic and export needs.

Mexican post-consumer bales, assessed by Platts as clear bottle bales with at least 95% PET content, have higher yields for PET flake production than US West Coast premium bales, which have a minimum of 70% PET content. But lower-quality bales from the USWC continue to compete with bales in Mexico.

Platts assessed post-consumer PET premium bales at 20.25 Mexican Pesos/kg (45.2 cents/lb) ex-works Central Mexico on March 11, while US recycled PET clear flakes were at 56 cents/lb FOB Los Angeles on March 11.

"Imported flake is killing domestic production," a US-based source said.

In Asia, purchasing interest is limited by the lack of sustainability mandates, focusing instead on exports to Europe and the US.

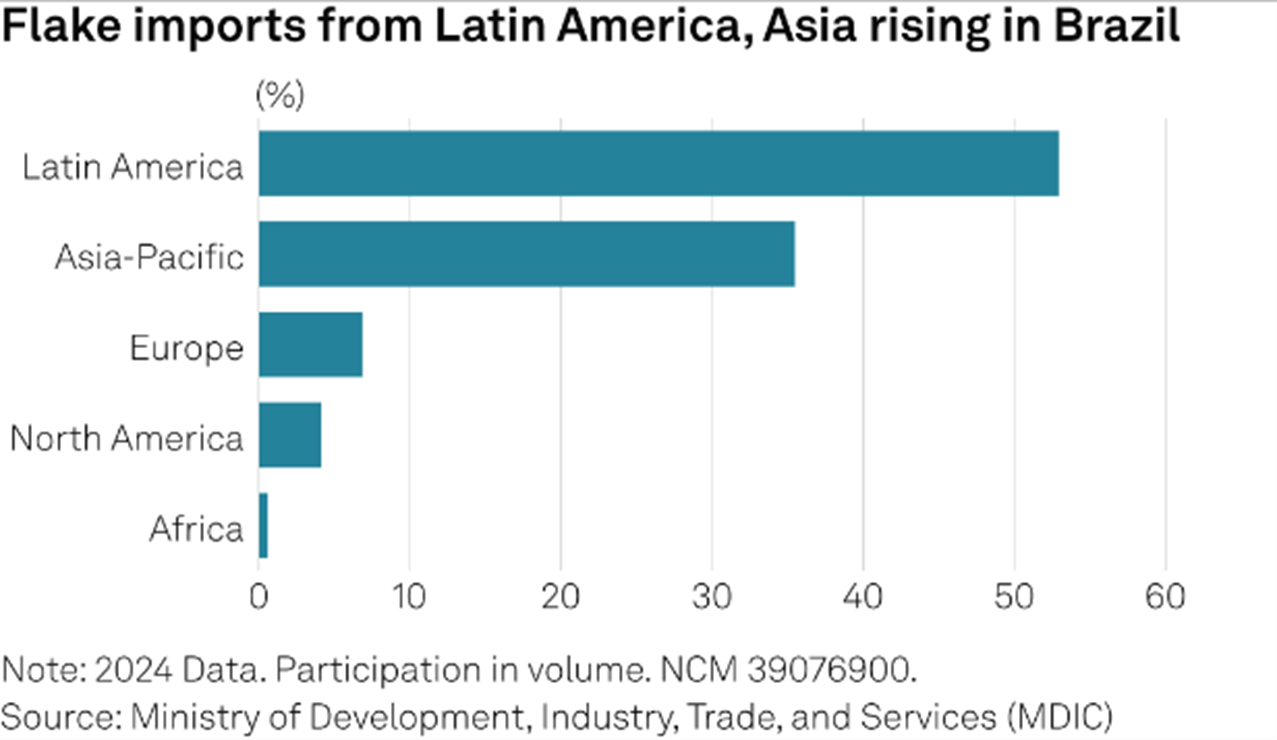

Since the second half of 2024, feedstock prices in the Brazilian R-PET market have surged sharply, driven by insufficient supply and robust demand. Flake imports have become key due to their competitive pricing and higher quality compared to some domestic alternatives.

But a ban on solid waste imports, including plastics, that took effect in January complicates these flows.

Platts assessed post-consumer PET clear bottle bales (95/5) at Real 5.60/kg DDP São Paulo on March 11. Recycled PET clear flakes were assessed at Real 9.75/kg DDP São Paulo.

Imported flakes from Asia were last heard at Real 8.10/kg DDP São Paulo, a discount of nearly 20% to domestic material.

These flakes are classified under the same product code as certain grades of virgin resin. Import figures for this product code increased by 20% year on year in net weight and 31% in financial volume in 2024, according to data from the Ministry of Development, Industry, Trade, and Services.

While sources assert the law was not intended to target flakes, recyclers warn that a ban on these imports could greatly impede the local recycling sector, as they are vital for securing feedstock.

"The law was a general disincentive to our domestic recycling chain," a recycler said. "If the authorities don't clarify this soon, no one will be making money because there will be no feedstock."