Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Fertilizers, Chemicals, Energy Transition, Renewables

December 11, 2025

By Mollie Gorman and Mark Astley

HIGHLIGHTS

Default carbon intensity for US ammonia rises sharply

Market participants express shock and concern

Other default values similar to the previous CBAM phase

Market participants in the ammonia sector expressed surprise at a proposed increase in the default carbon intensity for US-origin ammonia under the EU's Carbon Border Adjustment Mechanism.

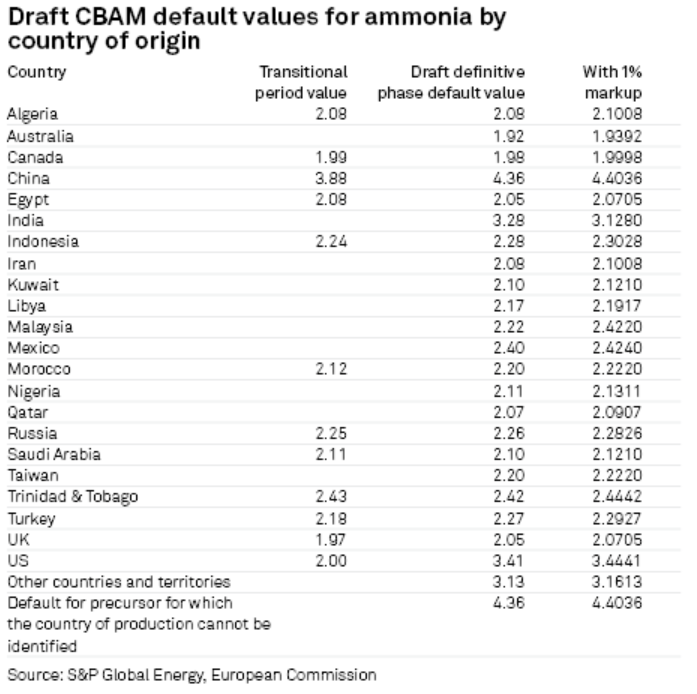

According to draft documents from the European Commission's CBAM committee, reviewed by Platts, US-origin ammonia will face a default carbon intensity of 3.41 mtCO2e from Jan. 1 when the definitive phase of CBAM starts, compared with 2 mtCO2e in the scheme's transitional phase. Platts is part of S&P Global Energy.

The documents also revealed that a decrease in the benchmark value for ammonia imported to the EU was approved by the CBAM committee.

Importers of ammonia will face a lower benchmark free allowance of 1.522 mtCO2e, according to the draft documents. The previously published benchmark for the scheme's transitional phase was 1.57 mtCO2e.

The documents have not yet been formally adopted, so they could still be subject to change.

The reduced benchmark free allowance and increased default carbon intensity value of US-origin ammonia suggested that ammonia importers' CBAM exposure when importing from US producers would increase from around $45/mt to $180/mt.

One Europe-based market trader said it was "disappointing."

New ammonia plants are expected to come online in the US in 2026, including at least two with carbon capture and sequestration technology, which should reduce their carbon intensity to near the benchmark value.

The trader said it was "torpedoing the very thing CBAM should be doing." They said it would mean no US-origin ammonia would flow into Europe.

In the first nine months of 2025, the EU imported a total of 2.06 million mt of ammonia from outside the region, of which close to 10% -- 202,000 mt -- arrived from the US, according to data from S&P Global Market Intelligence's Global Trade Atlas.

A European buyer said they hoped the draft documents "do not come true."

"This seems a bit unfair on gas-based ammonia producers," they said. "The US has been a reliable partner of ammonia to Europe."

It would leave US producers highly reliant on verification schemes to prove their carbon intensity was lower, the buyer said.

A second European buyer said it "looks like the EU wants a tariff on ammonia from the US, implemented via CBAM."

Default values for every other common origin of ammonia to Europe are very similar to those used from the transitional period.

Russia increased from 2.25 mtCO2e to 2.28 mtCO2e, while Algeria was unchanged, and decreases were seen for Egypt from 2.08 mtCO2e to 2.05 mtCO2e, and Trinidad & Tobago from 2.43 mtCO2e to 2.42 mtCO2e, according to the draft documents.

The draft documents also revealed the fertilizer industry would see a 1% penalty markup for using the default values, revised down from the originally planned 30%.

Products & Solutions

Editor: