Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Agriculture, Coal, Metals & Mining Theme, Biofuel, Metallurgical Coal, Ferrous, Non-Ferrous

July 08, 2025

HIGHLIGHTS

Indonesia and Thailand face steep US tariffs on seafood, ethanol, and palm oil exports.

Indonesia's $2.1 bil seafood exports, Thailand's $1.7 bil seafood exports to US at risk

Palm oil value addition efforts in both countries face tariff threats

Indonesia and Thailand, two of Southeast Asia's most export-driven economies, are bracing for a new wave of steep US tariffs that threaten their top-performing sectors, including seafood, ethanol, and palm oil derivatives.

US President Donald Trump confirmed on July 7, on his TruthSocial posts, that he would impose higher tariffs on several trade partners starting Aug. 1, with Indonesia facing a 32% rate and Thailand 36%, unless they come to the table with what he called "acceptable proposals." Those rates are unchanged from earlier rounds but reinforce an aggressive US posture that also targets Japan, South Korea, Bangladesh and Cambodia.

For Indonesia, seafood is at the heart of its agri-export economy. The world's second-largest seafood exporter after China, Indonesia, shipped nearly $2.1 billion worth of seafood to the US in 2023, according to US National Oceanic and Atmospheric Administration data, with shrimp, tuna, and crab as leading items. This trade, vital to coastal livelihoods across Sulawesi, Java and Sumatra, is already squeezed by soft global prices this year. The Indonesian Frozen Seafood Association said US buyers had begun to delay contracts since Trump's announcement, raising the risk of an inventory glut.

Thailand is in a similar position. The US remains its single largest seafood export market outside Asia, taking in about $1.7 billion in Thai seafood products in 2023, US Census Bureau data showed.

The Thai Frozen Foods Association warned that higher tariffs could "hand market share to Vietnam and India," even as Thai processors have invested heavily in sustainability certifications to maintain US access.

Ethanol is another sector under pressure. The tariff threat comes at a particularly challenging time when both countries have scaled up ethanol output — Thailand as part of its bioeconomy strategy to reduce reliance on fossil fuels and boost sugarcane sector incomes, and Indonesia as part of its B35 and E5 blending mandates.

Thai ethanol exports to the US crossed 250 million liters in 2023, while Indonesia has started supplying small but growing volumes. Industry officials fear higher tariffs will sap already thin margins in a market where Brazilian and US corn-based ethanol dominate.

The palm oil complex represents another critical vulnerability in US–ASEAN trade disputes. While crude palm oil itself faces restrictions, Indonesia and Malaysia have expanded exports of palm-derived oleochemicals, biodiesel feedstock, and specialty oils to the US, worth hundreds of millions of dollars annually.

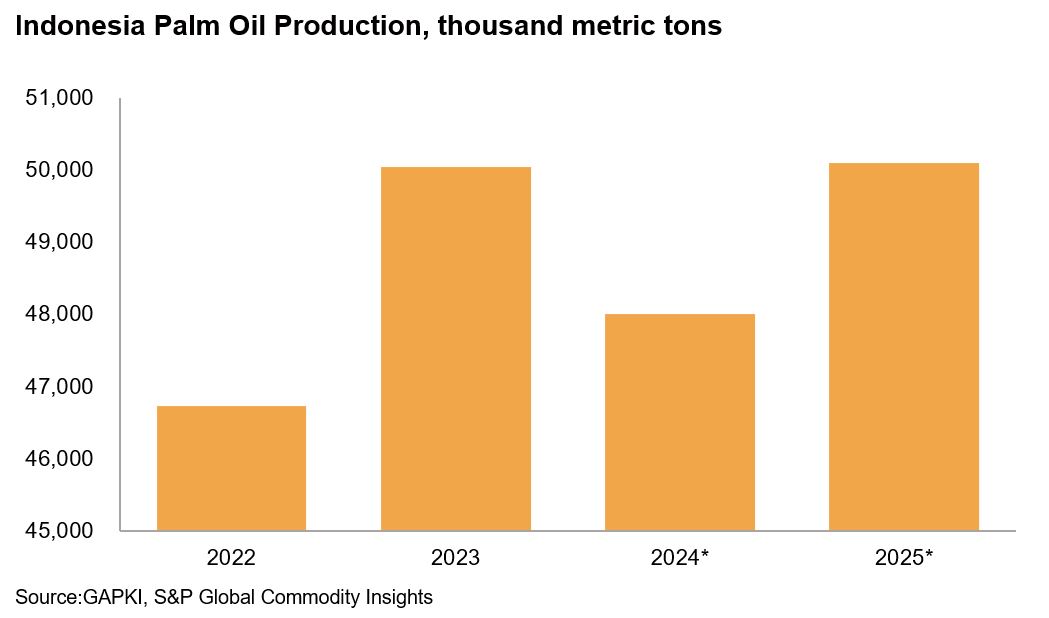

The Indonesian Palm Oil Association noted that higher tariffs on palm-based biodiesel and downstream products could hurt value-added diversification efforts.

Indonesian palm oil exports to the US may fall due to Trump's threat of a 32% tariff on Indonesian exports, Hadi Sugeng, secretary general of the Indonesian Palm Oil Association (GAPKI), said July 8.

The US imported 1.9 million mt of palm oil in 2023-24, making it the fifth largest importer globally, US Foreign Agricultural Services said in a June report.

Indonesian palm oil products account for 85% of US palm oil imports and may lose market share to Malaysian palm oil, which faces lower tariffs, and other vegetable oils, Sugeng said.

The Indonesian Ministry of Trade and Thailand's Commerce Ministry have so far withheld formal comment but are reportedly working through ASEAN and bilateral channels to seek an exemption or compromise before the August deadline.

However, Trump left some room for negotiation, saying he is "open to extensions if countries make proposals," though he made clear the US intends to extract concessions to protect American industry.

The US imported nearly $5 billion of seafood, ethanol and palm-based products combined from Indonesia and Thailand in 2023, underscoring the high stakes for producers in both countries. Analysts say the tariff threat could ripple through rural economies just as global demand recovery shows signs of fragility in 2024.

Even as Trump kept tariff rates for Indonesia unchanged since the first announcement made in April, the president warned the country in a letter that any transhipments will invoke higher tariffs, indirectly flagging the re-export strategy used by China.

From the metal market perspective, China has ramped up its steel shipments to countries like Vietnam and Indonesia in recent years after weak domestic demand pushed Chinese steel suppliers to explore overseas demand.

China's steel product exports to Indonesia rose 54% since 2021, reaching 8.2 million mt in 2024, S&P Global Commodities at Sea data showed. While Indonesia's exports of similar products to the US are not large volumes, shipments grew at a rate of 157% since 2021 to 2024.

Indonesia is also home to one of the world's largest bauxite and nickel reserves, but the country has banned bauxite exports and has emphasized building a value chain for nickel to promote its domestic processing industry. Bauxite is the raw material to produce aluminum, which already carries an escalated 50% tariff rate when shipped to the US.

Platts, part of S&P Global Energy assessed Nickel Pig Iron FOB Indonesia at $113.49/mtu, down 16 cents/mt day over day.

Products & Solutions