Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Agriculture, Rice

October 09, 2024

HIGHLIGHTS

Export duty cut, new crop pressure prices

Indian PB 5% retains competitiveness among origins

Bumper 2024 kharif crop to boost exports in 2024-25

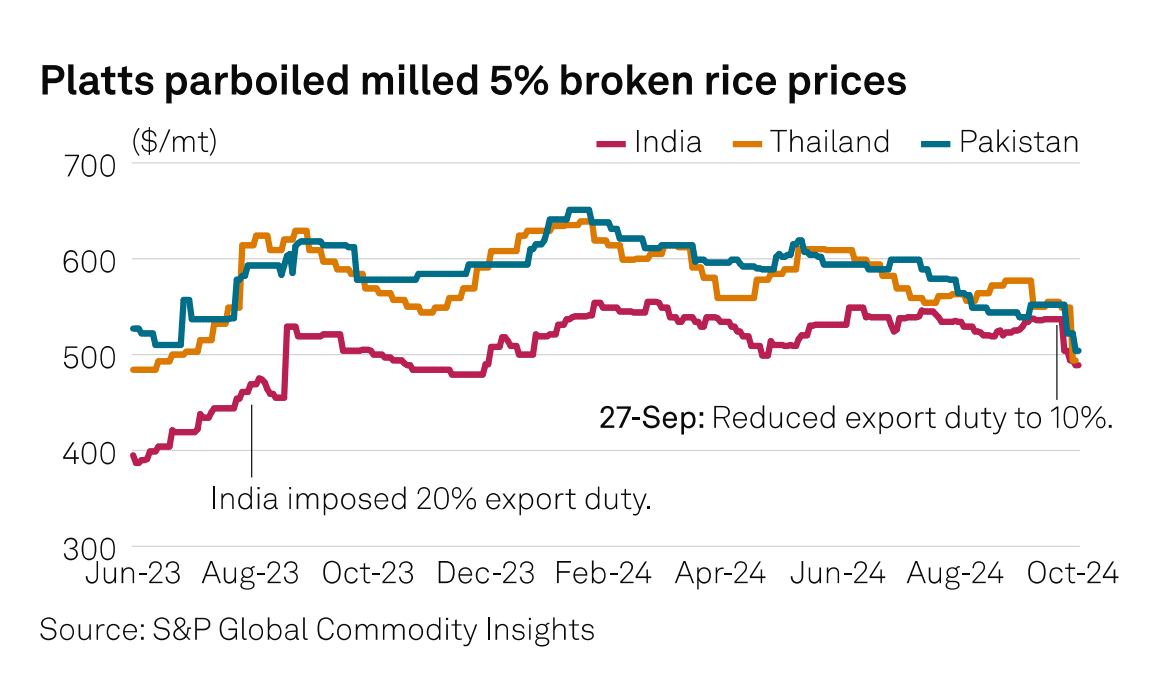

Indian parboiled milled rice 5% STX price reached a 10-month low Oct. 8, with Platts assessing it at $489 per metric ton FOB, down 3% on the year, due to the reduction in export duty on parboiled rice and new crop arrival pressure, S&P Global Commodity Insights data showed.

Indian PB 5% retains its competitiveness among other origins despite a 10% export duty and is likely to attract more international demand from price-sensitive West African destination markets.

India slashed the export duty on parboiled rice to 10% from 20% on Sept. 27 and lifted the ban on non-basmati white rice exports, but introduced a minimum export price of $490/t the following day.

Platts lowered its PB 5% STX assessment by 3% on the week and 7% on the month.

The fall is attributed to reduced duty on PB 5% exports and pressure from new crop arrival, with harvest expected to reach the market in coming weeks.

The recent rice export policy changes in India have led to a downtrend in other origin markets.

Compared to other origins, the Platts Indian parboiled 5% STX assessment was at a $15/t discount to Pakistan parboiled 5% STX and $5/t discount to the Thai parboiled 5% STX assessment on Oct. 8, Commodity Insights data showed. This showed that Indian PB 5% maintains its competitiveness over other origins.

Sources anticipate PB 5% prices to soften further as the 2024 kharif harvest enters the market after mid-October.

Kharif and rabi are the two main crop seasons in the Indian subcontinent. Kharif, also known as monsoon crops, are sown at the beginning of the rainy season, usually from July to October. Rabi, also known as winter crops, are sown after monsoon has ended, usually from October to April.

With the 2024 kharif crop expected to be a bumper harvest, India is forecast to export 20.5 million metric tons rice in marketing year 2024-25 (October-September), up 37% on the year, Commodity Insights data showed.