Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Agriculture, Rice

January 08, 2025

HIGHLIGHTS

Exporters lower offers on competitive Vietnamese prices, lower global demand

Vietnam's white rice remains most competitive at $429/mt FOB

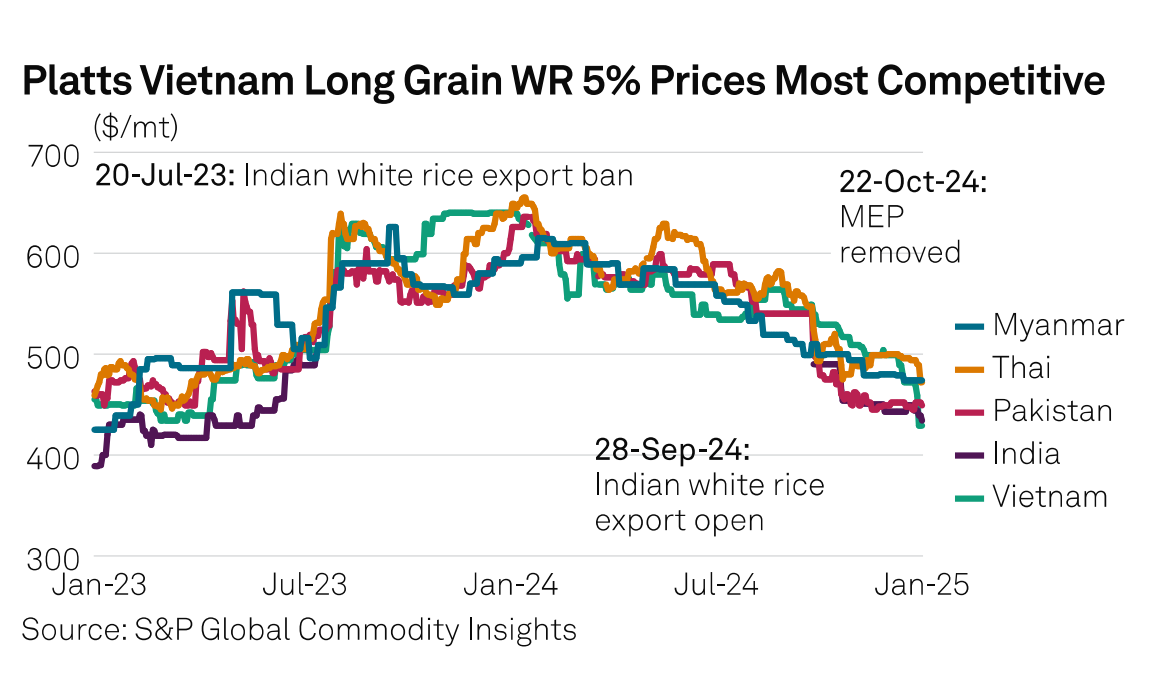

Indian 5% broken white rice prices have slumped to a 19-month low, highlighting a downtrend in the country's white rice market, S&P Global Energy data showed.

Platts assessed Indian 5% broken white rice at $434/mt FOB Jan. 8, down $9/mt month over month and $13/mt lower since May 31, 2023 when it was at $447/mt FOB, Energy data showed.

This steep price slide is likely to make Indian-origin rice competitive in the region, market sources said.

India imposed a ban on the export of white rice in July 2023. The country lifted the ban Sept. 28, 2024 on non-basmati white rice exports but introduced a minimum export price of $490/mt. Subsequently, on Oct. 23, 2024, the Ministry of Commerce and Industry announced the removal of this minimum export price for non-basmati white rice.

"Lower global demand and pressure from competitive Vietnamese prices have led to exporters lowering their FOB offers for white rice," a trader said.

As of Jan. 8, Platts assessed Thai rice at $472/mt FOB, Vietnamese rice at $429/mt FOB, Pakistani rice at $449/mt FOB, and Myanmar rice at $474/mt FOB FCL, according to data from Energy.

Despite lowered Indian 5% WR prices, Vietnam WR 5% remains most competitive and at a discount of $5/mt to Indian rice.

An Indian exporter said there is no demand for white rice locally or internationally.

"The [Indian] government is now even supplying white rice into the market through Open Market Sale scheme. Most white rice from India goes to East African countries and buying for Ramadan is also done," the exporter said.

Mirroring similar view, another India-based exporter said, "main Indian white rice destination markets are out" and that "Mozambique is currently experiencing a civil unrest, while Mombasa has import duty on rice imports."

Market participants anticipate white rice market to be bearish on higher supply unless demand rebounds from east African countries and Indonesia.

India is forecast to export 21.5 million mt of rice in the marketing year 2024-25 (October-September), up 49.3% year over year, according to Energy data.