Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 15 Dec, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

A Smaller ESG Market, But a More Honest One

The truth is, advertising can be challenging. When the U.S. Securities and Exchange Commission created new disclosure mandates for investment advisers and firms that market their products under an environmental, social and governance umbrella, it was thought that the ESG market might shrink. With a few high-profile fines for mislabeled ESG funds, the SEC has sent a clear message that greenwashing will no longer pass muster. Assets under management in the ESG market have shrunken precipitously, but that shrinkage is a sign of market maturity, as fewer, but more committed, investment owners are left.

On May 25, the SEC shared a new set of proposed rules intended to hold companies accountable for their ESG and sustainability promises amid growing investor demand for more clarity. Under the new rule, firms offering ESG funds and products are required to provide greater depth on their methodologies and investment strategies. Funds promising an ESG impact are required to explain what impacts they seek to achieve and the key metrics they are using to benchmark progress.

"What does 'fat-free' mean? Well, in that case, you can see objective figures, like grams of fat, which are detailed on the nutrition label," SEC Chairman Gary Gensler wrote in a statement published with the proposed rule. "Funds often disclose objective metrics as well. When doing so, investors get a window into the criteria used by the asset managers for the fund and the data that underlies the claim."

Under the rules, funds that include “ESG” in their name would now be required to invest 80% of their assets in holdings that align with that language. Firms that claim to consider environmental factors in their investment strategies would now be required to disclose their carbon footprint.

As it happens, science-based approaches to climate risk proved too high a hurdle for many firms and funds that previously labeled themselves ESG. According to a report released by sustainable investing organization US SIF, $8.4 trillion in U.S. investment assets were held by firms that factored ESG into their investment decisions at the start of 2022. That figure was $17.1 trillion at the start of 2020, according to the previous report. While it may appear that the bottom has fallen out of the ESG market, it's much more likely that $9 trillion in ESG funds were merely mislabeled.

The investment industry is not alone in attempting to define ESG in a rigorous way. The insurance and banking sectors have also struggled to define and measure ESG and, specifically, to measure climate impact. As regulators and customers demand higher standards from companies and products with a sustainable focus, the market will inevitably contract, but a new baseline for genuine growth will then be available.

Today is Thursday, December 15, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

Listen: Ep34: Liz Ann Sonders On The 2023 Macro Outlook, Her 300,000 Twitter Followers & Inflation

Liz Ann Sonders, chief investment strategist at Charles Schwab, joins Paul Gruenwald, Global Chief Economist at S&P Global Ratings, and host Joe Cass on this episode of Fixed Income in 15. Discussion focused on the 2023 macro outlook, U.S. rate cycle, sticky inflation, Liz Ann’s Twitter 300,000 Twitter following and Paul’s cycling over lockdown.

—Listen and subscribe to Fixed Income in 15, a podcast from S&P Global Ratings

Access more insights on the global economy >

U.S. Bank Share Repurchases Down Sequentially, YOY In Q3

U.S. banks' common stock repurchases dropped in the third quarter as capital requirements faced upward pressure and the macroeconomic outlook weakened. Overall, banks bought back $4.42 billion in common shares during the period ended Sept. 30, compared to $7.14 billion in the second quarter and $28.17 billion in the third quarter of 2021, according to an S&P Global Market Intelligence analysis.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

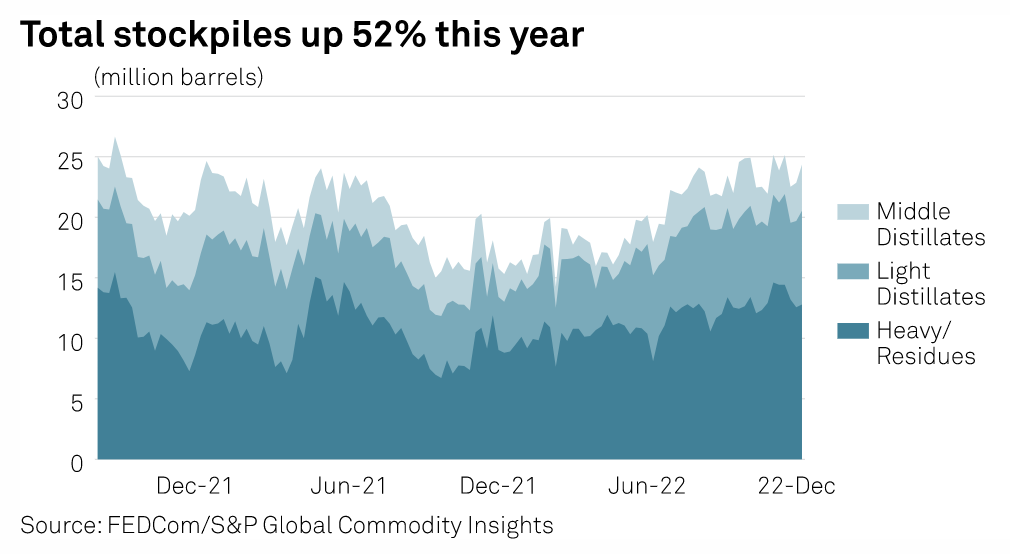

Fujairah Data: Oil Product Stocks Rise 6.6% On Week Led By Middle Distillates

Oil product stockpiles at the UAE's Port of Fujairah climbed 6.6% to a three-week high in the seven days ended Dec. 12, with gains across all categories, according to Fujairah Oil Industry Zone data published Dec. 14. Total inventories were at 24.360 million barrels as of Dec. 12, the highest since Nov. 21, the FOIZ data provided exclusively to S&P Global Commodity Insights showed. Middle distillates jumped 21% over the latest week while light distillates climbed 8.9% and heavy distillates increased 2%.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

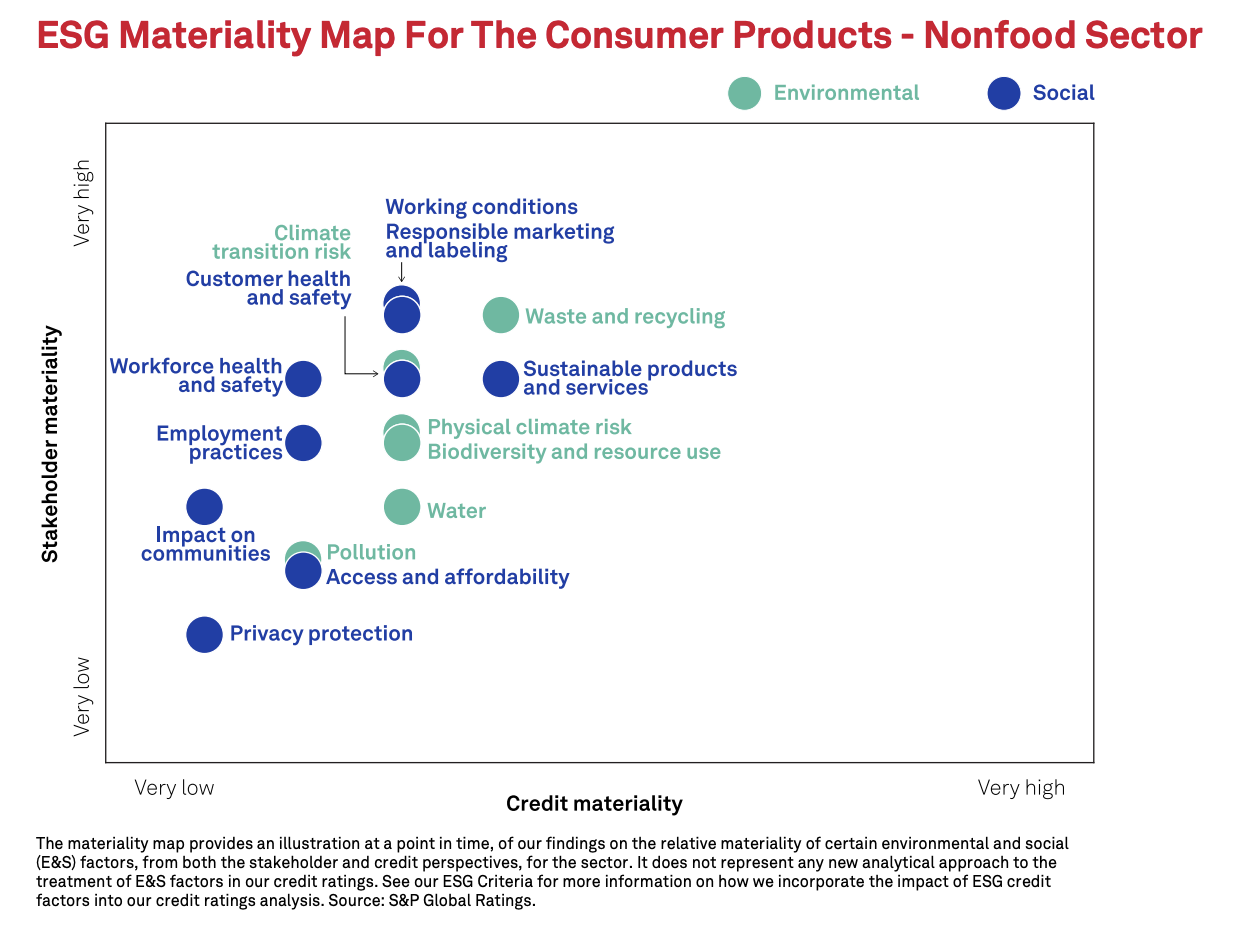

ESG Materiality Map: Consumer Products – Nonfood

This sector map provides an illustration of S&P Global Ratings’ current findings on the relative materiality of 15 environmental and social factors, from both the stakeholder and credit perspectives, on the Consumer Products - Nonfood sector. The consumer nonfood sector covers a wide variety of companies in the consumer goods segments, both branded and private labels, and includes personal luxury, apparel, household, beauty and personal care and white-goods products.

—Read the report from S&P Global Ratings

Access more insights on sustainability >

Usual Sun States Shine Bright At Top Of US Solar Capacity Factor Leaderboard

The weighted average U.S. solar capacity factor stayed flat year over year in 2021. This possibly reflected greater operational efficiency, as more than 58% of the states individually operating in excess of 100 MW of utility-scale photovoltaic capacity experienced solar radiation below the norm. Negative climatology deviations ranged from -0.1% in Nevada to -4.6% in Mississippi.

—Read the article from S&P Global Market Intelligence

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 95: Holidays With Supply Chains

The pandemic has made us all supply chain specialists as we worked to find things in a time of constraint. Eric Johnson, a senior technology editor at the Journal of Commerce, joins host Eric Hanselman to talk about technology in the logistics industry and what’s changing in this complex market. Much like the ecosystems around the cloud, there’s a Cambrian explosion of companies working to address logistics complexity. Check out the TMP Tech conference here.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence