Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 6 Oct, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Amazon vs. Regulators – A Shifting Battlefield

Amazon launched in 1995 as a startup with an unusual business plan – sell books online, rather than through bookstores. The scrappy underdog has since transformed into a world-beating conglomerate and has drawn the attention (and occasionally the ire) of antitrust regulators. Amazon has responded to potential regulation much as it might respond to a challenger of its e-commerce or cloud hosting business — with energy and focus. Now, the regulatory battles are shifting to the state level and Amazon is pivoting to meet the new challenge.

For years, Amazon has had a reputation as an unstoppable force that swallowed competitors and entire markets between quarterly earnings calls. The company has always disputed this characterization, attributing its success to low prices and a range of products to meet customer needs. Regulators, responding to complaints from some of Amazon’s competitors, have taken a hard look at the company from an antitrust perspective. The key anticompetitive claim, according to S&P Global Ratings, is that Amazon’s private-label sales competes against and undercuts third-party sellers in its marketplace. Amazon has visibility into third-party seller data and uses it to inform its own private-label brand strategy.

In 2021, S&P Global Market Intelligence analyzed Amazon’s lobbying expenditure, finding that its lobbying costs had increased steadily every year since 2011. During the first quarter of 2021, Amazon spent an estimated $5.1 million on lobbying, according to the Center for Responsive Politics, a Washington, D.C.-based nonprofit that tracks money in politics.

"They know they are going to be regulated," Alex Petros, policy counsel for nonprofit public interest group Public Knowledge, said at the time. "They are trying to grow, and at the same time, Congress is waking up to the power of dominant digital platforms."

The American Innovation and Choice Online Act, a bill sponsored by Sen. Amy Klobuchar, D-Minn., and Sen. Chuck Grassley, R-Iowa, has stalled short of a vote on the Senate floor. If the U.S. House of Representatives switches to a Republican majority during the upcoming midterm elections, it is unlikely that the bill will come to a vote. While Republicans are ambivalent toward Big Tech, their criticisms center on censorship rather than antitrust concerns.

With a divided federal government looking likely, state politicians are increasingly looking to their own laws and resources to take action, according to S&P Global Market Intelligence. California Attorney General Rob Bonta filed a lawsuit in September alleging that Amazon violated California business competition laws in requiring third-party sellers and wholesalers to offer the lowest prices for their products on Amazon. Texas, New York and Colorado are also considering cases against the e-commerce giant.

Amazon has contested the claims in the California lawsuit. But it is looking increasingly like Amazon may be fighting a multifront and multistate battle with regulators.

Today is Thursday, October 6, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

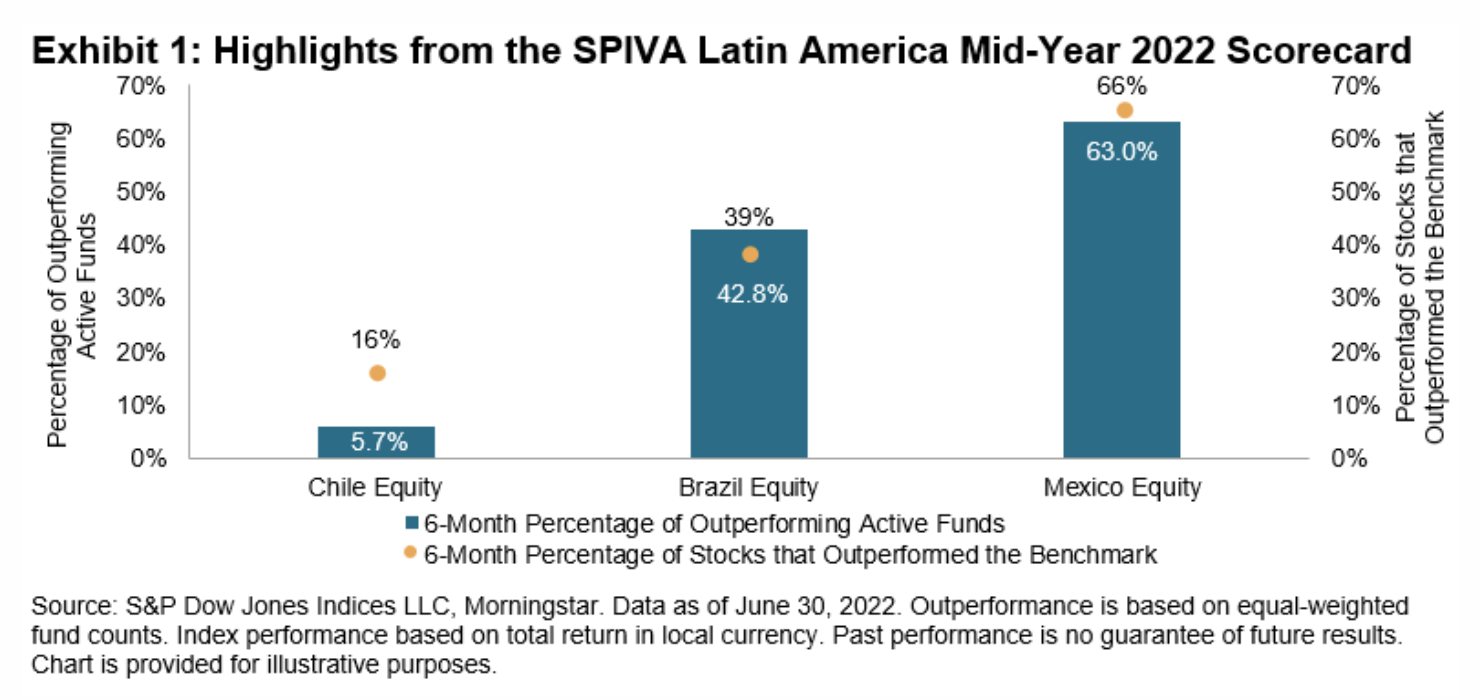

Dissecting The Divergent Performance Among Latin American Fund Managers

The semiannual S&P Indices Versus Active Scorecards measure the performance of actively managed funds against their corresponding benchmarks in various markets around the world. According to the latest SPIVA Latin America Mid-Year 2022 Scorecard, the YTD performance among active managers across Latin American countries varied significantly.

—Read the article from S&P Dow Jones Indices

Access more insights on the global economy >

Smart Contracts Could Improve Efficiency And Transparency In Financial Transactions

Smart contracts are a core building block of decentralized applications, facilitating the execution of specified tasks (such as payments) based on predetermined business rules. Using smart contracts in financial transactions can improve efficiency and reduce reliance on third parties like asset servicers and custodians, as well as make transaction resolutions faster — enhancing creditworthiness and the integrity of business dealings.

—Read the report from S&P Global

Access more insights on capital markets >

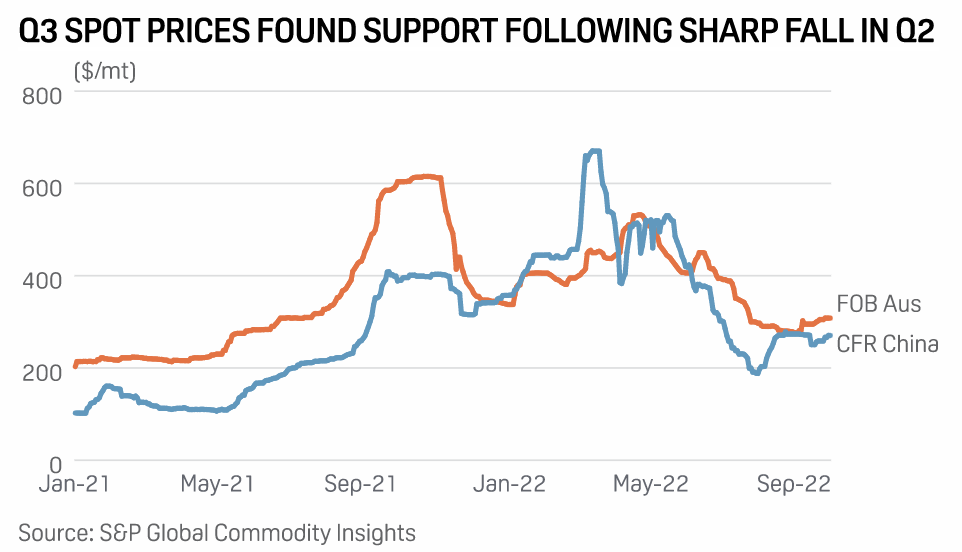

Trade Review: Asia Met Coal Market Sees Light Ahead On Q4 Restocking Demand, Scarce Supplies

The seaborne metallurgical coal market is entering the fourth quarter on firmer footing, as weather-related disruptions stoke supply worries while year-end restocking demand from India and China keep prices supported after a volatile Q3. Benchmark Platts premium low-volatile hard coking coal prices, basis FOB Australia, declined $31.5/mt, or 10%, on the quarter to $270.50/mt while PLV CFR China was down $86/mt, or 22%, to $308/mt at the end of Q3, S&P Global Commodity Insights data showed.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

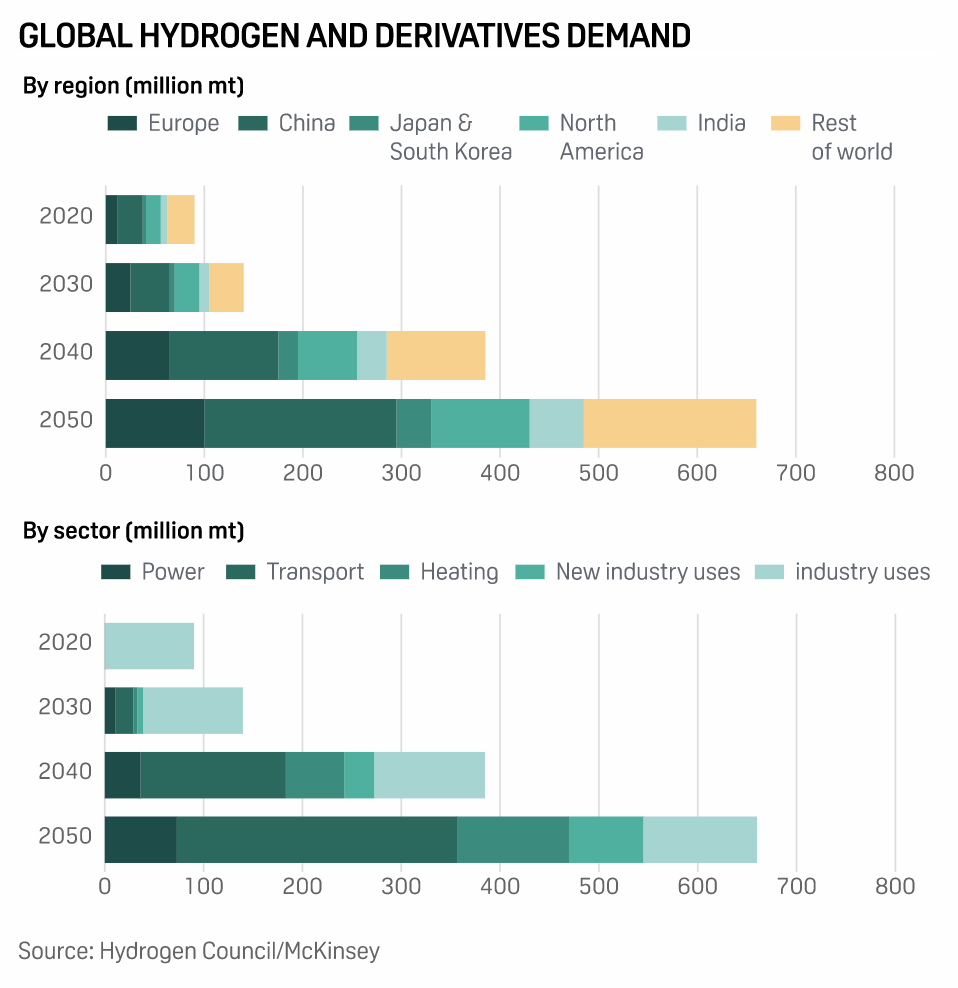

Policy Headwinds For Clean Hydrogen In Europe Temporary: Hydrogen Council

Policy headwinds facing low-carbon and renewable hydrogen projects in Europe will be temporary, with projects poised for swift deployment once there is regulatory certainty, the Hydrogen Council told S&P Global Commodity Insights. Ahead of the Oct. 5 publication of a report on future global hydrogen flows, Hydrogen Council Executive Director Daryl Wilson said that despite short-term EU policy uncertainty regarding rules on renewable hydrogen and the U.S. stealing a march on Europe in terms of tax incentives for hydrogen projects, Europe was still well placed to roll out production projects and infrastructure.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

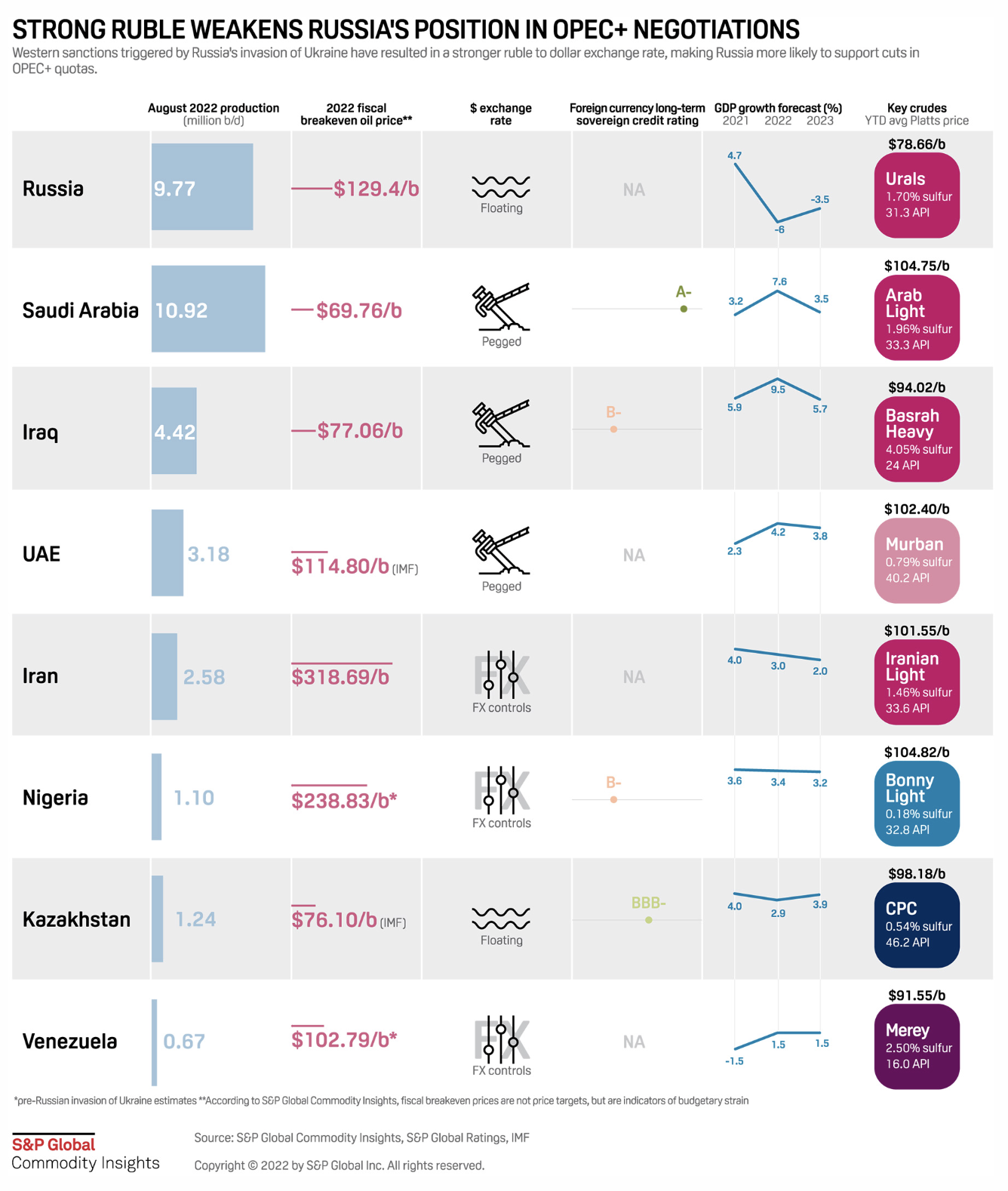

OPEC+ Chops Oil Quotas, In Another Snub To The U.S., As White House Threatens Retaliation

OPEC and its allies on Oct. 5 slashed their production quotas by 2 million b/d for the next 14 months in a bid to stabilize sliding oil prices, provoking a strong backlash from the U.S., which had warned the group to avoid a potential supply squeeze and distance itself from Russia. The new quotas, which start in November and will remain in place through December 2023, were agreed at the OPEC+ alliance's first in-person meeting since March 2020 in Vienna.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 85: Taming Complexity For The Digital Next

Melanie Posey, the 451NEXUS conference chair, is back to talk about the sessions and the expanded content with host Eric Hanselman. One of the biggest challenges organizations face in digitization and the shift to hybrid operations is complexity. It’s not simple to tame, but greater use of automation and operational integration can help. The conference covers this and more.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence