Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Coal, Metals & Mining Theme, Metallurgical Coal, Ferrous

May 29, 2025

By Olivia Zhang and Samuel Chin

HIGHLIGHTS

China rewires seaborne coal strategy amid falling steel demand

China's pivot from prime coal to lower grades accelerates

US coal sidelined by tariffs; low-ash Indonesian coal gains traction

Hopes that China would reemerge as a key player in the seaborne metallurgical coal market after resuming Australian imports are fading, as Chinese demand for premium hard coal has weakened following structural declines in steel consumption and pig iron output.

This unfolded alongside growing reliance on domestic and Mongolian supply, as the widening price spread between Premium Low Vol Hard Coking Coal FOB Australia and CFR China discouraged imports amid ongoing geopolitical headwinds.

Chinese buyers are expected to remain cautious, shifting toward lower-cost, lower-grade coals -- a trend that could reshape seaborne coking coal trade flows well beyond 2025.

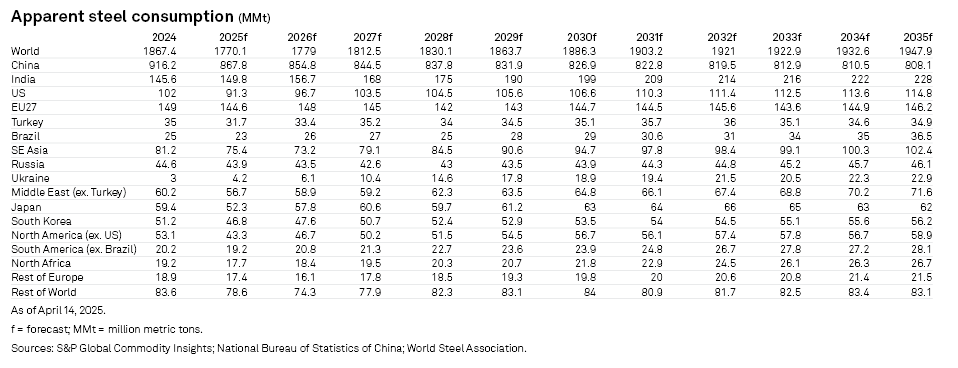

China's apparent steel consumption is projected to decline over the next decade, dropping 6.9% from an estimated 867.8 million mt in 2025 to 808.1 million mt by 2035, S&P Global Energy analysts said.

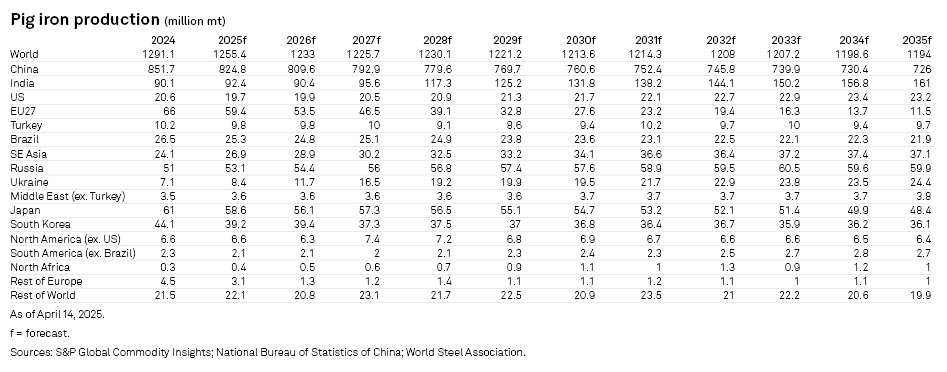

The country's pig iron production is also expected to fall, down 12% from about 824.8 million mt in 2025 to 726 million mt by 2035. This decline could displace around 12% of coking coal demand from Chinese steelmakers over the next decade, according to calculations by Platts, part of Energy.

Market sources expect China's steel production to continue declining in the near to mid-term amid ongoing real estate challenges and the government's carbon reduction goals.

"On top of that, Chinese end-users now have more options to source coal -- from domestic supply, Mongolia, portside stocks or various import origins," a Chinese trader said. "So, we have to consider marketing some of our [seaborne] coal elsewhere in Asia."

From January through mid-May, seaborne premium hard coking coal spot transactions destined for China -- regardless of incoterm -- accounted for less than 11% of total seaborne trades, compared with 22% in 2024 and 17% in 2023, according to data compiled by Platts.

China has been notably absent from spot purchases of Australian prime coking coal, largely due to the wide gap between FOB Australia and CFR China prices.

Platts assessed Premium Low Vol Hard Coking Coal at $191/mt FOB Australia on May 14, $21.50/mt above the Premium Low Vol CFR China assessment of $169.50/mt, widening from a $3.90/mt spread at the start of the year.

The widening price spread was exacerbated by tightening Australian supply -- driven by India's steady demand and stronger payment capacity -- while China saw rising domestic coal production and increased inflows from Mongolia.

China's raw coal output, including non-coking coal, rose 8.1% year over year to 1.2 billion mt over January-March, National Bureau of Statistics data showed.

Mongolia's coking coal exports to China are expected to remain robust in 2025, supported by China's 5% gross domestic product growth target, said Dulguun Baasandavaa, acting CEO of the Mongolian Stock Exchange, through which all coking coal from state-owned companies is sold.

However, Baasandavaa said Mongolian coal prices are unlikely to return to their 2021-2024 highs, citing shifting market fundamentals amid rising Chinese coal supply and weaker steel sales.

As a result of the widening price gap, no Australian premium spot cargoes have been sold into China since April, with fewer than three Panamax cargoes heard sold to the Chinese market in the first quarter, according to spot data compiled by Platts.

China's seaborne met coal imports from Australia fell 70% month over month to 163,263 mt in March, Chinese customs data showed. Imports from Canada dropped 29% to 828,065 mt over the same period.

"Since 2020, following the unofficial ban on Australian coals, the market has pushed coke makers to seek alternatives," a local Chinese trader said. "With the steel market depressed, the coal market has evolved accordingly. Stamp-charged coke ovens have adapted by substituting premium hard coking coal with more stable and competitively priced tier-two coals from Mongolia."

Domestic coal's significant cost advantages have led even coastal mills -- traditionally active seaborne cargo buyers -- to retreat from the international market and focus more on domestic supply, South China end-users said.

"There is little room to trade in the seaborne prime coal segment; even attractively priced Canadian cargoes are seen as uncompetitive," a major Chinese seaborne trader said. "Portside and domestic prices are simply too low for forward-delivery seaborne deals to make any sense."

As domestic coal prices in China soften and seaborne prime material remains costly, Chinese traders are shifting procurement toward lower-grade, low-ash coals -- including tier-two hard coking coal from Australia and Canada, as well as semi-hard and semi-soft coals from Indonesia.

This shift was accelerated by China's 15% additional tariff on US met coal, effective Feb. 4, retaliating against the US 10% tariff on all Chinese goods. US met coal exports to China plunged 84% month over month to 207,703 mt in March, Chinese customs data showed.

"The absence of US coal has created a vacuum in low-ash supply," a Singapore-based trader said. "At the same time, improving mill margins have boosted demand for more efficient hot metal production, making low-ash characteristics increasingly desirable."

Low-ash hard coking coals such as Canadian Conuma and Australian Daunia have long been favored by Chinese end-users but have become expensive due to the decoupling of FOB and CFR hard coking coal prices since April, a Chinese trader said, citing indirect pressure from increased domestic and Mongolian supply.

Indonesian coals like Tuhup and Mutu -- with ash levels around 4%-6% after washing -- are seeing rising demand, the first source said. While lower in rank than tier-two Australian or Canadian coals, these grades offer attractive discounts and less downside risk, the source added.

Indonesia's met coal exports to China surged 98% month over month to 154,153 mt in March, Chinese customs data showed, highlighting a marked shift in buying preferences.

"Although there is Chinese interest, the hurdle with relying on Indonesian coals is the lack of consistent export volumes," an Indonesian trader said. "We typically see only around 3 million-6 million mt exported annually, with most going to Japan and India."

"Volumes are limited to just a few suppliers because Indonesia predominantly produces thermal coal. Plus, Chinese prices can be a bit discouraging for miners here," the trader added.

Indonesia exported 4.2 million mt of coking coal in 2024, down 27% from 2023 amid lower prices and sustained high mining costs, according to S&P Global Commodities at Sea data. Exports to Japan accounted for 64% of the total, with India and China making up 30% and 3.2%, respectively.

A recovery in China's demand for Australian prime coal depends on a rebound in supply -- something market participants doubt will happen in the near term.

"It will take time for key Australian mines like Appin, Moranbah North and Oaky Creek to restore production following their respective incidents since late March," a Chinese trader said.

Additionally, mine maintenance -- typically starting in July, the beginning of the new fiscal year for some major Australian miners -- may further limit spot availability, an international trader said.

In China, market participants said the upside potential for domestic coking coal prices remains limited due to ample supply and possible demand cuts if domestic steel production slows later this year.

"Therefore, FOB Australia prices are more likely to correct lower and narrow the gap with CFR China prices," a Beijing-based trader said.

"Once Australian supply outpaces demand in non-China markets, a drop in FOB prices could bring them back in line with CFR China levels," a Singapore-based trader said. "Until then, value-hunting in the low-ash alternative segment will remain the dominant strategy for Chinese buyers."

Products & Solutions