Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Metals & Mining Theme, Non-Ferrous

December 22, 2025

By Merin Jacob and Samantha Beh

HIGHLIGHTS

Market uncertain, awaiting DRC cobalt shipments

Cobalt shipments to China expected late Q1 2026

Bullish market expected through early 2026

This is part of the COMMODITIES 2026 series, where our reporters bring to you key themes that will drive commodities markets in 2026.

Market participants remain uncertain about the cobalt market due to a lack as clarity regarding the resumption of export shipments from the Democratic Republic of Congo.

The uncertainty follows a cobalt export ban imposed in February 2025 by the DRC's Authority for Regulation and Control of Strategic Mineral Substance Markets. The DRC later announced the ban would be lifted on Oct. 16 and replaced with an export quota system, though details on implementation and shipment schedules remain unclear.

The ongoing uncertainty has left market participants in limbo, resulting in cautious sentiment as they consider various scenarios for how the cobalt market could unfold in 2026.

"There are infinite scenarios. Realistically, we need granularity on what the DRC is doing to make any educated guesses," a European-based trader said.

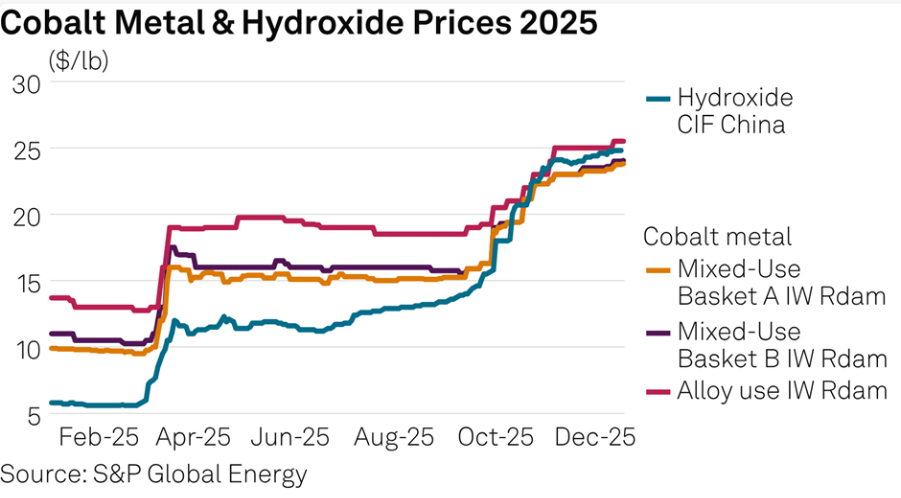

In 2024, the cobalt market was oversupplied, with cobalt hydroxide CIF China assessed prices declining 13% from $6.70/lb on Jan. 2, 2024, to $5.80/lb on Jan. 2, 2025. Following the DRC export curb, prices surged by approximately 328% in 2025, rising from $5.80/lb in January to $24.85/lb as of Dec. 19.

As cobalt metal is produced as a byproduct of cobalt hydroxide, movements in hydroxide prices also influence cobalt metal value.

On Dec. 19, 2024, European Cobalt Metal 99.8% Mixed-Use Basket A IW Rotterdam was assessed at $10.05/lb, rising by 139% to $24/lb by Dec. 19, 2025. Over the same period, European Cobalt Metal 99.8% Mixed-Use Basket B prices rose from $11/lb to $24.20/lb, an increase of 120%. Meanwhile, European Cobalt Metal 99.8% Alloy Use prices rose from $13.70/lb to $26/lb, up by 89.8%, reflecting dramatic shifts across the cobalt market.

While sources remain uncertain regarding exactly when cobalt shipments from the DRC will be shipped, they anticipate deliveries reaching China toward the end of the first quarter of 2026. However, further delays cannot be ruled out due to truck congestion or the Lunar New Year in February, which sources indicate could lead to potential port closures.

A Chinese consumer shared that smelters purchasing cobalt hydroxide noted the export permit could be approved in early December. This would allow shipments to reach Chinese factories after the Lunar New Year, with an estimated transit time of 45 to 55 days, the consumer said.

A Xiamen-based trader also highlighted challenges in taxation and procedures for cobalt exports with the DRC government. An international trader noted that exports have remained slow and bureaucratic, with only small amounts expected to arrive in China by March, which is unlikely to alleviate the current market tightness.

Due to the required export procedures, cobalt metal production may only begin in late April or May, depending on whether producing cobalt metal or selling cobalt sulfate is more profitable, according to an international trader.

With technical improvements, a Chinese trader believed it could become more cost-effective than using intermediates.

"Lately, the premium has reduced. If that's still the same in April, why would you want to produce metal. If you don't have an incentive to produce metal, there's less metal around; therefore, the price will destabilize or marginally increase," said a European-based trader.

However, other traders said that dissolving cobalt metal into sulfate remains challenging due to investment, profit margin, logistical, or environmental issues. Some Chinese factories have started adopting this process, with monthly output per factory estimated at only a few hundred tons.

A Shanghai-based trader observed that the trend began in October but cautioned that it carries risks and may not be sustainable at current prices. Overall, traders observed uncertain profitability, with little incentive to expand dissolving capacity amid market uncertainties.

Market participants anticipate prices to remain firm for the remainder of 2025, with a surge expected in January 2026.

"January will be an exciting month for everybody," said a European-based trader. "Everyone is expecting an upward price rally. The reason we haven't been seeing much activity is that everybody is waiting to sell in January, when the prices will go up, up, and up every day," the trader added.

A European-based consumer agreed, "Players may try to make further gains and push the market for next year. There will be exciting figures in January".

A European trader highlighted that while it is difficult to predict exact price movements, volatility is certain in the cobalt market as the supply from the DRC is projected to meet around half of global demand.

"We are shackled to policy measures, not fundamentals anymore. So, the fragility and volatility are so ripe," said the European-based trader.

ARECOMS is said to be testing exports with a pilot run involving Glencore and finalizing its quota allocation system, a step that could mark the resumption of cobalt exports from the DRC.

Mining companies are expected to retain their Q3 2025 quotas. Miners could initially ship around 18,000 tons of cobalt for the remainder of 2025, with annual shipments of approximately 96,600 tons potentially planned for 2026 and 2027.

Market participants noted that any increase in cobalt availability could influence price movements in 2026.

"European cobalt metal prices are forecast to rise in the March 2026 quarter, as delays to DRC shipments intensify supply tightness," said Alice Yu, associate director of cobalt analytics at S&P Global Energy CERA.

"The inventory in China is forecast to get depleted by January 2025, resulting in a supply squeeze. Prices are unlikely to drop substantially in 2026," Yu added.

Products & Solutions

Editor: