Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 19 Oct, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Rise of Renewable Natural Gas

As the transition to a low-carbon economy accelerates, more renewable and clean alternatives to fossil fuels have come into play. One promising alternative energy source that has emerged in recent years is renewable natural gas, also known as biomethane or trash gas, which hinges on the idea of turning trash into fuel.

Renewable natural gas (RNG) is rapidly gaining momentum in the US as a lower-carbon substitute for conventional natural gas, S&P Global Commodity Insights experts said in an episode of the “Platts Future Energy” podcast. Whereas conventional natural gas is derived from fossil fuel deposits, RNG is produced through the decomposition of organic waste from biological sources such as dairy and livestock manure, landfills and wastewater treatment facilities. RNG is created when methane — a hazardous greenhouse gas emitted when organic waste breaks down — is captured in biogas form through anaerobic digestion and upgraded to meet natural gas pipeline specifications.

"It might be a little bit of a hyperbole, but RNG could be going to the moon. … This market is taking off like a rocket," Alex Klaessig, senior director for the Global Hydrogen and Renewable Gas Forum of S&P Global Commodity Insights, said on the podcast.

Operating RNG facilities — mainly anaerobic digesters — have increased tenfold in the US since 2011 to exceed 300 in 2023, and more than 450 additional facilities are under construction or in development, S&P Global Commodity Insights Low-Carbon Pricing Analyst Hope Raymond said on the podcast, citing the RNG Coalition. By 2024, the US RNG market is expected to grow 97% year over year and another 50% in 2025, Klaessig said. As the US RNG market is still relatively small and less established compared with Europe, it has more room for growth.

RNG is also proving to be an attractive M&A market for major oil and gas companies and is drawing interest from investors. In late 2022, BP acquired RNG producer Archaea Energy for $4.1 billion and Shell bought Nature Energy for nearly $2 billion. Earlier in 2023, Marathon Petroleum took a 49.9% stake in LF Bioenergy from Cresta Fund Management for $50 million, while Viridi Energy and American Organic Energy joined forces to develop a food waste-to-RNG facility in New York.

The versatility of RNG and the fact that it can be used without the need for massive infrastructure changes make it “a low-hanging fruit,” Klaessig said. In its raw biogas form, RNG can be used onsite to generate electricity for industrial, commercial and residential applications. It can also serve as a feedstock for bioproducts such as hydrogen and green methanol, which are manufactured to help reduce the carbon footprints of high-emitting sectors. Once upgraded from its biogas form, RNG becomes a so-called drop-in fuel, which means it can be used interchangeably with conventional natural gas and injected into existing pipelines, Raymond said.

Regulatory incentives are helping drive RNG adoption in the US, particularly in the transportation sector. On the federal level, the Renewable Fuel Standard program being administered by the Environmental Protection Agency allows RNG projects to earn credits called renewable identification numbers (RINs) that can be monetized, Senior Biofuels Analyst Jamie Dorner said on the “Platts Future Energy” podcast. RNG can generate RINs when sold to gasoline and diesel refiners or importers, which are obligated under the program to buy an EPA-specified volume of renewable fuel each compliance year. Some states, led by California, are also advancing the use of RNG through low-carbon fuel standard programs, Dorner said.

While RNG is primarily used in the transportation sector to fuel natural gas vehicles, the voluntary market is also expected to boost demand as more customers in carbon-emitting sectors voluntarily buy credits to offset unavoidable emissions. Utilities and other companies that rely on natural gas-fired electricity are increasingly turning to RNG as they work to meet their emissions reduction targets.

As more companies set decarbonization goals and implement strategies to achieve them, RNG is “a natural starting point. ... It's a feel-good story about investing domestically in US farmers and waste facilities to turn what is a nasty byproduct or waste stream into something that fights climate change with the potential for some lucrative revenue stream,” Klaessig said. “It's a veritable American dream."

Despite the promising prospect of RNG as a fuel of the future, some hurdles need to be addressed to ensure widespread adoption in the US and elsewhere, including high costs, limited supply of biological sources and regulatory uncertainty, according to S&P Global Commodity Insights.

Today is Thursday, October 19, 2023, and here is today’s essential intelligence.

Written by Pam Rosacia.

Emerging Markets In Southeast Asia: The Forces Shaping The Outlook For 2024

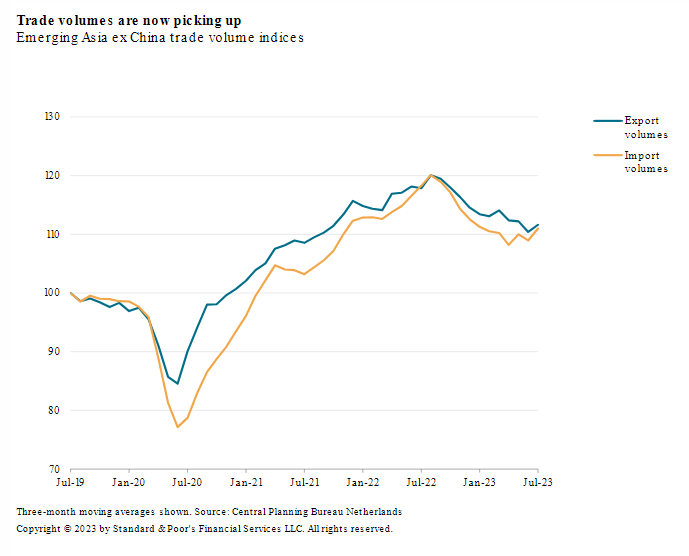

Emerging markets in Southeast Asia will enter 2024 at an inflection point. Weaker trade and fading reopening momentum have staunched growth in 2023. Five key themes will determine the growth landscape. First, external demand is set to recover but slower global growth will dampen the upturn. Second, capital outflow pressures have risen amid tighter global monetary conditions. Third, central banks may ease policy next year. Fourth, fiscal policy is gradually consolidating. Fifth, domestic demand is resilient.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

SPIVA MENA Mid-Year 2023

After falling in 2022, the region’s markets recovered in the first half of 2023. For example, the S&P Pan Arab Composite, which had declined by 5.7% last year, rose by 5.4%. This first half of the year was a relatively favorable environment for active management in the region, as only a minority of active managers underperformed. As Exhibit 1 illustrates, active performance was especially strong in Saudi Arabia, where no managers lagged the benchmark.

—Read the article from S&P Dow Jones Indices

Access more insights on capital markets >

Aging Tankers, ESG Obligations And Compliance Consequences

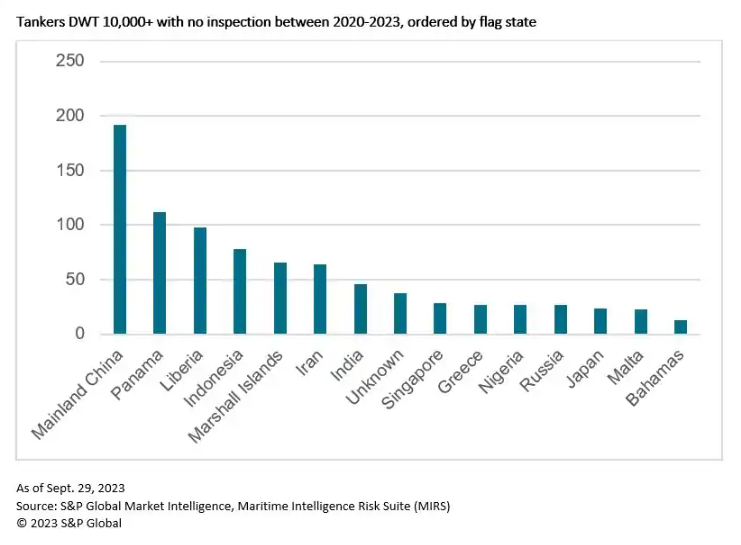

Following the explosion in May 2023 onboard the Pablo, a 26-year-old tanker vessel of 97,000 deadweight tonnage (DWT) resulting in loss of life but avoiding environmental catastrophe due to being unladen, the conversation has turned again to the shadow fleet of aging crude oil tankers used to transport Russian cargo and the potential for oil spills as a result of poorly maintained vessels and a lack of safety inspections. Most recently the G7 Price Cap Coalition released an “Advisory for the Maritime Oil Industry and Related Sectors” on October 12, 2023, highlighting concerns that vessels with unverified P&I provision, for example, are a challenge to hold accountable for the heavy economic burden generated by a potential instance of environmental damage.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

Listen: How Climate Conversations Are Shifting To Concrete Solutions, Faster Action

In today's episode of the ESG Insider podcast, hear about several of the big themes heard about at Climate Week NYC that will inform conversations at COP28, the UN’s climate conference taking place in Dubai later this year. Hear how Climate Week was marked by a focus on implementing concrete solutions at speed and explore the challenges around data availability and disclosure. And hear how the physical impacts of climate change are affecting the insurance sector.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

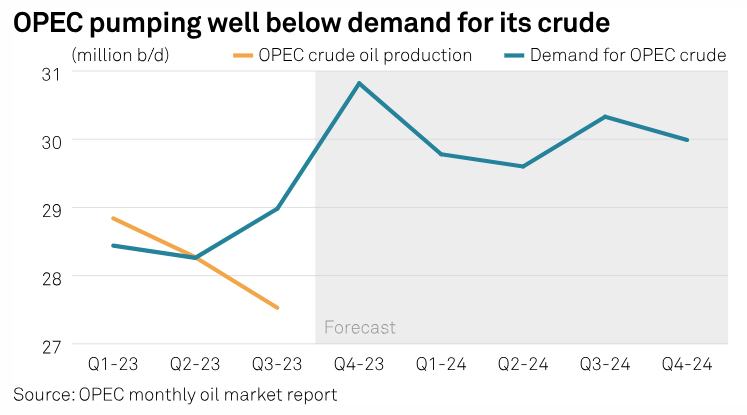

Saudi Aramco Sees Oil Market As Balanced And 'Reasonable'

Saudi Aramco has spare crude production capacity of 3 million b/d to meet any increase in oil demand, although the market is currently seen as being balanced and "reasonable," CEO Amin Nasser told an Energy Intelligence Forum in London on Oct. 17. The company can ramp up oil production if needed "in a couple of weeks," Nasser said, adding the more spare capacity that is used up, the more concern there will be in the market.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Power Of AI: Wild Predictions Of Power Demand From AI Put Industry On Edge

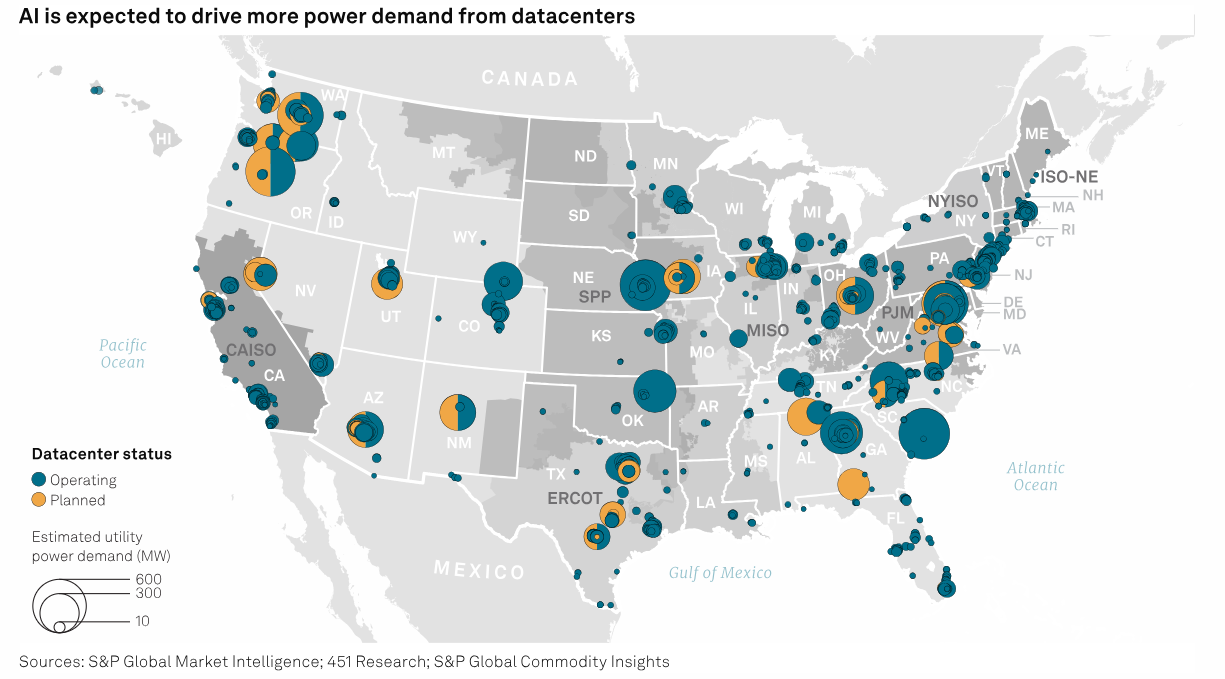

The rapid push to adopt artificial intelligence and machine learning in various segments of the energy sector will have far-reaching impacts that are only just starting to be understood. However, the electricity market, which already faces serious challenges from rapid renewables growth and widespread electrification, is expecting some significant net demand gains as a result of the new technology. This feature begins to explore some of the main power sector impacts and will be part of a longer series that addresses AI in several important areas of the energy industry.

—Read the article from S&P Global Commodity Insights