Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Aug 31, 2022

Algeria's Law No. 19-13 of 11 December 2019 modified the country's legal/fiscal framework for the hydrocarbons sector. The law reintroduced Production Sharing Contracts (PSCs) and Risk Service Contracts (RSCs) so that prospective contractors are now offered participation contracts (royalty and tax contracts involving a participation between Sonatrach, Algeria's national oil company (NOC), and one or more co-contractors (partner/s)), PSCs, or RSCs.

Overall, the point of the law was to have a more attractive upstream legal/fiscal framework after some years of scarce foreign investments in Algeria's hydrocarbons sector. For more information about Law No. 19-13, please see our legal insight article "Algeria's 2019 Hydrocarbons Law - An Assessment Two Years On" (published in December 2021).

After the enactment of Law No. 19-13, in the period 2020-2021, Algeria passed more than 40 decrees covering various aspects of the hydrocarbons sector as reformed by Law No. 19-13. This article provides some notes about Law No. 19-13 and some of the decrees, clarifying some of the more important points within them and, at the same time, identifying points that still need additional clarification because they are open to different interpretations.

Art 230 of Law No. 19-13 states that, apart from the contracts converted to the terms of Law No. 19-13 under Art 231, all mineral titles, permits, authorisations, hydrocarbon contracts, and concessions for pipeline transportation issued or concluded before the publication date of Law No. 19-13 in the Official Gazette, including participation contracts based on Law No. 86-14 and the parallel and related contracts concluded based on Law No. 05-07, still apply according to their original terms and conditions.

Art 231 of Law No. 19-13 states that contractors to exploration and/or exploitation hydrocarbon contracts based on Law No. 05-07, i.e., participation contracts, could request the application of the terms of Law No. 19-13 to their contracts on the condition that no production based on a development plan had occurred before 24 February 2013. However, the National Agency for the Valorisation of Hydrocarbon Resources (ALNAFT) had to receive the request for the application of Law No. 19-13 to these existing contracts within a year of the publication of Law No. 19-13.

Law No. 19-13 does not provide any details on what the cost carry forward mechanism might be for PSCs under the new law. Despite Algeria having recently started to sign, through direct negotiations with the interested companies, new PSCs (for example, in March 2022, Eni signed, under the terms of Law No. 19-13, a new PSC for the basin of Berkine South), the country has yet to provide a model PSC based on Law No. 19-13. For the investors this is a key point because with hydrocarbon projects the initial years have capital-intensive requirements.

The 2004 Model PSC may offer some guidance in this regard. It may be that the carry forward mechanism under a Law No. 19-13 PSC would work in the same way, i.e., if the 49% share of production passed to the contractor were insufficient for the contractor to recover its costs (including any costs from carrying Sonatrach), these costs would be carried forward to be recovered in the following year(s). In Algeria, Sonatrach must have with participation contracts, PSCs, and RSCs, respectively, a minimum 51% share in the partnership, at least 51% of the hydrocarbon production, and at least 51% of the value of the production. Yet only a model PSC based on Law No. 19-13 may confirm this point.

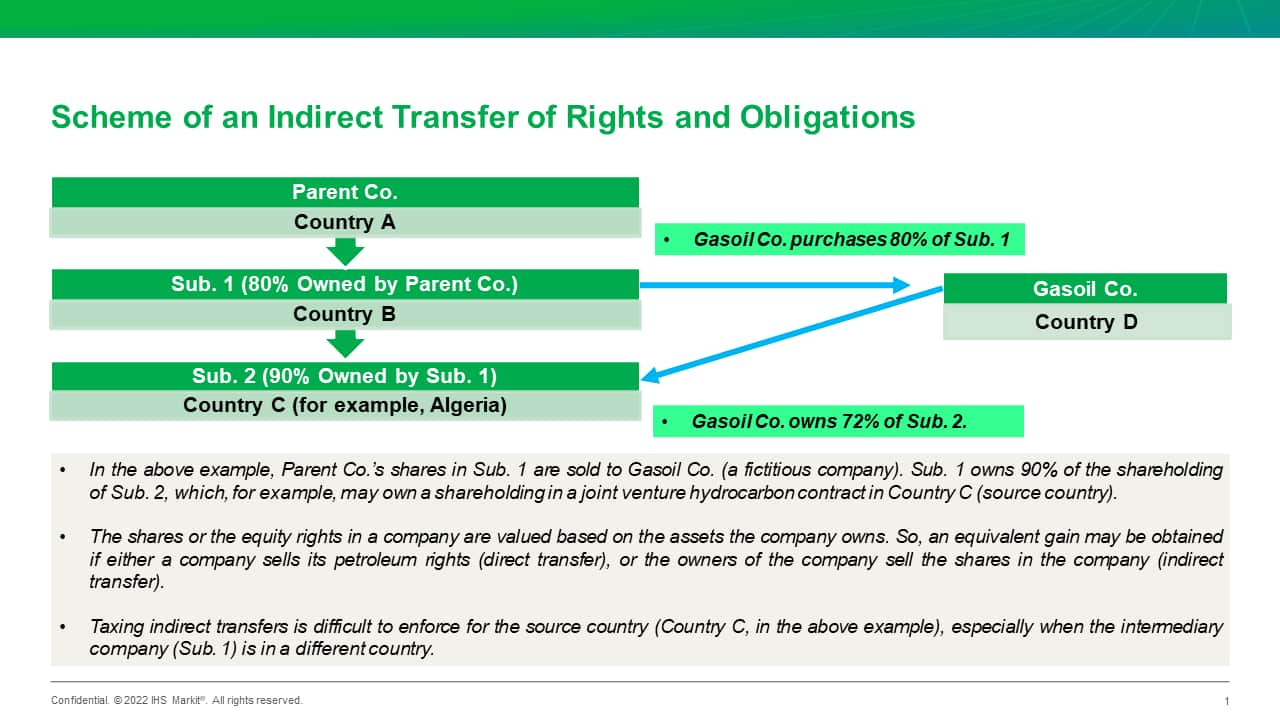

Art 205 of Law No. 19-13 states that, in Algeria, the transferring co-contractor must pay an administrative tax for any transfer of rights and obligations. The administrative tax is a non-deductible transfer payment equal to 1% of the value of the transaction, and the transferor pays it.

Art 2 of Decree No. 21-98 states that the contracting parties may transfer any or part of their rights and obligations held under the hydrocarbon contract between them or to any other person according to the conditions of ALNAFT's award and the hydrocarbon contract.

In relation to participation contracts, Sonatrach may transfer any or part of its rights and obligations corresponding to the difference between the shareholding held and the minimum 51% shareholding mandatory for Sonatrach to hold by Law No. 19-13 (Arts 96-100 and 205).

In relation to PSCs and RSCs, Sonatrach may transfer any or part of its rights and obligations corresponding to its percentual participating shareholding in the financing of upstream operations.

Art 11 of Decree No. 21-98 states that theco-contracting party must notify the minister in charge of hydrocarbons of any change of control affecting the co-contractor directly or indirectly. Art 14 states that if the change of control is incompatible with the co-contractor maintaining its participation shareholding, the minister in charge of hydrocarbons will notify the co-contractor whose rights and obligations will be transferred with priority to Sonatrach or distributed in equal shares among the other contractors. If no contracting party desires to accept the rights and obligations of the co-contractor deemed to be now in an incompatibility position because of the change of control, Sonatrach will obtain all the co-contractor's shareholding.

Law No. 19-13 and its implementing decrees have modified, one more time, Algeria's legal/fiscal framework for the hydrocarbons sector. The goal of this reform was to spur foreign direct investment (FDI) in the hydrocarbons sector. Until now, the results have been mixed, with increased interest in Algeria's hydrocarbons sector over the first six months of 2022 probably due more to the current Russia-Ukraine conflict than to the reform of the legal/fiscal framework for the hydrocarbons sector. The resulting system is not simple, as the country, for contracts involving contractors other than Sonatrach, is now going to manage three different types of hydrocarbon contracts, which is not an easy task. Moreover, while the enacted decrees have provided some clarification on some points that were not defined in Law No. 19-13, the decrees are many in number, and some fiscal calculations are quite complex.

This article is an excerpt from the longer, more detailed legal insight "Some Notes for Investors in Algeria About Law No. 19-13 of 11 December 2019 and Its Implementing Decrees" which was published on July 1, 2022, and it is available only to our subscribers.

***

Want to learn more on this topic and access similar reports? Try free access to the Upstream Oil and Gas Demo Hub to explore selected energy research, analysis, and insights, in one integrated platform.

Posted 31 August 2022 by Alessandro Bacci, Senior Petroleum Legal Analyst, PEPS, S&P Global Energy

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.