Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Maritime & Shipping

June 05, 2025

HIGHLIGHTS

Maersk announces $2,800 per reefer container PSS for India-US shipments

Surcharge expected to impact shrimp prices, supply chains

Adds to recent US tariffs on Indian shrimp exports, complicating situation for importers.

Higher freight rates raise concerns about shrimp pricing, supply dynamics.

Shipping company A.P. Moller-Maersk announced on June 3 a $2,800 increase in the peak season Surcharge (PSS) for shipments from the Indian Subcontinent to the US East Coast and Gulf Coast, a move that could impact shrimp prices and supply chains.

The surcharge, effective July 1, affects shipments from key shrimp-exporting nations, including India, which is the primary source of shrimp imports to the US. "I was told there's a PSS by other carriers as well," a market participant told Platts, part of S&P Global Energy, highlighting the broader implications for the industry.

The announcement adds to recent tariffs imposed by the US, which initially set a 26% duty on Indian shrimp exports, pausing such tariffs for 90 days on April 9. This tariff led to a temporary halt in exports, as Indian exporters, operating on a Delivered Duty Paid basis, were unable to absorb the additional costs.

The 90-day pause has since reduced this tariff to 10% for most countries, including India, until July 9.

The new Peak Season Surcharge of $2,800 per reefer container further complicates the situation for importers. "It doesn't surprise me, considering the steamships need to find a way to make up lost revenues while things were dormant," a US-based importer of Indian shrimp said.

Market participants estimated the freight from India to New York at $4,500 per reefer container.

While the surcharges will take effect on July 1, their potential impact on shrimp pricing and supply dynamics in the US market is already a concern for stakeholders as they prepare for the upcoming summertime season, when consumption is seasonally higher.

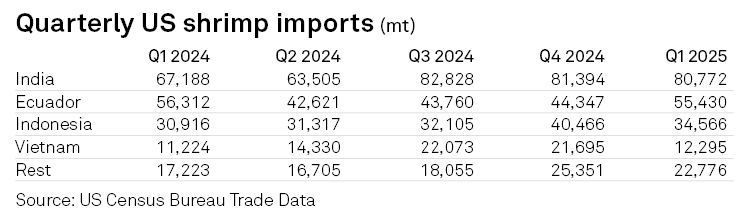

In 2024, India exported approximately 295,000 mt of shrimp to the US, accounting for nearly 40% of the total 763,000 mt imported. Ecuador, the second-largest exporter, followed with around 187,000 mt, representing about 25% of US imports. In response to changing market dynamics, Ecuador has increased its production of peeled and deveined shrimp, aiming to lessen its reliance on China, its primary export destination. As a result, Ecuador's market share in the US has risen to nearly 27% in the first quarter of 2025.

The rise in freight rates, including Maersk's new PSS, could provide Ecuador with a competitive advantage as importers reassess their sourcing strategies.

Platts is part of S&P Global Energy

Products & Solutions

Editor: