Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Feb 27, 2025

By STEFAN MODRICH

Google's datacenter in St. Ghislain, Belgium, includes an on-site solar farm. A planned expansion announced in 2024 will include an additional 1.4 MW of capacity at the solar farm.

|

Major datacenter build-outs aimed at meeting the rising demand for AI are complicating efforts by hyperscalers to lower their carbon footprints. But as much as AI is creating this problem, it also may be at least part of the solution.

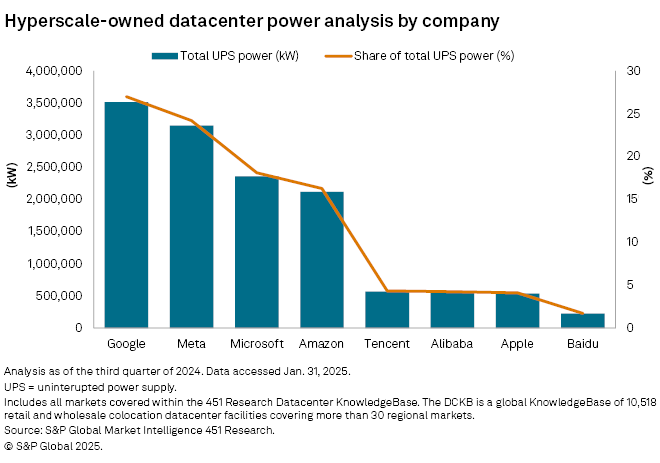

US datacenters are projected to consume nearly 800 TWh in 2030 — more than double 2024 levels, according to S&P Global Market Intelligence 451 Research's Datacenter Services & Infrastructure Market Monitor & Forecast. Roughly 30% of that projected power consumption is expected to come directly from hyperscale datacenters like those operated by Alphabet Inc.'s Google LLC, Meta Platforms Inc. Microsoft Corp. and Amazon.com Inc.

A large part of this increased power consumption is due to generative AI. Generative queries and workloads consume 10 to 30 times more energy than traditional or task-specific AI tasks. With US companies looking to stay ahead in the AI race — especially in the face of competing generative AI platforms such as China's Hangzhou DeepSeek Artificial Intelligence Co. Ltd. — hyperscalers are in the difficult position of trying to balance their rising energy needs with the aggressive net-zero targets they set before generative AI took off. Their existing strategies, such as renewable energy projects and carbon removal credits, are expanding and evolving as companies rethink their approach to carbon-free energy. Alternative energy sources and AI-driven workload management are also being deployed.

"To solve this, we need breakthroughs," said Sam Uyeno, a partner at technology consulting firm West Monroe who specializes in energy and utilities. "There is not a clear pathway right now to having everybody achieve their net-zero goals, including the high-tech sector and hyperscalers."

Supply and demand

One factor that is both a challenge and opportunity is that the current energy supply is not enough to meet expected demand.

Nearly 60% of global tech companies, datacenter developers and energy providers do not believe that the current pace of energy deployment in the US is enough to meet the energy demand caused by AI, according to a KPMG survey. In the same survey, 55% of hyperscalers and datacenter developers said they were willing to pay up to 50% more of their current expenditures on electricity costs to expand capacity.

With companies having to look for new energy sources and willing to pay more for them, that could accelerate the tech industry's move toward renewables and clean tech, said Angie Gildea, national sector lead for energy at KPMG.

This is already visible at hyperscalers such as Microsoft.

"The rapid growth in demand for AI innovation to fuel the next frontiers of discovery has provided us with an opportunity to redesign our infrastructure systems, from datacenters to servers to silicon, with efficiency and sustainability at the forefront," Mark Russinovich, chief technology officer and technical fellow for Microsoft Azure, Microsoft's global enterprise-grade cloud platform, wrote in a September 2024 blog post.

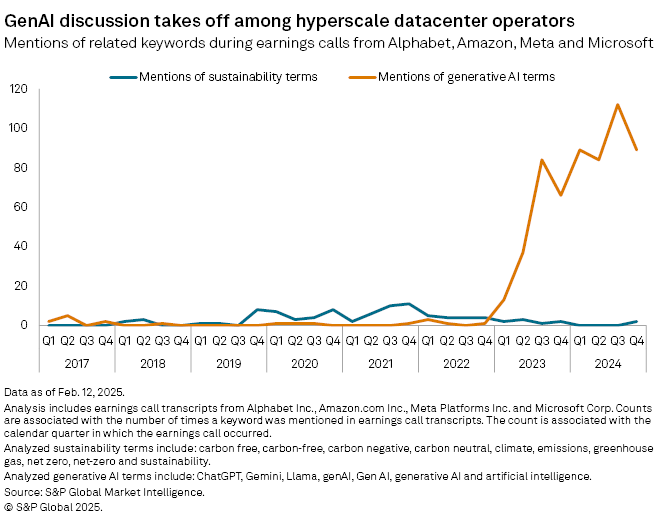

Still, it is notable that Microsoft and other hyperscalers have reduced the frequency with which they mention sustainability terms on their earnings conference calls in recent years following a peak in late 2021, according to S&P Global Market Intelligence data. Meanwhile, since the launch of OpenAI LLC's ChatGPT in late 2022, the number of mentions of generative AI-related terms has skyrocketed.

And while 94% of KPMG respondents are implementing some form of carbon mitigation efforts for their datacenters, 60% said they are at least somewhat likely to delay their sustainability targets due to the increasing energy demands placed on datacenters.

"Businesses are really between a rock and a hard place for where they put their resources and their capital," Gildea said. "Not only do they have this growing need for electricity by things like AI and datacenters, but we also have the growing need to make our infrastructure more resilient with some of these extreme weather events that we're seeing."

Crossing the Rubicon

Despite the shifting public focus toward generative AI, sustainability is still a priority for hyperscalers, experts said.

"I truly think we've crossed the Rubicon in this regard," said Hans Dyke, an attorney and partner who advises clients on energy infrastructure at Bracewell. "In terms of the energy grid and the energy technology markets and what our clients do, building infrastructure and owning infrastructure assets, I don't see a real risk in the sustainability piece going away. It's just too embedded now into the way we finance projects, in the way corporates procure clean energy."

Google still says it aims to achieve net-zero emissions across all of its operations and value chain by 2030, despite having reported a 13% year-over-year increase in total greenhouse gas emissions for 2023, the most recent year reported. Meta similarly aims to reach net-zero emissions across its value chain by 2030, and Microsoft has committed to being carbon negative by the same year, meaning it will remove more carbon dioxide from the atmosphere than it emits. Amazon is targeting 2040 for net-zero carbon emissions across its operations.

The way these companies are approaching their goals, however, has shifted to include a broader definition of carbon-free energy sources.

In particular, nuclear energy will likely play a key role in powering the country's electric grid to meet future datacenter demand, industry experts said. The US Energy Department is looking to lower barriers to entry and streamline permitting for companies like Austin, Texas-based Aalo Atomics, which is working with the DOE to build an experimental 10-MW microreactor at the Idaho National Laboratory expected to go online by 2027.

"One of the things that excites me the most about this moment with nuclear power, in particular, is that it too, has a technology leap forward that can check all of the public trust boxes and provide lower economics and help with climate change," said Jon Guidroz, senior vice president of commercialization and strategy at Aalo Atomics. "So if we're successful, we untether humanity's growth from our impact on Earth and enable a thriving ecosystem broadly. And I think that's a once-in-a-generation opportunity. That's going to create a tremendous amount of shared value across all phases of humanity."

In 2024 alone, Google, Amazon and Meta all announced significant nuclear contracts. Google partnered with Kairos Power LLC to deploy 500 MW of advanced nuclear projects beginning in 2030; Amazon said it was working with advanced nuclear developer X-energy and Dominion Energy Inc. for advanced reactor projects; and Meta is seeking proposals for up to 4 GW of nuclear by the early 2030s.

"For Silicon Valley and its offshoots, nuclear is a sensible solution amid quickly steepening AI-related load forecasts," Tony Lenoir, an analyst with the S&P Global Commodity Insights Energy Research team, wrote in a January report.

Other energy sources

Beyond nuclear, natural gas will remain a key energy source in the portfolio of datacenter operators, according to a report from S&P Global Ratings. If 50% of incremental capacity comes from natural gas-fired units, including baseload and peak suppliers, the grid would require up to 50 GW of incremental generation supply. Up to 3 Bcf/d of this demand could be met with natural gas, Ratings said in the report.

Natural gas is attractive for the same reason nuclear is: Datacenters need uninterrupted, around-the-clock access to power. One key reason to keep natural gas in the rotation is that it can alleviate transmission bottlenecks, Exiger LLC CEO Brandon Daniels said.

"Even if renewable installations are available or there is the grid infrastructure and sustainable electricity, there are gaps in the grid that don't allow for sustainable transmission," Daniels said. "Those same gaps in the grid also can create intermittency issues with wind- and solar-powered installations."

Microsoft is working with Houston-based Enchanted Rock LLC, which provides electrical resiliency microgrids, to help supply its San Jose datacenter with power — including renewable natural gas — starting in 2026.

Renewable natural gas includes captured methane emitted by food, agricultural and animal waste, turning it into fuel while keeping it out of the atmosphere. While renewable natural gas only accounts for 1% of overall gas use, it could grow to more than 8% by 2050, according to an estimate from the Coalition for Renewable Natural Gas.

"Natural gas provides a very elegant, homegrown solution for balancing the grid and providing capacity during those peak hours where loads are high and we don't have enough renewable resources available to meet that need," said Allan Schurr, chief commercial officer of Enchanted Rock. "I think the pathway may be a little more meandering than what it was just a few years ago, but they're still focused on getting there."

'New levers to pull'

Beyond alternative energy sources, datacenter operators and tech companies will need to find "new levers to pull" for decarbonization, said West Monroe's Uyeno. In particular, Uyeno sees a window of opportunity for the most innovative tech giants to leverage their AI capabilities to optimize their supply chains and energy pipelines for sustainability.

"One new lever that's probably not tapped enough is, how do you use AI to evaluate datacenter operations and start to make it more efficient," Uyeno said. "Or, how does a datacenter look at all of its generation and load pool with AI to operate more efficiently?"

AI can be deployed to advance efforts to reach net-zero targets, streamline energy permitting and potentially abate emissions, according to Accenture projections. In one scenario, AI has a continued and lasting negative impact on net-zero trajectories. In another, it has a rapid positive impact, and in a third forecast, it increases emissions but has a positive impact on net-zero objectives in the medium-term.

Meta, for instance, used AI to run simulations to adjust how fans in its datacenters are used for cooling. Based on the simulations, Meta was able to reduce the fans' energy consumption by 20%.

"Another example is applying AI to novel formulations of concrete to reduce the carbon footprint in use in our datacenters," Blair Swedeen, global head of net-zero and sustainability at Meta, told audiences at Climate Week NYC. "That approach has reduced the carbon footprint of that concrete by about 40% ... and then we open source them to make them available to the broader community."

Experts emphasize that companies do not have to choose between sustainability and AI, or sustainability and profits. Both are a false dilemma.

"By taking manageable risks, you can reduce your capex by up to 40%, for instance, while producing the same amount of energy, and then you can use the savings to build carbon capture or whatever you need, or make your product more affordable for end customers," Maksim Sonin, an energy executive and projects fellow at Stanford University, told Market Intelligence. "AI, despite all this growing energy demand, is set to help us to drive things in this way."

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Consumer Insights is a regular feature from S&P Global Market Intelligence Kagan.