Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Metals & Mining Theme, Ferrous

December 19, 2025

HIGHLIGHTS

Imports to remain a key focus as domestic prices trend upward

EBITDA of Brazilian steel mills under pressure

Construction companies await firm demand for projects next year

This is part of the COMMODITIES 2026 series, where our reporters bring to you key themes that will drive commodities markets in 2026.

Participants in Brazil's domestic rebar sector anticipate that 2026 will bring tight financial margins and a likely continuation of the intense market share competition among steelmakers that characterized this year.

Furthermore, Brazilian imports of rebar are expected to increase if the price hikes announced by domestic steel producers for January and February materialize.

A buyer dismissed the discussion of steel mills' price hikes for early next year as mere "noise." According to him, the proposed price hikes are more about efforts to restore margins lost over the past 12 months than a reflection of rising demand for rebar. Sources indicated that producers were seeking price increases of 7% to 13% from construction companies.

Platts, part of S&P Global Energy, assessed weekly Brazilian domestic rebar prices unchanged at Real 3,400/metric ton ($614.83/mt) ex-works Dec. 19, within a Real 3,300-3,500/mt range, taxes excluded, due to a lack of deals, offers, and bids

From January to November, Brazilian rebar prices fell 18%. Comparing November 2025 to November 2024, prices were down by 19%

A distributor anticipates strong demand in 2026 for popular housing construction, along with a potential improvement in medium and high-end projects, driven by expectations of lower interest rates in the second half of the year.

According to a real estate sector consultant, next year is expected to see increased job creation in the infrastructure segment, particularly for older contracts that will complete their licensing and financing phases in 2026 and move into the implementation stage. "What keeps me up at night is 2027, which will be a year of hangover for the Brazilian economy's neglected angles, such as the fiscal problem and the increase in public debt linked to still high interest rates."

Several construction companies anticipate a good year in 2026, with existing projects to be continued and new ones to be initiated. Expectations of a recovery in Brazilian household income and consumption—driven by declining interest rates and expanding credit—were a common theme among all sources consulted by Platts.

According to November data from Aço Brasil, the Brazilian steelmakers' institute, long steel production fell by 8.8% year over year, with 848 mt produced in 2025 compared to 929 mt in 2024. From January to November, the decline was 1.9%, 9,280 mt in 2025, compared to 9,457 mt in November 2024.

The entity foresees a 2.2% decline in crude steel production in 2026 compared to 2025, totaling 32,412 mt. This is accompanied by a 1.7% decline in domestic sales (20,797 metric tons) and a 1% increase in apparent steel consumption, considering both flat and long steel, at 27,005 mt.

Aço Brasil identified trade defense as a top priority for the steel sector's 2026 agenda, emphasizing its importance for market recovery. The institute highlighted measures such as tariff quotas, hard quotas, tariff increases, safeguards, antidumping and countervailing duties, a border carbon adjustment mechanism, and local content requirements.

The recent and unprecedented situation of Brazilian imports in the long steel segment, and particularly flat steel from China, has impacted the balance sheets of domestic steelmakers.

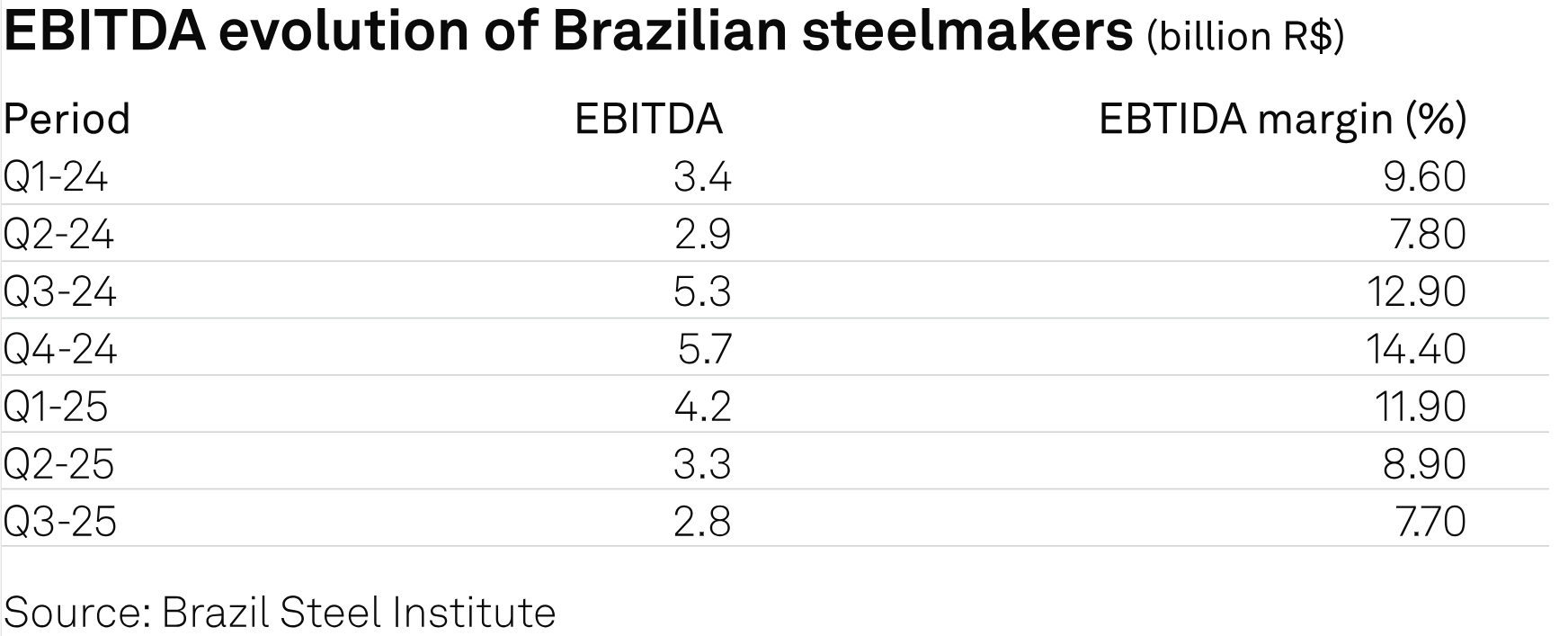

According to Aço Brasil, the EBITDA of steel mills associated with the institute dropped by 47.5% in the third quarter of 2025 compared to the same period in 2024, and by 16.7% compared to the second quarter of 2025. When comparing the fourth quarter of 2024 to the third quarter of 2025, the decline was 51.7%.

André Gerdau Johannpeter, chairman of the board of directors at Aço Brasil and steelmaker Gerdau, said at a press conference on Dec. 16 that an acceptable EBITDA for the sector would be around 15%.

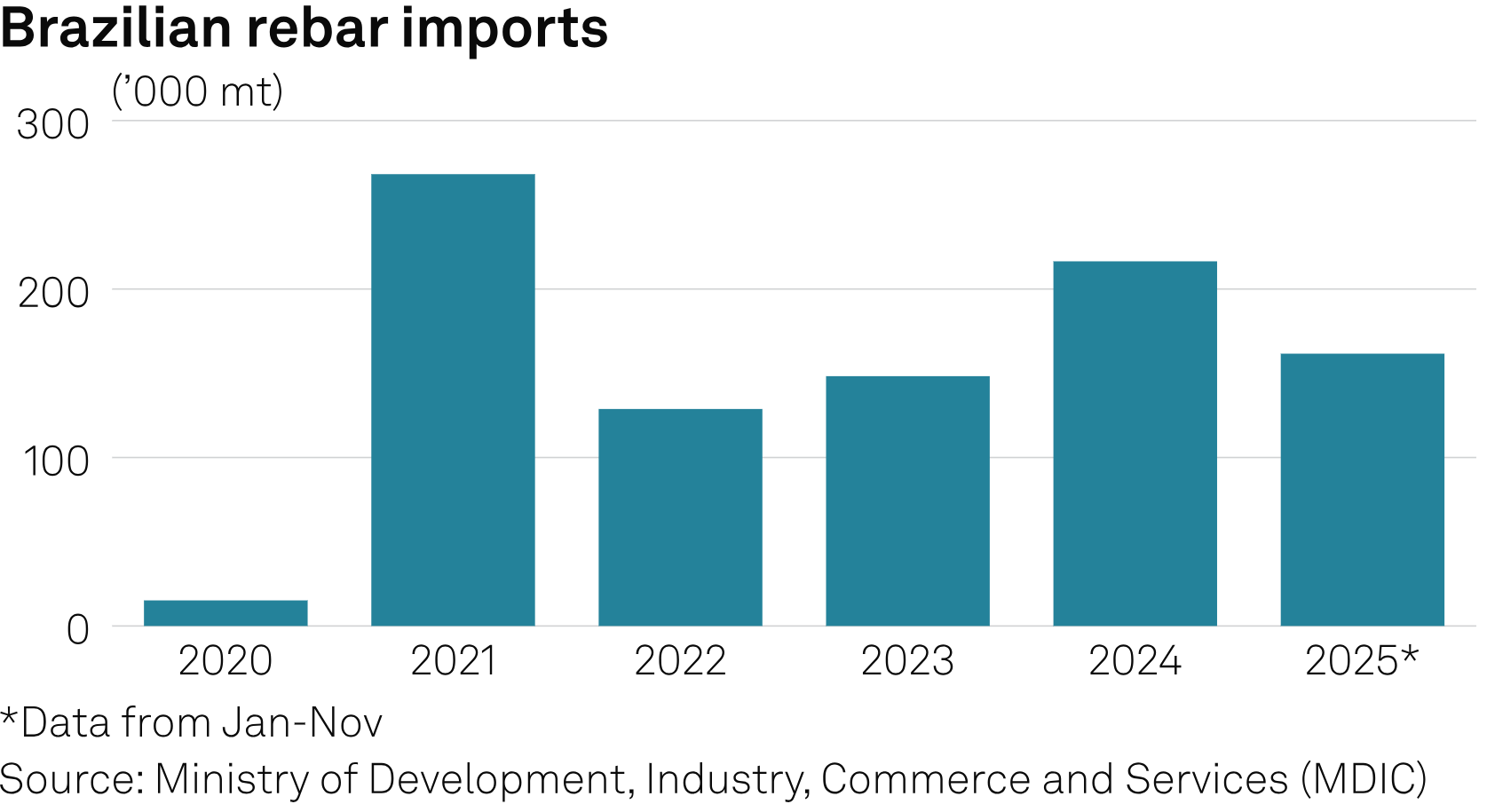

After adding 216,446 mt of rebar imports in 2024, the fourth-highest level in Brazil's historical record, accumulated rebar imports totaled 161,628 mt from January to November 2025, according to data from the Brazilian Ministry of Development, Industry, Commerce and Services (MDIC). Sources said the dynamics were largely influenced by the decline in prices in the domestic market.

Buyers and traders anticipate an increase in imports in 2026, in response to a potential rise in domestic prices during the first quarter. Sources expect prices to be higher next year, as there is no 'price war' on the horizon like the one that drove prices down in the domestic market throughout 2025.

Purchases abroad were once again boosted by the bilateral agreement between Mercosur and Egypt in 2025, as they were in 2024, which guaranteed a 0% tariff on rebar from that country. As of November 2025, Egypt accounted for 76% of Brazil's total long steel imports, making it the country's leading supplier.

Between January and November 2025, the primary entry points for foreign products were the ports of Santa Catarina in southern Brazil, renowned for their tax incentives. Itajaí handled 122,327 mt, while São Francisco do Sul received 31,171 mt.

Products & Solutions

Editor: