Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 18 Aug, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Energy Impact of the Inflation Reduction Act

On Aug. 16, U.S. President Joe Biden signed the Inflation Reduction Act, or IRA, into law. The IRA includes nearly $370 billion in federal spending for decarbonization efforts over the next decade. While the bill is expected to reduce the U.S. budget deficit by about $300 billion and expand healthcare benefits, the bulk of funding under the new law will go toward clean energy technology.

The legislation, which passed the House of Representatives on Aug. 12, in a straight 220-207 party-line vote, includes funding to support clean energy and transportation, renewable energy, and U.S. electric grid expansion. Some of the funding comes in the form of new tax credits for nuclear plants, energy storage and hydrogen.

According to an independent analysis from Princeton University, the provisions of the law could help the U.S. with a 40% cut to economywide emissions by 2030, relative to 2005 levels. Under the conditions of the Paris Agreement on climate change, the U.S. is required to halve its emissions by 2030. The gap between projected emissions reductions under the law and emissions targets has drawn scrutiny from environmental groups.

The bill will hasten the further development of wind and solar energy in the U.S. By extending tax credits over the longer term, the wind and solar industry can avoid the uncertainty that temporary tax credits have created for the industry in the past. This sends a clear signal to potential investors that returns from clean energy technologies are reliable over the longer term. Other clean energy technologies, such as nuclear, carbon capture and geothermal, will also receive funding in the form of tax credits. As mentioned in a previous Daily Update, the IRA includes support for hydrogen through a new tax credit of $3/kg for low-carbon hydrogen.

In addition to incentivizing energy producers to pursue clean energy technologies, the law also offers consumers a federal consumer tax credit of up to $7,500 on new electric vehicle purchases from U.S. automakers. Many of the law’s tax credits, like the EV subsidies, require companies to meet new domestic sourcing and labor requirements.

However, substantial barriers to new clean energy projects remain. Arduous siting and permitting requirements have delayed a number of projects and further legislative action has been planned to create simpler fast-track approvals.

Under the new law, some large U.S. utilities have expressed increased interest in expanding renewable energy generation. According to S&P Global Commodity Insights, Constellation Energy Corp. President and CEO Joseph Dominguez said the package of nuclear tax incentives included in the IRA should increase the company's value.

Not everyone in the energy sector wins under the new law though. Surprisingly, given the crucial support of Sen. Joe Manchin of coal-producing West Virginia, coal stands to lose out.

"Coal's share in U.S.-installed capacity has already declined by 30% during the past decade. The IRA is expected to accelerate retirements substantially as renewables reduce the revenue available to thermal plants," said Xizhou Zhou, vice president, Global Power and Renewables at S&P Global Commodity Insights.

Today is Thursday, August 18, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

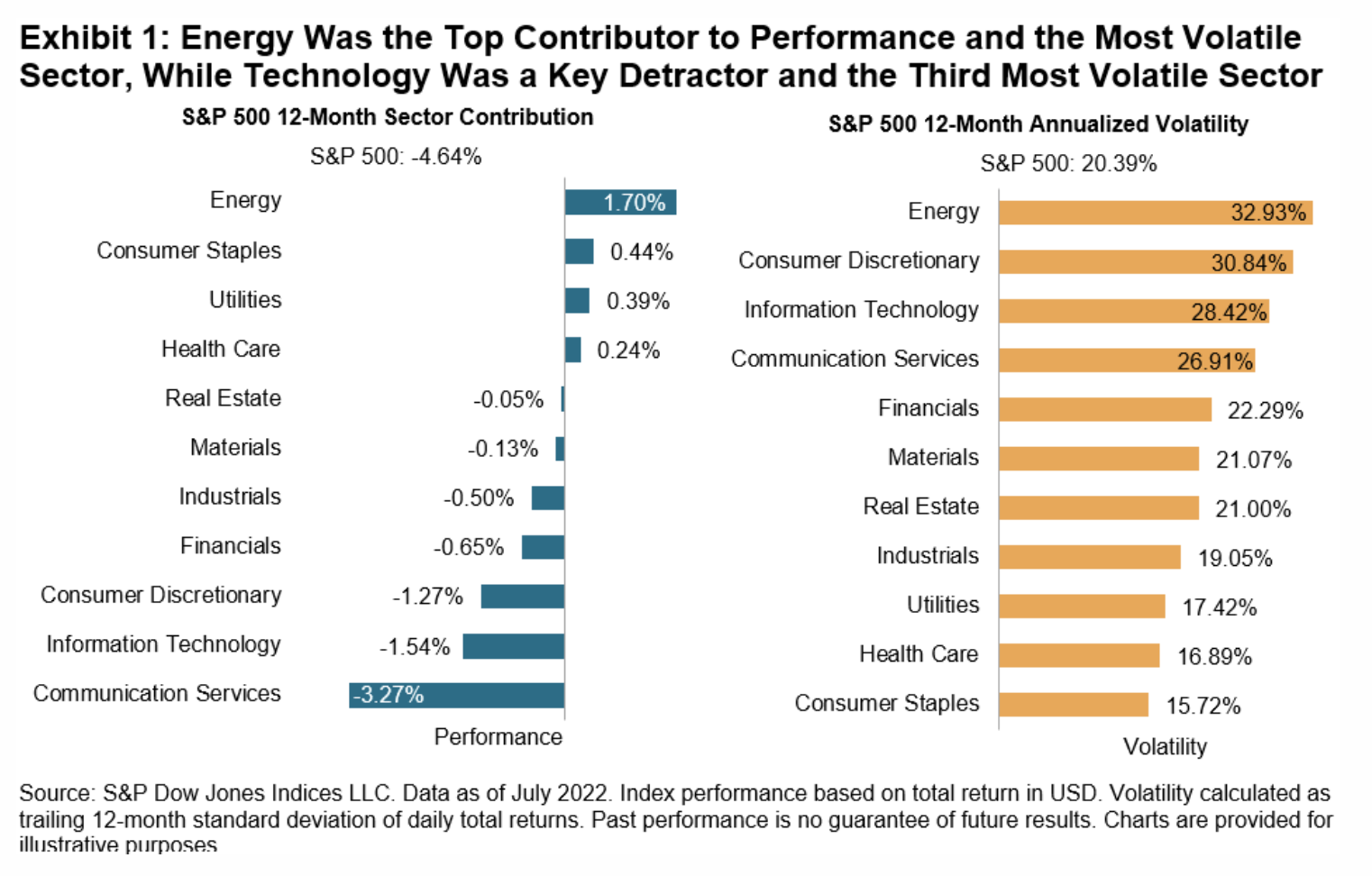

Defensive Dynamics

2022 has been a tumultuous year characterized by reversals, with the S&P 500 down 20% in the first six months of the year and rebounding by 9% in July. In this uncertain environment, seeking defensive exposures via sectors could mitigate portfolio risk, but a nuanced perspective may be required to understand which sectors offer the best defense.

—Read the article from S&P Dow Jones Indices

Access more insights on the global economy >

Global Private Equity, Venture Capital Deal Value Falls 63% In July

Global private equity and venture capital entries in July slipped to the lowest monthly totals of the year, slowed by soaring inflation and rising interest rates. Deal value worldwide was down 63% in July to $43.05 billion from $116.47 billion during the same month a year ago, according to S&P Global Market Intelligence data. The month saw a total of 1,579 transactions, a 29.2% decline from the 2,231 deals booked in July 2021.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

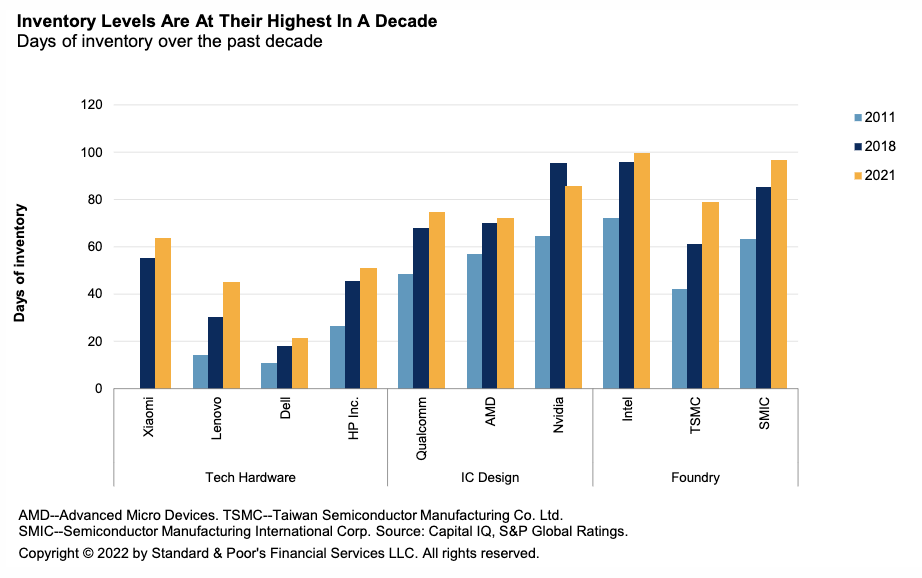

Asia-Pacific Tech Hardware Issuers Grapple With High Inventory And Falling Demand

Rising stock, falling demand. This growing imbalance could create a cash flow and earnings headache for the Asia-Pacific tech hardware issuers S&P Global Ratings rate. For most, it's not so bad; for a select few, dips in cash flow could squeeze rating headroom and cloud outlooks. Makers of PCs and smartphones are likely to experience the weakness first, and it could spread to other technology hardware companies up the supply chain. We forecast global smartphone shipments to decline by 5% this year and PC shipments to fall by 10%.

—Read the report from S&P Global Ratings

Access more insights on global trade >

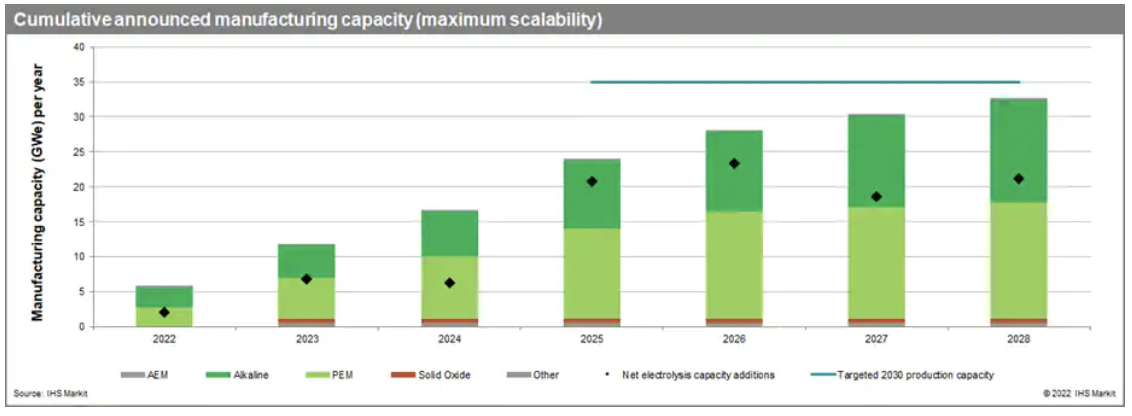

Current Electrolyzer Manufacturing Capacity Could Quadruple By 2025 As OEMs Scale Facilities In The Face Of Rising Demand

New capacity expansions will be for both PEM and alkaline. Highly automated manufacturing facilities can reduce the labor of assembly, as well as the manufacturing cost of key components such as anodes and cathodes. Oversupply is possible as announced capacity exceeds expected demand. Manufacturers will need to thread a fine needle, balancing investments in additional capacity with market conditions.

—Read the article from S&P Global Commodity Insights

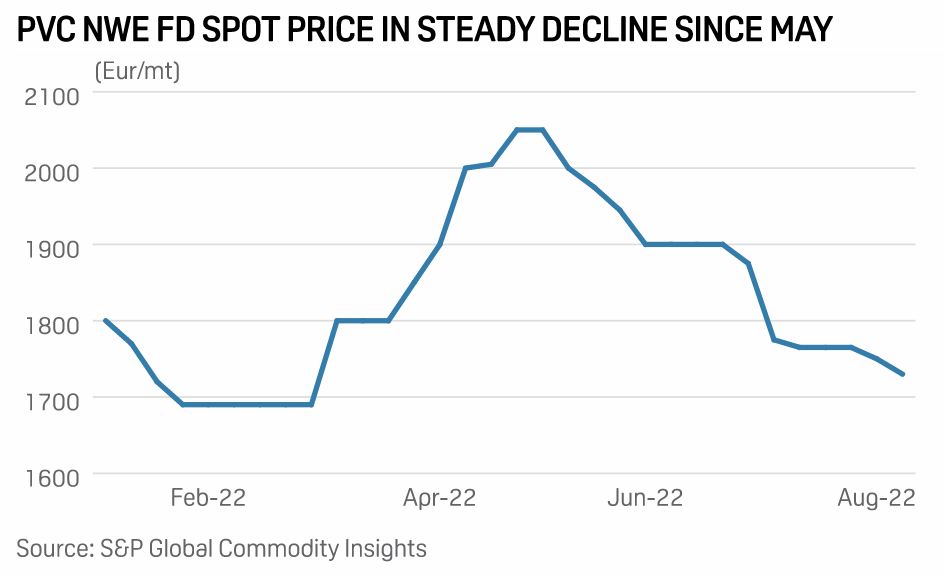

European Polymers Face Difficult Winter On Demand Destruction, Competition For Supply

Key European polymer markets face a bearish cocktail of demand destruction from the cost-of-living crisis and planned extra supply from new plants that could leave the industry facing a supply-demand hangover. Polymers, including polyethylene, polypropylene, and polyvinyl chloride which underwent a coronavirus-induced boost from working from home and pharmaceutical needs, now see demand weakening on a worsening economic picture and anticipated additional production capacity largely from China and the U.S.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

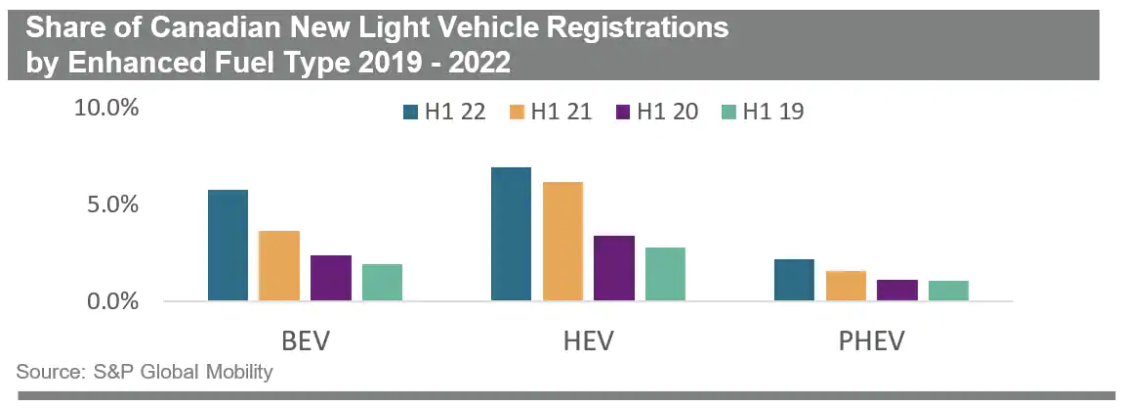

Automotive Insights – Canadian EV Information And Analysis Q2 2022

When compared to H1 2021, new vehicle registrations fell by 11.8% overall and the combined volume of xEV light vehicles (EV/PHEV/HEV/FCEV) did increase by 15.5% in H1 2022Z—xEVs now account for 14.8% of all new registrations, while traditional ICE vehicles account for 85.2%. Further comparisons of H1 2022, BEVs and PHEVs saw volume gains (11,960 and 2,844), while HEV and FCEV each saw volume declines.

—Read the article from S&P Global Mobility

Access more insights on technology and media >