Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Crude Oil

January 03, 2026

HIGHLIGHTS

No incidents reported at oil facilities

Maduro captured by US

Venezuelan exports decline in December

Venezuela's government accused the US of trying to seize the country's oil as large-scale US strikes Jan. 3 rocked the country, and Venezuelan President Nicolas Maduro was captured.

“The objective of this attack is none other than to seize Venezuela's strategic resources, particularly its oil and minerals, in an attempt to forcibly break the nation's political independence. They will not succeed,” the Maduro government said in a statement.

US President Trump had earlier Jan . 3 said on social media that Maduro and his wife had been flown out of the country.

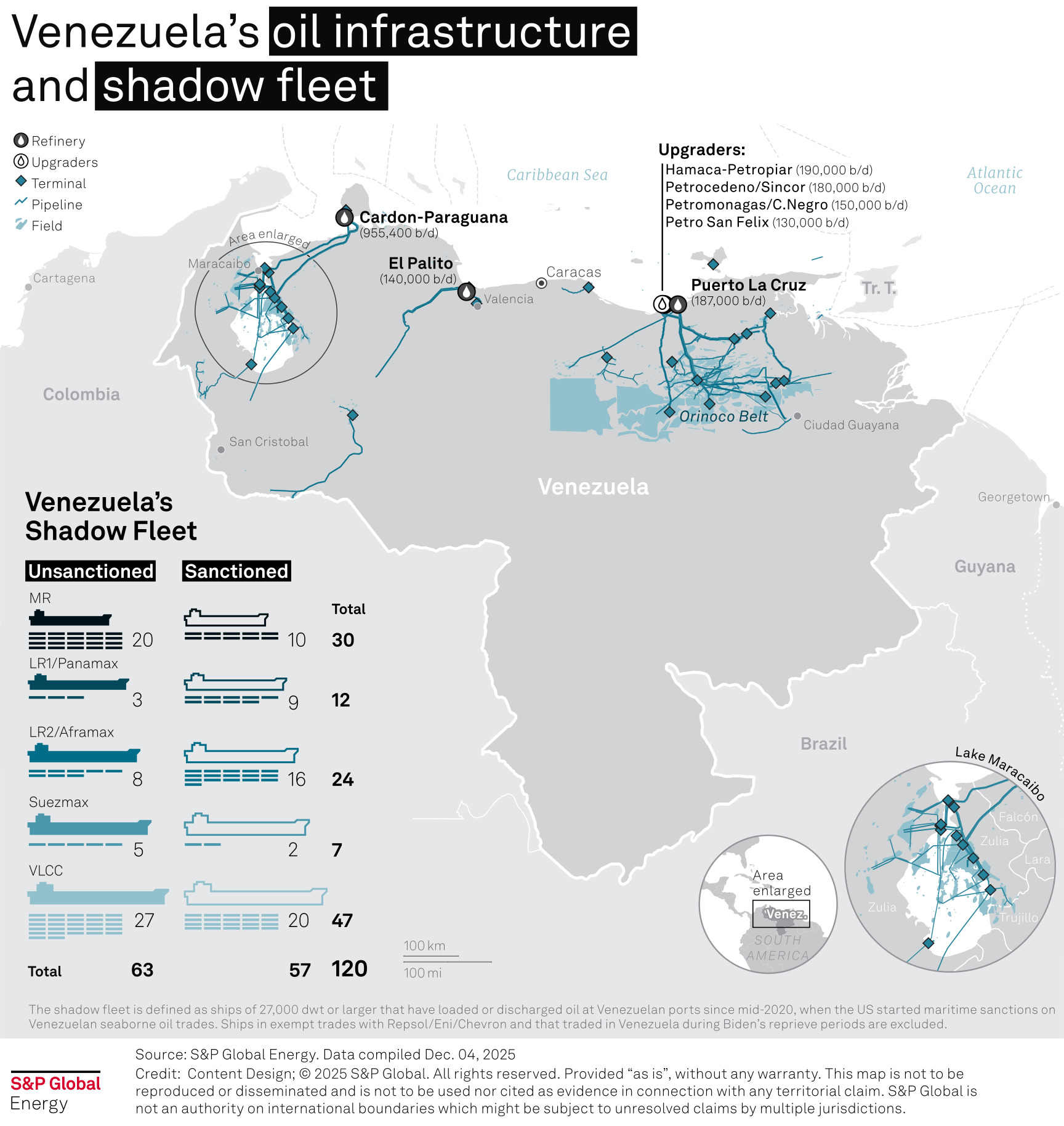

Venezuelan crude production and exports had already declined in December as the US intensified enforcement of sanctions on oil tanker shipments from the country.

Venezuela exported 19 million barrels of oil in December, down from 27.2 million barrels in November and down from 20.7 million barrels in December 2024, according to S&P Global Commodities at Sea data.

No incidents have been reported at oil facilities, oil fields, refineries, or oil ports, according to sources who spoke on condition of anonymity.

“Chevron remains focused on the safety and well-being of our employees, as well as the integrity of our assets," Bill Turenne, Chevron's Head of Public Policy Communications, said in an email to Platts. "We continue to operate in full compliance with all relevant laws and regulations.”

Some analysts have questioned how significant the events in Venezuela will be for oil markets.

"Overall, I assess that Brent crude prices will rise only marginally at the open on Sunday evening, by $1-$2 or even less. As with other geopolitical events in 2025, the market will quickly conclude that there is already ample oil supply, notably in the first quarter, and that a temporary loss of Venezuelan oil has largely been priced in," said Arne Rasmussen, chief analyst and head of research at Global Risk Management, in a note to clients Jan. 3.

Platts Dated Brent was last assessed Jan. 2 at $60.975/b. Platts is part of S&P Global Energy.

"At the margin, fears of a loss of Venezuelan oil could support the HSFO market, which is based on residual oil, of which there is plenty in Venezuelan crude," said Rasmussen.

In a post on X, formerly Twitter, US Vice President JD Vance said the administration offered "multiple off ramps" to Maduro in recent weeks.

"But (the administration) was very clear throughout this process: the drug trafficking must stop, and the stolen oil must be returned to the United States," a reference to Trump's previously stated view that Venezuela's oil industry nationalization under former President Hugo Chavez was an illegal seizure of US companies' assets.

In an interview on Fox News earlier Jan. 3, Trump responded to a question on the future of Venezuela's oil industry by saying US companies would be "very strongly involved in it."

"That's all," Trump continued. "What can I say? We have the greatest oil companies in the world."

Products & Solutions