Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 9 Feb, 2024 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

What Comes After the Washington Consensus

For most of the year, the town of Davos in the Swiss Alps is a ski resort. However, for a few wintry days every January, Davos plays host to CEOs, government officials and public figures attending the annual World Economic Forum. The first meeting of the forum took place in 1971, and the rise in importance of these meetings has coincided remarkably with the global dominance of a system of beliefs known as the Washington Consensus. While definitions vary, the Washington Consensus is generally defined to include a belief in the benefits of open markets, frictionless trade and limited geopolitics. It is perhaps fitting, then, that S&P Global Ratings Chief Economist Paul Gruenwald chose this year to publish the article, “End of the Washington Consensus.” According to Gruenwald, the final days of the Washington Consensus are upon us, driven by a combination of rising inequality, the global financial crisis and the attraction of China’s state-driven economy.

At its best, the Washington Consensus was responsible for an impressive increase in global wealth and a commensurate fall in global poverty. The institutions that supported the Washington Consensus were established at a conference in Bretton Woods, NH, in 1944 by 44 allied nations looking to create an economically stable postwar order. Incomes and wealth boomed, at least in aggregate, and billions of people were lifted from poverty. The Bretton Woods Institutions included the International Monetary Fund, the World Bank and the World Trade Organization, all of which supported the primacy of markets, a limited role for the state, multilateralism and globalization, and the free movement of workers and capital. Following the end of the Cold War, the Washington Consensus became a global consensus that led to a period of unprecedented economic globalization in the 1990s and 2000s.

While profitability rose and asset prices soared during these years, the seeds of doubt were also planted. Income inequality soared. Globalization created clear economic winners and losers, particularly in advanced Western economies. High-income groups fared quite well, but those working in the manufacturing sectors saw their wages stagnate and jobs disappear. The global financial crisis of 2008 created a crisis of confidence in US-style capitalism. At the same time, the Chinese economy seemed to be thriving under a state-led model.

Nationalist movements around the world have harnessed anti-global sentiment, promoting tariffs to protect domestic manufacturing and withdrawing from multilateral institutions. The close alignment of Chinese industry and the Chinese state is perceived as a method of protecting “national champions” — companies of strategic importance to a country’s economy. The Bretton Woods Institutions continue to function, but they are being crowded by new groups, including the Asian Infrastructure Investment Bank and the New Development Bank. Political engagement between China and the US has become less frequent, despite ongoing trade ties.

There are many who will not mourn the end of the Washington Consensus. However, global problems such as climate change, the energy transition, debt relief and healthcare often require global solutions. The critics of globalization at times prefer to deny the existence of these problems rather than cede any ground to a discredited and decaying consensus.

Today is Friday, February 9, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

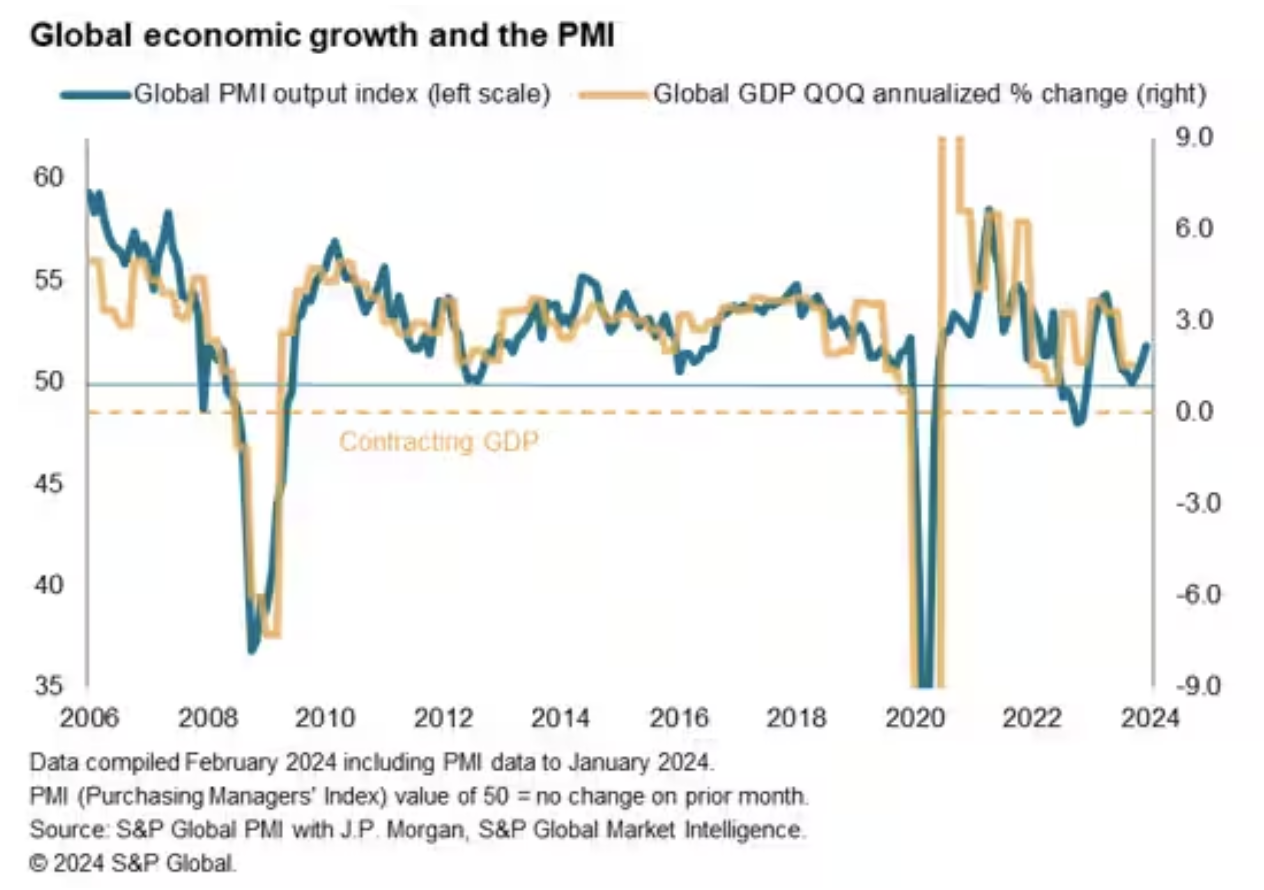

Global PMI Signals Faster Economic Growth And Brighter Prospects At Start Of 2024

Global output growth accelerated for a third straight month in January, according to the S&P Global PMI surveys. Looser financial conditions helped boost financial services activity and consumer spending, while manufacturing was also buoyed by a reduced focus on inventory reduction. Growth picked up in the US, Japan, UK, India and Brazil, and downturns moderated in the eurozone, Canada and Australia. China's (mainland) economy also continued to expand.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Credit FAQ: What Lies Ahead For UAE Banks In 2024

High interest rates and reduced non-oil sector activity slowed credit growth in the United Arab Emirates (UAE) in the last quarter of 2023. However, banks are reporting exceptional full-year 2023 profitability on the back of lower provisioning requirements and higher interest margins. Furthermore, liquidity improved as deposit growth outpaced new lending.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

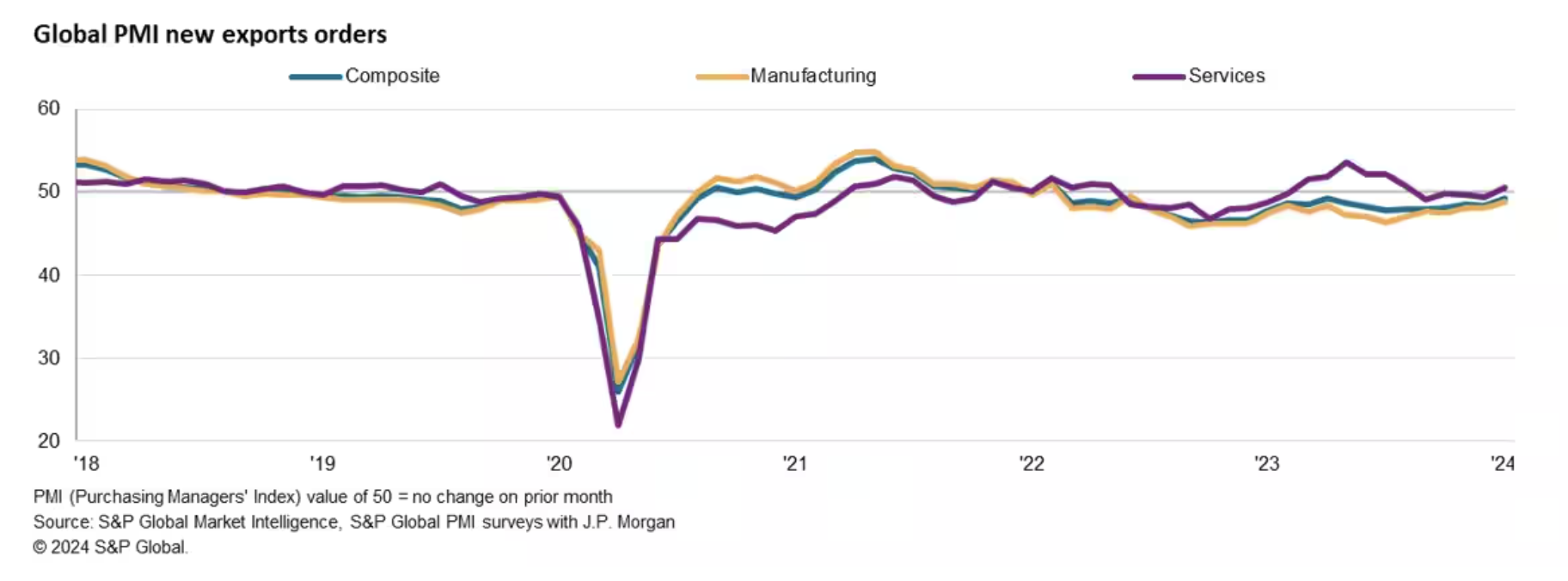

Trade Downturn Eases At Start Of 2024 Despite Red Sea Disruptions

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated a further deterioration of global trade in December, thereby extending the sequence of decline to nearly two years. That said, the rate of contraction eased to the weakest in nine months and was only marginal despite heightening disruptions around the Red Sea at the start of the year. The seasonally adjusted PMI New Export Orders Index posted 49.2, up from 48.4 in December, rising to a level just below the long-run average.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

Listen: How The Insurance Industry Is Seeking Solutions To Climate Change And Nature Loss

Many companies have crafted climate-related strategies and taken steps to measure and manage their climate-related risks. Many companies are only in the early stages of understanding how nature relates to climate, but this topic has been steadily climbing the sustainability agenda. In today’s episode of the ESG Insider podcast, hear about how the insurance industry is managing the joint challenge of climate change and biodiversity loss — and what solutions it is bringing to the table.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

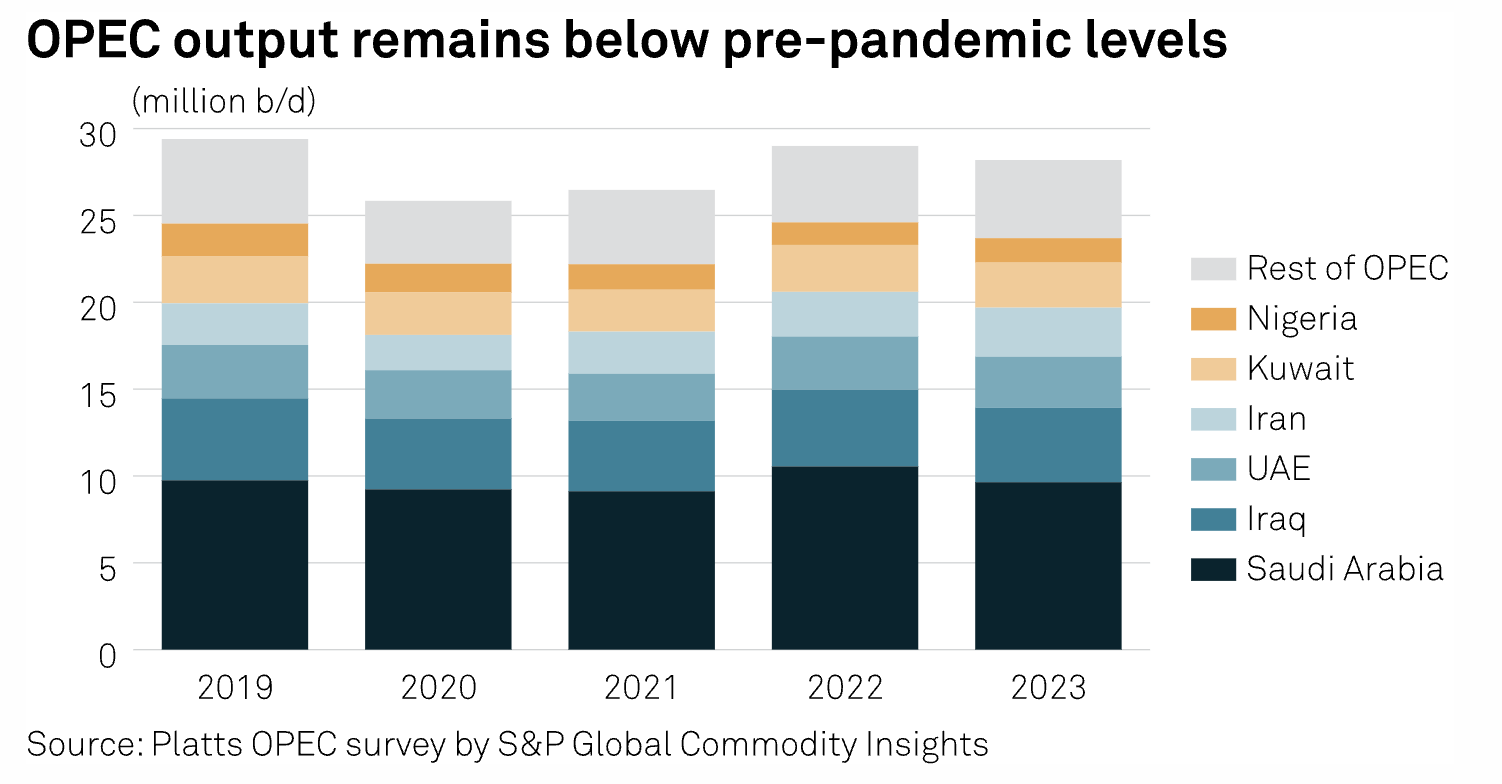

OPEC Says Continued Investments In Oil Projects Crucial For Global Energy Security

The global energy industry has to ensure that investments to the oil industry continues to flow despite a changing landscape, and any big shift in focus could potentially act as a stumbling block for energy security as well as create a volatile market, OPEC Secretary General Haitham al-Ghais said. "We need to reiterate that the misguided notion of no longer investing in new oil projects would undermine the security of energy supplies and lead to major volatility," he told the India Energy Week Conference in Goa.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

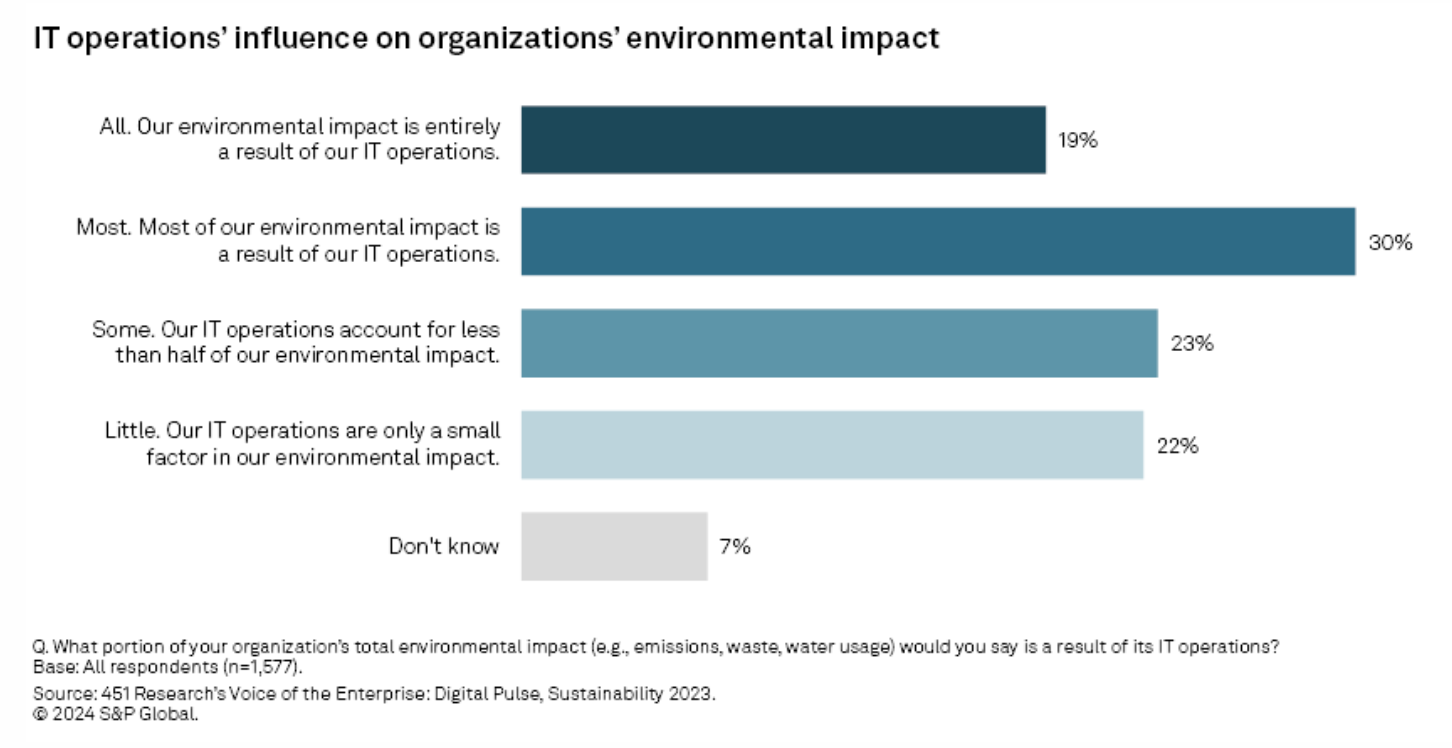

Economic Pressures May Delay Anticipated Sustainability-Driven IT Spending

Businesses are becoming attuned to responsibilities and customer requirements related to environmental responsibility. In many cases, they recognize that meeting those responsibilities — along with their own established targets for sustainability — will require significant technology investment in the years to come. However, those investments may be on hold for some organizations as current economic pressures exert themselves and drive organizations to prioritize other immediate operational concerns ahead of progress toward sustainability objectives.

—Read the article from S&P Global Market Intelligence

Content Type

Location

Language