Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 10 Jan, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

After an energetic year for mergers and acquisitions, what will 2022 bring for deal-making?

2021 saw a trillion-dollar M&A run alongside the rise of consolidation across the energy industry and an explosion of initial public offerings through special purpose acquisition companies, or SPACs. Market participants expect this year to bring a continuation of strong M&A activity, alongside new deal-making trends. Technology may emerge as a leading driver of consolidation in 2022 after private equity firms pursued cybersecurity deals last year and the financial technology sector experienced rapid growth.

"There is recognition that consumers don't necessarily want to have six or seven apps on their phone and have to manage all those things separately," Raul Vazquez, CEO of the consumer loan company Oportun, told S&P Global Market Intelligence in an interview. "This suite bundling is one of the biggest drivers in fintech M&A, both this year and will be in the coming years."

2021 was the third-highest year on record for overall M&A, with transactions totaling $4.1 trillion, according to S&P Global Market Intelligence data. The third quarter of last year marked the fourth consecutive period that the cumulative announced value of global M&A topped $1 trillion—making it the longest streak since the data started being tracked in the 1990s. Through the fourth quarter of 2021, deal-making permeated across banking, media, REIT, and utility sectors in North America. This momentum is likely to continue, despite the uncertainties of how omicron and other coronavirus disruptions may affect global economic and market activity.

Oil, gas, and renewable energy producers turned to M&A throughout 2021 to weather the storm of pressure that the COVID-19 rained on global demand. The consolidation of oil and gas companies that, faced with bankruptcy, joined together to stay solvent will reshape the industry landscape for years—especially as they invest in the transition away from fossil fuels to clean energy. Now, industry experts anticipate that M&A across the U.S.’s power and utilities sectors is likely to continue into 2022 with support from federal policy and private capital as a means of strengthening companies’ renewable energy investments and environmental, social, and governance profiles, according to S&P Global Market Intelligence.

"The interesting thing is the activity picked up [in 2021], but the deals look a lot different than they have in the past," Jeremy Fago, a U.S. power and utilities deals leader at PwC, told S&P Global Market Intelligence in an interview. "I don't think that we're going to see the megadeals that we saw in [2016, 2017 and 2018] over the next year or two … We may see a couple of those, but I think the interesting thing about the ESG piece of this is although it may be driving some reshuffling of capital and some shuffling of portfolios, it may actually cause some challenges on the regulatory front."

After the first quarter of last year saw an extraordinary surge of SPACs, investors dubbed 2021 the year of the SPAC. But new accounting guidance issued by the U.S. Securities and Exchange Commission in April 2021 on warrants, which give investors the right to buy additional shares at a later date, curbed both investor interest and the number of new SPACs created due to increased uncertainty about equity valuations and increased regulatory scrutiny. That slowdown didn’t stop SPACs from generating billions from their IPOs. By year-end 2021, SPACs with insurance as one of their intended target sectors raised approximately $3.6 billion from 20 IPOs, according to S&P Global Market Intelligence data. The SPAC that debuted on the Nasdaq in September and merged with former President Donald Trump's media company in October provided a total return of 416.9% for the year, leading all financial stocks, according to an S&P Global Market Intelligence analysis of financial institutions that trade on the NYSE, the NYSE American, and the Nasdaq.

“I think [2022] is definitely going to be a wild ride. Clearly the SEC is going to tighten up on SPACs,” Georgetown University Associate Professor James Angel, who studies the market structure and regulation of global financial markets, told Yahoo Finance in an interview at the end of December. “Now, we have a number of SPACs that have gone public in the last two years, and their two-year clock is ticking. So, we'll have a number of SPACs get very desperate to do deals, and they're going to bring some deals to the market that aren't going to be all that great.”

Today is Monday, January 10, 2021, and here is today’s essential intelligence.

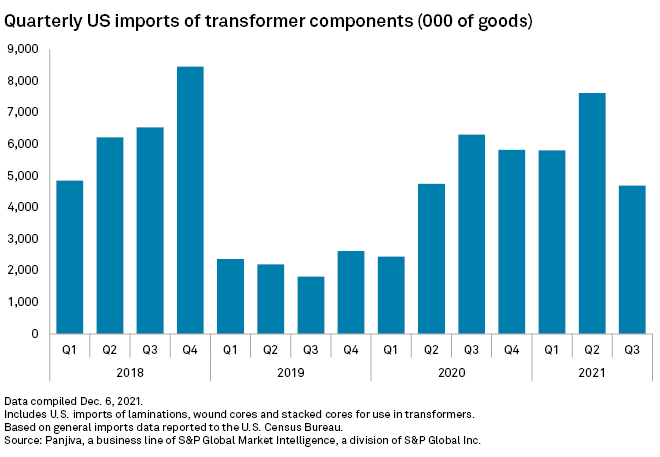

Biden's Infrastructure Act Spurs U.S. Electrical Steel Imports, Production

U.S. imports of the type of steel used to make transformers picked up pace in 2021 as manufacturers prepared for a surge in taxpayer-infused infrastructure spending to modernize the nation's power grid.

—Read the full article from S&P Global Market Intelligence

Commodities 2022: U.S. Steel Groups Focused On Trade Enforcement, Decarbonization

Enforcing US trade laws and continuing decarbonization efforts in steelmaking are the top priorities for the US steel industry heading into 2022, according to the leadership of the two largest groups representing the industry.

—Read the full article from S&P Global Platts

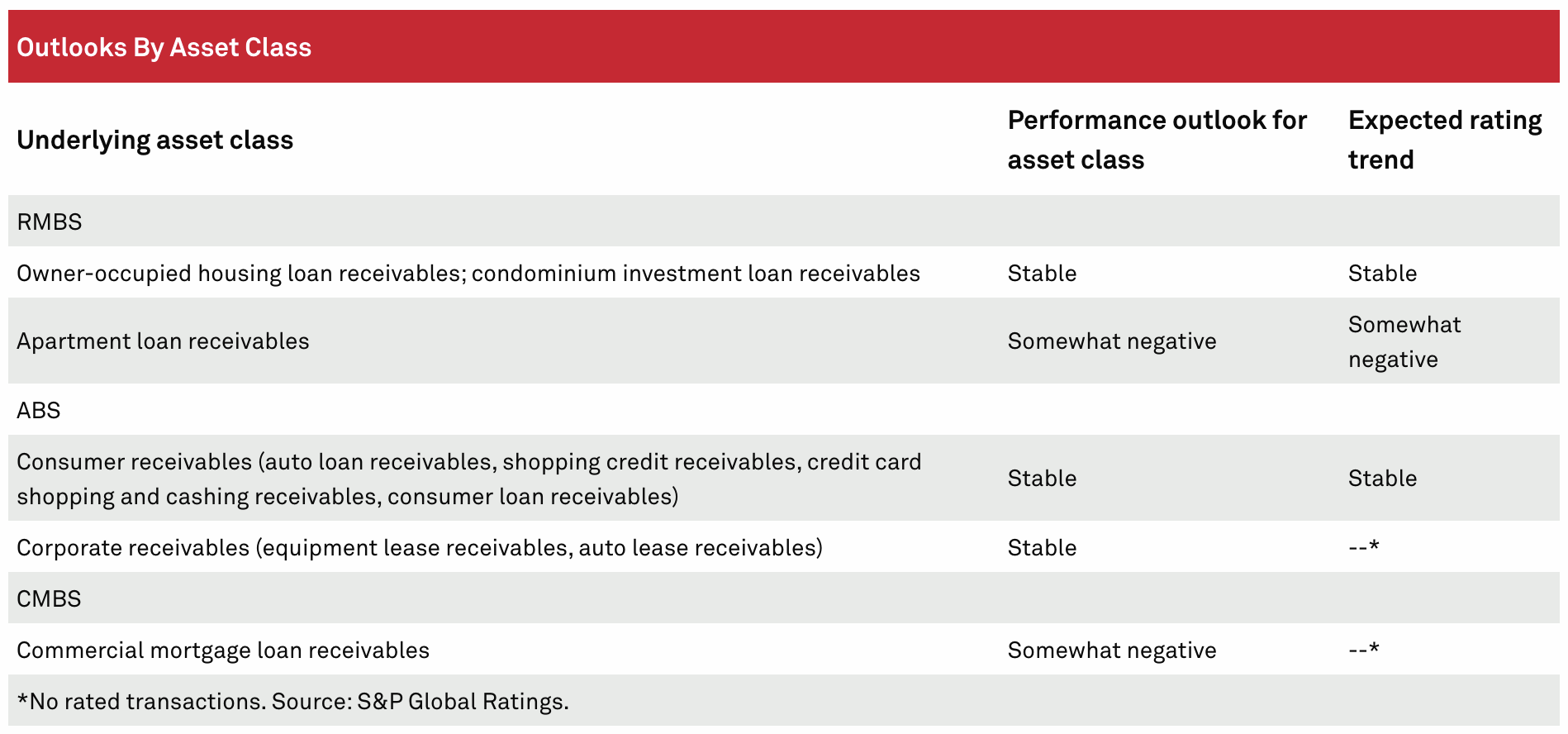

Japan Structured Finance Outlook: Coexisting With COVID

S&P Global Ratings expects Japan's economy to grow in line with a moderate recovery in economic activity and the unemployment rate to remain around 2.5% in 2022. As pandemic risk endures, the performance of the assets underlying securitizations may come under stress if further waves lead to the suppression of economic activity. Assets backing apartment loan RMBS and CMBS will be somewhat negative; other asset classes will perform stably. Rating trends will generally remain stable, except for apartment loan RMBS, which will likely be somewhat negative.

—Read the full report from S&P Global Ratings

Outlook For U.S. Not-For-Profit Acute Health Care: A Booster May Be Needed

S&P Global Ratings’ view remains stable as the sector continues to weather the pandemic well--albeit with the benefit of significant federal aid. S&P Global Ratings expects that healthy balance sheets, demand for services, and improved revenue yield will continue to support hospitals. But there are operating headwinds given significant ongoing expense and revenue pressures likely to continue over the next year.

—Read the full report from S&P Global Ratings

North American Insurance Services 2022 Outlook: Strong Economic Conditions And Rate Environment Support Stability

S&P Global Ratings is maintaining its stable outlook on the North American insurance services sector. The sector is supported by strong economic conditions, rate environment, and exposure unit trends. Capital market and deal activity is likely to remain robust in 2022 with relatively high deal multiples.

—Read the full report from S&P Global Ratings

Federal Aid Could Boost Otherwise Lukewarm Utility Stock Performance In 2022

Some power sector equity analysts expect utility stocks to underperform the broader market in 2022, but also acknowledged that the fate of the $1.7 trillion Build Back Better package could impact valuations if parts of the legislation pass in a standalone bill.

—Read the full article from S&P Global Market Intelligence

Listen: Next In Tech, Episode 46: Payments Evolution In Digital

The payment part of digital engagement has evolved from a technology best left to specialists, to something that’s a critical part of customer engagement. Principal research analyst Jordan McKee joins host Eric Hanselman to look at how payment technology and functionality is being integrated into software platforms that are extending to financial services offerings to increase revenue opportunities. They’re leveraging market adjacencies to deepen customer ties and provide better insights.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence

Automakers Announce Range Of New Evs, EV Concepts At CES 2022

Automakers have announced and showcased a number of new electric vehicle and EV concepts at the Consumer Electronics Show 2022, held Jan. 5-8 in Las Vegas, setting the tone for 2022 to be another year of growth in EV innovation, production and adoption.

—Read the full article from S&P Global Platts

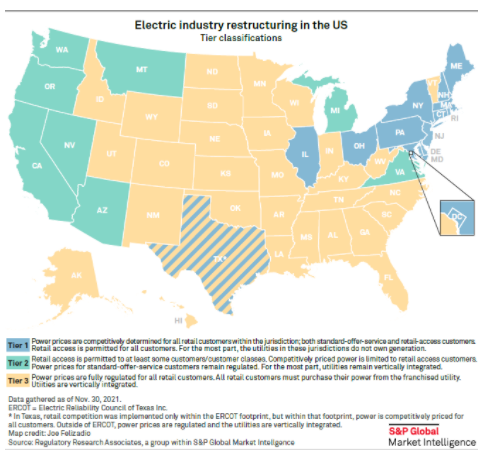

U.S. Regulators Juggle Stranded Cost Recovery, Abatement Strategies

The U.S. energy sector is in the midst of an extended period of transformative change, broadly referred to as the energy transition. Power and gas providers are scrambling to respond to increasing demands from public policymakers, regulators and customers to improve the reliability and resiliency of the grid in the wake of more frequent weather events, while at the same time moving away from carbon-emitting generation and heating resources to renewable and/or zero-emissions resources.

—Read the full article from S&P Global Market Intelligence

FEATURE: South Korea's Move To Label LNG As Green Fuel Buys Time For Energy Transition

South Korea's move to include LNG in its taxonomy for green fuels will buy the country more time to transition to a net zero economy and help allay immediate concerns about energy security given its heavy dependence on gas for power generation.

—Read the full article from S&P Global Platts

Inclusion Of Nuclear In EC Sustainable Power Taxonomy Boon For Hydrogen: Trade Body

The European Commission's inclusion of nuclear power generation in its sustainable investment taxonomy will help build a hydrogen economy across the continent, industry association Hydrogen Europe told S&P Global Platts Jan. 7.

—Read the full article from S&P Global Platts

Watch: Market Movers Asia, Jan 10-14: Markets Await Indonesia's Next Move After Coal Export Ban; Omicron Threat Weighs

On this week's Platts Market Movers Asia with Associate Editor Nicholson Lim: Asian refiners are planning to reduce their term crude oil purchases and conduct more spot buys amid prolonged uncertainty due to the coronavirus pandemic.

—Watch and share this Market Movers video from S&P Global Platts

Kazakhstan's Tengiz Oil Field Operator Says Resuming Normal Output After Protests

Kazakhstan's Tengiz oil field, the country's highest-producing crude source, is gradually returning to normal production levels after protests at the site disrupted operations, the Chevron-led operating consortium, Tengizchevroil, said Jan. 9.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language