Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Mar 21, 2023

By Kallol Saha and Mrinal Bhardwaj

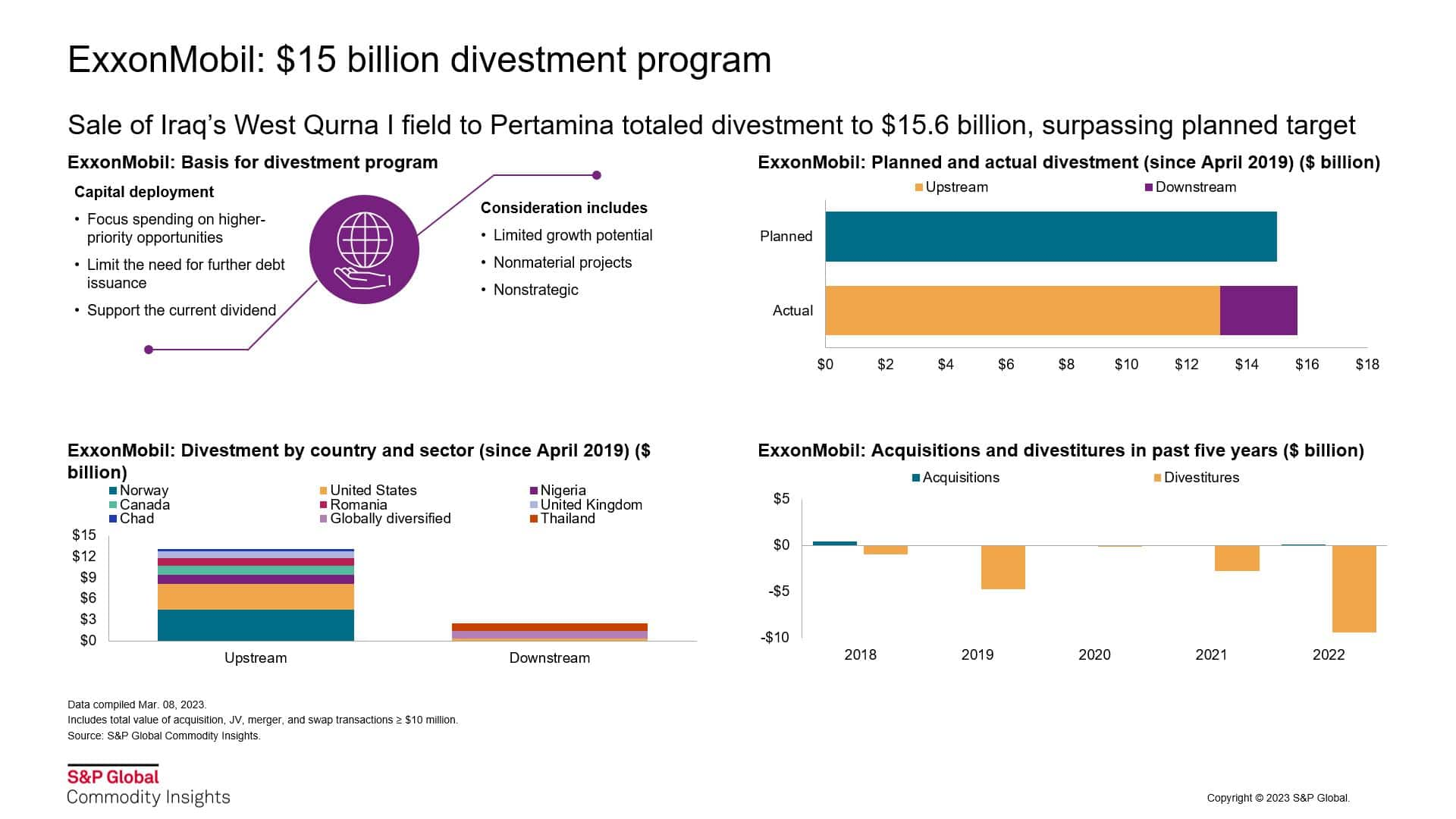

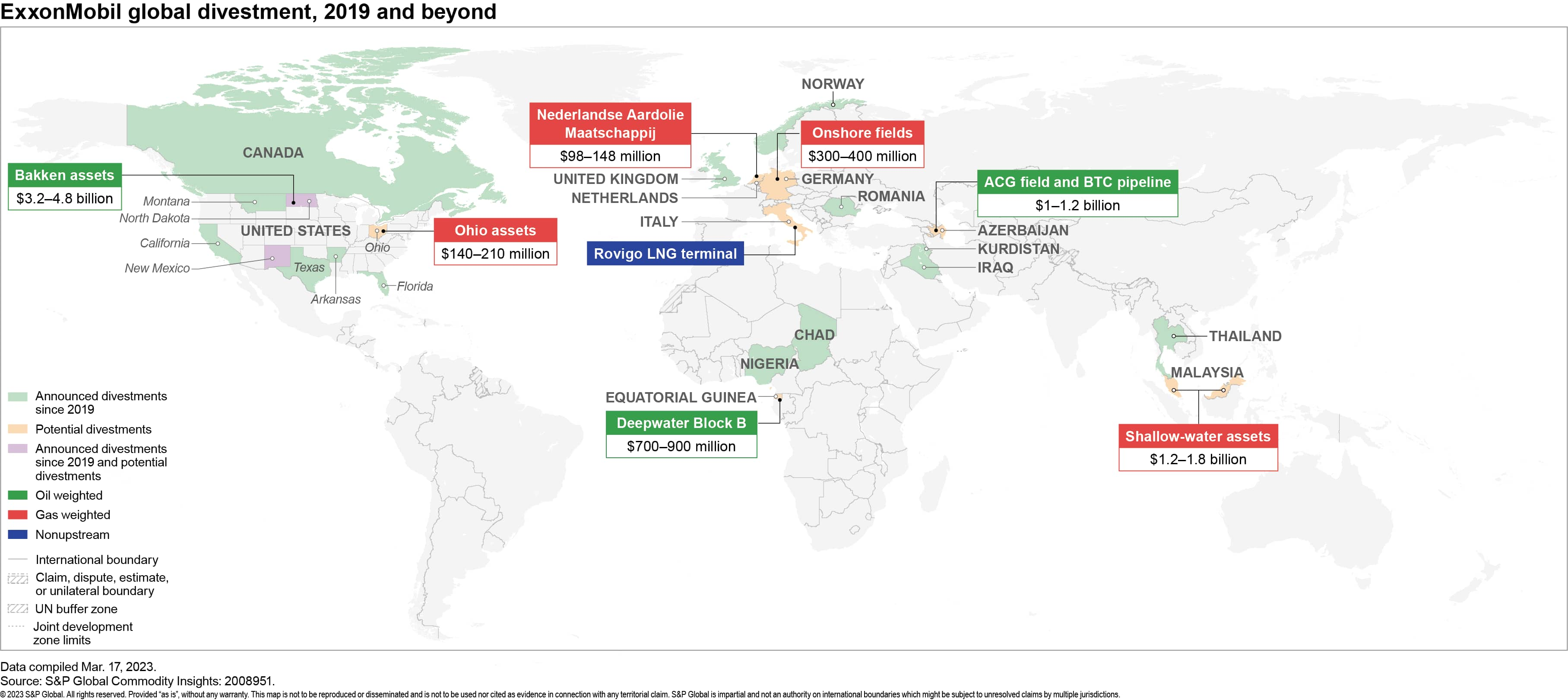

$15 billion divestment program — ExxonMobil Corporation continues its portfolio high-grading to sell nonstrategic assets and focus investment on higher-priority projects, limiting the need for further debt issuance, and supporting the current dividend. Following the sale of its stake in Iraq's non-operated producing West Qurna I oil field to Pertamina, ExxonMobil's total divestment has reached about $15.6 billion since April 2019, surpassing the $15 billion divestment plan.

The current divestment program potentially includes assets across Malaysia, the United States, Germany, Equatorial Guinea, Azerbaijan, and the Netherlands. ExxonMobil's current upstream investment priorities are deepwater Guyana and Brazil, LNG projects in Mozambique and Papua New Guinea, and the unconventional US Permian Basin, which it considers as key strategic development areas.

ExxonMobil has announced a capital budget of $23-25 billion in 2023 with a capex guidance of $20-25 billion/year from 2024-2027. It includes investments in the next development in Guyana and increased spending in US unconventional assets.

Learn more about our research and insight capabilities through our Companies & Transactions Service.

***

Want to learn more on this topic and access similar reports? Try free access to the Upstream Demo Hub to explore selected energy research, analysis, and insights, in one integrated platform.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.