Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Metals & Mining Theme, Maritime & Shipping, Non-Ferrous, Ferrous

June 03, 2025

By Staff

This week's Commodity Tracker highlights the reactions of various steel and aluminum associations to US President Donald Trump's recent tariff announcement, the compensation cuts pledged by OPEC+ overproducers, and the expansion of the so-called "shadow fleet" transporting sanctioned oil.

What's next? Trump's tariff announcement has spurred reactions from various steel associations. American Iron and Steel Institute CEO Kevin Dempsey welcomed the announcement, saying the tariffs would help prevent new import surges that would injure US steelmakers. Most of the US aluminum industry is calling for a consistent trade policy. Ugur Dalbeler, the CEO of Turkish steelmaker Colakoglu and vice president of Turkey's steel exporter union, said the tariffs will likely have negative repercussions on global trade, while Canadian Steel Producers Association CEO Catherine Cobden said the high tariffs "will create mass disruption and negative consequences" for US and Canadian supply chains and end-users.

Related topic: Trump and Commodities

What's happening? Compensation cuts pledged by OPEC+ overproducers are likely to limit the group's crude output growth, despite plans to increase quotas by 411,000 b/d in May, June and July. OPEC+ announced the July quota increase for eight producers implementing voluntary crude production cuts -- Saudi Arabia, Russia, Iraq, the UAE, Kuwait, Kazakhstan, Algeria and Oman -- on May 31. Analysts see the move as a further indication that the group has shifted to a strategy of prioritizing market share over shoring up oil prices. OPEC said that the move is a response to healthy market fundamentals, although some delegates have indicated that they do not support the policy at current oil prices. Platts, part of S&P Global Energy, assessed Dated Brent at $66.83/b on June 2.

What's next? OPEC+ voluntary producers will next meet on July 6 to discuss output quotas for August. The group submits revised compensation plans once a month, taking into account the previous month's production. OPEC may release details of these plans. The group can also call extraordinary meetings if it considers that market conditions require a change in strategy.

Related infographic: OPEC+ to discuss H2 crude output as geopolitics rattle markets

What's happening? The "shadow fleet" transporting sanctioned oil now consists of 940 crude and product tankers, accounting for around 17% of the global in-service tanker capacity, according to a joint study by S&P Global Energy and Market Intelligence. This compares with 591 tankers, or 10% of the global fleet, in April 2024, based on a previous study. Russia, Iran and Venezuela have been acquiring aged tankers via state or associated interests to maintain their overseas oil sales amid escalating geopolitical conflicts. This trend has accelerated since Russia's invasion of Ukraine in February 2022.

What's next? Western owners have continued to sell their old ships into the shadow fleet, often indirectly and possibly unknowingly (those deals are generally not sanctioned). Meanwhile, South Asian cash buyers are not willing to recycle shadow fleet tankers as such deals would be sanctioned. The average age of shadow fleet vessels is 20 years, raising concerns over safety and environmental risks.

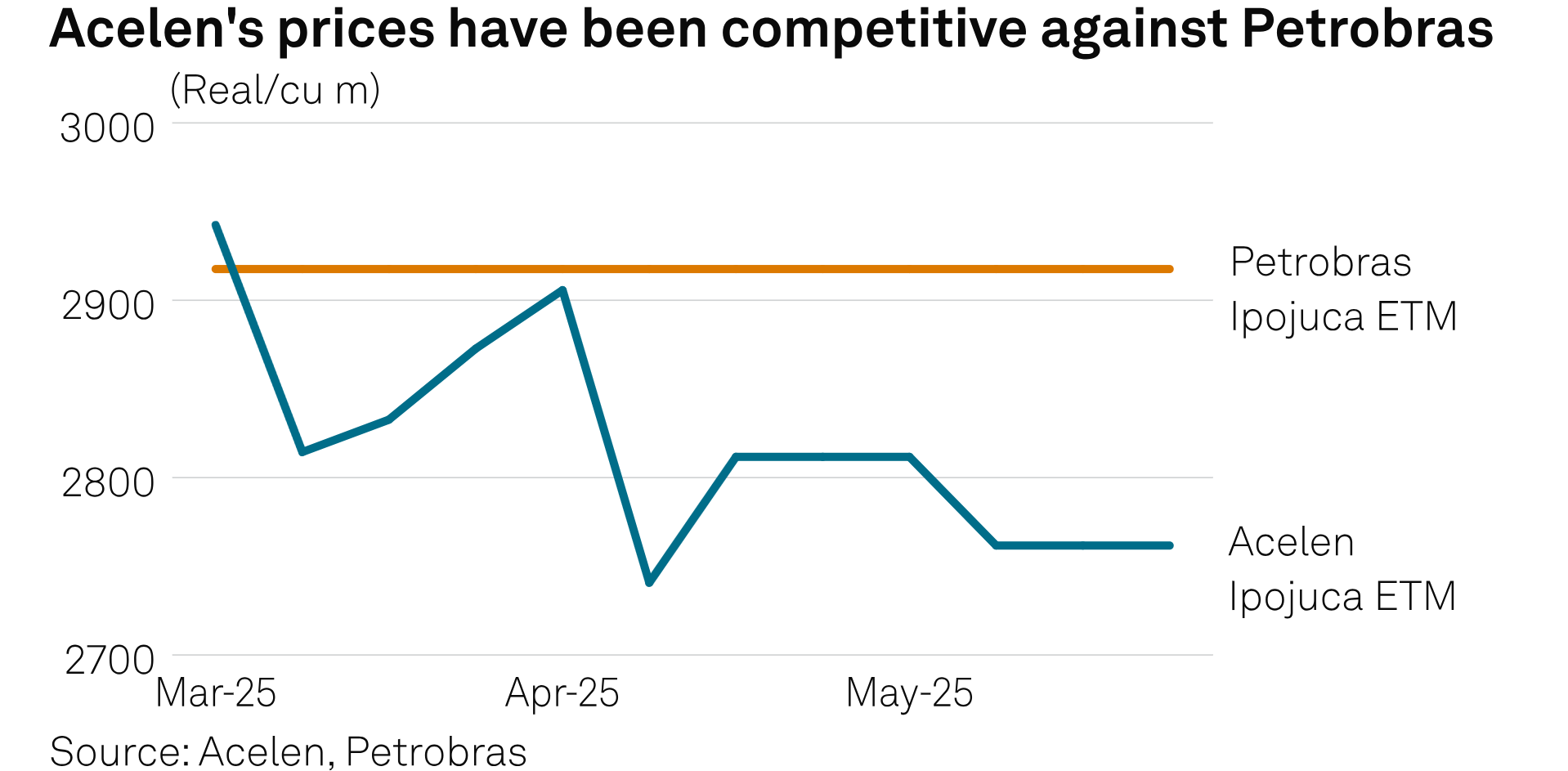

What's happening? Gasoline supplied by Petrobras has been gradually losing its appeal in Northeast Brazil since March amid more competitive prices offered by Acelen, a top private refinery in the region, and attractive opportunities arising for regional distributors to import. Acelen's prices have reached discounts as low as 160/cu m against the state-controlled company's references. A rising ethanol-gasoline parity in the northeast, coupled with a mostly open import arbitrage window, also created opportunity for regional distributors to import volumes at competitive levels. Brazil's gasoline import parity prices have been below domestic references for 45 of the 66 past business days.

What's next? Petrobras announced June 2 its first major price readjustment since July 9, 2024, an average Real 170/cu m drop, which may put the company back at a competitive position.

What's happening? Northwest European used cooking oil prices have fallen to a six-month low settling at $1,160/mt on May 29, the lowest since November 2024. This decline stems from fraud concerns weighing on UCOME premiums and shifting trade dynamics. Chinese UCO exports are increasingly diverting to Europe instead of the US due to tariff disputes and the exclusion of Chinese-origin used cooking oil from the 45Z clean fuels credit.

What's next? Market sources expect UCO demand will recover in the coming months as it remains a crucial feedstock to meet RED compliance targets. Alternative feedstocks like tallow appear insufficient to serve as viable substitutes for meeting regulatory requirements.

Reporting and analysis by Rohan Somwanshi, Rosemary Griffin, Max Lin, Isabela Rocha, Uzma Gulbahar

Products & Solutions