Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Agriculture, Energy Transition, Refined Products, Biofuel, Renewables, Jet Fuel

August 27, 2025

HIGHLIGHTS

UK slaps up to 54.65% antidumping duties on Chinese biodiesel

Move to protect local producers amid competition, weak demand

Gulf feedstocks benefit as Chinese volumes face higher barriers

The UK's Trade Remedies Authority recently recommended extensive antidumping duties on Chinese biodiesel imports, highlighting escalating tensions in global renewable fuels trade, with proposed tariffs for non-cooperating exporters reaching up to 54.65%, exceeding the EU's 2024 penalties of around 35%.

The investigation was initiated on June 5, 2024, following an application by the Renewable Transport Fuels Association. The recommendation for antidumping duties came on Aug. 22.

While framed as a protective measure to shield struggling domestic producers, the decision could reverberate far beyond the UK's borders, reshaping trade flows, investment signals and even China's renewable fuels strategy.

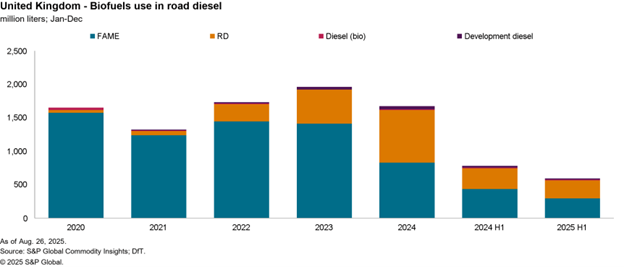

Official data from the Department for Transport showed a significant decline in UK biomass-based diesel consumption, dropping 32% year over year in the first half of 2025, as demand for both FAME (-37%) and renewable diesel (-24%) contracted due to reduced road fuel demand and blending rates.

Producers have buckled under the combined weight of weak domestic demand and cheaper imports. Greenergy suspended operations at its Immingham FAME plant, while AB Foods' Vivergo bioethanol facility announced its closure after failing to secure government support.

Against this backdrop, TRA's findings of "material injury" from dumped imports reflect a sector already in survival mode.

"The duties are an attempt to level the playing field and give domestic producers breathing room," a market source said.

China's rapid scale-up in biodiesel and hydrotreated vegetable oil exports has placed it squarely in the crosshairs of both UK and EU trade officials.

UK investigators concluded that Chinese biodiesel has been sold well below market value, undercutting European producers by margins that made survival difficult.

The UK has set a more lenient 15.68% duty on named companies, including EcoCeres, Jingu Group and Zhuoyue, while all others face the prohibitive 54.65% rate.

With EU penalties already limiting access, the UK's action could further squeeze Chinese biodiesel exporters out of Europe altogether.

Industry watchers suggested that the duties could accelerate China's pivot toward sustainable aviation fuel. Like the EU, the UK has explicitly exempted SAF from antidumping duties, creating an incentive for Chinese refiners to reallocate capacity.

"This could become a catalyst for faster Chinese entry into the SAF export market, where regulatory exemptions and strong global demand make the economics far more attractive," a Singapore-based trader said.

The pressure on Chinese biodiesel is already shifting the balance in waste-based feedstocks across Europe.

According to a UAE-based analyst, recent developments around antidumping duties on Chinese biodiesel continue to shift trade patterns.

"With Chinese volumes facing higher barriers, buyers in Europe are increasingly sourcing waste-based feedstocks from alternative origins, and GCC [Gulf Cooperation Council] UCO is emerging as a key beneficiary," the analyst said.

Imports of UCO are holding firm in the $1,130-$1,160/mt range, with spot activity in the Amsterdam-Rotterdam-Antwerp region reaching as high as $1,220-$1,255/mt.

As Europe reduces reliance on Chinese biodiesel, GCC-origin UCO is increasingly positioned as a competitive and trusted supply option.

The market is expecting that strong compliance, traceability and geographical advantage will keep prices well supported.

The UK is simultaneously pursuing trade liberalization elsewhere. Under the UK-US Economic Prosperity Deal, tariffs on US ethanol imports were eliminated, as tariffs on US ethanol (GBP160/cu m for undenatured ethanol and GBP85 for denatured grades) will fall to zero through a 1.4 billion-liter quota. This volume is equivalent to the size of the UK's fuel ethanol market.

The move exerted direct pressure on domestic ethanol producers such as Vivergo and Ensus. This resulted in plant closures and reduced domestic capacity -- an ironic consequence of a policy intended to safeguard local producers.

This duality highlights the policy tension of balancing the protection of domestic industry with the need to provide affordable renewable fuels for consumers while adhering to climate mandates.

With the Renewable Transport Fuel Obligation climbing to 13.55%, the UK cannot afford supply shocks, yet tariffs risk tightening availability just as blending mandates rise.

The UK's action sits within a broader wave of protectionism in renewable fuels:

EU: Finalized 35.6% antidumping duties on Chinese biodiesel and RD in February.

US: Exemptions for small refiners and reviewing trade defense against Chinese and Southeast Asian waste-based biodiesel.

China: Facing narrowing arbitrage into both Europe and the UK, likely to redirect exports to SAF or new growth markets in Asia.

According to market sources, the timing is critical for the UK as demand for waste-based feedstocks tightens globally, with Europe attaching ever-higher premiums to traceable UCO. If imports from China retreat, UK refiners could face higher costs for both biodiesel and SAF production.

In the short term, duties may give UK producers some breathing space, but the long-term outcome is far from guaranteed.

Market fundamentals indicated that weak domestic demand, high reliance on imports and intensifying global feedstock competition are likely to remain largely unchanged.

Moreover, if Chinese producers succeed in redirecting volumes into the SAF market, the UK may find itself trading one dependency for another: less vulnerable in road fuels but increasingly reliant on foreign supply in aviation.

Policymakers face the challenge of ensuring that mishandled trade remedies do not deter the essential investments required to establish the UK's next-generation fuel supply base.

Platts, part of S&P Global Energy, assessed UCOME FOB Straits at $1,245/mt on Aug. 27, unchanged day over day.

Platts assessed UCOME FOB North China at $1,170/mt on Aug. 27, unchanged day over day and below two offers.

Platts assessed the Asian SAF-jet fuel spread at $1,319.77/mt on Aug. 27, up $45.20/mt day over day.

Products & Solutions