Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Agricultural innovation can help India cut emissions, improve energy security and boost farmers’ incomes.

Published: August 3, 2023

By Sana Khan and Swati Mathur

Highlights

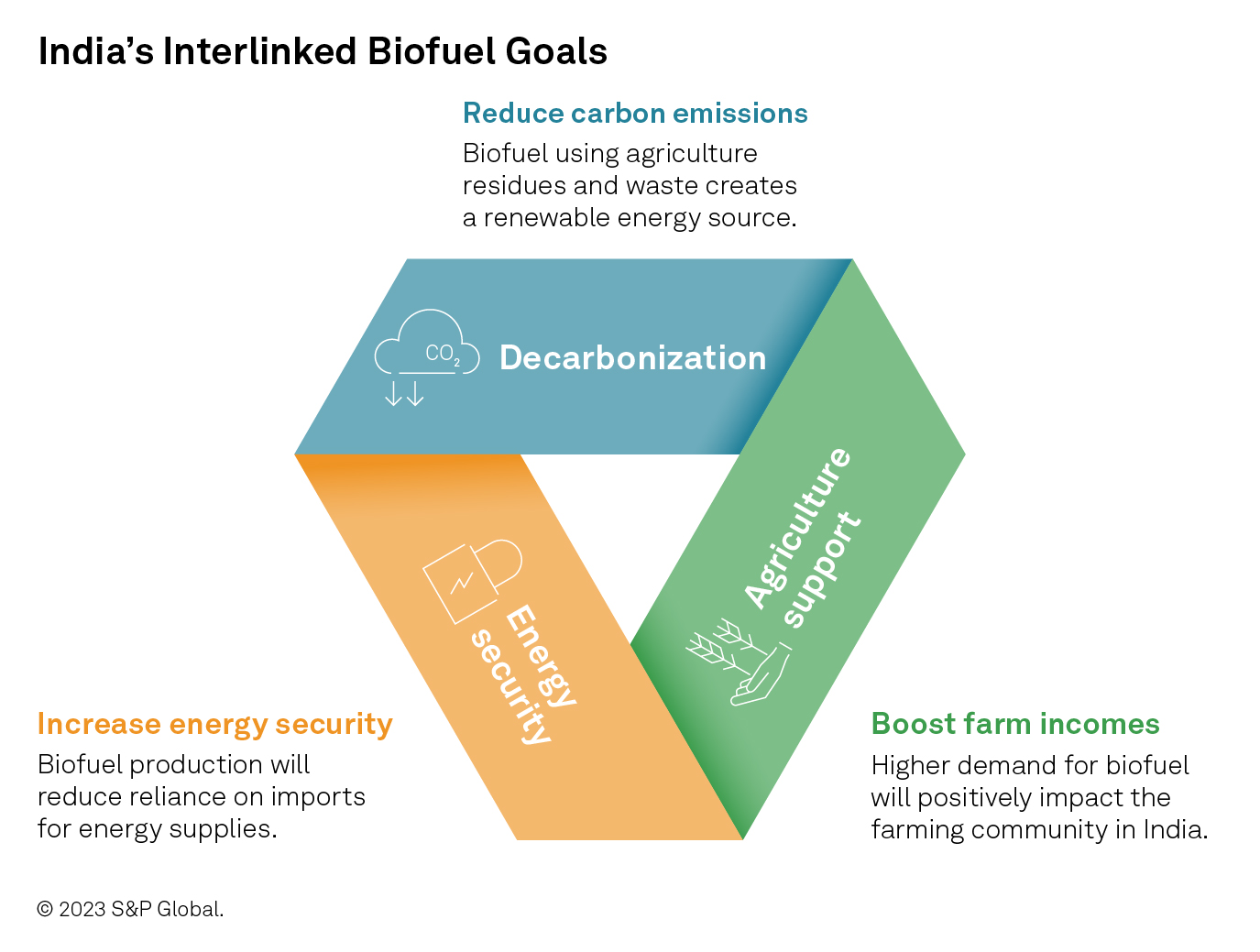

India’s agriculture sector plays a critical role in the country’s bioethanol sector, as well as supporting moves toward food security, energy security and decarbonization goals.

The country has come a long way with bioethanol policies, and it is likely to achieve a 10% ethanol blending target in 2023–24. There will be pressure on agriculture to meet future targets, so innovation will be important.

Participating in biofuel will provide farmers with an opportunity to improve economic efficiency. It will also create competition between food and fuel producers for valuable crops.

Indian agriculture can help the nation tackle three of its biggest challenges — feeding a huge and expanding population, ensuring sufficient energy supplies and curbing emissions. Still, meeting these goals will require a coordinated effort with alignment across policy, investment and agricultural research. Surpassing mainland China as the world’s most populous country, according to the UN, has only heightened these challenges, especially as S&P Global Market Intelligence expects India’s population to grow further over the coming decade.

The Indian agricultural sector has been a great success story over the past 60 years. After years of import dependency punctuated by severe droughts in the mid-1960s, a series of policy initiatives and technology shifts boosted agriculture production and made India self-sufficient in areas such as wheat, rice, sugar and animal proteins. This “green revolution” demonstrated that Indian farms can achieve dramatic productivity increases with the right policies, technology and investment. Indian agriculture again needs an astute mix of policy, technology and investment to meet the interlinked goals of food security, energy security and decarbonization in the 21st century.

India is the third-largest energy consumer in the world, and its long-standing overreliance on imports poses a long-term challenge to economic growth. The nation gets 85% of its crude oil from overseas, based on a 10-year average of S&P Global data. At the same time, India is home to a large farming population, which the World Bank says generates about 18% of GDP. The biofuel industry is an opportunity to tackle the country’s energy challenges and create an extra income stream for farmers. Additionally, India’s pledge at the 2021 UN Climate Change Conference (COP26) to cut 1 billion metric tons of carbon emissions by 2030 requires the concerted use of renewable energy sources.

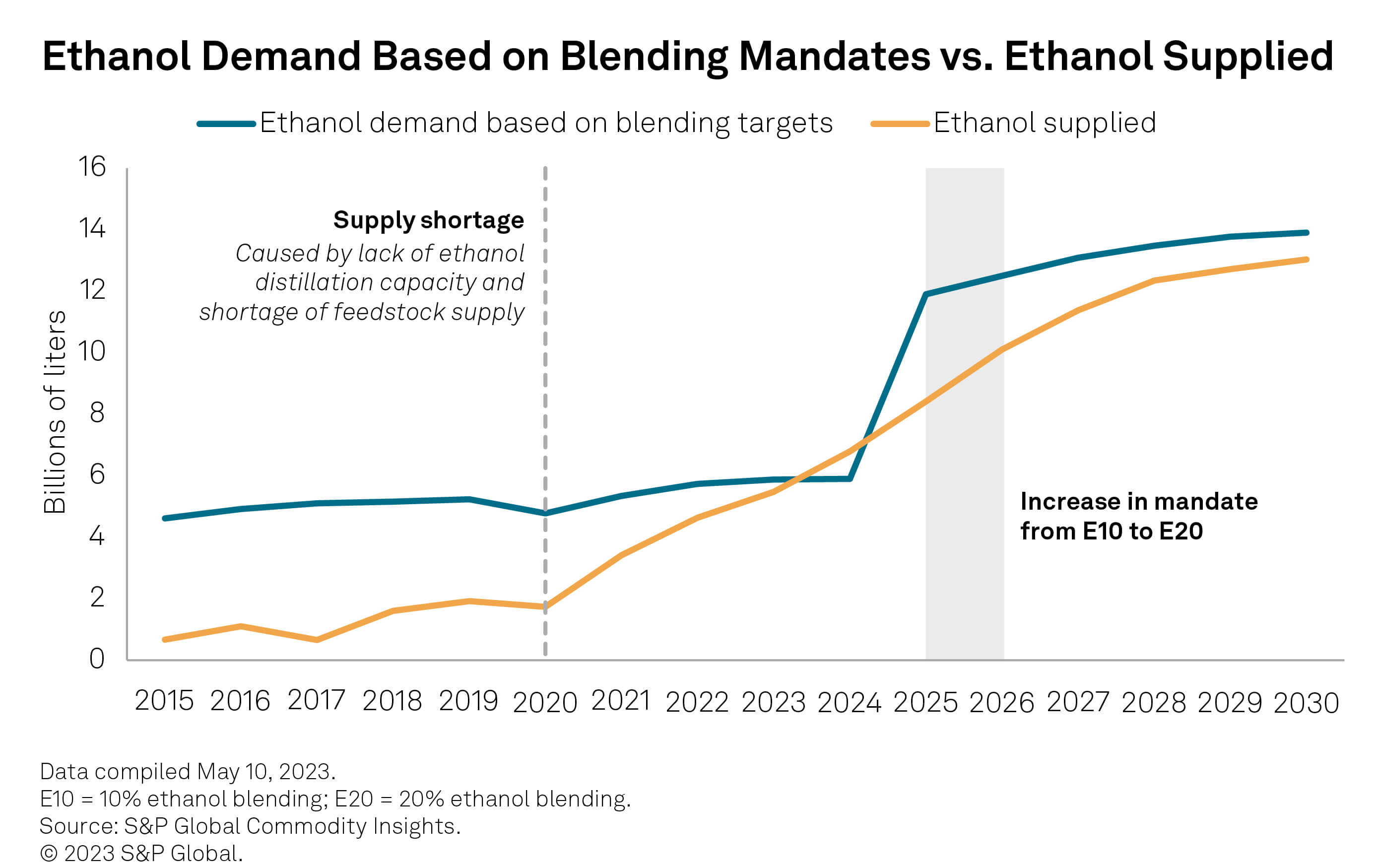

More than 90% of the biofuel produced in India is ethanol, predominately from sugar. India has come a long way with its bioethanol policy, and the nation is likely to achieve a goal of 10% ethanol blending in conventional fuel in 2023–24. Still, further supplies will be needed to meet an ambitious target of hitting 20% ethanol blending (E20) by 2025–26.

India has also moved forward with bioethanol as a sustainable aviation fuel. Many milestones have already been achieved, and the fuel is undergoing commercial trials.

Still, India’s wider bioethanol push is being held back by a lack of ethanol distillation capacity and a shortage of feedstock supply. Expanding distillation requires investment, and the government is actively tackling the issue. The feedstock deficit depends on the agriculture sector. Reducing food waste would also help.

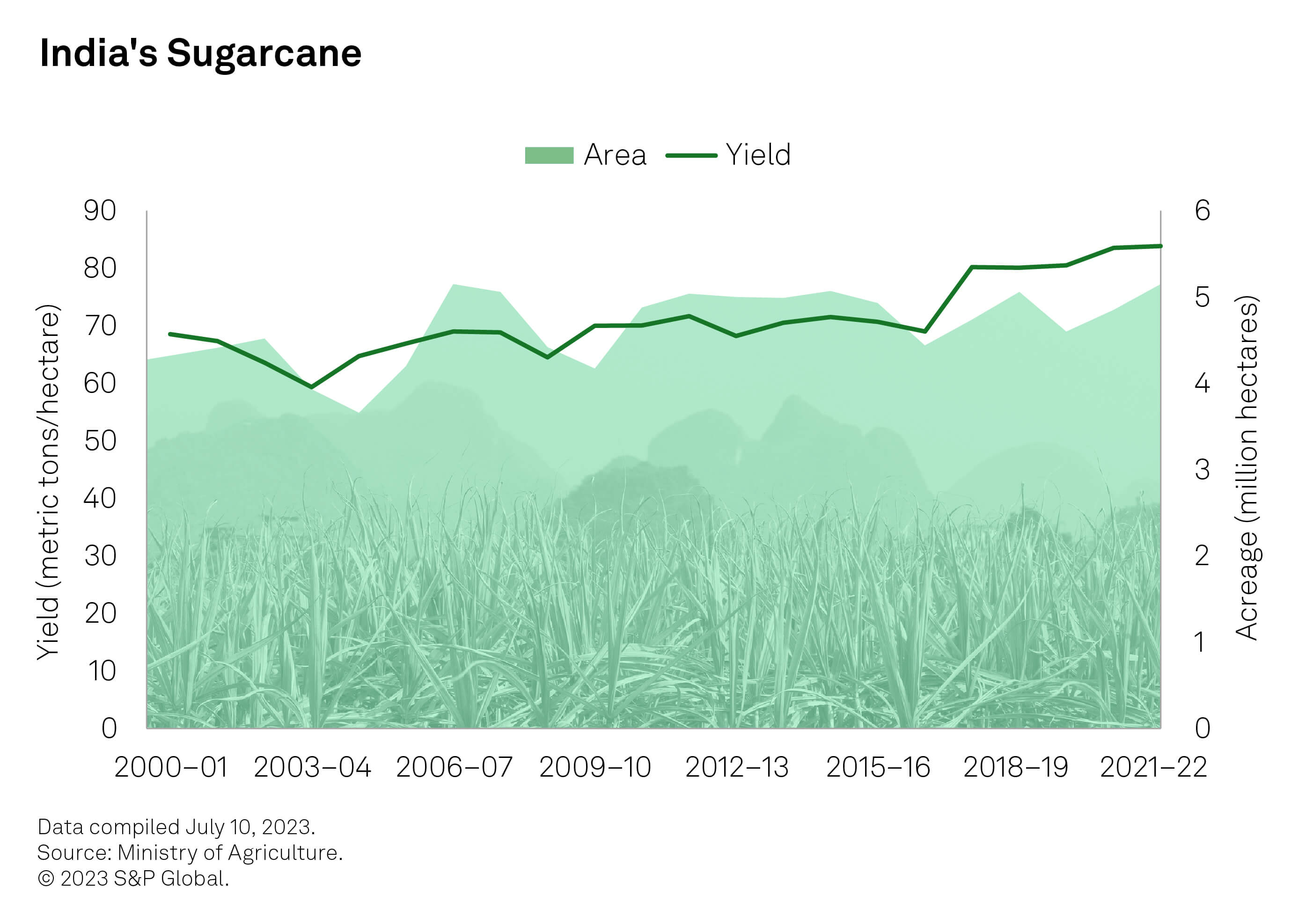

India’s sugar yields have surpassed Brazil’s in the last five years, climbing to 80 metric tons/hectare versus the South American nation’s 75 metric tons/hectare. New sugarcane varieties and the ongoing adoption of drip irrigation instead of rain-fed irrigation have fueled this improvement. Still, supply isn’t sufficient to reach the target of E20 by 2025–26. Increasing the acreage used for water-intensive sugarcane is also problematic, especially after recent droughts.

The government aims to boost ethanol feedstock with rice and maize, which would utilize the nation’s increasing grain-based distillery capacity. Guidelines will be needed for both crops to avoid the “food versus fuel” debate. Maize yields will also have to catch up with those of rice.

Ethanol could generate emission savings in India totaling 68 million metric tons of carbon dioxide equivalent (MMtCO₂e) from 2022 to 2030 if the country meets its targets, according to S&P Global calculations. That’s equivalent to about 29 billion liters of gasoline, or the emissions generated by 15 million gasoline-powered vehicles per year. Achieving bioethanol targets will enable India to move further toward fulfilling its COP26 pledge to cut 1 billion metric tons of projected carbon emissions by 2030 and reduce the carbon intensity of its economy by 45% versus 2005 levels. Furthermore, turning crop residues into biofuels, instead of just burning them, would prevent as much as 3 billion tons of carbon emissions, according to the UN’s Food and Agriculture Organization, while also improving air quality.

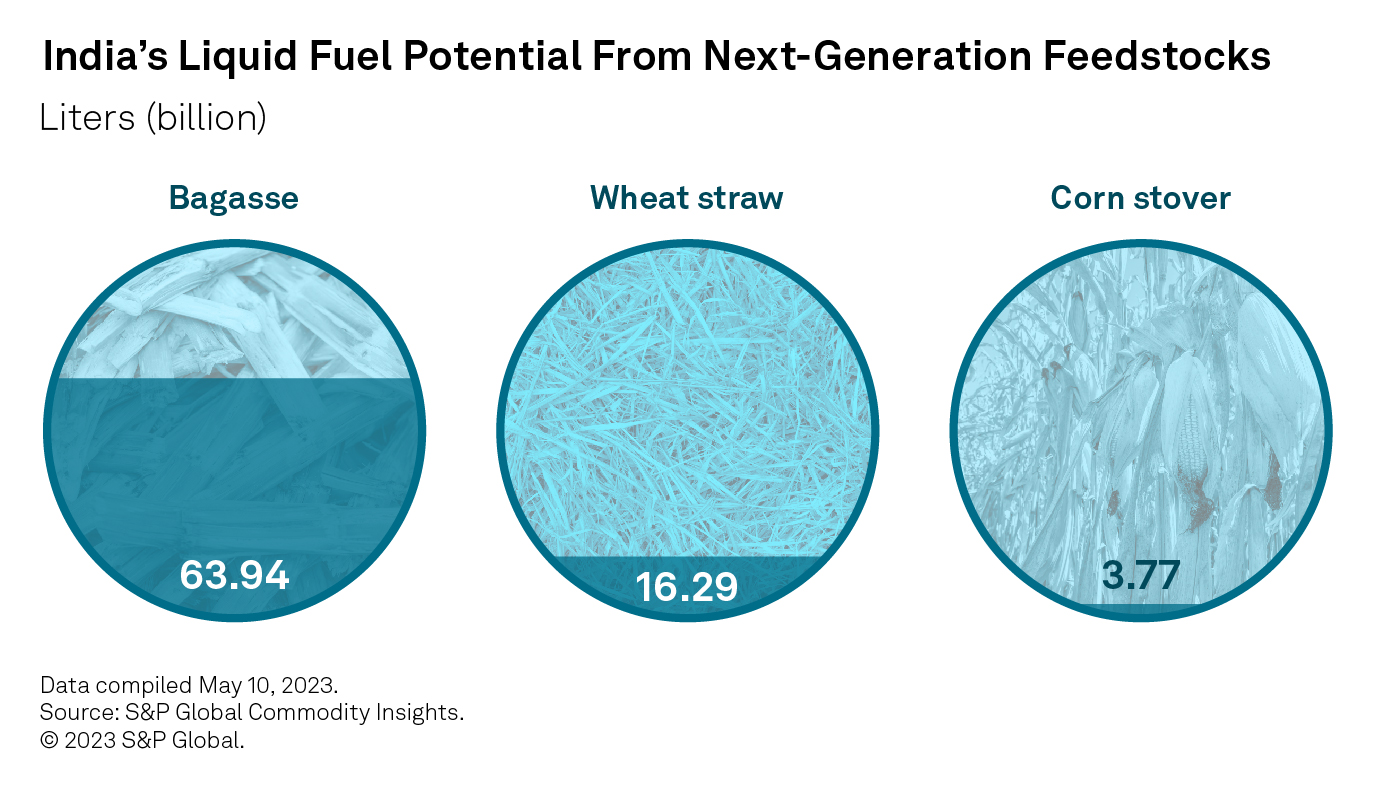

Agricultural waste can be turned into a valuable product and renewable energy source. This gives farmers a new income stream, as well as reducing the amount of waste that ends up in landfills and cutting energy costs for consumers. India’s government recognizes the large potential of biomass-to-fuel. It amended the National Policy on Biofuels in 2022 to set up second-generation biorefineries that can convert residues into bioethanol.

Waste from just bagasse, wheat straw and corn stover could be enough to surpass India’s total E20 requirements, as there is potential for 84 billion liters of ethanol, based on 2025 crop output forecasts. To take advantage of this, India will need significant investment in infrastructure to recover biomasses efficiently and in ag-tech to convert biomass to biofuel through processes such as cellulosic fermentation and gasification.

Looking Forward

India’s ethanol shortfall is an opportunity for local farmers to participate in a booming sector and generate additional income. Sugarcane farmers are already benefiting from government action, including support for higher sugar recoveries. Technology investments and improved yields would add further gains. Grain farmers can similarly benefit as most existing ethanol plants can process sugarcane or grain. Still, any shift to fuel from food would stoke food security concerns. So, what should be expected in India’s biofuel sector in the coming decade?

India’s adoption of innovative ag-tech and new crop varieties through gene-editing will create a consistent feedstock supply to meet bioethanol targets, leading to energy security, higher farmer incomes and ultimately decarbonization.

Biomass-to-fuel capacity building will surpass domestic demand and make India an exporter of low- carbon biofuel, once the full potential is realized.

Advanced technologies such as alcohol-to-jet can position India’s biomass sector as an important supplier of sustainable aviation fuel, thereby tapping into what will be a significant and growing market.

Any program that reduces food waste will free up agriculture production for biofuel and bioenergy purposes, as well as easing concerns about food security.

The right policy, investment and strategy mix will lead to technology solutions that achieve a “win-win- win” situation.

India’s ethanol blending target faces feedstock challenges on its path | S&P Global Commodity Insights (spglobal.com)

Biofuel Feedstock Trade Flows | S&P Global (spglobal.com)

10 Cleantech Trends in 2023 (spglobal.com)

INDIA CEO SERIES: India's crude strategy a cushion for both global, domestic prices, says Puri | S&P Global Commodity Insights (spglobal.com)

India's energy options and the roadmap ahead | S&P Global Commodity Insights (spglobal.com)

Next Article:

Unlocking India’s Capital Markets Potential

This article was authored by a cross-section of representatives from S&P Global and in certain circumstances external guest authors. The views expressed are those of the authors and do not necessarily reflect the views or positions of any entities they represent and are not necessarily reflected in the products and services those entities offer. This research is a publication of S&P Global and does not comment on current or future credit ratings or credit rating methodologies.

Content Type

Language