Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Electric Power, Energy Transition, Renewables

August 05, 2025

By Francisco Sequera and Carlos Barraza

HIGHLIGHTS

Growth in renewable capacity expected, impacting REC competition, market dynamics

New York aims for a 70% renewable grid by 2033, with increased electricity demand

REC prices should rise as the average cost of NYSERDA contracts will increase: source

Tier 1 RECs pre-sale aims to balance supply, demand while reducing ratepayer costs

New York state is intensifying its commitment to clean energy with the release of the Draft 2025 Energy Plan and the recent launch of the Vintage 2026 Tier 1 Renewable Energy Certificates (RECs) Voluntary Pre-Sale from New York State Energy Research and Development Authority, which point to a strong market focus on decarbonization and renewable energy generation that could have significant price implications for RECs.

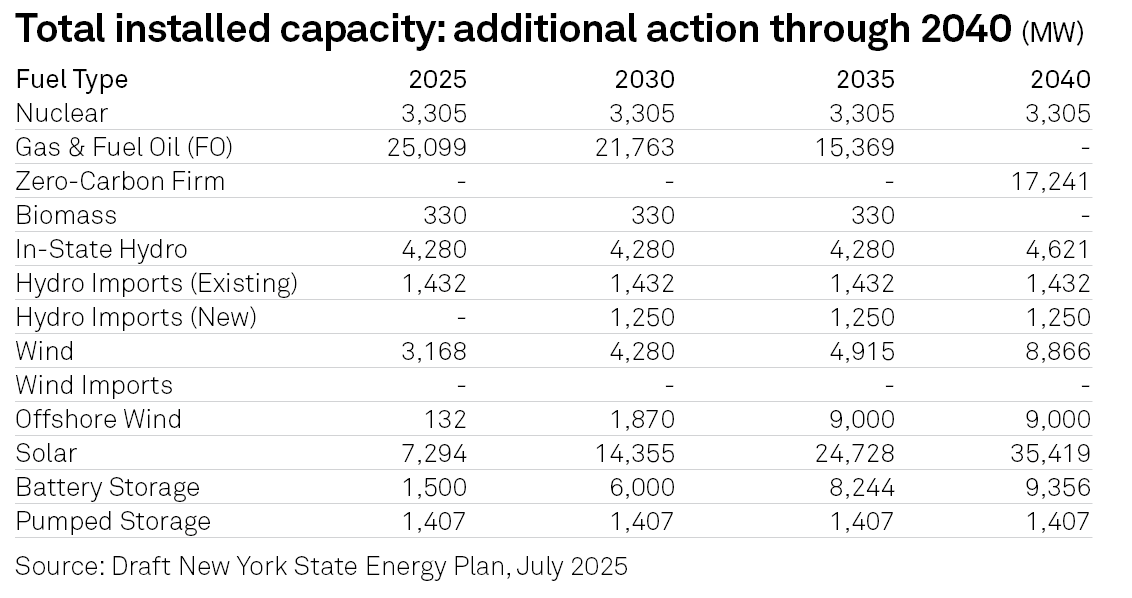

The Draft 2025 Energy Plan serves as a comprehensive road map for New York's energy transition through 2040. It projects a shift toward a 70% renewable grid by 2033, with a notable increase in electricity demand, which, alongside a complete phaseout of fossil fuel-based generation, is expected to drive up the value of renewable energy credits as the state seeks to meet its ambitious clean energy targets.

Key highlights from the Energy Plan include a projected 26% increase in annual electricity demand by 2040, which will likely place upward pressure on REC prices as demand for renewable energy sources rises.

"NYSERDA has a substantial annual inventory of Tier 1 RECs from operating in-state renewables, with many more generators planning to begin operation in the coming years, such that there are enough RECs to meet significantly more demand," a spokesperson from NYSERDA told Platts.

" I do expect NYSERDA contract prices to increase, and as a result, the Tier I REC charge passed through to LSEs [Load-Serving Entities] would likely increase," a market participant said Aug 5.

In conjunction with this road map, NYSERDA's Vintage 2026 Tier 1 REC Voluntary Pre-Sale, which opened on July 30, offers 4 million RECs at a fixed price of $23.96/MWh. This fixed pricing strategy indicates a structured approach to managing supply and demand in the market.

"The Voluntary REC Sale price is set based on the net-weighted average price of NYSERDA's total Tier 1 REC inventory," the spokesperson said. In determining the Tier 1 REC pre-sale price, NYSERDA would sum the projected procurement costs and annual MWh of generation from resources that have existing Tier 1 REC agreements with NYSERDA, both fixed and index-priced contracts.

"The RECs are offered for sale at NYSERDA's cost to purchase, and the full sale revenue is used to reduce ratepayer costs," the NYSERDA spokesperson said.

Last year, during the 2025 Tier 1 pre-sale, over 2.75 million Tier 1 RECs were available, but only 58,500 were sold to the voluntary market. This year, the offer increased by 1.15 million REC. However, NYSERDA remains optimistic about market participation this year.

"NYSERDA has continued to engage the market through various activities like conference presentations, webinars, and direct meetings with interested organizations, and the level of interest in sale participation has been encouraging," the spokesperson said.

When inquired about the market appetite for Voluntary Tier 1 RECs, a trader stated, "I have not seen much interest. It appears that all but 1,000 of the 2025 RECs were purchased by other government agencies, suggesting a lack of demand from outside these entities." However, he also expressed interest in the results of the ongoing pre-sale for the 2026 vintage RECs on Aug. 5.

All revenue generated from voluntary REC sales is applied directly to reduce the overall cost of the Tier 1 program. "The 2025 sales directly reduced ratepayer Tier 1 obligations by nearly $1.5 million," the spokesperson added.

Recent market assessments from Platts, part of S&P Global Energy, show New York's Tier 1 RECs closing at $41/MWh for compliance year 2024 and wind RECs at $4.5/MWh for vintage 2025, suggesting a robust market for renewable energy credits.

As the final State Energy Plan is developed, potential updates to federal tax laws and regulatory policies could further influence the market dynamics for RECs, making it essential for stakeholders to stay informed of these changes.

Overall, New York's ambitious clean energy goals, coupled with the strategic pricing of RECs, are likely to create a dynamic environment for renewable energy markets in the coming years.

Editor: