Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Agriculture, Energy Transition, Refined Products, Oilseeds, Biofuel, Renewables, Jet Fuel, Carbon, Vegetable Oils

January 21, 2026

HIGHLIGHTS

Plantation economics rely on oil and meal revenue

Pongamia oil targets UCO pricing, supplements supply

Carbon credits help finance long-cycle plantation

Pongamia oil could emerge as a scalable, sustainable aviation fuel feedstock later this decade if plantation economics, regulatory eligibility, and offtake demand align, Guillaume Foucheres, managing partner at Canopy Energies, said in an interview with Platts, part of S&P Global Energy.

Canopy Energies is developing one of the world's largest pongamia plantations in Madagascar, positioning the tree-based oilseed as a complement to used cooking oil, which currently dominates the hydroprocessed esters and fatty acids SAF pathway but faces structural supply constraints.

As the global SAF and HVO build-out accelerates, markets are straining under tightening supplies of waste and vegetable oils and increasing scrutiny of sustainability claims. Attention is increasingly shifting to non-food feedstocks, with pongamia re-emerging as a credible option.

The crop is a nitrogen-fixing legume tree capable of delivering high oil yields on degraded land.

"We don't see pongamia as a short-term solution," Foucheres said. "This is a long-cycle agricultural project, but SAF demand will need additional feedstocks beyond UCO."

The company has already planted over 1 million pongamia trees across Madagascar's eastern coast and secured 14,000 hectares of additional land, targeting 50,000 ha by the mid-2030s. Full commercial production of roughly 75,000 metric tons of pongamia oil annually is projected in 2035 if execution follows the plan.

According to Foucheres, the project differentiates itself from other pongamia initiatives, including those led by mining and energy conglomerate giants across the globe, by prioritizing ecological suitability over genetics-led yield optimization.

"We started with the land, not the tree," he said.

Pongamia is native across a belt stretching from Madagascar to Australia and typically thrives in coastal regions with sandy soils and high rainfall. Canopy's plantations are located in areas receiving more than 1,500 mm of annual rainfall, consistent with where the species naturally occurs.

"More than 90% of pongamia occurrences in Australia are found in regions with over 1,000 mm of rainfall," Foucheres said. "Trying to grow it in drier zones introduces unnecessary risk."

According to Canopy, Madagascar was selected after Canopy assessed other regions, including parts of Southeast Asia and Papua New Guinea. While Papua New Guinea met the ecological criteria, Madagascar offered additional advantages, including large contiguous land plots, proximity to port infrastructure and one of the world's lowest agricultural labor costs.

Of the 14,000 has secured by Canopy Energies in Madagascar, around 60% — roughly 8,400 has — will be planted with pongamia, with the remainder allocated to complementary land uses. At assumed mature yields of about 12 mt/ha, this equates to around 100,000 mt/year of seeds, producing roughly 15,000 mt of oil and 35,000 mt of meal at full maturity, Foucheres said.

Canopy's oldest trees are less than three years old, meaning commercial yields are yet to be realized. Canopy is instead benchmarking yields based on mature pongamia trees located within 150 km of the plantation area.

On maturity, the company assumes seed yields of around 30 kg per tree, with approximately 400 trees /ha, equating to about 12 mt of seeds /ha. After accounting for husks and oil content, this translates to an estimated 1.2 mt of oil /ha.

Foucheres acknowledged this is lower than palm oil yields (3.5 mt/ha) but said lower land and labor costs in Madagascar offset the difference.

"In Australia, everything is expensive, so you must chase yield," he said. "Here, the cost base is fundamentally different."

Canopy expects pongamia meal to play a significant role in project economics. With seeds yielding roughly 30% oil and 70% meal, the company estimates that meal could account for around half of total revenue.

Indicative internal pricing assumptions are around $1,000/mt for oil and $250/mt for meal, Foucheres said.

Madagascar currently imports soybean meal, largely from India, at prices closer to $500/mt due to customs duties. While pongamia meal has lower nutritional value than soy, Canopy applies a conservative discount to ensure local competitiveness.

"We are realistic about the limitations of the meal," Foucheres said. "But locally, it still makes economic sense."

At the 14,000-ha plateau, Canopy projects roughly 100,000 mt of seeds annually translating to approximately 15,000 mt of oil and 35,000 mt of meal. At these prices, that's roughly $15 million in oil revenue plus $9 million in meal revenue, totaling approximately $24 million annually.

Canopy benchmarks pongamia oil against UCO and other waste oils, which remains the primary HEFA feedstock for SAF producers globally. The company's business plan assumes UCO-equivalent pricing in the range of $1,000–1,200/mt.

Foucheres said UCO supply is structurally capped due to collection and logistics constraints.

"You cannot recover all the oil used for cooking," he said. "If SAF scales meaningfully, other feedstocks will be required."

The company also claims that its pongamia oil carries a negative carbon footprint, as the trees are grown on degraded land and annual biomass growth exceeds harvested volumes.

Canopy has yet to decide whether it will export dry seeds for crushing abroad or invest in domestic crushing capacity in Madagascar.

Exporting seeds would reduce capital requirements and operational complexity, while local crushing would allow meal to remain in Madagascar, where it has higher value. However, small-scale crushing plants often struggle to achieve economies of scale.

"We are still evaluating the trade-offs," Foucheres said, adding that any local crushing facility would likely involve a joint venture with an established industrial partner.

A final decision is expected within the next two years.

"We're in discussions about the downstream business," Foucheres said. "Either we sell dry seeds at Tamatave, the main port on the east side of Madagascar, and they get exported to Japan, crushed, and transformed into SAF. Or we do the crushing in Madagascar."

The economics pull both directions.

"We talked to Bunge about technical issues," Foucheres recalled. "When we told them we wanted a crushing facility for 50,000 mt, they told us it's too small. They're used to massive facilities. But we're still in discussions. If we do crush in Madagascar, it would likely be a JV with a larger industrial partner, potentially a specialist in vegetable oil from Japan.'

The plantation is registered as a Verified Carbon Standard (VCS) project 5160 and is nearing full registration following site visits by third-party validators. Over its lifetime, the project is expected to generate around 2.8 million carbon credits, with fewer than 500,000 pre-sold so far.

The company secured pre-financing from Orange, the French telecom company, against future carbon credits. It's pursuing similar arrangements with other investors.

Nature-based credits from the project are expected to trade above $20/mt, reflecting biodiversity and social co-benefits, according to Foucheres.

"Carbon is not the core business," he said. "It helps de-risk the project, particularly in the early years."

Canopy initially developed the plantation with European biodiesel markets in mind under the EU's RED II framework. Subsequent changes under RED III, which allow double-counting of tree-based oils grown on degraded land only for aviation, shifted the company's focus toward SAF.

Japan's planned 10% SAF mandate from 2030 has also influenced Canopy's commercial strategy, given Japanese companies' familiarity with pongamia as a species and existing research into the crop.

Once planting of the initial 14,000 has is completed — expected within two years — full maturity will take around eight years, Foucheres said.

At that point, Canopy estimates annual production of around 100,000 mt of seeds, generating roughly $24 million/year in revenue before carbon credits.

Foucheres cautioned that pongamia should not be viewed as a near-term fix for SAF feedstock shortages.

"This is about building supply for the next decade and beyond," he said. "If SAF demand continues to grow, projects like this will be necessary."

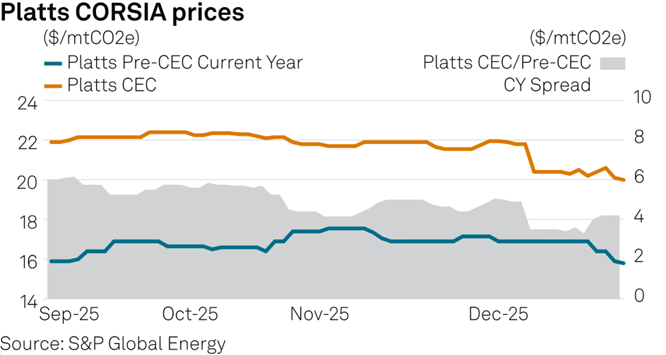

Platts, part of S&P Global Energy, assessed the SAF (HEFA-SPK) FOB FARAG outright price up 1.9% week over week at $2,310/mt Jan. 15, despite a lack of buying interest, as jet FOB FARAG levels rose $59.25/mt.

The SAF premium to jet barges fell $20/mt over this period, closing at $1,540/mt, with CIF cargoes remaining at a $10/mt premium.

Products & Solutions