Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Crude Oil

August 5, 2025

By Atul Arya

One of the most important developments in the global economy over recent months is that oil prices did not spike dangerously, even as uncertainty around crucial Middle Eastern trade routes hit historic levels.

Crude oil prices fluctuated between $60/b and $80/b before, during and after the 12-day conflict between Israel and Iran. Even at the height of concerns that the Strait of Hormuz could be blocked, markets held surprisingly steady. While $20 swings in oil prices are a lot for markets to handle, similar but ultimately less impactful concerns over supply disruptions in Nigeria and the North Sea in 2008 pushed oil to record highs above $145/b, and generated price swings that were nearly twice as big.

The substantial expansion of the global oil futures markets over the past decade, and the interplay between them, are an important and often overlooked reason why energy markets have handled historic levels of uncertainty without burning out the global economy.

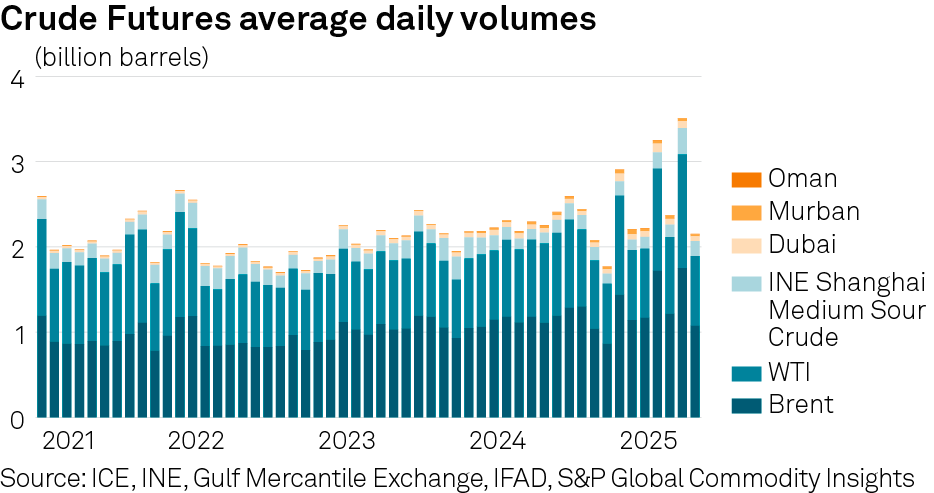

The modern oil derivatives landscape has played a vital role in mitigating market volatility. In the past 15 years, it has grown from two major crude oil futures contracts to six. Those six crude futures contracts collectively allow for up to 3.5 billion b/d of crude oil futures liquidity trading across the world's major financial and energy centers. These include ICE Brent, CME WTI, IFAD Murban, INE Crude, ICE Dubai and GME Oman. This geographic spread enables round-the-clock liquidity pooling across time zones and market participants.

The strength of this global network of futures contracts lies in its ability to integrate both physical and financial risk. The inclusion of WTI Midland in the Brent basket in 2023 created important trans-Atlantic connections and brought fresh liquidity to the market. Similarly, Murban and Oman crudes are deliverable against the Dubai and INE contracts, as well as IFAD and GME, respectively, creating arbitrage opportunities that rapidly mitigate possible price shocks.

June brought record activity in futures overall -- but not record price movements. This demonstrates that liquidity in global futures is deep at an important moment in history. OPEC’s ample spare capacity and commitment to provide consumers with energy security have been important in helping markets navigate war and other disruptions this year. But we should also recognize the role of the growing list of globalized and increasingly interconnected oil futures contracts and financial instruments, which although often underappreciated, pool liquidity across continents and provide a buffer for markets to absorb risk.