Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Energy Transition, Carbon, Emissions, Hydrogen

December 23, 2024

HIGHLIGHTS

Regional competitive CO2 advantages help mitigate challenges

Over 200 million mt/year proposed CO2 capture capacity across sectors

Strong CO2 transportation infrastructure; timeline for Class VI wells uncertain

The US Gulf Coast heavy industry views carbon capture and storage technology as crucial for decarbonization while facing hurdles such as high costs, class IV permits and construction delays, and unclear business models.

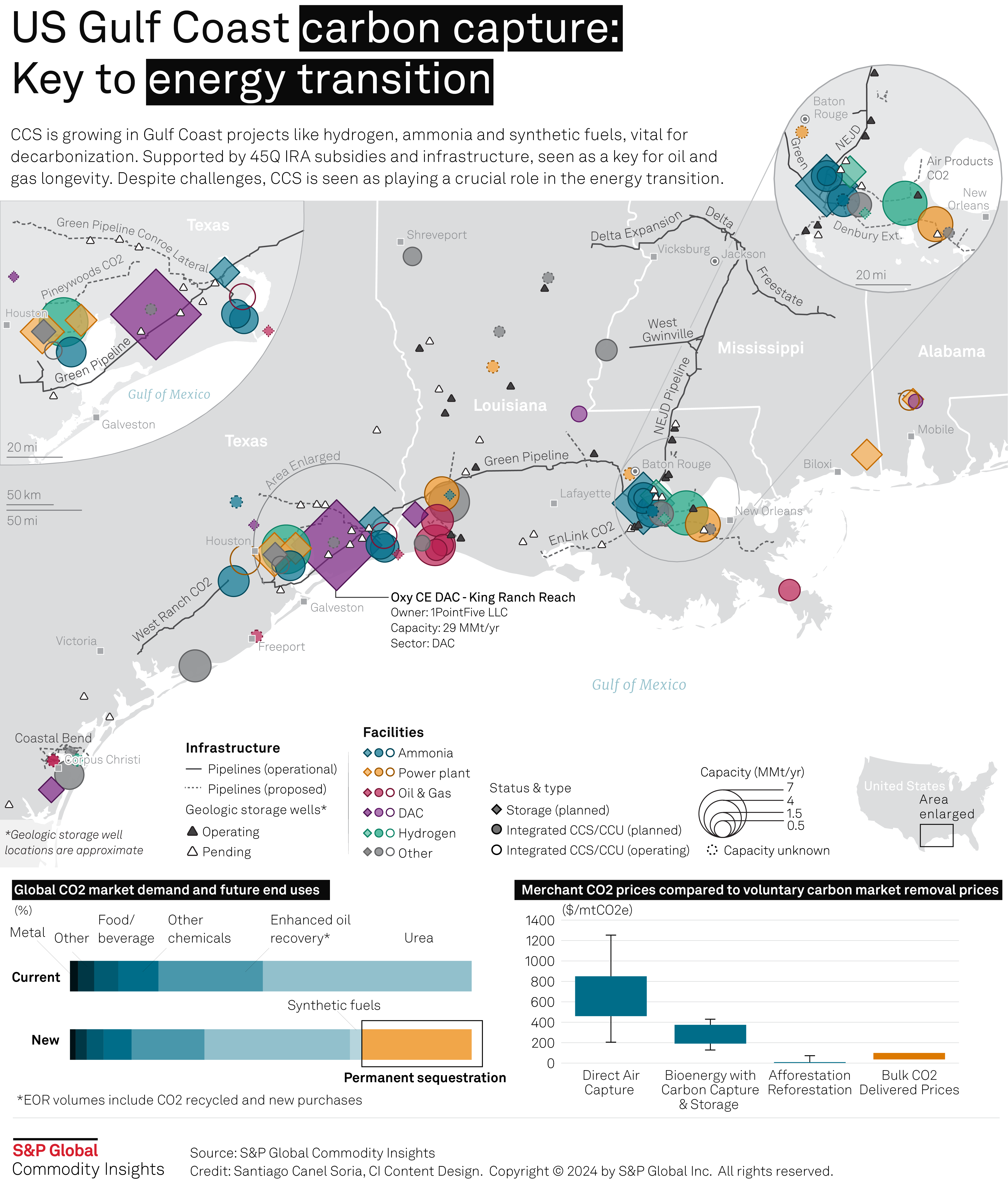

The Gulf Coast region has vast forms of carbon capture technologies being proposed and built such as direct air capture and integrated capture technologies across various hard-to-abate industrial sectors like ammonia, hydrogen, BECCS, power plants, methanol, to name a few, totaling over 200 million mt/year of CO2 capacity, according to S&P Global Commodity Insights data.

Drivers for CCS technology in the USGC include competitive CO2 capture costs, government support for CCUS from the Inflation Reduction Act 45Q corporate tax credits, transportation and storage infrastructure, a voluntary carbon market and the emergence of offtake CO2 agreements, according to Commodity Insights.

"The lack of a clear business model is the main challenge for CCS in the region since 45Q is only enough for a very limited set of industries including ethanol, natural gas processing, ammonia, and some hydrogen projects," said Paola Perez Pena, Clean Energy Technology, Principal Analyst at Commodity Insights. "Thus, projects in other sectors need to find additional revenue streams making it a challenge to finance."

While hydrogen and ammonia developers view price transparency as beneficial for securing financing, the $85/mt from the 45Q tax credit is also seen to bring flexibility in applications where capture costs are expensive.

"The USGC is well positioned with existing infrastructure to transport CO2 yet the timeline on some of the class VI wells is still a little bit uncertain despite the fact that Louisiana is a primacy state," Perez Pena said.

The majority of class VI CO2 permanent sequestration permit applications filed with the US Environmental Protection Agency and the Louisiana Department of Energy and Natural Resources are located in the USGC, with most issued and permitted wells in Louisiana.

Data on current Class VI projects under EPA review shows that the process from application receipt to permit approval typically takes just over two years, while newer sequestration wells are estimated to take less than two years.

"Delay in these approvals is causing a hold-up in major CCS-based 'blue' ammonia projects," said a low-carbon ammonia producer in the USGC, who is awaiting approval on their sequestration well, adding that the delay is impacting finalizing offtakes destined to Asia, and challenging to meet delivery by 2029-2030.

CO2 pipelines are expanding in the Gulf Coast, with over 500 miles currently active, including the Green Pipeline, formerly Denbury and now ExxonMobil, from Texas to Louisiana and the 180-mile NEJD pipeline from New Orleans to Mississippi. Additionally, there are over 200 miles of proposed pipelines either connecting to major lines or leading directly to storage sites.

A CO2 pipeline operator in the USGC with CO2 agreements from heavy industry is seen charging $50-$60/mt all in sequestration to end-users, the USGC developer added.

"Our strategy has been to secure land with access to barging, docking, rail, and CCS infrastructure from a nearby smaller-scale service provider to avoid the high costs charged by larger CO2 pipeline service providers in the USGC," a second USGC developer said.

Merchant bulk CO2 prices in the USGC range from $40-$100/st ($36-$91/mt), depending on composition/purity and transportation distance by truck, according to a source.

This compares to carbon removal credits in the voluntary carbon market, which have been seen around $200-$1,300/mtCO2e for DAC, $100-$400/mtCO2e for bioenergy with CCS and afforestation at $2-$67.50/mtCO2e, depending on delivery terms and geography. The Platts Tech Carbon Capture price was assessed at $130/mtCO2e on Dec. 23, a 7% rise from the beginning of the year.

Under the IRA 45Q, tax credits can reach up to $180 per metric ton for carbon removed via DAC.

DAC projects appeal to a limited group of buyers due to high costs as its considered unique for its high-quality removal capabilities, attracting corporate investment, Perez Pena added.

Hydrogen and ammonia projects using CCS plan to bundle their emission reduction attributes with their low-carbon product and market it at a premium versus participating in the VCM.

Platts assessed the blue ammonia premium on the US Gulf Coast at $30.15/mt on Dec. 20, accounting for the cost of capturing 90% of CO2 during production. This resulted in an outright 'low-carbon' blue ammonia price of $530.15/mt, considering the premium and the conventional US Gulf FOB assessment of $500/mt.

CO2 capture costs across heavy industries are influenced by factors such as the purity of the CO2 stream, the capture technology used, the size and design of the plant, and the plant's utilization rate, according to Commodity Insights.

Current global CO2 market demand is at 270 (MMtCO2/year), primarily going to urea, enhanced oil recovery, fabricated metals, other chemicals, food, and beverage, to name a few, according to Commodity Insights data.

CCU technology is expected to be crucial for supplying CO2 to boost low-carbon e-fuel production, transitioning from enhanced oil recovery (EOR) to synthetic fuels in the US by 2030.

Despite challenges, improvements in plant capacity, economies of scale, technological innovations, and hub networks like pipeline systems are expected to boost CCS efficiency and lower costs through optimized transport and storage.