Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 9 Sep, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Implications of the Nord Stream 1 Shutdown

Europe was already facing a grim winter of high gas prices and limited supply, but on Sept. 2, Gazprom announced the closure of Nord Stream 1, the pipeline running under the Baltic Sea that previously supplied 12% of annual European gas demand. This is not the first time the Russian government, under President Vladimir Putin, has used gas supplies as a tool of geopolitical pressure. However, given Europe’s long-term dependence on cheap Russian gas, the outlook for European energy markets is dire.

Countries across the EU are racing to reduce gas consumption by 15% before the onset of winter to ensure households and businesses have sufficient supply. Confronting the increasing likelihood that Russia will continue to throttle the supply of natural gas to Europe, governments have been investing in gas storage "at whatever cost" to establish supply security. This competition for supply is already driving up prices within Europe, a trend S&P Global Ratings anticipates will continue over the next few months. A perfect storm of factors is conspiring to further drive up energy costs: low hydro availability due to drought conditions; low French nuclear generation; the slow return to coal-fired generation; and an apparent reluctance from people and businesses to moderate energy consumption.

In the eye of the storm, Germany and Italy are particularly reliant on Russian natural gas. But energy policy is already affecting the political calculus across the eurozone and nearby countries. European governments are attempting to reduce demand and carbon emissions, and control prices through a proposed cap on wholesale gas prices. It will be challenging to address even one of these goals in current circumstances. It will likely take several years before Europe has the energy infrastructure and supply to move beyond this crisis.

In a recent article entitled “Nord Stream 1 Shutdown: Will Utilities And Markets Freeze This Winter?” S&P Global Ratings estimated that Europe's energy bill will exceed its pre-pandemic levels by well over €1 trillion. But it’s not clear who will bear the cost, besides consumers. Despite government interventions, a fundamental redo of Europe’s energy markets will be complex and creates risks for rated utilities. Proposed taxes on windfall profits may hit earnings for energy providers. However, European governments have signaled a willingness to support liquidity on energy exchanges and at domestic utilities to keep the power flowing.

U.S. liquefied natural gas, or LNG, imports initially seemed like a quick and easy way to rebalance Europe's gas market. But imports are expected to increase very little in the fourth quarter. A lack of adequate natural gas tankers and limited supplies have driven up costs for LNG and some European countries such as Germany have no facilities for regasifying LNG anyway.

In the meantime, it is unlikely that Russia will soon become a reliable supplier of natural gas again. The latest shutdown of Nord Stream 1 is not unexpected. Gas flows have been trickling through at reduced rates since the war in Ukraine began. While the EU has slammed Gazprom’s closure of the pipeline, they have little leverage against a supplier on which they have become all too dependent.

Today is Friday, September 9, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

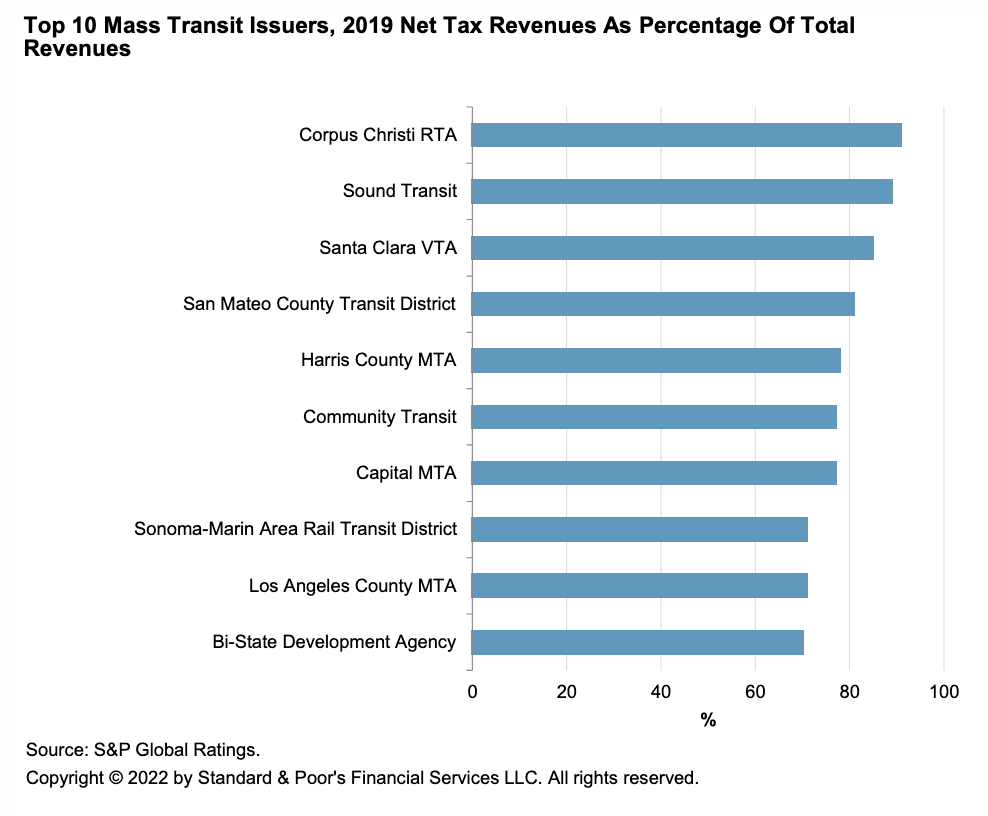

U.S. Transportation Infrastructure Transit Sector Update And Medians: Long-Term Funding Decisions Loom For Many Mass Transit Operators

Many mass transit operators that depend on fare revenue face uncertainty as pandemic-related federal aid runs out over the next few years. S&P Global Ratings expects providers will have to make tough decisions about sustainable tax and revenue models. It does not expect a full recovery to pre-pandemic ridership in the foreseeable future. It thus believes the credit quality of many transit operators will depend on their ability to adjust operations and align financial performance to achieve structural balance after federal aid is depleted.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

De Novo Bank Boom Hindered By Elevated Capital Requirements

Ever-rising capital demands, driven by increased technology and talent expenses and higher capital requirements from regulators, are dampening the prospects of some de novo bank hopefuls. For the third consecutive year, the number of de novo applications is on track to fall short of levels seen in 2018 and 2019. Just 10 de novo applications have been filed thus far in 2022, according to S&P Global Market Intelligence data, compared to 17 applications in all of 2018, 20 applications in 2019 and the hundreds of applications filed in the years prior to the Great Recession.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

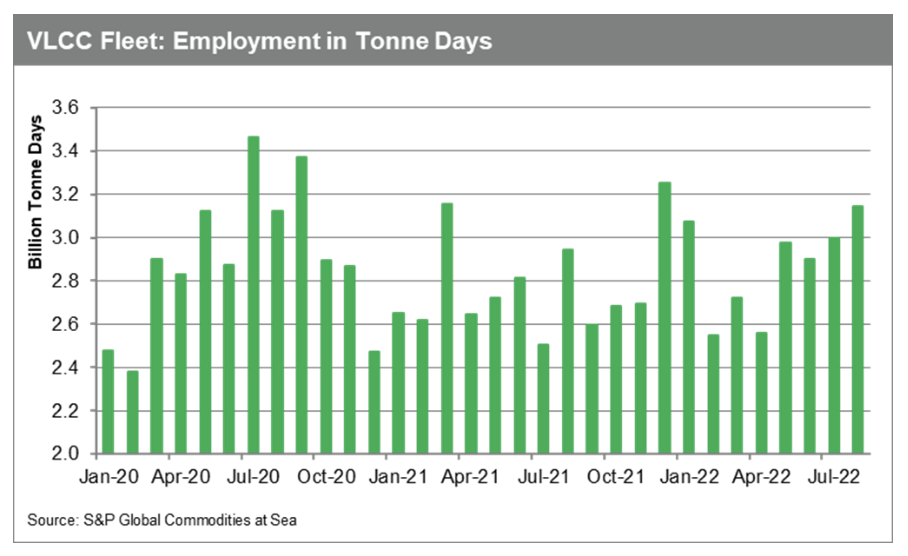

Tankers At Sea Insight: VLCC Segment Breaks Out Of Rut As Higher Employment In Summer Buoys Earnings

More VLCCs managed to secure employment in August, as higher demand for crude spurred by stronger refinery processing and robust refined products cracks in the Atlantic Basin boosted utilization rates significantly. Demand for shipping crude oil increased due to more cargoes traded and longer distances covered.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

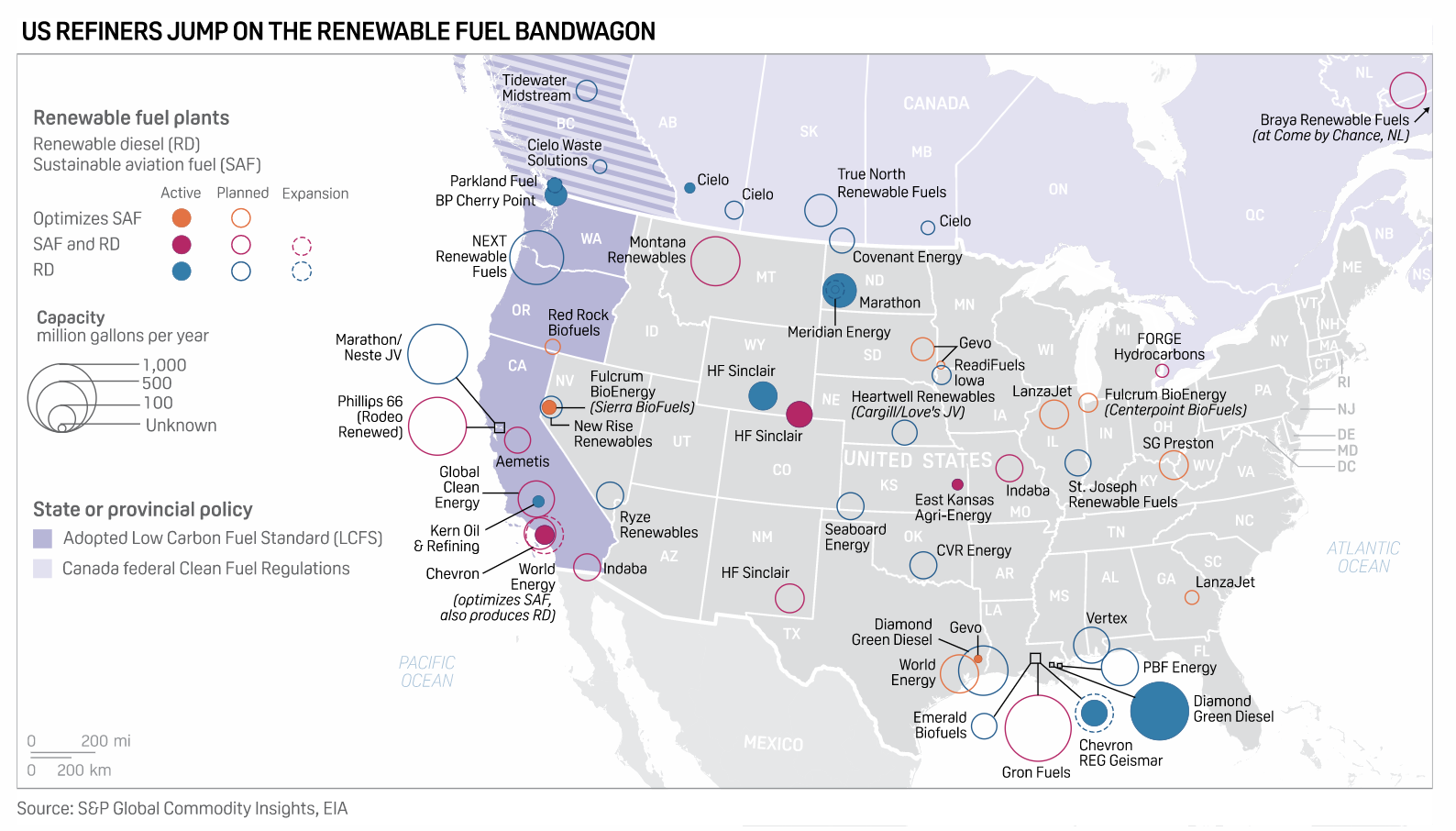

Inflation Reduction Act Charts A New Course For U.S. Biofuels Industry

On Aug. 16, U.S. President Joe Biden signed the Inflation Reduction Act of 2022 into law, providing incentives to various sectors, including the biofuels industry. The Act does not replace the existing Renewable Fuel Standard, so the EPA will continue setting volumetric blending mandates each year. Though ethanol is mentioned only thrice in the lengthy law, ethanol producers will benefit from its carbon capture, utilization and storage provisions, clean fuel production credits and incentives for ethanol-based sustainable aviation fuel.

—Read the article from S&P Global Commodity Insights

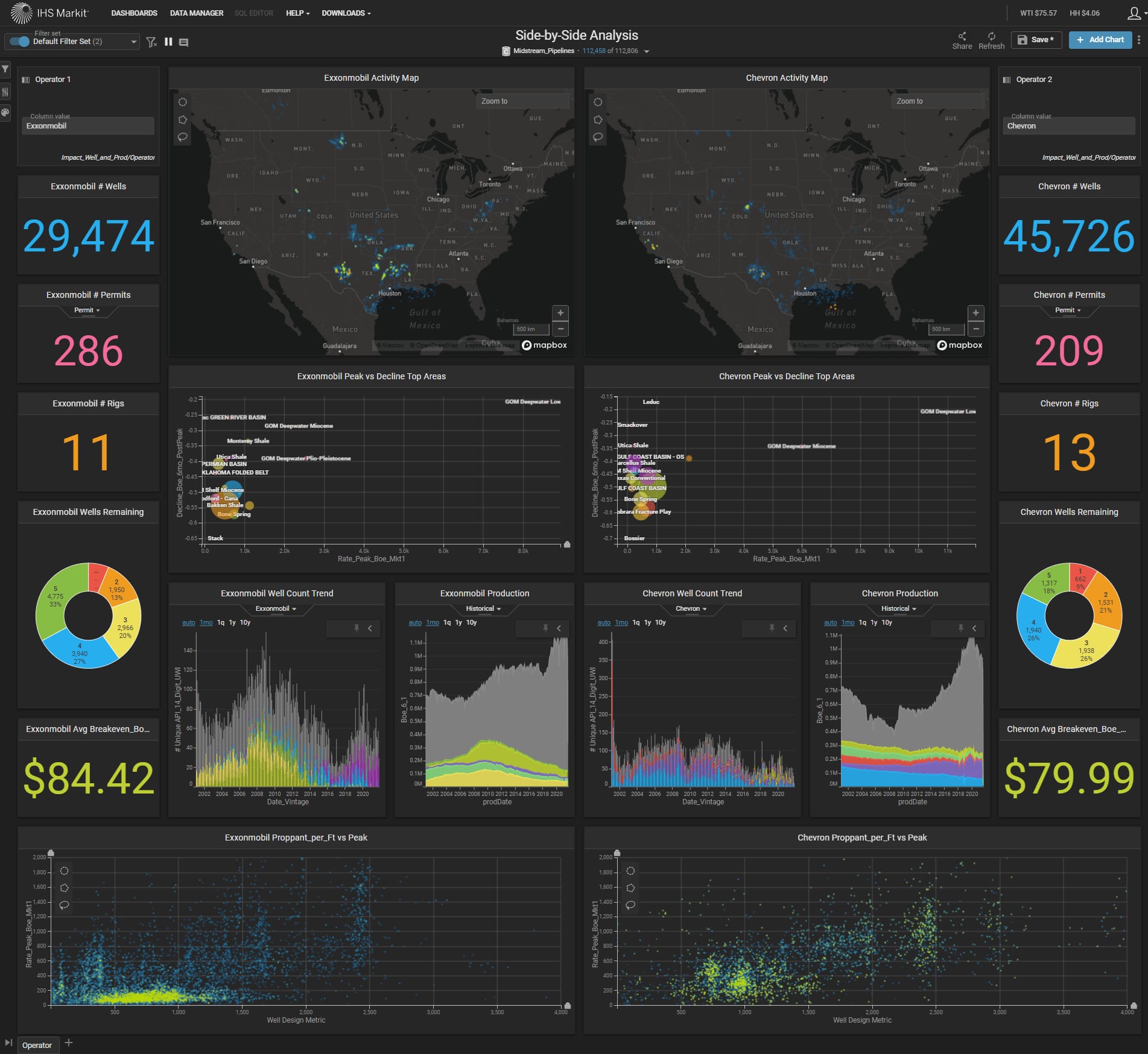

Oil And Gas Asset Valuations: Validating Sellers’ Claims

Placing a value on an oil and gas company is easier said than done. The value of an exploration and production company is driven by its assets; the value of a company's assets is driven by commodity prices, which change every day. As the past decade has shown, downturns and drastic price swings are the new normal. In order to make smart investment decisions and decrease risk, analysts must thoroughly evaluate every potential investment.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Digital Engineering: The Enterprise Journey Toward Digital Twins In An Industrial Metaverse

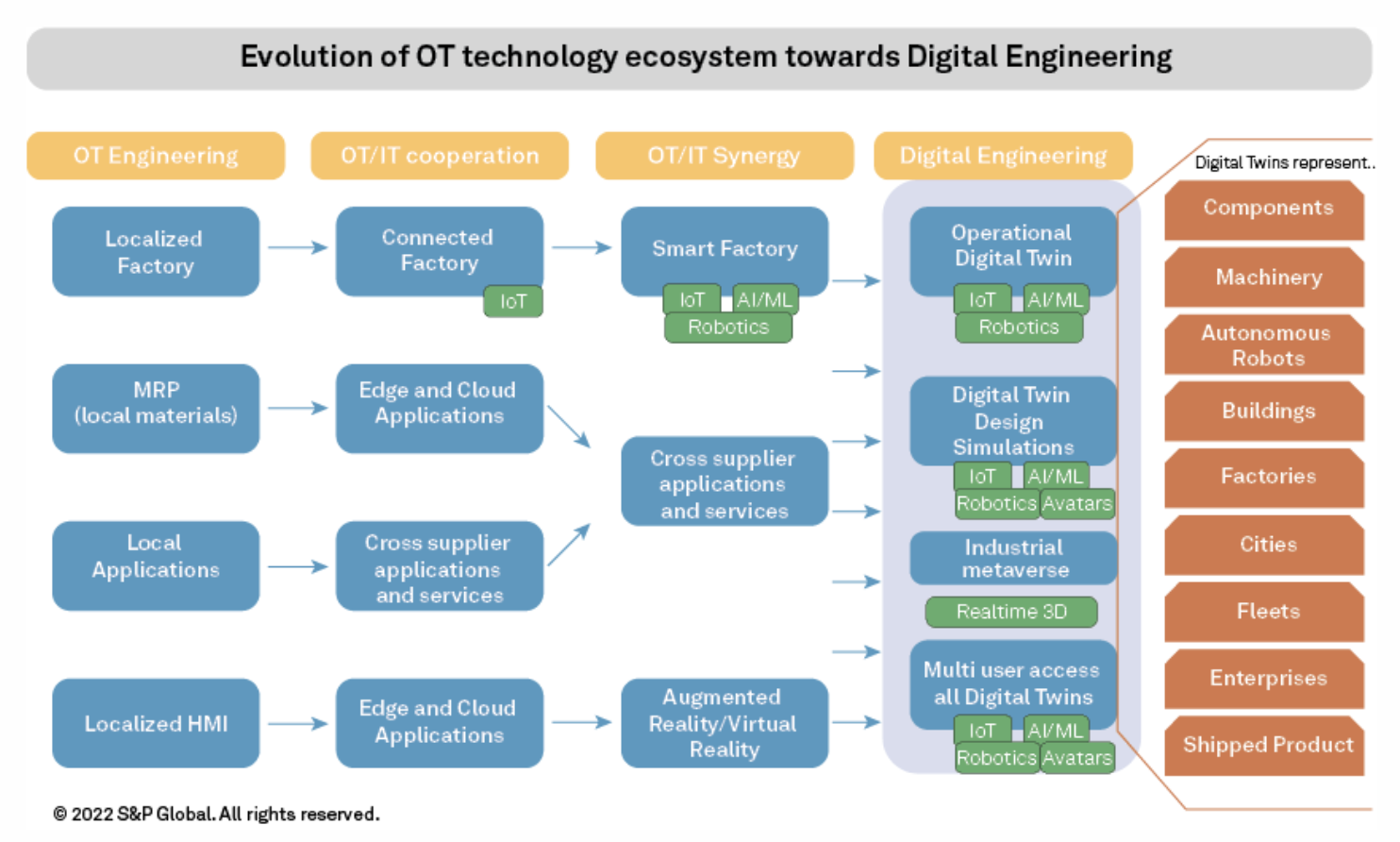

The world of emerging technology has always been awash with buzzwords, and it is the job of industry analysts to try and make sense of what is happening or going to happen in and around their fields of expertise. They are seeing the evolution and convergence of technology approaches and a shift in the industrial sector from what was previously called "digital transformation" toward a fuller view of the digital ecosystem, creating an opportunity for the concept of "digital engineering" to be the next major service advancement in operational technology.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >