Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Biofuels, Energy Transition

January 08, 2026

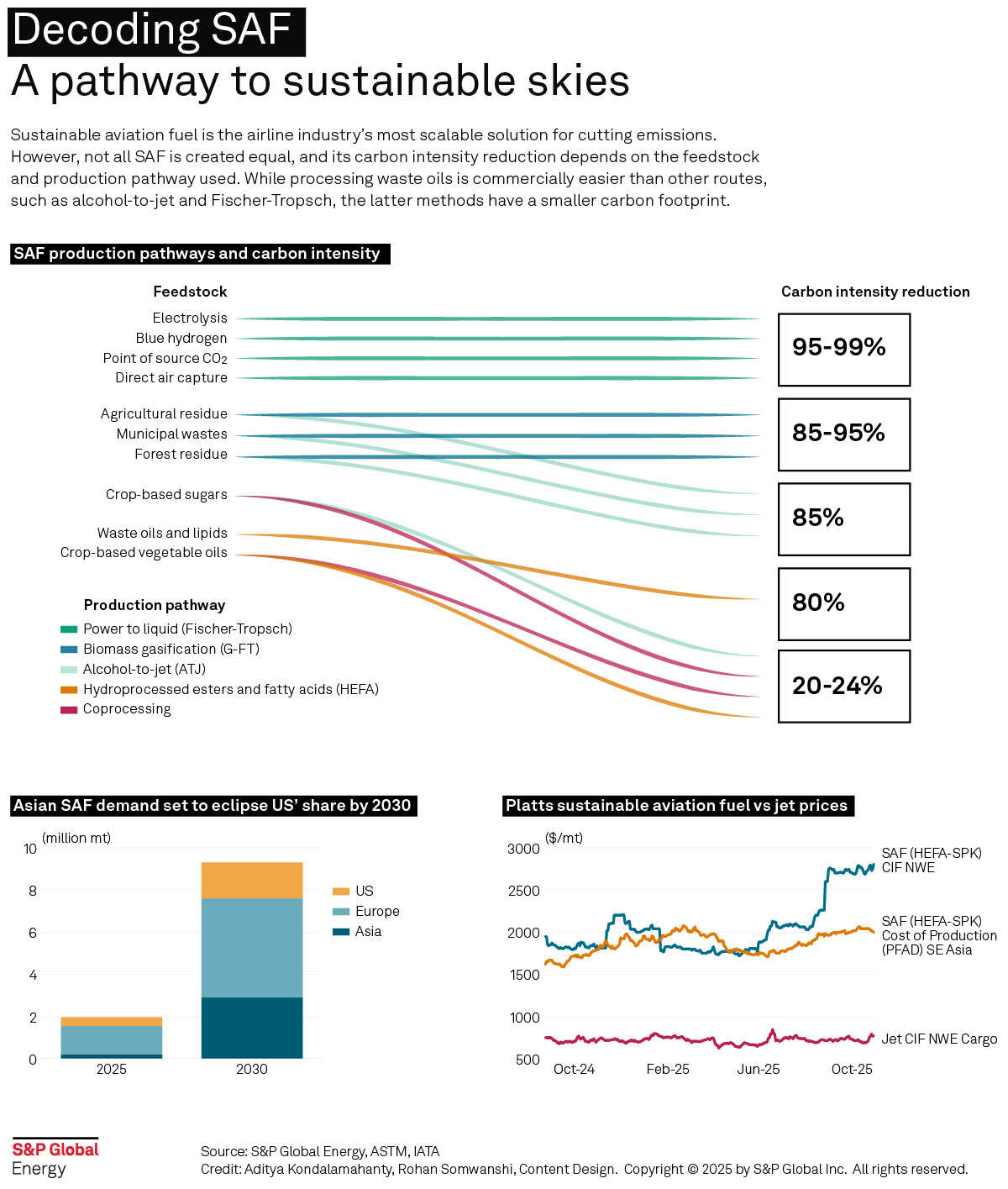

While accounting for approximately 3% of global energy-related carbon dioxide emissions in 2024, according to S&P Global Energy data, aviation’s environmental footprint is set to expand dramatically as passenger traffic could more than double to 10 billion journeys annually by 2050, according to the International Air Transport Association.

Unlike road transport where electrification offers a clear pathway, aviation faces unique decarbonization challenges that require innovative solutions and unprecedented coordination.

Nevertheless, many airlines have pledged to reach net-zero carbon emissions by 2050. Current decarbonization efforts primarily focus on scaling up the supply of sustainable aviation fuels, enhancing aircraft efficiency and utilizing carbon offsets. The most affordable SAF today is about three times more expensive than conventional jet fuel.

SAF adoption is central to IATA’s Net-Zero 2050 roadmap. SAF solutions are expected to provide the largest share of aviation’s carbon abatement through to 2050, while offsets will also play an important role.

Policies vary across regions, with Europe leading ambitious regulatory frameworks. The EU’s ReFuelEU Aviation policy, effective January 2025, mandates 2% SAF blending, escalating to 70% by 2050. This “stick” approach includes steep penalties for noncompliance and specific subtargets for renewable fuels of nonbiological origin, reaching 35% by 2050. EU aviation emissions have been covered under the emissions trading system since 2012.

While the US Inflation Reduction Act’s Clean Fuel Production Credit (45Z) had offered $1.25-$1.75/gal for SAF, implementation delays drove producers toward renewable diesel instead. This summer’s One Big, Beautiful Bill Act introduced new hurdles and reduced the relative attractiveness of producing SAF. State-level initiatives in Illinois, Nebraska, Minnesota and Washington provide additional tax incentives. California’s Low-Carbon Fuel Standard currently favors renewable diesel over SAF.

Asian markets target a modest 1% SAF adoption by 2026-27, with Singapore, Taiwan and Japan setting higher international flight targets of 3%-10% by 2030.

The Carbon Offsetting and Reduction Scheme for International Aviation, adopted by the International Civil Aviation Organization in 2016, entered Phase I in January 2024 with 128 participating countries. The scheme aims to offset international aviation emissions growth above baseline levels, set at 85% of 2019 industry emissions.

S&P Global Energy Horizons analysts forecast Phase I credit demand at 155 million metric tons of carbon dioxide equivalent against just 17.5 million mtCO2e available supply from two projects. Sufficient credits for 2024-26 compliance are not expected to materialize until after deadlines expire.

CORSIA-eligible credits averaged $20.97/mtCO2e in the first half of 2025, significantly above nature-based removals credits at $14.98/mtCO2e, according to Platts data, although still cheaper than SAF alternatives.

Managing price risk is an intrinsic part of commodity markets, but for new markets such as SAF, this can pose unique challenges. A large majority of SAF is priced at a significant premium to jet fuel. The result can be a volatile premium, a particularly challenging scenario when contracts are being priced as jet fuel plus a fixed premium and may require break clauses when prices fluctuate outside a set range.

According to S&P Global Energy Platts data, SAF prices in Europe lost 39% of their value in 2024, falling from nearly $3,000/metric ton at the beginning of the year to under $1,716/mt in May as production increased but new demand failed to materialize.

Such a price move may be helpful for airlines, but it hurts production margins and investments, with the construction of several facilities canceled or paused, citing “challenging market conditions.”

So far in 2025, SAF prices have fallen to record lows, with the global SAF market oversupplied, a notable shift for a market where lack of availability is a long-term concern. Prices have rebounded ahead of the first European compliance deadline, with outright prices reaching more than $2,750/mt over the third quarter.

The SAF market is currently estimated at only 1.1 million mt in 2024, less than 0.5% of global jet fuel consumption. Demand is concentrated in Europe and North America, which together accounted for almost 90% of global consumption in 2024.

SAF capacity is increasing, and Horizons analysts expect it to reach 4.3 million mt by the end of the year, with about 25 dedicated SAF plants in operation globally. There is additional SAF produced as a by-product of renewable diesel or from plants with a more balanced RD/SAF yield. Regional capacity/demand imbalances are already emerging and could be an indicator of future trade patterns.

More than half of the existing dedicated SAF capacity, roughly 2.3 million mt, is in Asia, despite low levels of demand in the region, with about 600,000 mt in North America and 400,000 mt in Europe.

Horizons analysts project SAF demand to increase tenfold by 2030 to above 11 million mt, and then rise exponentially to almost 80 million mt by 2050. SAF is expected to account for 18.6% of the world’s aviation fuel in 2050.

Horizons tracks RD and SAF plants and projects and has identified over 190 new dedicated SAF projects announced worldwide. If all of these projects come to fruition, SAF capacity could grow almost tenfold to more than 40 million mt by 2030. Most projects are in North America (15.8 million mt), Asia (13.4 million mt) and Europe (7.2 million mt). However, only a fraction of them, equivalent to 7.3 million mt of SAF capacity, have reached a final investment decision, with 28.5 million mt of capacity still awaiting approval.

With the world needing 80 million mt of SAF by 2050, according to Horizons estimates, the scale of the task is significant.

Nearly two-thirds of the planned capacity by 2030, or 25.3 million mt, is hydro-processed esters and fatty acids, or HEFA. While this is a commercially mature and cost-effective SAF production technology, it is constrained by lipid feedstock availability.

Options beyond HEFA exist, but they will need to be developed. One-fifth (8.4 million mt) of announced capacity by 2030 will rely on the alcohol-to-jet, or AtJ, pathway, and the rest on Fischer-Tropsch, methanol-to-jet and other newer pathways. Of the approximately 110 non-HEFA bio-SAF projects announced globally, the vast majority (105) are “speculative,” or in the feasibility or pre-FEED stage and have yet to reach FID.

Finally, power-to-liquids, or PtL, is touted as the answer to these issues and the long-term solution to decarbonizing aviation. However, the e-SAF sector is also facing headwinds, with most planned projects yet to reach FID. The main hurdles are related to policy uncertainty, technology risks, reliance on other key value chains and project financing.

Global passenger volumes are forecast to grow by an average of 3%-4% per year, which may outpace average efficiency gains and SAF uptake. Offsets will play a key role if the industry is to achieve its decarbonization targets, but regulations and related costs remain uncertain.

SAF mandates will continue to rise and will require billions in capital expenditure. The aviation operating environment remains uncertain, and the appetite for investments in SAF capacity has slowed down over the last year. Supply is constrained, policy support is uncertain, and concerns around cost competitiveness, with even the more affordable SAF pathways and feedstocks costing about three times the price of conventional jet fuel, remain a growing issue. If the industry is to ramp up SAF production considerably, more costly technologies such as 2G-AtJ and PtL will be needed.

With Rachel Gerrish, James Simpson, Roman Kramarchuk, Terry Ellis, Pierre Georges, and Charlotte Radford.

This article, by S&P Global Ratings and S&P Global Energy CERA, Horizons and Platts, is a thought leadership report that neither addresses views about individual ratings nor is a rating action. S&P Global Ratings and S&P Global Energy are separate and independent divisions of S&P Global. A version of this article was first published in the December 2025 issue of Insights Magazine.

Products & Solutions