Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

Events

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

Events

About S&P Global

Corporate Responsibility

Culture & Engagement

Generative AI is here and it's set to reshape the world–but with progress comes tough choices. Explore the latest research and solutions from S&P Global on the intersection of energy, datacenters, and AI.

Look Forward: Artificial Intelligence

Rapid expansion of datacenters to meet growing demand for cloud and AI services is one of several converging trends that will strain the US power sector's infrastructure in the coming years.

Much attention to date has centered solely on datacenter electricity demand. However, this misses the bigger picture. As datacenter capacity underpins a larger share of economic activity, it will contribute to reshaping historical patterns of electricity consumption throughout the broader economy. Early evidence indicates these trends may offset some of the rise in direct electricity consumption from datacenters.

In the US, near-term outlooks for gas- and coal-fired electricity generation are higher as demand growth driven by AI and cloud services outpaces the development of new power supply and transmission infrastructure. New AI tools for the power sector may help, but they will take time to implement and may not fully resolve issues of power grid adequacy and rising emissions from AI workloads.

Efforts to expand power sector infrastructure development will likely remain a focus of US federal government action as maintaining and growing the country's global lead in AI depends on the adequacy of power infrastructure.

Look Forward: Energy at the Crossroads

The range of potential AI applications in energy systems is immense. S&P Global categorizes these applications into three groups to serve as a road map for industry AI progression: improving efficiency, managing large and complex systems, and accelerating the innovation cycle.

The early returns from AI are impressive. S&P Global Commodity Insights data and analysis reveal individual assets lowering costs by 10%-25%, improving productivity by 3%-8% and increasing energy efficiency by 5%-8%, easing the path for clean energy investment.

Achieving results at an enterprise or industry scale is far more challenging. Navigating regulatory issues, establishing effective partnerships and engendering workforce trust are critical to realizing widespread adoption.

Data Centers

For most casual users, AI and cloud computing services can seem detached from the physical world. But every online save, search, and AI query requires a server and, typically, data storage. As those services expand, demand for the hardware that enables them is surging, leading to commensurate growth in data centers—the power-hungry facilities which house the infrastructure.

S&P Global Ratings estimates incremental U.S. power demand from data centers could be 150-250 terawatt hours (TWh) between 2024 and 2030.

That looming demand has taken the power sector by surprise and will require about 50 gigawatts (GW) of new generation capacity through 2030—necessitating about $60 billion of investment in generation and $15 billion in transmission.

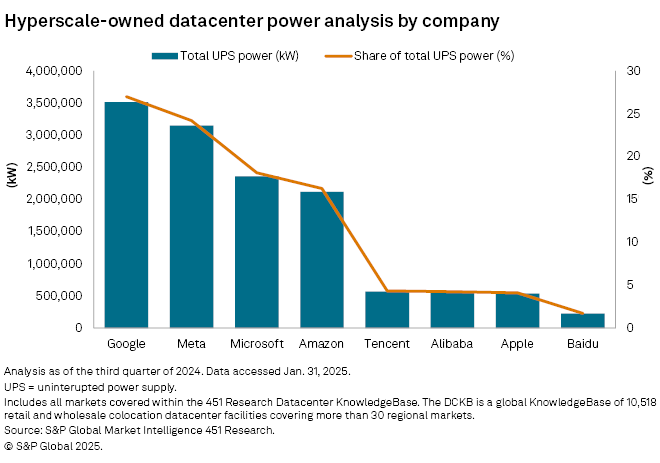

The voracious energy needs of datacenters remain a focal point in the market. Annual electricity consumption by leading companies has reached levels comparable to the total demand of some countries. While large technology companies and datacenters have been at the forefront of sustainability ambitions, their incremental power demand will further reshape the clean energy procurement markets.

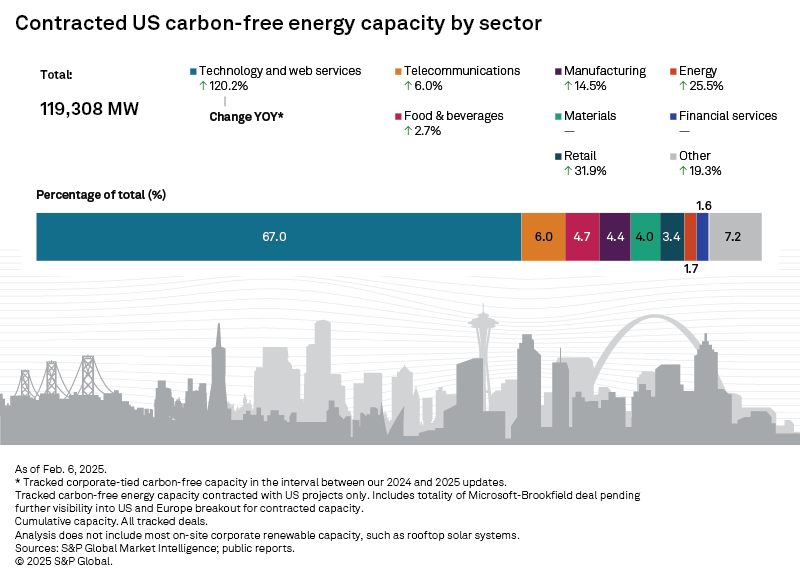

The rise of AI has caused expectations for datacenter electricity demand — and by extension, overall power demand — to skyrocket since the unveiling of ChatGPT in the fall of 2022, prompting a rush toward clean energy purchases. Corporations in the US have contracted nearly 48 GW of additional clean energy capacity in the 12 months since our February 2024 update, with Big Tech driving most of the activity.

Data Centers

Surging demand for space to house AI and cloud computing hardware is an opportunity for U.S. data center owners and developers. Risks relating to power and water requirements and financing will have to be managed.

Why it matters: The surge in data center demand will create significant growth opportunities for data center entities. As projects multiply and average project sizes increase, power and water requirements, financing, tenant concentration, and cost inflation emerge as constraints. Navigating these risks are key considerations when assessing data center owners' and developers' credit quality.

What we think and why: Not all data center owners are the same. Credit risks differ between hyperscalers and retail/colocation leasing models. Access to energy is an increasingly important consideration. Obsolescence risk is less of a credit issue for the near and intermediate term. Increasing risk appetite to accompany growth could affect credit performance.

This report explores our views on the risks and opportunities in data centers and their potential credit implications, regardless of their financing structure. We maintain ratings on data centers across the corporate, project finance, and structured finance practices.

Generative AI and cloud services are strong demand factors; growth in both model training and inference (in which a trained machine-learning model draws conclusions based on data) have proven to be significant contributors to data center revenues. Computation needs for a ChatGPT query are more than 100 times higher than for traditional internet searches. Estimates indicate that daily queries on ChatGPT are in the millions while Google responds to about 8.5 billion searches every day.

Data Centers

Data centers' growing demand for electricity will require additional natural gas to support generation, necessitating a response from the North American midstream energy sector.

Why it matters: Data center expansion is central to cloud computing and AI. Sustained growth in data center capacity will require significant amounts of new energy that alone cannot be met by renewable sources.

What we think: North American midstream energy suppliers are already benefitting from increased revenues due to geopolitical energy security concerns. Additional demand from data centers should contribute to at least a decade of supply growth that should be supportive of midstream sector credit quality, though the benefits will accrue most to operators in gas fields near data center hotspots.

Data Centers

Significant incremental demand for power from data centers will affect power market dynamics and should have positive credit quality implications for companies in the merchant power sector.

Data Centers

Data center electricity demand should boost revenues at North America's investor-owned regulated utilities and provide modest support for the industry's credit quality.

S&P Global Ratings' base case assumes that annual electricity sales growth at about 1% for several decades will transform an industry used to stagnation but won't fully meet the tech industry's needs.

Contracts and rates for data centers should be structured to shield existing customers from price hikes related to meeting new demand.

Resulting increases in capital spending and cash flow deficits will necessitate careful and consistent funding that supports credit quality.

Major datacenter build-outs aimed at meeting the rising demand for AI are complicating efforts by hyperscalers to lower their carbon footprints. But as much as AI is creating this problem, it also may be at least part of the solution.

Since the launch of ChatGPT, the amount of infrastructure required for AI over the long term has been anyone's guess. The largest IT and AI firms, particularly in the US, have seemed to lean toward overbuilding rather than being caught without capacity, making investors nervous about the returns on these AI investments.