Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Research & Insights

Who We Serve

Research & Insights

Who We Serve

Nature & Biodiversity

Case Study — 10 Dec, 2024

The Client: Samsung SDS Co., Ltd

The Users: ESG Planning Group

With half of the world’s GDP highly dependent on nature1 , biodiversity loss is a growing concern for global business leaders. The World Economic Forum’s 2024 Global Risks Report again underscored the significance and severity of nature-related risks in the next ten years, ranking them as the most critical challenges being faced globally. These risks transcend geographic boundaries, industry sectors and value chains, and require urgent and collective response.

In 2023, the Taskforce on Nature-related Financial Disclosures (TNFD) was formed to support a shift in global financial flows away from nature-negative outcomes to nature positive outcomes. The organization set out recommendations and guidance that encourage and enable companies to integrate nature into decision-making and assess, report and act on their nature-related dependencies, impacts, risks and opportunities..

Samsung SDS saw that their stakeholders were increasingly interested in nature-related risks, and in response, decided to have its ESG Planning Group team create a Sustainability Report including nature risk analysis. This was an uncharted area for members of the team, and they needed to tap into external expertise to guide them through the process.

Members of the ESG Planning Group needed access to data and a methodological framework that could help them understand:

The company was familiar with S&P Global Sustainable1 ("S1"), which provides data, analytics and opinions on sustainability risk and opportunities across sectors and markets. They reached out to the firm to discuss what capabilities were available.

Voluntary adoption of TNFD is a proactive step to stay ahead of investor and regulatory demands and take early action to demonstrate a commitment to environmental responsibility.

Specialists from S1 discussed Nature Risk on the S&P Global Climanomics® platform, a tool that helps companies and financial institutions profile nature-related risks associated with location-specific business activities. The solution draws heavily on the principles outlined by the TNFD and the Nature Risk Profile methodology launched by S1 and the UN Environment Programme World Conservation Monitoring Centre (UNEP-WCMC) in January 2023. It enables reporting entities to respond to the recommendations of the TNFD by supporting implementation of its framework.

The methodology rests on two core building blocks for profiling nature-related risks: (1) dependencies on nature and (2) impacts on nature. These are broken into key indicators that are assessed using client-provided asset-level data and global nature-related datasets. The methodology can be applied at the asset, company, and portfolio level.

Nature Risk applies S1's Nature & Biodiversity Risk methodology to client-provided asset data and would enable the climate strategy team to:

S1 collaborated with the risk management team to collect essential data that covered both the company’s own operational assets, plus the assets it was financing. S1 leveraged its Nature & Biodiversity dataset to evaluate the nature-related impacts and dependencies of these assets, and then aggregated the results to the portfolio level. The assessment covered 159 major asset and operating sites across industries within the financial institution’s home market. There were regular meetings during the engagement to help the risk management team understand the data collection process, methodology, and results. The results were then integrated into a TNFD report.

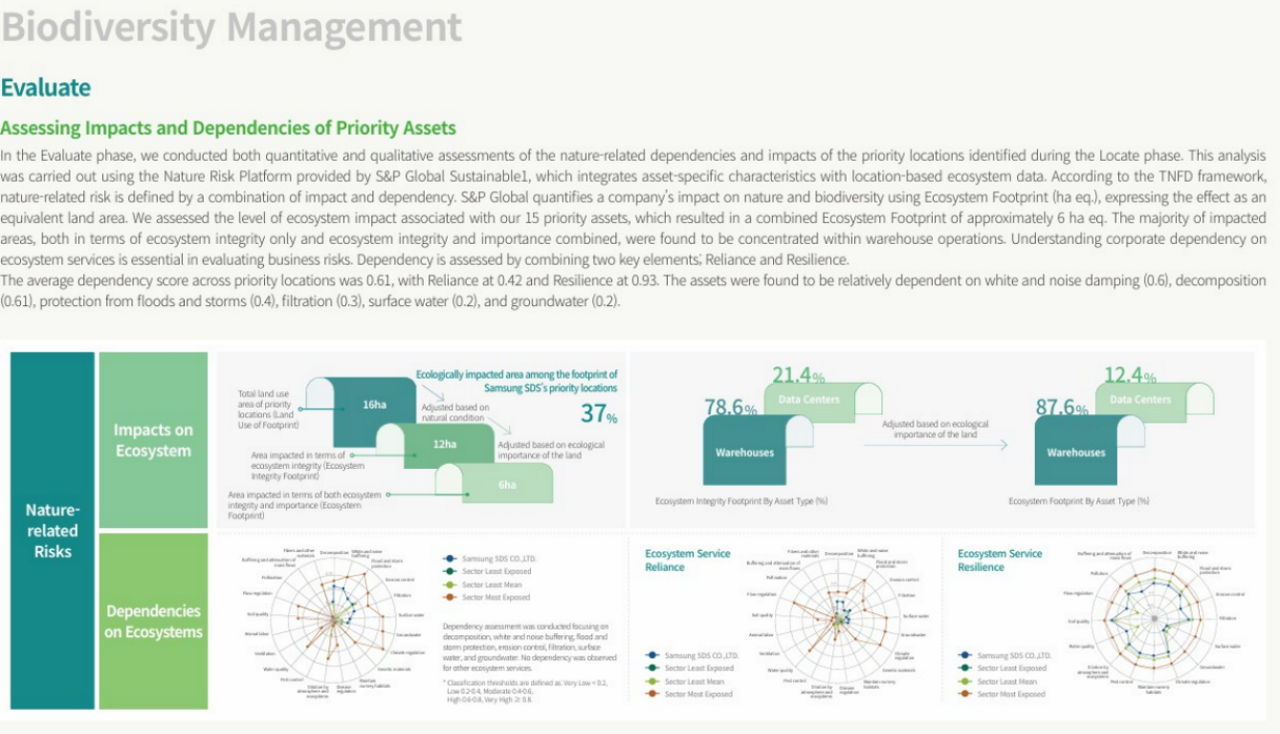

The Ecosystem Footprint measures a business’s direct and operational impact on nature and biodiversity. The metric combines three areas of analysis: (1) the areas of land impacted by a company (land area), (2) the degree to which the location-specific ecosystem integrity is reduced (ecosystem degradation) and (3) the significance of the location-specific ecosystem impacted (ecosystem significance).

The three come together to calculate the equivalent impact on the most significant areas globally in terms of biodiversity conservation and ecosystem services provision. This produces an Ecosystem Footprint expressed as the equivalent number of hectares in the most globally significant ecosystems that would be fully degraded by a company's operations.

Biodiversity Areas, as defined by the International Union for Conservation of Nature, are sites contributing significantly to the global persistence of biodiversity. KBDs are identified at the national, sub-national or regional level by local stakeholders based on standardized scientific criteria and thresholds. Protected areas are geographically defined spaces managed through legal or other effective means to achieve the long-term conservation of nature with associated ecosystem services and cultural values

Dependency scores consider the level of reliance that a business's direct operations have on 21 different ecosystem services, as well as the expected resilience risk of the ecosystem providing these services, where these businesses are operating around the world. The score is on a scale from 0 to 1, where 0 represents no dependency risk and 1 represents very high risk.

Reporting servicesassist with publishing the results of the TNFD analysis to identify and assess nature-related dependencies, impacts, risks, and opportunities to help turn metrics into action.

Importantly, S1 has enhanced the original methodology developed with The UN Environment Programme (UNEP) to show company-specific results, not just those at an industry level.

By using S&P Global’s Nature Risk Platform, Samsung SDS evaluated the nature-related risks associated with its major assets and published the key findings in its 2025 Sustainability Report.

Link to the Samsung SDS Sustainability Report

Link to the Samsung SDS Sustainability Report

The analysis enabled members of the risk management team to meet their goal of being first to market in their home country with a TNFD report to show the financial institution’s leadership position on nature-related issues.

Members of the climate strategy group saw the Nature Risk Platform as a best-in-class tool to help them understand and manage the company's specific exposure to nature-related risks and their impacts and subscribed to the solution. This has enabled them to:

The analysis enabled members of the risk management team to meet their goal of being first to market in their home country with a TNFD report to show the financial institution’s leadership position on nature-related issues.

1"Nature Risk Rising: Why the Crisis Engulfing Nature Matters for Business and the Economy", World Economic Forum, January 2020, www3.weforum.org/docs/WEF_New_Nature_Economy_Report_2020.pdf.